Ezra Roizen's Blog, page 2

April 9, 2024

MBP: Valuation = Opportunity / Scarcity

As discussed in the MBP book, the core equation for startup M&A valuation is opportunity divided by scarcity (in the context of each potential strategic partner’s (“PSP’s”) strategy - the equation changing from pairing-to-pairing). If the PSP and you develop a strategy with a billion dollars in value, and they perceive your startup as the only way to unlock that value, then your scarcity denominator is one and you’ll receive max value. However if you are one of ten ways they could unlock the opportunity then your value drops precipitously.

Most startups have a handle on how to develop the opportunity part of the equation. They have a good feel for the macro trends, customer needs, and market gaps. However, it’s surprising how few startups have an equality developed articulation of their scarcity. We’re going to remedy that right here.

The broad view of scarcity

Scarcity is much more than a few pieces of intellectual property. It’s all that you are - you’re going to want to take a broad view. Additionally, your value to a PSP isn’t just in what you are today, but it’s in your ability to help them unlock a much bigger future. Your scarcity narrative is the story of your startup in motion towards a much bigger future.

Ultimately your scarcity narrative is going to be contoured to your startup, but as a starting point there are elements that I’d say are pretty much universally applicable, these would be:

Platform

Team

Industry knowledge

Design expertise

Proprietary techniques

Extended ecosystem

You’ll find that as you develop your thoughts on each of these elements other elements unique to your situation will be revealed. Remember, your scarcity is in the context of the PSP’s view of the opportunity - so the weight of different elements will change based on their priorities.

Platform

Think of the concept of “platform” in two ways: 1) as encompassing the technology you’re developing; and 2) as anticipating that your current efforts are the base for a next round of innovation in collaboration with the PSP. Your current efforts are just the most recent manifestation of a much larger vision. You’re always becoming.

As you lay out your platform, a few elements that will typically be featured:

Your current capabilities and offerings

Architecture and technology stack

Intellectual property and significant innovations (not every important innovation has a patent on it - discuss hard problems you’ve solved)

Important integrations (don’t underestimate the work you’ve done to harmonize third party services)

Platform is the starting point, but it’s just the starting point.

Team

Getting a startup off the ground is a herculean effort; a seemingly impossible process of forming hard-to-find financial and human capital. I’d say the latter is the hardest part: identifying, recruiting, and synchronizing a world class team to work on a cutting edge problem is no trivial feat. Your team is likely your greatest accomplishment. Your team is what’s going to power the PSP’s strategy, and you’ll want to show that it’s the right one to do it.

Think of your team as a person. How would you describe that person? What would be their credentials? What would establish their credibility? What would their core competencies be? In what areas do they excel?

Beyond core competencies outline whatever else sets your team apart. Prior work experiences, educational backgrounds, technical and innovative accomplishments. Extending further, what can you describe about your culture? How has your team come together into a cohesive unit?

Make the story of your team the centerpiece of your scarcity narrative. Showcase their strength and cohesion.

Platform and team are the two big rocks of scarcity - but they're not the only stones. Let’s dig deeper and uncover the rest of the story.

March 11, 2024

Free MBP Book + MBP.co Office Hours

For this week (March 11 to 15) we’ve unlocked the Kindle app version of the Magic Box Paradigm book for free download. Spread the word. Must read for startup leaders. Get the MBP book for FREE here.

In addition, for paid MBP.co subscribers we’re holding MBP office hours on March 21st at 8am PT. This is a great opportunity to get your startup strategic partnership and M&A questions answered.

The meeting information is:

March 2, 2024

MBP: Startup M&A Bidding Wars

If you haven’t already - get the second edition of the MBP book here. This all makes a lot more sense if you’ve read the book!

The prevailing wisdom in startup M&A is that the best way to maximize price is to drive competition. The holy grail being a bidding war between aggressive acquirers. That you should design your startup M&A strategy with the ultimate objective of creating a highly competitive field of potential acquirers. Talk to virtually any investment banker, and many board members, they will immediately default to “competitive process” as the driving force in startup M&A valuation.

Bidding wars happen, and in some cases they can enhance an outcome. But be careful if you’re designing a strategy that has as its singular focus a culmination in a bidding war.

The MBP posits that you might in fact be the casualty in a bidding war. I’d argue that a bidding war is at best a fortunate byproduct of a well executed strategy, and at worst a bad idea.

Let’s unpack why.

PBI size and strength

As it says in the MBP book valuation is derived from the unique utility of your startup to each particular buyer. Each buyer-seller pairing has its own valuation profile. This is because the partner big idea (“PBI”) powering the acquisition is going to be different from buyer to buyer. One PBI may be massive in scale, while another may be much more modest.

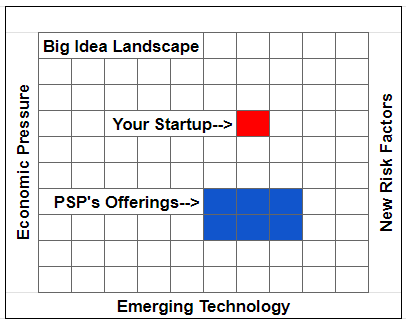

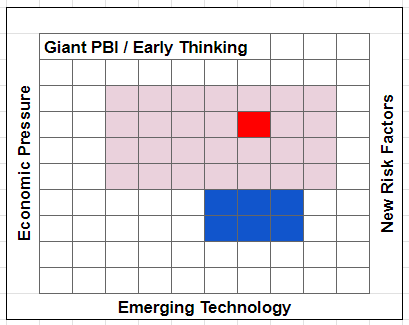

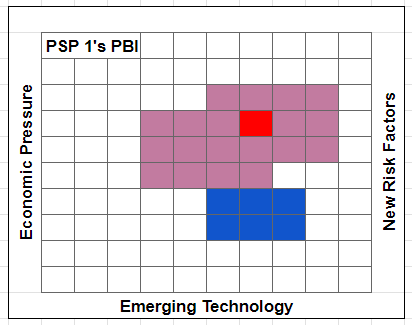

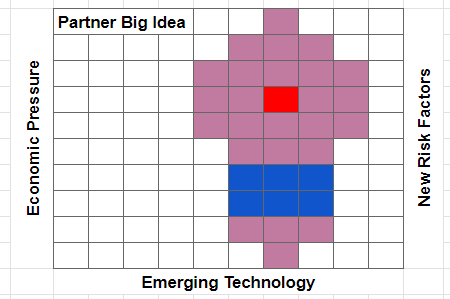

In the MBP.co post MBP New Gap Chapter 5.5: PSP liftoff I introduced the Big Idea Landscape concept. Where we think of the PBI in terms of squares on a grid. Let’s employ this grid again, but this time in the context of bidding wars.

The Big Idea Landscape frames the PBI within the major market forces creating the opportunity for the potential strategic partner (“PSP”) and your startup.

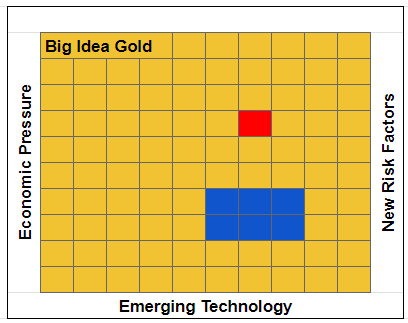

There are 100 squares, but only 7 filled in. The PSP has 6 elements of the big idea and your startup has 1. The 97 other squares are the gold. It's in these squares that together you’re going to build the partner big idea.

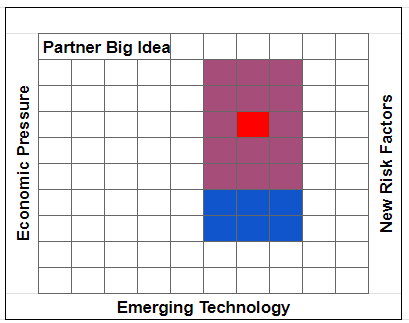

You want the PBI to be big, and for your startup to be at the center of it. The PBI is represented by the purple squares (purple being a blend of your red square and their blue squares). You are in the middle of the action - you are the key square that unlocks the other squares. One square to rule them all, my precious.

You want your valuation to be a function of the potential of the purple squares - not simply the intrinsic value of your red square. You want to be valued on what the PBI will be, not what your startup is today.

Let’s add one more dimension to the purpleness of the PBI squares, shade. The darker the squares the greater the commitment that the PSP has to the PBI.

Lots of factors go into commitment. As we saw in the MBP.co post on the Waze acquisition the deal with Buyer A fell apart because it came to pass that the acquisition thesis wasn’t as clear as everyone had hoped, the teams didn’t click, and there was a lack of executive leadership for the PBI. The PBI covered a lot of squares, but it was in a light shade of purple.

PBI scenarios

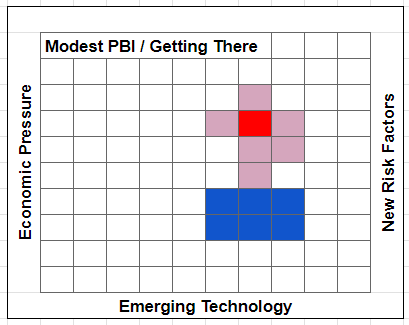

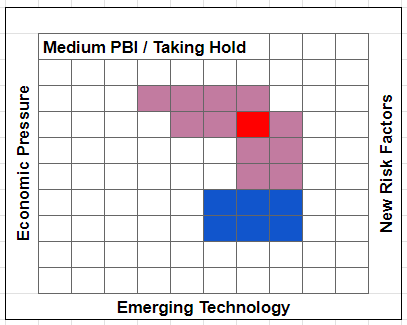

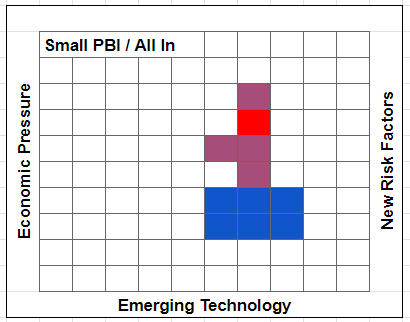

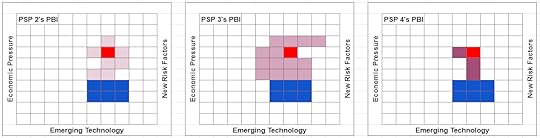

Let’s plot a few PBIs at various levels of maturity (and an update from the original post - and per a great question from Marty McMahon - in reality the blue squares would be in different locations and different number from PSP to PSP - but to keep things simple I’m keeping them in the same spot).

Potentially giant PBI but still very early in its formation (light shade):

Modest PBI that’s starting to gain some traction in the organization (shade getting darker):

Medium sized PBI taking hold in the organization, on the verge of getting serious (shade is almost dark):

Pretty small PBI, but they are ready to roll, all in (doesn’t get more purple than that)!

Understanding PBI size, shape, and shade

Most PSPs are large, distributed, organizations and getting alignment on even relatively small decisions takes time. Now imagine the kind of time it takes to align on a massive new strategy, in a brand new arena.

Remember it’s not just a small decision about acquiring your red square, it’s a much bigger decision about entering all the purple squares. In the MBP book I dive into the process of developing PBIs, but the complexity doesn’t stop with just the development of the PBI. The PBI exists in the PSP’s organizational context. To execute the PBI the PSP is going to need a mountain of organizational alignment. Just a short list aligning elements: corporate objectives, product strategy, economics, regulations and compliance, operations, cultural, deal team capacity, executive sponsorship, and business unit leadership. The fewer of the key elements aligned at the PSP, the lighter the shade of purple.

Further, it’s risky to think that pressure from the startup is going to coalesce the PBI and darken the shade of purple. More often than not startup pressure is going to cause the PBI to fade away.

The other problem is that if you’re not working closely with a given PSP you don’t know the real shape and size of their PBI, let alone its shade. If we look again at Waze’s first (failed) run with Buyer A, we see that they jumped into deal mode while the PBI’s shade was still pretty light - resulting in a failed deal. There’s an argument to be made that moving that process more slowly, deeply understanding the nature of the PBI, and the level of commitment Buyer A actually had to it, before diving into deal-mode would have been a better plan.

Moving thoughtfully through the PBI build-up process will give you a much clearer understanding of the size, shape, and most importantly, the shade of each PSP’s PBI. This participation in the PBI creation process will enable you to do everything you can to develop the biggest PBI possible, while also giving you critical visibility into the PSP’s position. Don’t fly blind!

Bidding war gone wild

You’ve known PSP 1 for years. With them you’ve developed a deep understanding of a powerful PBI. You get a call from the general manager of the division you’ve been working with and you can tell she’s feeling out your interest in potentially being acquired. You know she’s excited about the strategy.

Let’s say this PSP 1’s PBI grid looks like the following:

You have a pretty good sense of the general size and shape of the PBI, and you know it’s beginning to take hold at PSP 1. They aren’t all in on the PBI yet, but it’s getting there. You call a board meeting and several of your board members think now could be a good time to be acquired. Further they think if PSP 1 might be interested then it must be the case that PSP 2, PSP 3, and even PSP 4 would also jump on this opportunity. They bring in an investment banker who tells them the best way to get the top price is to get your startup prepared, reach out to the premier buyers, run a competitive auction, and leverage the resulting competition to reach the max valuation. The banker is hired on the spot.

You don’t know these other PSPs nearly as well as PSP 1, and they don’t know you. They are, however, familiar with your general arena, and PSPs hate to lose out on an opportunity that might benefit a competitor, so they all jump in to take a look. Given this is all moving pretty fast it’s hard for you to know exactly the contours of their PBIs, but in reality here’s how things look on their side of the table:

PSP 2 is just too early in their thinking and they quickly decide to pass on the opportunity to acquire your startup. PSP 3 is talking about a pretty big opportunity and they are energized by the scale of the potential. They want to stay in the game and communicate that they are very interested and will be competitive from a valuation standpoint. PSP 4 has been working on a similar strategy for months and it so happens you would fit perfectly into it! They are in also! The banker is pumped and reports back that PSP 3 and 4 are in the game.

PSP 1 is a bit annoyed that what started as a genuine exploration has turned into a mele. But they also understand that business is business and they make their offer. PSP 3 isn’t sure if this is exactly the right time, but since they’ve figured out the PSP 1 is in the game they decide to play a bit longer and make their offer. PSP 4 loves this idea and makes their offer.

PSP 4’s PBI is just much smaller in scale than the others, so their offer is commensurately small, and is rejected on arrival. They are a little put off by the unceremonious rejection as they saw a great fit, and had moved quickly. The PBIs for 1 and 3 are relatively close in size. With a push PSP 3 elevates their initial proposal to 25% higher than where PSP 1 is willing to go.

PSP 3 is the top bidder by a good margin. You let PSP 1 know that you’re going a different direction and sign a term sheet with a 90 day exclusive period with PSP 3.

But the shade of PSP 3’s PBI isn’t all that dark, they are still getting there on the PBI. In reality they aren’t very committed to this PBI, nor this acquisition, and they’re starting to think they overbid. They make a few attempts to re-trade on the agreed upon deal based on things they discover in due diligence, but it’s all too expensive and there are just too many parts of the PBI still to figure out. They give you a call, terminate the transaction, and release you from exclusivity.

You make a flurry of calls. PSP 1 has moved on to an alternate startup. No luck there. PSP 2 is still too early in their thinking. PSP 4 was a bad breakup, they were really into it, feel jilted, and don’t return your call.

No deal, burned bridges, and you might have actually helped the other startup you can’t stand get a deal done as the replacement to you with PSP 1!

The two fundamental flaws in the thinking here were:

1) Thinking that your red square was the part driving value, and that the value of that single square must be roughly equivalent to all parties. But it’s not the red square - it’s the purple squares. You want to be valued on what you can do together with the PSP, not valued on what you’re worth alone.

2) A massive underestimation of how long it takes to develop a PBI. You need dark purple to pull off a startup acquisition. PBIs (particularly big ones) are complex and require an enormous amount of organization alignment, it’s rare you can rush out and find several of them already baked.

When can bidding wars make sense?

February 1, 2024

Hot Take #5: Mapping the Waze Acquisition

If you haven’t already - get the second edition of the MBP here.

The billion dollar acquisition of Waze was a landmark startup M&A transaction. Breakout transactions like Waze don’t live in isolation. They impact the entire startup ecosystem - creating a dent in the universe and causing gravity to shift to adapt to the new reality. It wasn’t just a big deal, it was a big deal.

Waze was an extraordinary company and I’m sure all involved are exceedingly happy with the outcome. But once we clear out the confetti and balloons what can we learn from the transaction? It turns out quite a bit.

You don’t often get a candid look at the workings of a startup M&A deal. But in the case of Waze we do. Noam Bardin, co-founder and CEO of Waze wrote an excellent post on both the Waze transaction and his M&A advice for founders. The post is spiced with a few LOL-producing side-swipes. It’s also written in an interesting format, blending a linear narrative with his abstractions and insights. It actually reminded me of reading passages from the Bible. I was simultaneously trying to imagine myself as the protagonist in the story, while also attempting to extract the transcendent meaning.

There’s some great advice in the post, much of which aligns very nicely with the MBP. In addition, there are a number of important insights peppered throughout, and I’m going to call out a few of those. And, there are a few places where Waze swerved out of the MBP lane and into risky territory. I’m going to highlight those too.

Let’s get to it.

Product teams drive startup acquisitions

As it says in the MBP book, you want to initiate a stream of open-ended conversations with the product teams at potential strategic partners (“PSPs”). In Bardin’s words: “exploring potential business with the potential acquirer’s product teams is a critical prerequisite…” These conversations aren’t M&A-or-nothing, but are instead about developing big ideas for potential collaboration.

In MBP-speak, the partner big idea (“PBI”) is a buildup. Acquiring your startup is something that’s considered after the Opportunity and Methodology theses have been developed. Acquiring you is one of several potential paths forward, and is determined by how best to Execute the PSP’s strategy.

To this end, I’m going to fuse two of Bardin’s six key lessons learned into one. If I take lesson #1: “Acquisitions start years before the actual sale.” and merge it with lesson #3 “Partnership discussions are the best catalyst for an acquisition.” We get pretty much a proxy for how to start building a PBI. In these two lessons Bardin makes the points that you should “get to know your potential acquirers and spend time with their product teams” so as to “imagine what a joint product could look like” - which can essentially be shorthand for the MBP Opportunity and Methodology layers of the PBI. He then transitions to the Execution layer when he says the ultimate outcome of the big idea is the PSP coming to the conclusion that “we would need to own you to do this.”

Two additional points here: the first is that the “joint product” is the key to the game. What you can do together is the engine of the deal. It’s the magic in the box. It powers every aspect of the relationship from interest, to urgency, to valuation. It’s more than just a subplot, it is the plot.

Second, I like Bardin’s choice of words when he says “partnership discussions” - discussions - as it says in the MBP - partnership discussions can be as, or even more, valuable than partnership implementations. Don’t avoid partnership discussions because you think the actual implementation of the partnership may be infeasible. Be liberal in your partnership discussions and conservative with your partnership implementations. Partnership discussions are a great conveyance for the materials for building big ideas.

Personalities, Method alignment, and exclusivity

There’s a great deal in the post about personalities and trust. This aligns with the MBP. M&A, and particularly startup M&A given its heavy emphasis on working together in the future, is a deeply personal enterprise. Bardin tells the story of how the first potential deal fell apart after the two technical teams came together but mixed like oil and water. Bardin attributed it to an age and experience gap, but I’d also wager that there was also a fundamental misalignment in the Methodology layer of the PBI.

As it says in the MBP, startup acquisitions live-and-die on method alignment. Beyond just age, there was probably a gap in the way they thought the opportunity should be pursued. Even if the difference was simply cultural, that’s a still a method-misalignment of sorts.

Which brings me to exclusivity.

Wait, how, why, does this connect with exclusivity??

The back cover of the MBP book has this leader: The last thing you want from a potential acquirer is a term sheet. Waze’s failed first buyer is a textbook example of why.

Bardin’s account of how the first deal melted away could almost be overlaid on the MBP Prologue - it’s the same story:

“I did not need those hours and immediately signed the term sheet and sent it back..

We began due diligence and it quickly became clear that we had some gaps…

We assumed the deal was done and the due diligence was to validate everything we had discussed…

On the other hand, [they] looked at it as the beginning of a process to determine what they should do with Waze…

We had days where we did not know what the next step was and sat around waiting…

We began feeling we had made a mistake and that [they were] not going to go through with the acquisition…”

If you turned the MBP Prologue into a poem this would be it. This progression is in fact the norm not the outlier for how most startup M&A discussions go. Too fast at the beginning, followed by rapid decay, ending in no deal.

If Bardin had been following the MBP he wouldn’t have signed the term sheet with the first buyer (at least not at that point). He clearly had an enormous amount of leverage in the negotiation. He could have instead focused straightaway on having the teams dive deep into building the PBI. They would have visited each other, designed the combined product strategy, assessed cultural fit, etc.

As it says in the MBP, the Opportunity and Methodology layers of the PBI are “free conversations.” Use the time (and momentum) to develop the thesis and figure out if this thing is going to work, before you get locked up. Startups too often think buyer diligence is confirmatory when in fact it’s exploratory. Don’t fall into the trap.

In addition, if Bardin had been able to sidestep the term sheet (and exclusive provision therein) he could have engaged in any number of parallel conversations with other PSPs. He would have had both a better shot at closing with Buyer A and a also a better shot at spinning up Buyers B,C, D…

This journey ultimately ends well for Waze, in spite of this traffic jam in the middle. But it may not for you. Your acquirers may not be as patient, nor as eager, as those surrounding Waze at that moment. I’d proceed with caution and design a strategy that keeps each PBI development process in play as long as you possibly can.

Leaks, competition, and stock

Leaks. Bardin’s warning about leaks are words to the wise. Although it sounds like in this case the leak catalyzed an alternate buyer and an improved price (and a deal that was actually going to close!). That’s an exceedingly fortunate outcome. Leaks can kill deals and there isn’t always another immediate bidder in the wings. Keep your deal team, and information flow, as tight as you can and stress to everyone the criticality of confidentiality.

Competition. Bardin also mentions that he put pings into several other logical buyers, but none of them “could move fast enough.” This is a really important point. It’s so rare that I’m going to call it a myth that you can rapidly shop a startup to several buyers simultaneously. Building a startup acquisition thesis takes a lot of time and PSPs don’t buy a startup because someone else is about to, they buy a startup because they feel they need to. Focus on building strong PBIs. PBIs are what create your optionality, not last minute shopping maneuvers.

Stock. Founders (and their investors) often eschew equity as the form of consideration in startup M&A transactions. This isn’t always smart. As discussed in MBP Spellbook 3: Startup-to-startup acquisitions, there are times when getting aboard a rocket ship might be a great call. In this case there was a world where this deal might have seen a 10x increase in value if they had taken stock in one of the buyers. That’s actually not that uncommon of an occurrence - I’ve seen many people make and miss ~10x times outcomes with the stock/cash decisions. Carefully consider consideration.

And here’s where Bardin and the MBP diverge

Bardin speaks at length about having “a clear framework among your decision-makers.”

January 7, 2024

MBP: Optimize Your Personal Introduction

You only get one chance to make a first impression. But even more importantly, your introduction sets the trajectory of the entire conversation. Make it count. It’s not filler time. It's the first move in what may be the most important game of your professional life.

It’s both amusing and shocking how bad many startup execs are at introducing themselves. They wander through an almost random selection of personal facts and histories only to stumble to a slightly confusing close. A jumbled mess of disconnected statements leading nowhere.

Why is your introduction so important?

Everything gets priced into the deal. Everything.

So, you want to set everything up as well as you possibly can. You are a big part of everything, arguably the biggest part. You want to set their impression of you up as well as you possibly can. In addition, your introduction sets up everything else, and you want to set all that up as well as you possibly can also.

As we know from the MBP startup valuation = opportunity/scarcity. So you want your introduction to both frame the opportunity, and establish your scarcity.

The poem of you

Your introduction should be a piece of professional poetry. Referencing Marilyn Singer’s site on what makes a great poem, you want to inspire both intention and emotion. Intention around your, and your startup’s, approach to this new market opportunity. Emotion through the excitement you are perfectly positioned to execute upon it.

You were born for this

You’re not going to go back to birth. But you want the throughline of your journey to show you were made for this moment. You didn’t stumble into it. You’re exactly where you’re supposed to be and all your previous experiences, even the ones that at first blush don’t seem relevant, led you to be here, now.

But what exactly is the moment? The moment is a blend of forces that you both anticipated and for which you are acutely prepared. But you can’t jump right to those or you’ll sound like a megalomaniac. There needs to be a buildup.

The ingredients of a great introduction to potential strategic partners

Interests

Education

Early work experience

Realization of long range market forces

Key professional junctures

Later work experience

The moment of clarity

Transition to your startup

I’ll do me

Nice to meet everyone. I’m Ezra, General Manager of Advsr. We are going to discuss Advsr more later, but as a bit of background on me I’ve always been interested in big ideas.

December 28, 2023

Hot Take #4: Canvas Ventures Startup M&A Wisdom

If you haven’t already - get the second edition of the MBP here.

As we continue our tour through popular posts on startup M&A, one that performs particularly well in the search rankings is a piece from Canvas Ventures. The first thing I like about this one is the title! It doesn’t zero in on the big three buzzwords that haunt the startup M&A conversation: exit, sell, and process. As we’ve discussed at length, the Magic Box Paradigm is about moving away from the sales process mindset and towards a more holistic view of developing strategic relationships.

Also, no frog DNA

The challenge with a lot of these short startup M&A pieces is that the perspectives are either coming from a vantage point that’s a couple hops removed from the front lines of transactions, or they’re based on a small sample size of deals. The result is that the authors tend to then do what they did in Jurassic Park, insert a bit of frog DNA to fill in the gaps. Out comes a dangerous breed of advice. However, what I also like about Mike Ghaffary’s perspective in this piece is that it’s free of technical frog DNA, and instead focuses on higher-order wisdom.

Think in terms of years, not months

Founders way, way, way underestimate how long it takes to develop relationships with potential strategic partners (“PSPs”). Ghaffary wisely advises that: developing strategic exit options should begin much earlier in the company’s journey than most founders realize. In fact, think in terms of years before a pending acquisition. But there’s an MBP twist here that we should add. It’s not just that PSPs move slowly - in fact sometimes they can move quite quickly. It’s that you never know when a PSP is going to move in your direction. Startup M&A is a buy-side driven business. PSPs make acquisitions when they have to fill in a need (not when you are ready to sell). By starting early, and creating a web of relationships, you put yourself on the radar of lots of PSPs - so when they are ready to make a move - you’re well positioned in their thinking. Starting early not only anticipates the likely slow moving nature of PSPs, but also anticipates the buy-side-driven nature of the startup M&A business itself.

It’s not M&A or nothing

M&A isn’t the only potential relationship with PSPs. They can represent commercial partners and even investors. Ghaffary is right on when he advises startups to think broadly about the helpful byproducts of strategic partner conversations.

Taking this relationship development framework further, Ghaffary echoes the ground game section of Chapter 5 of the MBP when he advises founders to research PSP priorities and thoughtfully leveraging their networks to create warm introductions to key PSP players. Extending this thinking Ghaffary says to approach these relationships as you would in building life-long friendships - because you are. In fact the people you’ll meet developing relationships at PSPs are a unique set. They share a great many things in common with you - most notably their professional field of interest and their excitement about launching new products.

As I’m writing it’s the week between Christmas and New Years - I’ve received dozens of happy holidays cards, texts, emails and calls from people I’ve met during my startup M&A adventures - come to think of it, more than from them than from family!

Get to the product people

As it says in the MBP: Consider the connection made with a PSP when you’ve engaged the product leads relevant to your startup. Corporate or business development teams are great conduits, but they aren’t the ultimate target. You need to be talking to product people. Ghaffary’s corollary is right in line with this thinking: One mistake founders make is assuming that a corporate development person...is the person that will champion an acquisition later. That assumption is incorrect. Ghaffary goes on to advise founders to: figure out who at the company has a P&L related to your startup. That person is someone who looks after the business or product area and is looking to grow it. And flipping back to Chapter 7 of the MBP book it’s

December 16, 2023

MBP New Gap Chapter 5.5: PSP liftoff

If you haven’t already - get the second edition of the MBP here.

I’m getting the same question over, and over, and over.

We’re going to answer it here.

It turns out there’s a gap in the Magic Box Paradigm book. It’s between Chapters 5 Filling the funnel and Chapter 6 How to build a PBI. The book jumps from sparking conversations with potential strategic partners (“PSPs”) straight to building partner big ideas (“PBIs”).

What the book doesn’t cover is how to get PSP conversations off the ground in the right way. Essentially the Zero to One of PBI formation.

For now we’ll call this gap chapter: Chapter 5.5 PSP liftoff.

Plot the future

You’ve secured the epic intro to the key person at a top PSP. How do you start the conversation in a way that best sets up the creation of a powerful PBI?

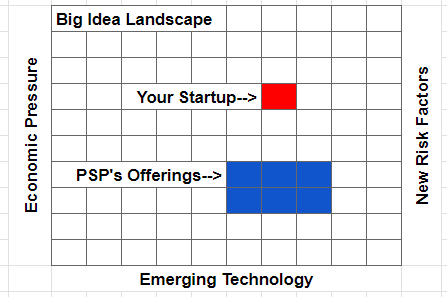

Let’s start with a visual. Imagine you could create a graph of the key aspects of how the world will be in a future state. A grid of how the world will look, say, five years from now. It’s probably more like a multi-sided object, but given that we’re working in two dimensions here, we’ll keep our thinking confined to a two dimensional space. On the axes of this grid are the key drivers of the future state. The axes may be new customer needs, emerging technologies, looming regulatory changes, shifts in society, economic pressures, or a blend of all of them (and more). These forces are creating a big new reality.

You’re ahead of the curve and the product you’re working on anticipates this emerging reality. The PSP also has a set of offerings that are highly relevant to the emerging reality. To frame the new reality grid we’ve selected three major market forces (just examples): Economic Pressure, Emerging Technology, New Risk Factors. Your new startup is well positioned close to the center of these market forces - but is just the start - it’s one box in a giant grid of opportunity.

The new reality grid has 100 squares. You’ve filled in one. The PSP is bigger and has six squares. Notice how easy it is to focus on your and their squares. There’s substance to them. They’re bright. They jump out to you. It would be very easy to center the conversation on the stuff that already is, and not on the stuff that is yet to be. That’s the trap.

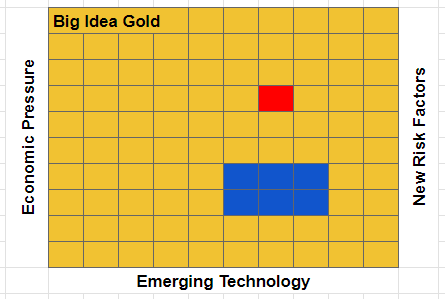

What you want to do is set up the conversation to focus, as much as possible, on the white space. The PBI is going to be formed from uncolored boxes. Some number of those boxes are going to be the shape of the portion of the future space the PSP wants to occupy. There are currently 7 filled in boxes and between the PSP and you. There are 93 other boxes to be discussed! There’s much more to discuss about what isn’t yet defined than there is to discuss about what is. The blank boxes are gold!

The PBI is going to be bigger than both of you, yet you’ll both influence its formulation (note the new squares are purple - the blend of red and blue) and you’ll both play central roles in its manifestation. But you are at the absolute center of the new area.

Linking to market forces

As you are introduced to the PSP it’s inevitable that you’re going to talk about yourself. But how are you going to talk about yourself? You’re going to talk about yourself in the context of the major market forces at the edge of the grid. Then you’re going to build the grid and locate yourself in it.

You: “Our efforts sit in a much larger context. First, there’s major economic pressure on XYZ. Second, the emergence of ABC technology has created tremendous potential. Third, with these new economic pressures and this emerging technology we see significant new risks…we’re addressing these by…”

This approach both enables you to set the stage for a thoughtful discussion of your current square, but to also expand the conversation to encompass their six squares, and then the other 93. The more you link your efforts to market forces the more the grid expands.

The conversation cycle

In the liftoff phase of the PSP conversation you’re going to have to give to get. You’ve likely been introduced to this PSP in the context of what you’re working on today and if you’re too cagy it’ll be weird. So whereas you want to think of these early conversations as an exploration and take an interview mindset, you can’t just say nothing about yourself. If you walk in with

November 22, 2023

Thanks Giving Away MBP

You can sit there listening to your crazy uncle Larry - or tuck away by the fire reading about startup M&A - easy call.

Amazon lets you run a Kindle app promo a few times a year - just kicked one off for Thanksgiving weekend - free copy of the Magic Box Paradigm e-book - grab now and spread the word.

If you’re in the startup biz and you haven’t read the MBP - then, well - you should read the MBP.

Grab it here: https://www.amazon.com/dp/B0CG86NT6F

November 13, 2023

Hot Take #3: The Exit Podcast and the Magic Box Paradigm

Last week I was looking at various references to the MBP and I stumbled on a great podcast on startup M&A called “The Exit.” BTW - in this poke-around-the-web I also found a research paper on startup M&A from the HEC Paris business school - the paper references the MBP 27 times! It was interesting to see the parts of the book the research team leveraged. The paper may be the topic of a future hot take (but I’ll have to brush up on my French).

But I digress. The Exit podcast featured a discussion with Adam Landis the founder of AdLibertas and centered on how he created the environment for AdLibertas to be acquired by Branch. It doesn’t sound like Landis used an investment banker or M&A adviser, but instead, took to heart what I say in the book, that: you, a good attorney, and a copy of the MBP may be all that’s needed and rolled his own transaction. Adam is not alone, I get emails all the time from founders who followed the MBP and became their own M&A adviser.

You should listen to this podcast with Landis, it’s excellent. We’re going to unpack why, and of course, fill in a bit more MBP color.

Why is it Always “Exit?”

As we so often need to do, let’s talk about the title. Once again the featured word is “exit.” The “sales process” and “exit” mindset are so deeply ingrained in the startup M&A conversation that they just can’t be avoided. An endless conversational whack-a-mole. As we know from the MBP, startup acquisitions should be approached as “entrances” not “exits” – they are an opportunity to take your vision to the next level by placing you on a larger stage an enabling you to make a bigger impact. Funnily enough, the way Landis speaks about his acquisition is very “entrance-y” in nature - he talks about joining Branch’s team and the big things they envision building together (and to be clear - it’s not *his* title - it’s the title of the podcast series more generally. A podcast series that seems quite good, title aside).

The MBP Aha Moment: Narrative

Around minute 14:00 Landis speaks to the zeroing in on the core value of their platform and its potential value to strategic partners generally. What I like about this realization is that he moved from thinking about his company as a standalone entity and towards thinking about what-about his company could be interesting to potential strategic partners (“PSPs”). He marries this shift in thinking to his discovery of the MBP book. He then makes a critical admission that was not only true for him, but is also true for most entrepreneurs: they don’t really know how to structure PSP conversations. Landis’s tldr summary of the MBP is quite interesting as he zeros in on the discussion of a startup’s three core narratives: #1 your narrative for investors, #2 your narrative for customers, and #3 your narrative for PSPs - and that narrative #3 is quite different from the other two. In the first two narratives you have to have everything figured out - it’s “your story” to use his words. However in #3, your narrative for PSPs, you have to help them build “their story” and find a way to enhance that story. Once Landis oriented himself this way the “conversations started to make more sense to him.” This is right on. Until you understand how to have the conversation you’re really just spinning your wheels.

The Importance of Air Game

Around minute 15:30 Landis goes on to describes how effective his thought leadership strategy was for gaining attention. Again, this is something we preach in the MBP and it’s often a hard concept for many entrepreneurs to internalize. Seeding the market not only positions you as a leader, but it’s also how you create your own luck. In Landis’ case his acquirer wasn’t a company he would have thought of as a likely PSP. Not one he likely would have put on a list to approach directly. It was they who found him via his air game content. They even went on to develop collaborative thought leadership. If you want to put your big idea creation engine into hyperdrive, create joint thought leadership with PSPs!

The Big Idea Changes the Conversation

Landis goes on to articulate something really important - when the conversation is in the context of a Partner Big Idea (“PBI”) it becomes strategically important to the PSP - and as such - it moves from a “zero sum” form of conversation (Landis calls this kind of conversation “transactional”) to something much more collaborative and positive.

MBP Approach to Valuation

At around minute 17:15 Landis shifts to discussing how the MBP changed his strategy for maximizing value. At the moment this potential acquisition conversation was heating up their business was in serious transition and their revenue was “tanking.” Traditional valuation frameworks (multiple of revenue, or EBITDA, or…) just weren’t going to work. The value of his company was going to need to be derived from the value it would create for the PSP. This is the MBP way - if you’re playing the game correctly the PSP cares a lot more about the big idea than they do about your independent performance - and Landis says just that. Landis makes another important point - that valuation was one of the last things they and the PSP discussed. As the MBP says - you want valuation to be determined at the culmination of the idea creation process, not at the start.

The Tortoise Beats the Hare

When the acquisition is driven by a powerful PBI it moves fast. It may seem at the start that following the MBP is the slow way to go about things, but it’s not the case, once the PBI takes hold the ground starts to shift and the PSP starts to drive the transaction forward. As it says in the MBP “the PBI starts to create its own weather.” In Landis’ case the PSP set up a very aggressive process to get the deal aligned and closed - in 30 days!

Sometimes It’s Just the One

Landis kicks himself for potentially not testing the market more aggressively. From what I can glean from the podcast I think it would have been exceedingly difficult to replicate the depth of engagement he had with the PSP at hand. A powerful PBI with strong executive sponsorship is a tough thing to spin up in a hurry. I think he was smart to get the deal-at-hand done. Landis goes on to articulate the “entrance” we discussed at the start. A big part of his decision making was around this as the next chapter he wanted to open up - this was the magic box he wanted to get to the top of the mountain.

Landis #1 Tip for Entrepreneurs

He says it around minute 25:49 - read the Magic Box Paradigm!

November 1, 2023

The Case of the Mythical M&A

Joined forces with Heidi on her podcast - this is one every founder needs to absorb.

The podcast and full transcript are on Threshold’s site here:

https://threshold.vc/podcast/the-case-of-the-mythical-manda

tldr - start developing strategic relationships today!