Andrew Rogerson's Blog, page 60

April 21, 2014

Courageous Entrepreneurs With Eric Anderton

Eric Anderton, CEO of the ABC Group, joined me on Money 2.0 to discuss the various aspects of being and operating as an entrepreneur. Eric has a long career as an entrepreneur and businessman, and is also a keynote speaker, trainer, and business consultant.

Our discussion begins on the shared view Eric and I have on the necessity of entrepreneurs in this economy and generally as the backbone of our country. Eric mentions that he is working on a book about entrepreneurship called The Courageous Entrepreneur, set to be released late in 2014.

Eric explains why he believes courageousness is an integral part of being an entrepreneur. He says entrepreneurs need courage and intelligent action to be successful. Eric says that innovation & marketing are the basic elements that make an entrepreneur. Eric maintains that innovation, the introduction of something new – a new method or device – is best thought through when you ask three key questions:

1) What is desirable to people; to the market?

2) What is possible – with the people you work with; with your own skill set; with technology?

3) What is viable; will people pay for it?

Eric says you need to ask these questions to get an idea going. You need to ask yourself these questions continually as well to reevaluate what you are doing and where you are going.

Eric talks about his consulting business where he walks business owners through these questions and more to help them formulate their business and marketing plans. Eric believes strongly that business is guided best through “intelligent and consistent action that is inspired through a higher purpose”.

Eric says when he first sits down with potential clients, he asks: “Why does your business exist?” and “Where is it going?” He says some entrepreneurs/business owners struggle to answer those two basic questions. Eric maintains that it is critical to know what you are about and what your direction is to make intelligent decisions in your business. Eric offers the example of Nike to prove this point. He says that Nike’s mantra is “to experience the emotion of competition, winning, and crushing competitors”. He says Nike married this with where they wanted their business is go, which they identified in the 1960s as “to crush Adidas”.

Eric explains his own long-term business plan. He says he is on a “20 year journey building a business education company on the foundation of courage, excellence, and value – generously giving of myself so that others experience abundance“. He says he marries this to 90-day planning windows. He says the 90-day strategic plans are where he reevaluates and repurposes efforts. During these evaluations he asks such questions as: What should we start doing/What should we stop doing to get where we want to go?

Eric is adamant that every business owner should stop and think every 90-days to be truly innovative. He says the 90-day evaluations should be translated into monthly, weekly and daily activities. He says this is where courage as an entrepreneur gets really practical.

If you would like to hear my conversation with Eric, please click here.

Courageous entrepreneurs with Eric Anderton

Eric Anderton, CEO of the ABC Group, joined me on Money 2.0 to discuss the various aspects of being and operating as an entrepreneur. Eric has a long career as an entrepreneur and businessman, and is also a keynote speaker, trainer, and business consultant.

Eric Anderton, CEO of the ABC Group, joined me on Money 2.0 to discuss the various aspects of being and operating as an entrepreneur. Eric has a long career as an entrepreneur and businessman, and is also a keynote speaker, trainer, and business consultant.

Our discussion begins on the shared view Eric and I have on the necessity of entrepreneurs in this economy and generally as the backbone of our country. Eric mentions that he is working on a book about entrepreneurship called The Courageous Entrepreneur, set to be released late in 2014.

Eric explains why he believes courageousness is an integral part of being an entrepreneur. He says entrepreneurs need courage and intelligent action to be successful. Eric says that innovation & marketing are the basic elements that make an entrepreneur. Eric maintains that innovation, the introduction of something new – a new method or device – is best thought through when you ask three key questions:

1) What is desirable to people; to the market?

2) What is possible – with the people you work with; with your own skill set; with technology?

3) What is viable; will people pay for it?

Eric says you need to ask these questions to get an idea going. You need to ask yourself these questions continually as well to reevaluate what you are doing and where you are going.

Eric talks about his consulting business where he walks business owners through these questions and more to help them formulate their business and marketing plans. Eric believes strongly that business is guided best through “intelligent and consistent action that is inspired through a higher purpose”.

Eric says when he first sits down with potential clients, he asks: “Why does your business exist?” and “Where is it going?” He says some entrepreneurs/business owners struggle to answer those two basic questions. Eric maintains that it is critical to know what you are about and what your direction is to make intelligent decisions in your business. Eric offers the example of Nike to prove this point. He says that Nike’s mantra is “to experience the emotion of competition, winning, and crushing competitors”. He says Nike married this with where they wanted their business is go, which they identified in the 1960s as “to crush Adidas”.

Eric explains his own long-term business plan. He says he is on a “20 year journey building a business education company on the foundation of courage, excellence, and value – generously giving of myself so that others experience abundance“. He says he marries this to 90-day planning windows. He says the 90-day strategic plans are where he reevaluates and repurposes efforts. During these evaluations he asks such questions as: What should we start doing/What should we stop doing to get where we want to go?

Eric is adamant that every business owner should stop and think every 90-days to be truly innovative. He says the 90-day evaluations should be translated into monthly, weekly and daily activities. He says this is where courage as an entrepreneur gets really practical.

If you would like to hear my conversation with Eric, please click here.

Only Reason A Business Never Sells

There is only one reason a business never sells. I can already hear you reading the headline and saying to yourself – what’s Andrew talking about. Yet it’s true and I would suggest every seller fails to consider it properly when trying to sell their business. Sure, there are many situations a business does not sell but there is only one reason.

Here are a four situations that prevent a business from selling.

1. A buyer with no money.It seems obvious but it amazes me how often I get calls from buyers inquiring about a business I have for sale and when they return the Personal Financial Statement I request with the Non-Disclosure Agreement their Liabilities exceed their Assets. When I phone to make sure the numbers are correct, they agree they don’t have any downpayment to buy a business but their explanation is that they presume the seller wants to sell and so would be willing to carry seller finance, that is, they expect the seller will carry 100% seller finance.

A buyer with an inadequate down-payment is not a buyer. They are simply a person with too much spare time on their hands as they will not be able to buy a business.

The other type of buyer which is similar to this ‘no down-payment’ buyer is the one that says they are being financed by investors. As soon as I hear this my request is to only speak with the investor as they will be the party to make any final decisions about the purchase.

One of the reasons I joined the Sacramento County Bar Association and CalCPA was so I could meet attorneys and accountants that specialize in helping business owners buy or sell a business.

A divorce attorney, personal accident injury attorney or bankruptcy attorney is not the lawyer I want helping with the sale of a business. It requires a different skill and knowledge set.

Equally, many accountants enjoy the very difficult work of putting together tax returns and financial statements but the predominate service they provide the business owner is looking backward to advise how well they did and that’s the extent of their help. Selling a business is a proactive and reactive process with one of the main pieces a seller needs help with understanding how much tax they would have to pay if the business sells. This is done during the negotiations as part of the Purchase Price or tax allocation. It also varies with different buyers wanting a different allocation and is one of the mains reasons why I use a CPA that specializes in the area is so the final tax allocation is fair to both buyer and seller.

3. Too many decision makersIn early 2013 I closed the $2.25 million sale of a family business. The business had been around for about 74 years and therefore had many family members with an ownership interest in the business from the grandfather or great grandfather that originally started the business. The company was run by a board of 9 family members. After working with a buyer for just on 11 months, a final board meeting was required where all shareholders had to approve the sale or it would die. If one family member was to vote against the sale it could not happen. As you can guess, one family member with less than 1% stock in the corporation decided they didn’t want to approve the sale because of something that happened about 32 years earlier.

Selling a business has many moving parts. Each shareholder in a business has its own personalities and motivations. The main reason we were able to get so far into the transaction was that one member was the point of contact and it was their role to communicate to the rest of the family.

4. What’s on the tax return is what the business makesBusiness owners are by nature optimistic. If they were not they would never go into business in the first place. Optimism however shows up when the seller wants to sell as they are able to highlight all the positives of the business; which makes perfect sense, but they also want to highlight all the potential earnings and ask the buyer to pay for it as part of their purchase price of the business.

One of the steps I take when putting the sale of a business together is to do a valuation so it recognizes the performance of the business. I buy data to see what the same type of business sells for in the same industry, that is, I compare apples with apples. For a buyer to achieve the potential the seller chooses to highlight, the buyer will have to spend their time and money upgrading the equipment, training and re-training the employees, adapting and deploying new technologies all of which requires constant attention.

In case you were wondering, what is the only one reason a business never sells? A business never sells unless there is a motivated buyer and a motivated seller. If one is missing the business never sells. You can have the most motivated, skilled, experienced, enthusiastic and financially qualified buyer but if the seller gets cold feet and decides they will not sell; it’s all over. Equally, you can have a seller that wants to offer what they consider the best price and the best terms of the sale but if the buyer is not motivated, for whatever reason, the business will not sell to this buyer. My role as the broker in the transaction includes to set things up for success, reach as many buyers as possible, organize third party finance such as an SBA loan if necessary and keep the communication wide open between all parties. Which is what I love to do.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my webpage Business valuation. For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

Only reason a business never sells

Successfully sell your business

There is only one reason a business never sells. I can already hear you reading the headline and saying to yourself – what’s Andrew talking about. Yet it’s true and I would suggest every seller fails to consider it properly when trying to sell their business. Sure, there are many situations a business does not sell but there is only one reason.

Here are a four situations that prevent a business from selling.

1. A buyer with no money.It seems obvious but it amazes me how often I get calls from buyers inquiring about a business I have for sale and when they return the Personal Financial Statement I request with the Non-Disclosure Agreement their Liabilities exceed their Assets. When I phone to make sure the numbers are correct, they agree they don’t have any downpayment to buy a business but their explanation is that they presume the seller wants to sell and so would be willing to carry seller finance, that is, they expect the seller will carry 100% seller finance.

A buyer with an inadequate down-payment is not a buyer. They are simply a person with too much spare time on their hands as they will not be able to buy a business.

The other type of buyer which is similar to this ‘no down-payment’ buyer is the one that says they are being financed by investors. As soon as I hear this my request is to only speak with the investor as they will be the party to make any final decisions about the purchase.

One of the reasons I joined the Sacramento County Bar Association and CalCPA was so I could meet attorneys and accountants that specialize in helping business owners buy or sell a business.

A divorce attorney, personal accident injury attorney or bankruptcy attorney is not the lawyer I want helping with the sale of a business. It requires a different skill and knowledge set.

Equally, many accountants enjoy the very difficult work of putting together tax returns and financial statements but the predominate service they provide the business owner is looking backward to advise how well they did and that’s the extent of their help. Selling a business is a proactive and reactive process with one of the main pieces a seller needs help with understanding how much tax they would have to pay if the business sells. This is done during the negotiations as part of the Purchase Price or tax allocation. It also varies with different buyers wanting a different allocation and is one of the mains reasons why I use a CPA that specializes in the area is so the final tax allocation is fair to both buyer and seller.

3. Too many decision makersIn early 2013 I closed the $2.25 million sale of a family business. The business had been around for about 74 years and therefore had many family members with an ownership interest in the business from the grandfather or great grandfather that originally started the business. The company was run by a board of 9 family members. After working with a buyer for just on 11 months, a final board meeting was required where all shareholders had to approve the sale or it would die. If one family member was to vote against the sale it could not happen. As you can guess, one family member with less than 1% stock in the corporation decided they didn’t want to approve the sale because of something that happened about 32 years earlier.

Selling a business has many moving parts. Each shareholder in a business has its own personalities and motivations. The main reason we were able to get so far into the transaction was that one member was the point of contact and it was their role to communicate to the rest of the family.

4. What’s on the tax return is what the business makesBusiness owners are by nature optimistic. If they were not they would never go into business in the first place. Optimism however shows up when the seller wants to sell as they are able to highlight all the positives of the business; which makes perfect sense, but they also want to highlight all the potential earnings and ask the buyer to pay for it as part of their purchase price of the business.

One of the steps I take when putting the sale of a business together is to do a valuation so it recognizes the performance of the business. I buy data to see what the same type of business sells for in the same industry, that is, I compare apples with apples. For a buyer to achieve the potential the seller chooses to highlight, the buyer will have to spend their time and money upgrading the equipment, training and re-training the employees, adapting and deploying new technologies all of which requires constant attention.

In case you were wondering, what is the only one reason a business never sells? A business never sells unless there is a motivated buyer and a motivated seller. If one is missing the business never sells. You can have the most motivated, skilled, experienced, enthusiastic and financially qualified buyer but if the seller gets cold feet and decides they will not sell; it’s all over. Equally, you can have a seller that wants to offer what they consider the best price and the best terms of the sale but if the buyer is not motivated, for whatever reason, the business will not sell to this buyer. My role as the broker in the transaction includes to set things up for success, reach as many buyers as possible, organize third party finance such as an SBA loan if necessary and keep the communication wide open between all parties. Which is what I love to do.

Are you thinking about selling your business and move to your next challenge? Would you like to know the value of your business? If you would like more information please visit my webpage Business valuation. For more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

April 16, 2014

How to Find the Right Franchise to Buy

The American Dream is to own and operate your own business. Why work for your boss and build their dream? It all sounds simple enough. Decide you want to own and operate your own business, find it and get on with it. As they say, if it was that simple everyone would do it.

So where’s a good place to start?

I get calls every week from people looking to own and operate their own business. As carefully as I can, I try to find out why you want to put your personal life on hold and dedicate yourself to owning your own business; and after owning and operating 5 of my own businesses in two countries it does require making sacrifices to get it all lined up and working properly.

What is intriguing is that the individual motivations vary and they are unique and include, “I don’t like to work for someone else, I want to do it myself.” “I’m tired of working at different jobs and being laid off.” “I’ve seen how my business runs their business and I think I can do it better or just as well.”

If becoming a business owner is top of your mind, how do you choose the right franchise? Just as importantly, where do I start?

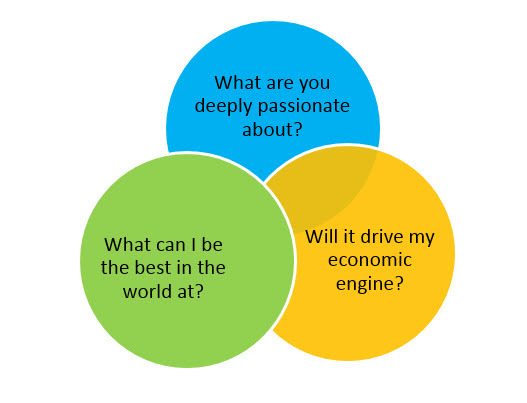

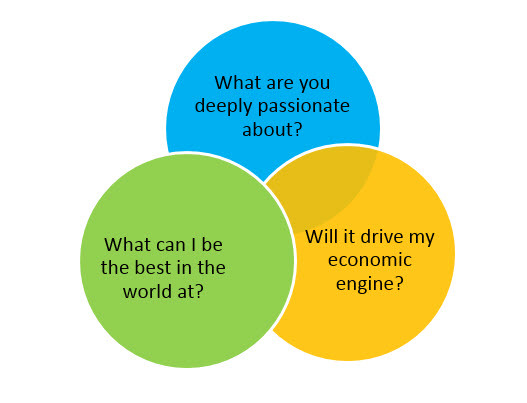

My solution is to start with what I call the three legged stool of success. The three legged stool of success requires you to look at your strengths and skills with the following by answering the following three questions so it unlocks who you are and what you are about.

Owning a franchise or business comes with a huge change in lifestyle while you learn new skills and managing the risk of business ownership. If you are doing something you love and bounce out of bed every morning as there are things to do that you want to do and be successful, that is the number one key to your success.

2. What can I be the best in the world at?It’s almost guarantee that you won’t be the only business offering your product or service. You will have competition. Having competition means you have to work to your highest level possible to achieve success. One of my primary goals with each of the five businesses I have owned and operated was simply to aim to be the best in the world. If you are the best at what you do, you have no competition. If you also are the best in the world your customers will become your cheapest and best marketing as they will shout your praises and drive more business to you. It’s that simple.

3. Will it drive my economic engine?It is very hard to make a business out of collecting and selling stamps, playing chess or being the best cheerleader for your favorite local football team. These are hobbies and by definition, a hobby is not a business as it simply doesn’t pay enough. If you can find a business you are passionate about and will allow you to be the best in the world, make sure it brings the income you need to not only build and sustain the business, but feed your family, pay your bills, fund your retirement and have a little left over in case the business isn’t running as well as you would like.

Owning and operating a franchise is not for everyone. However, neither is starting a new business from scratch or trying to find the right existing business to buy. Use the three legged stool to help guide you and one of the best things about buying a franchise is the large range of franchises in so many different industries.

If you would like more information about buying a franchise please visit my webpage Buy a franchise or buy a copy of my book – Successfully buy your franchise. For more immediate help with buying a franchise, send an email to Andrew Rogerson or give me a call on 916 570-2674.

How to find the right franchise to buy

The American Dream is to own and operate your own business. Why work for your boss and build their dream? It all sounds simple enough. Decide you want to own and operate your own business, find it and get on with it. As they say, if it was that simple everyone would do it.

So where’s a good place to start?

I get calls every week from people looking to own and operate their own business. As carefully as I can, I try to find out why you want to put your personal life on hold and dedicate yourself to owning your own business; and after owning and operating 5 of my own businesses in two countries it does require making sacrifices to get it all lined up and working properly.

What is intriguing is that the individual motivations vary and they are unique and include, “I don’t like to work for someone else, I want to do it myself.” “I’m tired of working at different jobs and being laid off.” “I’ve seen how my business runs their business and I think I can do it better or just as well.”

If becoming a business owner is top of your mind, how do you choose the right franchise? Just as importantly, where do I start?

My solution is to start with what I call the three legged stool of success. The three legged stool of success requires you to look at your strengths and skills with the following by answering the following three questions so it unlocks who you are and what you are about.

Owning a franchise or business comes with a huge change in lifestyle while you learn new skills and managing the risk of business ownership. If you are doing something you love and bounce out of bed every morning as there are things to do that you want to do and be successful, that is the number one key to your success.

2. What can I be the best in the world at?It’s almost guarantee that you won’t be the only business offering your product or service. You will have competition. Having competition means you have to work to your highest level possible to achieve success. One of my primary goals with each of the five businesses I have owned and operated was simply to aim to be the best in the world. If you are the best at what you do, you have no competition. If you also are the best in the world your customers will become your cheapest and best marketing as they will shout your praises and drive more business to you. It’s that simple.

3. Will it drive my economic engine?It is very hard to make a business out of collecting and selling stamps, playing chess or being the best cheerleader for your favorite local football team. These are hobbies and by definition, a hobby is not a business as it simply doesn’t pay enough. If you can find a business you are passionate about and will allow you to be the best in the world, make sure it brings the income you need to not only build and sustain the business, but feed your family, pay your bills, fund your retirement and have a little left over in case the business isn’t running as well as you would like.

Owning and operating a franchise is not for everyone. However, neither is starting a new business from scratch or trying to find the right existing business to buy. Use the three legged stool to help guide you and one of the best things about buying a franchise is the large range of franchises in so many different industries.

If you would like more information about buying a franchise please visit my webpage Buy a franchise or buy a copy of my book – Successfully buy your franchise. For more immediate help with buying a franchise, send an email to Andrew Rogerson or give me a call on 916 570-2674.

March 31, 2014

Business valuation trends in 2014

Owning and managing a business hopefully comes with lots of stable and ‘normal’ times but it also comes with extreme highs and lows and lots of drama in between. In September 2008 the Great Financial Recession hit hard and hit every business in the US and reverberated around the world considerably lowering their valuation.

Over the last 6 years the economy has stabilized and continues to grow but we feel like we are still in recession. It is therefore constructive to look at the business valuation data to see where we have come from and where we are going.

Pratt’s Stats is a company that collects data on the merger of and acquisition of privately held businesses and just concluded a recent analysis of 2013 data. Here’s some of their highlights which shows business valuations are getting stronger and returning to normal levels.

Business valuation trendsBusiness values are on the rise:The median selling price to EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) was 2.96 times which was up slightly from 2.88 times in 2012.Manufacturing was the major sector with the greatest median selling price to EBITDA at 5.69 times.Retail was the sector with the lowest at 2.01 timesThe Tech sector, which is considered a subsector of the ‘Services’ industry continues to have a very impressive median selling price to EBITDA at 12.98 times in 2013.Public companies buying privately held companies are much more aggressive with their acquisitions. The median selling price to EBITDA was 9.55 times while individuals buying companies was 2.78 times.The size of revenue also matters. That is, the highest net sales tend to have a larger median selling price to EBITDA ratio than the companies with lower net sales. The actual numbers were not provided but breaking down the amount of revenue into five equal sized quintiles, the ratio declines from 6.02x to 3.13x to 2.63x to 2.45x to 2.00x, respectively.Healthcare valuation multiples increase slightlyDespite all the change in the healthcare industry due to the Affordable Care Act, Mergers and Acquisition activity is returning from the data put together by Frost and Sullivan. Frost and Sullivan employ approximately 1800 analysts world-wide to analyze the growth of companies, identify opportunities and best practices. The segments they expect to attract the most activity include post-acute care, surgical and emergency center segments.

Small online business valuationsAnother company called Digital Exits looked at what is happening with the value of small businesses that specialize in selling online products or services. Their study was of 250 sales transactions and here’s what they found.

The average sale price of an online business that sold was $514,725On average, the final sale price was 90% of the asking priceE-commerce and advertising websites were able to attract the highest multiple at 2.6 times earningsFor websites that generated leads, they had the lowest multiple at 1.8 times earningsThe study is adding the 2013 data and it expects the average multiple to increase from 2.6 to 2.8 times earnings.Are you ready to sell your business and move to your next challenge? Would you like to know the value of your business? How about own and operate your own franchise? If you would like more information please visit my webpage Rogerson Business Services. If you would like more immediate help you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

March 28, 2014

License and permits to operate a business

There are many laws that apply to owning and operating a business. There are Federal laws including the requirements of the Internal Revenue Service. There are State laws including the different legal entities you can choose and the selling, sales and use taxes and distribution of alcohol. You then have local laws that are enforced at the County or Parish level that cover licenses and permits to operate certain types of businesses.

To make sure you comply with the local licenses and permits where you live, either go online and find your local county website and check out what you require for what reasons or go in and speak to one of their advisors at their front counters. Face to face is probably the best way to go as you can ask questions and get clear answers on what you need to do, when you need to do them, the costs and many other pieces of information.

If you are required to obtain a license or permit, there will inevitably be forms to complete and a process to follow. While you are at the front counter you can get the forms and understand the process you need to follow to make sure the paperwork is filed correctly.

What type of licenses or permits are required? You may be surprised, hence the reason I recommend you go and speak to someone in person. Because of a license requirement you may decide not to offer that product or service. Some obvious examples of licenses and permits include selling tobacco, firearms, alcohol and food (restaurants and cafes etc.) Some lesser known examples include a permit to conduct a public dance, daycare or child care service, palm reading or fortune telling, dismantle autos, arcade and gaming centers.

Owning and operating a business is all about minimizing risk. Do your research properly the first time and follow the law with what you need and should not be doing so you can focus on the very reason you went into business in the first place and that was to make a profit.

If you would like more information about selling a business, buying a business, buying a franchise or a related service such as valuing a business, please visit my webpage Services and choose from the drop down menu the information you would like. For more immediate help, you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

March 26, 2014

Is a technology franchise right for you?

The lifeblood of any business is the reliability and strength of their IT. Small to medium-sized businesses need affordable, dependable IT support solutions. CMIT Solutions is a leading provider of IT services for small and mid-sized businesses (SMBs). They operate on a managed services model that offers specialized outsourced IT services at affordable and consistent monthly rates.

The lifeblood of any business is the reliability and strength of their IT. Small to medium-sized businesses need affordable, dependable IT support solutions. CMIT Solutions is a leading provider of IT services for small and mid-sized businesses (SMBs). They operate on a managed services model that offers specialized outsourced IT services at affordable and consistent monthly rates.

CMIT Solutions helps entrepreneurs tap into the growing market for small business IT support. Over the past 18 years, they have grown to 130 franchise units that are operated by local entrepreneurs. Their services include monitoring servers and software 24-7, resolving IT issues as they occur, storing data securely, and implementing disaster recovery processes.

SMBs represent a market niche that IT companies have neglected. Major technology companies rely on high-dollar accounts and generally ignore businesses with five to 99 employees. The only real competition for the SMB market are the “break-fix” vendors that usually cannot offer round-the-clock support, affordable bundled services, or long-term relationships. CMIT Solutions offers SMBs proactive and reliable IT help, helping businesses avoid “break-fix” solutions.

Is a CMIT Solutions franchise right for you? Below are company highlights to consider.

Industry trends:Technology is becoming more complex and advancing more rapidly.Small business functions, from billing to marketing to customer service, rely almost exclusively now on IT systems.Most small businesses do not specialize in technology, creating more demand for dependable tech specialists.Technology is more widely available than ever, which means its use by small businesses will continue to increase.The proliferation of mobile devices (laptops, smart phones, tablets) and the additional security risks they represent are issues that most small businesses are not prepared to address.Industry Statistics:Small businesses –

Represent 99.7 percent of the 6 million American employer firms.Employ just over half of all private sector employees.Pay 44 percent of total U.S. private payroll.Create more than half of private, non-farm gross domestic product.Have created 64 percent of net new jobs over the last 15 years.Hire 40 percent of high-tech workers.Small business and technology –

American SMBs were expected to spend more than $125 billion on technology in 2011, up from $120 billion in 2010.The International Data Corporation predicts that SMB IT spending worldwide will reach nearly $630 billion in 2014, with annual growth averaging 5.5 percent.Of American SMBs, 71 percent expected their IT budgets to grow in 2011.Eight of every 10 American SMBs consider themselves early or middle adopters when asked how quickly they adopt new technology – indicating that businesses are willing to spend to keep technology up to date even with limited budgets and staff.Only 25 percent of SMBs currently use mobile solutions, but 43 percent expect to be using them within the next 12 months.Nearly one-third of SMBs have adopted some form of cloud technology, and 35 percent expect to begin using the cloud in some form within the next yearThe Opportunity for outsourced IT solutions -

SMB owners say their three top IT challenges are: IT budget constraints, aging IT products, and costly maintenance.The top five drivers for IT purchases: general upgrades, improvement in speed or performance, improvement in employee productivity, desire for new capabilities, reduction of complexity.Of small firms, 57 percent rely on internal, non-IT staff for IT support.(Source: Technology Adoption Trends Study, CompTIA)

“Solution providers should take advantage of the opportunity here. Keeping in mind that small businesses have little time to devote to IT analysis, providers should present concise descriptions of products or services that will bring rapid return on investment.”“Most small and medium businesses handle IT support internally, so there is ample opportunity for service providers to market the benefits of outsourcing.”Key CMIT Solutions business features include:White collar, Executive modelRecurring revenue creates higher business valuation, steady income streamLow number of Professional employeesBusiness to Business – 8-5 Monday through Friday600 billion dollar, underserved market in the SMB spaceHigh marginsRamp time can vary depending on the ability of the candidate to create relationships and businessBenefits of a CMIT Solutions franchise include:Recession Resistant – small businesses are more stable in the US and they NEED outsourced IT solutionsCompetition – Competition exists at the local level primarily with several independent type 1-2 person shops. Most of these are reactive to their clients’ needs. Some strong regional players; less competition from other franchise concepts.An ideal candidate would be:People with business backgrounds and sales/marketing experience.Candidates with IT management experiences are a big plus.Must be a strong leader, have passion for achieving results through others, be a good judge of character, and have an affinity for building long-term client relationships.Role of franchisee:Networking, sales, identifying technology challenges with local business owners, manage client relationships – building a “Trusted Advisor” role with clients. Scalable business model with few employees, low overhead and high margins.Total investment in a CMIT Solutions franchise:

The total investment range is $129,300 – $170,000.

If you would like more information about buying a franchise please visit my webpage Buy a franchise or buy a copy of my book – Successfully buy your franchise. If you would like more immediate help with buying a franchise you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.

Is a CMIT Solutions franchise right for you?

The lifeblood of any business is the reliability and strength of their IT. Small to medium-sized businesses need affordable, dependable IT support solutions. CMIT Solutions is a leading provider of IT services for small and mid-sized businesses (SMBs). They operate on a managed services model that offers specialized outsourced IT services at affordable and consistent monthly rates.

The lifeblood of any business is the reliability and strength of their IT. Small to medium-sized businesses need affordable, dependable IT support solutions. CMIT Solutions is a leading provider of IT services for small and mid-sized businesses (SMBs). They operate on a managed services model that offers specialized outsourced IT services at affordable and consistent monthly rates.

CMIT Solutions helps entrepreneurs tap into the growing market for small business IT support. Over the past 18 years, they have grown to 130 franchise units that are operated by local entrepreneurs. Their services include monitoring servers and software 24-7, resolving IT issues as they occur, storing data securely, and implementing disaster recovery processes.

SMBs represent a market niche that IT companies have neglected. Major technology companies rely on high-dollar accounts and generally ignore businesses with five to 99 employees. The only real competition for the SMB market are the “break-fix” vendors that usually cannot offer round-the-clock support, affordable bundled services, or long-term relationships. CMIT Solutions offers SMBs proactive and reliable IT help, helping businesses avoid “break-fix” solutions.

Is a CMIT Solutions franchise right for you? Below are company highlights to consider.

Industry trends:Technology is becoming more complex and advancing more rapidly.Small business functions, from billing to marketing to customer service, rely almost exclusively now on IT systems.Most small businesses do not specialize in technology, creating more demand for dependable tech specialists.Technology is more widely available than ever, which means its use by small businesses will continue to increase.The proliferation of mobile devices (laptops, smart phones, tablets) and the additional security risks they represent are issues that most small businesses are not prepared to address.Industry Statistics:Small businesses –

Represent 99.7 percent of the 6 million American employer firms.Employ just over half of all private sector employees.Pay 44 percent of total U.S. private payroll.Create more than half of private, non-farm gross domestic product.Have created 64 percent of net new jobs over the last 15 years.Hire 40 percent of high-tech workers.Small business and technology –

American SMBs were expected to spend more than $125 billion on technology in 2011, up from $120 billion in 2010.The International Data Corporation predicts that SMB IT spending worldwide will reach nearly $630 billion in 2014, with annual growth averaging 5.5 percent.Of American SMBs, 71 percent expected their IT budgets to grow in 2011.Eight of every 10 American SMBs consider themselves early or middle adopters when asked how quickly they adopt new technology – indicating that businesses are willing to spend to keep technology up to date even with limited budgets and staff.Only 25 percent of SMBs currently use mobile solutions, but 43 percent expect to be using them within the next 12 months.Nearly one-third of SMBs have adopted some form of cloud technology, and 35 percent expect to begin using the cloud in some form within the next yearThe Opportunity for outsourced IT solutions -

SMB owners say their three top IT challenges are: IT budget constraints, aging IT products, and costly maintenance.The top five drivers for IT purchases: general upgrades, improvement in speed or performance, improvement in employee productivity, desire for new capabilities, reduction of complexity.Of small firms, 57 percent rely on internal, non-IT staff for IT support.(Source: Technology Adoption Trends Study, CompTIA)

“Solution providers should take advantage of the opportunity here. Keeping in mind that small businesses have little time to devote to IT analysis, providers should present concise descriptions of products or services that will bring rapid return on investment.”“Most small and medium businesses handle IT support internally, so there is ample opportunity for service providers to market the benefits of outsourcing.”Key CMIT Solutions business features include:White collar, Executive modelRecurring revenue creates higher business valuation, steady income streamLow number of Professional employeesBusiness to Business – 8-5 Monday through Friday600 billion dollar, underserved market in the SMB spaceHigh marginsRamp time can vary depending on the ability of the candidate to create relationships and businessBenefits of a CMIT Solutions franchise include:Recession Resistant – small businesses are more stable in the US and they NEED outsourced IT solutionsCompetition – Competition exists at the local level primarily with several independent type 1-2 person shops. Most of these are reactive to their clients’ needs. Some strong regional players; less competition from other franchise concepts.An ideal candidate would be:People with business backgrounds and sales/marketing experience.Candidates with IT management experiences are a big plus.Must be a strong leader, have passion for achieving results through others, be a good judge of character, and have an affinity for building long-term client relationships.Role of franchisee:Networking, sales, identifying technology challenges with local business owners, manage client relationships – building a “Trusted Advisor” role with clients. Scalable business model with few employees, low overhead and high margins.Total investment in a CMIT Solutions franchise:

The total investment range is $129,300 – $170,000.

If you would like more information about buying a franchise please visit my webpage Buy a franchise or buy a copy of my book – Successfully buy your franchise. If you would like more immediate help with buying a franchise you are welcome to send an email to Andrew Rogerson or give me a call on 916 570-2674.