Michele Wucker's Blog, page 5

October 30, 2018

Around My Mind: Michele’s new LinkedIn Series

I’ve launched a new weekly LinkedIn series, “Around My Mind” – a regular walk through the ideas, events, people, and places that kick my synapses into action, sparking sometimes surprising or counter-intuitive connections. I’ll show how the topics I ponder connect in sometimes surprising ways. Many of my musings will relate to gray rhinos –the obvious yet neglected risks we face but often ignore not just despite but because they are so obvious. I’ll also spend a lot of time considering markets and the global economy; the Fourth Industrial Revolution and the future of work; immigration and demographic change; policy ideas big and small; cultural attitudes toward risk; and how the human mind works –and how these play out in both day to day life and in business and around the globe. SUBSCRIBE HERE.

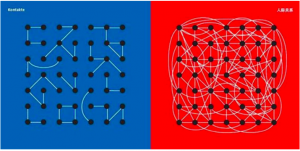

Image from Yang Liu, East Meets West. Berlin: Taschen, 2015

Image from Yang Liu, East Meets West. Berlin: Taschen, 2015How do we get from Point A to Point B? Not just a particular A to B, but in general. Do you think of yourself of taking a linear or meandering path?

The answer might not be as, well, direct as you might think.

As a journalist and policy analyst, I long thought of myself as taking the rational, direct approach. Yet there have been many times when this strategy led me only to butt my head against a brick wall. By necessity, I had to learn to go around, particularly when working across cultures. For someone with a Midwestern background that prioritizes order and frowns on uncertainty, it was an acquired skill, to put it kindly.

As I’ve spent more and more time in Asia, particularly since China has incorporated into its financial risk strategy the gray rhino metaphor I coined for obvious but neglected dangers, I’ve realized two important things. First, my approach to problems is very different from most Americans. Second the Western ideal of rationality is not as rational as we’d like to think; it’s more of an illusion.

My gray rhino metaphor makes the simple point that we need a fresh look at the obvious because humans tend to tune out ever-present risks and thus are surprisingly vulnerable.

Gray rhino theory thus directly contradicts Western ideals of rationality and agency: if something is obvious, so the thinking goes, of course we’re dealing with it –so if something goes wrong, it must be because it was beyond our ability to foresee and predict. This is not direct, clear thinking: it is circuitous rationalization.

Many Asians, by contrast, intuitively understand what I mean, and apply gray rhino thinking to everything from financial risk to urban safety to personal lives.

What explains this difference? The answer lies partly in how different cultures process information –in systems or silos, in close or broad focus– and in how members see themselves and their ways of thinking.

The Chinese designer Yang Liu, who grew up in both China and Germany, expressed the differences between Asian and Western thinking in her 2015 book of infographics, East Meets West. The image that I’ve included above this post involves the difference between Asian and Western views of connections and contacts; Westerners see a greater number of bilateral relationships, while Asians see a much more complicated web of connections.

Another drawing in Liu’s book represents a Western approach to problem solving as footsteps marching straight through the middle of a dot, contrasting with the Asian approach of walking right around the edge. And yet another shows Western self-representation as a straight line between two dots, compared to a circuitous line between two dots for Asians.

After looking at Liu’s images, I was startled to realize that I identified much more closely with the Asian views than the Western ones. I grew up in the Midwest and Texas, made my first trip abroad to Germany and Belgium, and worked in Latin America early in my career, this came as something of a surprise.

Liu’s book goes to show that not every Asian or Westerner is like every other, so it’s important not to let stereotypes constrain how we see other people.

Her images also show the importance of complex systems thinking –something I will explore over the course of this series. Great power comes from embracing serendipity, and from stepping back and take a big-picture look at the connections between our ideas and experiences.

My friend Jerry Michalski maps his brain using The Brain app that shows not just what he’s been thinking about, but how those thoughts and ideas connect to each other. He’s amassed hundreds of thousands of entries.

Since I’ve been writing and speaking a lot about risk lately, the first thing I looked for was what Jerry had thought about risk.

Jerry’s been working on trust building lately, so naturally he included an article connecting risk, trust, and impact. The piece’s premise was a familiar theme for me –that promoting innovation means supporting “good” risk—but it added some welcome nuance, particularly that you can’t support risk without building trust.

The authors cited a survey of philanthropy by the Open Road Alliance that found donors and grantees rarely had frank and open conversations about risk and unexpected obstacles. The result is that foundations generally fail to provide enough support for grantees should events take an unforeseen turn.

One of the Open Road Alliance’s recommendations, thus, was that grantmakers open a conversation about risk throughout the application process, signal an acceptance of the presence of risk, and formally exploring partners’ risk appetites.

I could not agree more. In fact, I’ve been spending much of my time lately having exactly this sort of discussion with people of all kinds of risk sensitivities and preferences, and exploring how people manage differences within relationships and teams. Part of that involves understanding how we came to our attitudes about the risks and opportunities in our lives, and that those paths are not as linear as we might think.

This column is about many things, but above all about the connections among many parts that both make up the backbones of systems and connect to other systems. I’ve called it “Around My Mind” to reflect the wide range of ideas and connections among them, as opposed to a more traditional and linear “On My Mind.” I’d love for you to join me on this journey.

I’ll be writing more about these issues in this weekly “Around My Mind” series. You can subscribe by clicking the blue button on the top right hand of this page. If you like it, I invite you to subscribe and share with others. Please don’t be shy about leaving comments or dropping me a private note with your own reactions.

September 22, 2018

SIMWomen September 27, 2018

Michele Wucker will be leading a gray rhino workshop on the Reskilling Revolution at SIMWomen 2018 in Schaumburg, Illinois, on September 2017.

A reskilling revolution unrivaled in size, scope and scale is upon us. Even as mobile, virtual reality, AI, blockchain and other new technologies yet to come change how companies do business and how customers consume goods and services, they also require a massive reskilling in your people. Things have never changed so fast, yet will never be this slow again. How prepared are you for this looming challenge? Are your people in the right roles with the right skills? If not, how will you get them there? Test your re-skilling readiness and hone your strategy in this interactive workshop based on the simple yet powerful “gray rhino” framework. Companies have used this flexible tool to prepare for Brexit before the vote; Asian leaders are using it to shape their AI, education, and financial policies; and your organization can harness the gray rhino to create a sense of urgency around re-skilling and develop a strategy to make it happen.

Details and registration information HERE.

Leadership Lessons of the Tango

Strategy + business, August 28, 2018

By Michele Wucker

Everything I learned about management and leadership I learned at…the dance studio?

Well, yes. As a beginner student of the Argentine tango two decades ago, I used to come home reflecting on how much of what I learned from the micro interactions in class applied to everyday life. Those lessons in communication, adaptability, and teamwork stayed with me for many years, and resonate anew now that I’ve taken up the dance again.

Tango dancers, business leaders, and rising stars tend to demonstrate drive, persistence, concentration, and commitment. They also are ambitious, competitive, and impatient. These Type A personality qualities are often the ingredients for success in business and in life. But they also can lead to problems if not managed well. This is especially so for teams in which — just as in the tango — both leaders and followers share these high-performance traits.

June 20, 2018

Global Challenges Foundation New Shape Conference

Who gets a say in how the world deals with global catastrophic risks?

I spent a few days in Stockholm at the end of May moderating a panel at and participating in the New Shape Forum, where more than 200 people from all around the world gathered to share ideas about how to manage the big 30,000-foot high global threats.

Our host was the Global Challenges Foundation, founded in 2012 by the Hungarian-born Swedish financial analyst Laszlo Szombatfalvy. He’d made his fortune by designing and applying a financial-market risk calculation and valuation model. Now 90 years old, he focuses his philanthropy on global catastrophic risks: threats with the potential to reduce the human population by 10 percent or more.

Opinion research the foundation has commissioned shows a surprising amount of support for increasing global efforts and coordination to deal with these risks. But conversations at the Forum made equally clear that the world needs new global risk governance models that more directly involve citizens.

The global economy may well have become much flatter, in Thomas Friedman’s words, as developing countries have entered global markets. But governance of global catastrophic risks has not.

We spent three days in discussions and workshops, examining how well existing institutions are managing risks like weapons of mass destruction, climate change, unchecked population growth, pandemics, and politically motivated violence.

We also engaged with the 14 finalists for the New Shape Prize –a $5 million pool of funds to support innovation in global governance. The foundation received an astonishing 2,700 submissions from 122 countries.

I was struck by how many of the proposals honed in on one particular problem: that the loftier and grander institutions and global efforts get, the less connected “ordinary” citizens feel. And without the active participation of global citizens, the odds of success are much lower.

Can Individuals Make a Difference?

A 2017 GCF opinion survey across eight countries (Australia, Brazil, China, Germany, India, South Africa, the United Kingdom, and the United States found that three quarters of adults considered themselves to be global citizens, and substantially agreed that individuals could make a difference. An astonishing 85 percent said that they cared about responding to global risks.

Six in ten respondents considered the world to be more insecure it was than two years earlier. Only 54 percent were confident that the current international system could make the decisions needed to address global risks. In other words, people are very worried -particularly about weapons of mass destruction, politically motivated violence, and climate change. (Despite the US administration’s withdrawal from the Paris Accord on climate change, the issue still was the third most concerning to American respondents.)

Overall, 62 percent of adults -and even higher numbers among men and older participants- also felt that only organizations or groups could be effective against global risks.

Perhaps what surprised me most was that seven of ten adults (71%) were in favor of creating a new global organization to respond to global risks. In the United States, the percent has jumped considerably over the past few years, to 67 percent from 49 percent in 2014. Perhaps that’s because of the way the United Nations has been used as a political football, but given the United States’ longtime attitudes about its own sovereignty and global leadership, this struck me as unusual.

As for the United Nations itself, six out of ten adults said they were confident in it, but nevertheless 85 percent overall thought it needed reforms to improve its ability. More than 90 percent of respondents in Brazil and India thought so.

At the same time, 62 percent of adult respondents believed they could personally make a difference on global issues. The number was even higher among people who considered themselves to be global citizens, among women and young people, and in most emerging countries. (China was an outlier, with only 47 percent of adults saying they could make a difference.) Nearly as many –58 percent overall—felt that a single individual could negatively impact global cooperation on catastrophic risks.

Are these results contradictory? Yes and no. Individuals can feel that they have a role, but that for such a role to be effective, others need to behave similarly in a way that organizations and groups are much better prepared to catalyze.

The winners of the 2018 New Shape Prize

The winners of the 2018 New Shape PrizeThe New Shape Prize

At the closing dinner May 29, the foundation awarded $1.8 million to three projects aimed at reforming global institutions. The winning proposals reflected the need to bringing more citizens into decision making and connect them with multinational groups with the power to act.

Soushiant Zanganehpour’s “AI-supported global governance through bottom-up deliberation” uses blockchain technology to confirm the identities of voters in a decentralized global, participatory and deliberative system.

“Global governance and the emergence of global institutions for the 21st century,” by Augusto Lopez-Claros, Arthur Lyon Dahl and Maja PCE Groff, would reform the United Nations General Assembly to make it directly elected by popular vote, while adding a second civil society-focused chamber.

Natalie Samarasinghe’s project, “A truly global partnership – helping the UN do itself out of a job,” brings businesses, non-governmental organizations (NGOs) and young people into a new UN governance structure. Meanwhile, the UN would transfer its development work to these stakeholders.

Global Challenges Foundation executive director Carin Ism was frank in her remarks concluding the conference: the foundation knows that its odds of success are very small. However, as she pointed out, when the potential impact is big, even a miniscule chance at succeeding becomes worth a try.

April 15, 2018

The Gray Rhino Norwegian Edition

The Gray Rhino is now available in Norwegian via Hegnar Media

Grå neshorn

Michele Wucker

Hvordan gjenkjenne og gjøre noe med de innlysende faresignalene som vi aller helst bare vil ignorere.

Et «grått neshorn» er en høyst sannsynlig trussel med store konsekvenser som likevel blir oversett – beslektet med både elefanten i rommet og en uforutsigbar sort svane. Grå neshorn er ikke tilfeldige overraskelser, men dukker opp etter en rekke advarsler og tydelige tegn. Boligboblen som sprakk i 2008, de omfattende ødeleggelsene etter orkanen Katrina og andre naturkatastrofer, de nye digitale teknologiene som snudde medieverdenen opp ned, Sovjetunionens sammenbrudd … alt var mulig å forutsi.

Hvorfor klarer ledere og beslutningstagere fremdeles ikke å forholde seg til åpenbare trusler før disse ikke lenger lar seg kontrollere? I Grå neshorn benytter Michele Wucker seg av sin omfattende bakgrunn innen kriseledelse og utforming av politikk og av dyptgående intervjuer med ledere fra hele verden, og viser hvordan man identifiserer og imøtegår strategisk kommende trusler som har store konsekvenser. Grå neshorn er full av overbevisende historier, eksempler fra virkelighetens verden og praktiske råd, og er nødvendig lesning for ledere, investorer, planleggere, strateger og enhver som ønsker å forstå hvordan man kan tjene på å unngå å bli trampet ned.

Medlemspris: 351,-

Spar: 118,- (veil. pris 469,-)

ISBN:9788271463472

Forfatter:Michele Wucker

Forlag:Hegnar Media

Språk:Norsk

Utgivelseår:2018

February 2, 2018

Who’s Talking about The Gray Rhino in China

Pointing to the existence of a gray rhino -a highly probable, high impact danger that nevertheless is being neglected, downplayed, or outright ignored- is a way to create a sense of urgency toward addressing it before panic sets in. Senior Chinese officials have used the term extensively for exactly this purpose for issues from financial risk to US tax policy to urban fire safety, earning it a spot on the “Top Ten New Terms of the 2017 Chinese Media” list compiled by China’s National Center for Language Resource Monitoring and Research in December 2017.

China’s President Xi Jinping keeps a copy of the Chinese edition of THE GRAY RHINO on his bookshelf, where media commentators noticed it during his 2018 New Year’s Day Speech, and has discussed the gray rhino with senior economic policy makers.

A reference to the gray rhino on the front page of People’s Daily in July 2017 following the National Financial Work Conference sent the prices of risky stocks down more than 5 percent in a day. The concept influenced Chinese policies on heavily indebted companies (covered on the front page of The New York Times) whose aggressive overseas expansions the government reined in.

In a much-commented-upon essay posted on the central bank’s website in November 2017, People’s Bank of China Governor Zhou Xiaochuan warned that China faced many gray rhinos, three in particular: macro-level financial high leverage and liquidity risk; credit risk including non-performing loans and increasing bond market credit defaults; and finally, shadow banking and criminal risk.

Cai Qi, secretary of the Beijing Municipal Communist Party Committee, referred to urban safety as a gray rhino after the tragic Daxing apartment fire in November 2017.

Senior Chinese officials told The Wall Street Journal in December 2017 that the US tax reform was a gray rhino threat to China, and raised interest rates in response to it.

China Banking Regulatory Commission director Guo Shuqing told People’s Daily in January 2018 that gray rhinos and black swans threaten China’s financial stability.

At Davos in January 2018, Fang Xinghai, vice chairman of the China Securities Regulatory Commission (CSRC), the nation’s stock market regulator, warned that China’s debt was a gray rhino, again generating headlines worldwide.

Shortly afterward, Fan Hengshan, vice secretary general of the National Development and Reform Commission (NDRC), the country’s top economic planning agency, warned in a commentary in the state-controlled Beijing Daily that the year to come faced many gray rhinos.

Baidu Baike, China’s largest online encyclopedia, explains the gray rhino and its evolution in China.

Read more below for additional detail on recent gray rhino coverage from China.

Close to retiring, China’s central-bank chief warns of financial risk. The Economist. November 9, 2017.

China’s Central Bank Governor Warns About Financial Risks — Again. The Diplomat, November 9, 2017.

Chinese Banks Enjoy Few Bad Loans But Central Bank Warns Of Risks Forbes, November 11, 2017.

Hidden Debts Accumulate at Local Levels. Caixin Global. December 27, 2017.

Beating Targets: China’s Economy Grew 6.9 Percent in 2017. The Diplomat, January 18, 2018.

China eyes black swans, gray rhinos as 2018 growth seen slowing to 6.5-6.8 percent: media. Reuters, January 29, 2018.

Use your browser to translate the following links from Chinese.

Zhou Xiaochuan: China must be vigilant “black swan” and “gray rhinoceros.” Gold Network. November 5, 2017.

Debt, shadow banking, capital market volatility, “gray rhinoceros” are moving toward China? qq, November 10, 2017

Zhong Wei: Considering Grey Rhino, China Should Balance Overall Gradual Reforms and Partial Radical Reforms. qq. November 16, 2017.

Exchange currency “gray rhinoceros” annual inventory. Gold Network. November 24, 2017

Ren Guanqing. The Greatest “Gray Rhinoceros”: an interview with Michele Wucker author of the Gray Rhinoceros Phoenix New Media, November 30, 2017.

Yearender: China moves to tame its “gray rhinos.” Xinhuanet. December 17, 2017

January 22, 2018

The Gray Rhino on FT Alphachat

I enjoyed talking with the FT’s Matt Klein about why we don’t deal with problems we see in advance – and how to fix it- on the January 18, 2018 edition of FT Alphachat, the conversational podcast about business and economics produced by the Financial Times in New York. Each week, FT hosts and guests delve into a new theme, with more wonkiness, humour and irreverence than you’ll find anywhere else.

I enjoyed talking with the FT’s Matt Klein about why we don’t deal with problems we see in advance – and how to fix it- on the January 18, 2018 edition of FT Alphachat, the conversational podcast about business and economics produced by the Financial Times in New York. Each week, FT hosts and guests delve into a new theme, with more wonkiness, humour and irreverence than you’ll find anywhere else.

January 12, 2018

The Gray Rhino on Xi Jinping’s Bookshelf

After Chinese President Xi Jinping’s annual New Year’s address, it has become an annual tradition for Chinese media to scour his bookshelf for new titles. In 2018, the new books include The Gray Rhino: How to Recognize and Act on the Obvious Dangers We Ignore, which was released in China in February 2017.

Other new economics books include textbooks on ecological economics, W.W. Rostow’s 1960 classic The Stages of Economic Growth: A Non-Communist Manifesto, and Money Changes Everything by William N Goetzmann. The bookshelf also included texts on understanding artificial intelligence, augmented reality, and machine learning, including The Master Algorithm by Pedro Domingos and Augmented by Brett King. Very good company!

Read the whole list here in Shanghaiist or, if your Chinese (or your browser translator) is good, a longer article on qq.

August 20, 2017

The Gray Rhino Goes Global

The gray rhino has continued its charge around the globe, with a front page, above the fold article in The New York Times July 23, 2017: “Let the West worry about so-called black swans, rare and unexpected events that can upset financial markets. China is more concerned about “gray rhinos” — large and visible problems in the economy that are ignored until they start moving fast.”

Here’s a roundup of some recent media coverage of China’s effort to crack down on its financial gray rhinos, including liquidity and credit risks, shadow banking, abnormal capital market fluctuations and real estate bubbles:

China ignores the ‘grey rhino’ threats to its economy at its own peril Andrew Sheng, South China Morning Post, July 21, 2017

From black swans to gray rhinos, Andrew Sheng, The Star (Malaysia), July 22, 2017

In China, Herd of ‘Gray Rhinos’ Threatens Economy Keith Bradsher and Sui-yee Lee, The New York Times, July 23, 2017

Beware the ‘grey rhinos’ of economic risk or ‘prepare for pain’, analyst warns China Sidney Leng, South China Morning Post, July 23, 2017

Watch out for ‘grey rhino’ in jungle of financial risks, China Daily, Jul 24, 2017

The $180 million conflict that kept Scaramucci out of the White House in January has only gotten shadier Linette Lopez, Business Insider, July 24, 2017

Wanda Swears Off Overseas Deals after Xi Exchange, Greg Isaacson, Mingtiandi, July 25, 2017

China’s Communist Leaders Focus on ‘Grey Rhino’ Private-Sector Risks Alex Frew McMillan, MarketWatch, July 26, 2017

Hunting rhinos: What Dalian Wanda saga says about China Karishma Vaswani, BBC News, July 26, 2017

Interview: Environment, resource constraints biggest “gray rhinos” in China: author

Xinhua, July 27, 2017

CINA. I tre rinoceronti grigi di Pechino. Graziella Giangiulio, Stampa (Italy), July 27, 2017

China to crack down on ‘gray rhino’ risks Li Xuanmin, The Global Times, July 30, 2017

Los cuatro ‘rinocerontes grises’ que amenazan con embestir al mercado Victor Blanco Moro, El Economista (Spain) July 30, 2017.

Chinese Government Concerned about ‘Gray Rhino’ [VIDEO] World Insight with Tian Wei, CGTN, August 3, 2017

China Steps Up Warnings Over Debt-Fueled Overseas Acquisitions By Sui-Lee We. The New York Times. August 18, 2017

July 21, 2017

The Gray Rhino Rattles Chinese Stocks

In front-page commentary published July 17th, 2017, People’s Daily, the official newspaper of China’s Communist Party, warned of the need to avert highly obvious “gray rhino” risks as well as rare and unpredictable “black swans.” The commentary rocked China’s stock markets and signaled a new policy direction intended to more aggressively address obvious financial risks.

The article said that China should “strictly prevent risks from liquidity, credit, shadow banking and abnormal capital market fluctuations, as well as insurance market and property bubbles.”

Taking the commentary as a sign that regulators would crack down on speculation, investors immediately dumped small-cap stocks, seen as more likely to carry debt that could become unmanageable. “China’s small-cap Shenzhen index plunged 4.3% on Monday. The ChiNext, which focuses on high-tech companies, plummeted 5.1% and closed at its lowest point since early 2015,” noted CNN Money.

The timing of the People’s Daily article was particularly telling, immediately following last week’s National Financial Work Conference, a key policy strategy session that occurs every five years. This year the conference created a “super-regulator,” intended to improve the country’s ability to tackle a financial crisis, that merged four existing supervisory watchdog. It also strengthened the central bank’s powers.

A few hours after the People’s Daily article appeared, new data showed the Chinese economy re-accelerating.

The Chinese government’s embrace of the gray rhino language generated widespread media coverage.

“The unusual zoological turn of phrase in the Party’s language could… hint at a genuine effort to re-energize its long-drawn-out regulatory clampdown,” Sunny Oh wrote for Marketwatch.

Similarly, ZeroHedge noted, “[I]n a surprising case of forward-looking prudence, the Chinese government is doing what numerous Fed members have also done in recent weeks, by setting a surprisingly wary tone about risk, demonstrated best by the front page commentary in the People’s Daily.”

Former Dallas Fed chief Richard Fisher referred to gray rhino risks on Squawk on the Street Monday.

Here’s some other notable coverage:

What’s a ‘gray rhino’ and Why Did It Cause Chinese Stocks to Drop? CNN Money, July 17, 2017

¿Por qué un ‘rinoceronte gris’ causó la caída de las acciones en China?

‘Tê giác xám’ ?ang ?e d?a th? tr??ng Trung Qu?c VNExpress (Vietnam)

Piyasan?n yeni korkusu: Gri gergedan BusinessHT (Turkey)

China’s Economy Charges On as Officials Target the Risk ‘Rhino’ Bloomberg News, July 17, 2017

China economy charges on as leaders target the risk `Rhino’ The Peninsula (Qatar), July 18, 2017

Why China Fears “Gray Rhino” Risk to Fragile Financial System Marketwatch, July 17, 2017

When a ‘Black Swan’ Will No Longer Do ZeroHedge, July 17, 2017

Xi’s Risk-off Push Ripples Through China as Transition Nears Bloomberg News, July 18, 2017

China Sentences to Ponder, Gray Rhino Edition Marginal Revolution, July 18, 2017

Beijing Watches Out for “Grey Rhino” and “Black Swan” in Jungle of Financial Risks South China Morning Post, July 19, 2017

People’s Daily Reference to the Gray Rhino -What Is It? jrj.com (Chinese Simplified Characters), July 19, 2017

China Ignores Gray Rhino Threats to its Economy at its Own Peril Andrew Sheng, South China Morning Post, July 21, 2017

Keeping Financial Risks at Bay, China Daily, July 20, 2017

Gray Rhinos, Game of Thrones, and TV’s Golden Age People & Profit, France24, July 21, 2017