Claire Akin's Blog, page 3

May 4, 2025

Custom Websites For Financial Advisors That Convert Leads Into Clients

In today’s digital age—with roughly 330,000 financial advisors in the United States alone—financial advisor websites are not just nice to have; they are a necessity, acting as one of the key differentiators between ultra-successful consultants and those who struggle to achieve their growth goals. With that said, understanding how to maintain a robust online presence can be the game-changer you need to attract and retain new clients.

The Power Of A New WebsiteAccording to Statista, only about one in three Americans make use of the services of a financial advisor, so you’ve already got your work cut out for you if you intend to expand your client list and grow as a business. An outdated website, therefore, is nothing but a significant roadblock on your path to growth, and one that leaves a bad first impression on potential clients.

A new website, on the other hand, can revamp your online identity in its entirety. The best financial advisor websites exude confidence and demonstrate to prospective clients that you are exactly the professional they are looking for. From top to bottom, your website should echo your brand values and provide a seamless user experience.

The Digital Handshake: Connecting With Clients OnlineFinancial advisor websites are the equivalent of a digital handshake, and considering that your site is the first thing potential clients interact with, it better be an impressively firm one.

In particular, you want a website that’s equally warm and friendly as it is clean, crisp, and professional. It should welcome visitors with clear messaging and engaging visuals, including testimonials, case studies, and client success stories, which can all work to add a layer of authenticity to your site.

Lead Generation: Turning Visitors Into ClientsA well-crafted website can mean the difference between a bounce and a conversion. Great websites are lead-generation machines that encourage customers to seek out more information, fill out a contact form, and book an appointment with the appropriate team.

As you (re)build your site, ensure the process of finding your contact information isn’t a game of hide-and-seek. If a prospective customer wants to take their next steps, make it as easy as possible for them to do so. The last thing you want is to lose out on a new business venture simply because your email address and phone number were hard to find.

Why Choose Indigo Marketing Agency?Indigo Marketing Agency has had the pleasure of working with some of the best independent financial advisors in the nation. Our clients are already experts in their field, but they need a website that showcases their knowledge and financial prowess.

While our clients enjoy a similar outcome—a new, optimized, high-performance website—we never use a one-size-fits-all approach to website building; instead, we take the time to get to know your business, target audience, and objectives. Then we work with you to create a website that captures your brand voice and values in an authentic, impactful way. At Indigo, it’s all about you and your clients.

Our Website ServicesIndigo Marketing Agency is not your average marketing firm, as we specialize in building financial advisor websites. Whether you need us to overhaul your existing site or build you a new one from the ground up, we’ve got you covered.

With our website-building services, you’ll receive the following:

A new mobile-optimized websiteUp to seven pages of fully custom website copyTop-tier conversion toolsCustom “Welcome Series” email campaign

Here’s a full list of website services we provide.

View the incredible transformation of three of our clients’ websites by comparing the before-and-after photos below:

Indigo: Crafting Financial Advisor Websites That Accelerate GrowthAll financial advisor websites are not created equal, so if you want your website to stand out and make an impact on the growth of your business, you need an optimized site from Indigo Marketing Agency.

When it comes to building financial advisor websites, Indigo is the team for the job. From compelling layouts to frictionless interfaces, we build customer experiences that your audience will love. Don’t just take our word for it, though; hear it straight from our dozens of satisfied clients, and then schedule your free strategy session with our marketing experts today.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started

90%

90% New website visitors vs. returning visitors

Read Case Study

50%

50% Increase in email click-through rate

Read Case Study

44%

44% Increase in website traffic

Read Case Study

21%

21% Website traffic from organic sources

Read Case Study

73%

73% Website traffic from organic sources

Read Case Study

20%

20% Website traffic from personal blog content

Read Case StudyThe post Custom Websites For Financial Advisors That Convert Leads Into Clients appeared first on Indigo Marketing Agency.

May 1, 2025

How to Turn Your Content Into a 24/7 Sales Team for Your Firm

Do you wish you had an agency sales machine to run all day, every day?

Imagine having a top-performing salesperson who never sleeps, never asks for a raise, and warms up prospects before they ever hit your calendar. Sounds too good to be true?

That’s exactly what strategic content can do for your business: become a 24/7 agency sales machine.

While most financial advisors are stuck in a cycle of repetitive sales calls, battling skepticism, and explaining the same things over and over again, top-performing advisors are doing something different. They’ve built content systems that pre-sell their services and build trust—before a meeting is ever booked.

In this post, we’ll walk through exactly how to build these systems for your firm—and why it could be the smartest growth move you make this year.

The Problem With the Traditional Sales ModelLet’s be honest: the old way of selling is broken.

You spend the first few meetings just trying to build trust, answer objections, and convince people you’re different from “every other advisor.” You compete on fees or returns because that’s all your prospects know how to compare.

Sound familiar?

This approach is not only exhausting—it’s inefficient in today’s digital-first world.

Prospects are researching you before they ever fill out a contact form. And if you’re not showing up with valuable content that speaks directly to their concerns, you’re missing a massive opportunity.

The Content-Driven Sales AdvantageInstead of chasing cold leads and repeating the same elevator pitch, imagine this:

You wake up to meeting requests from qualified prospects.

They’ve already read your blog, watched your videos, or downloaded your free guide.

They’re not asking, “Why should I work with you?” They’re asking, “How can we get started?”

That’s what happens when you build a content-driven sales system.

Here’s how it works:

1. You create valuable, educational content that addresses your ideal client’s key questions and concerns.

2. Prospects discover and consume this content at their own pace—on your website, social media, email newsletter, or YouTube.

3. They come to see you as a trusted expert long before you’ve even spoken.

4. When they finally reach out, they’re already 70–80% sold on working with you.

Your sales calls transform from persuasion to partnership.

The Three Pillars of High-Impact ContentTo make this system work, your content needs structure and purpose. At Indigo, we break it down into three key pillars:

1. Foundational ContentThis is your digital first impression.

A clean, professional website that speaks directly to your niche’s pain pointsAn articulated planning or investment philosophyClient success stories and testimonials that demonstrate real resultsDoes your website sound like every other advisor’s? If so, you’re already at a disadvantage. Foundational content is what helps you stand out and builds instant credibility.

2. Ongoing Value Content

2. Ongoing Value ContentThis is what keeps you top-of-mind and builds trust over time.

Educational videos that explain complex financial topics in simple termsBlog posts answering common questions your clients are already GooglingA monthly email newsletter sharing practical, bite-sized insightsThis content positions you as the go-to resource in your niche—and keeps you visible during the weeks or months it takes for a prospect to make a decision.

3. Conversion-Focused ContentThis is where things get tactical.

Downloadable guides, like “10 Tax Planning Tips for Business Owners”Checklists or worksheets tailored to a specific stage in life or financial situationWebinars and on-demand videos addressing niche-specific challengesSelf-assessment tools to help prospects evaluate their own needsThe goal? To give prospects a helpful, low-risk way to raise their hand and enter your world.

Why This Works So WellOnce your content ecosystem is in place, the benefits compound quickly:

Educated Prospects = Easier ConversationsYour content has already answered their basic questions. By the time they book a meeting, they’re not just aware—they’re interested.

You’re no longer starting from zero. You’re picking up a conversation already in progress.

Faster Sales CyclesWhen trust is built in advance, the decision-making process speeds up. Instead of taking months to warm up, prospects move forward in weeks—or even days.

Higher Conversion RatesWhen people feel like they know you, like your approach, and understand your value, more of them say “yes.” That means more leads become meetings, and more meetings become clients.

Better Clients Who Stick AroundPeople who consume your content and still reach out are usually a great fit. They resonate with your message. They respect your expertise. And they’re more likely to become long-term, loyal clients.

Getting Started: A Simple Blueprint

Getting Started: A Simple BlueprintYou don’t have to become a full-time content creator. Start small, and build momentum. Here’s how:

Identify your most common prospect questions. These are your first content topics.Choose a format that feels natural. Writing, video, or audio—it’s about what you can commit to consistently. Create a basic content calendar. Just a few pieces per month can make a difference.Repurpose your content. A blog post can become an email, a social post, or a YouTube short.Always include a call to action. What’s the next step for someone who wants more?Track what works. Pay attention to which topics get engagement, clicks, or conversions—and double down on them.Over time, your content library becomes a powerful sales asset. It grows in value with every post, video, or guide you publish.

Would you like a FREE content calendar? Snag it here.

Your Content Is Your Competitive EdgeIn a world where clients are researching you before ever reaching out, your content is your first impression. It’s your silent salesperson. Your digital handshake.

And the advisors who embrace this aren’t just getting more leads—they’re getting better ones.

Prospects who understand your process, respect your expertise, and are eager to get started.

Ready to Build Your Own 24/7 Sales System?

Ready to Build Your Own 24/7 Sales System?At Indigo Marketing Agency, we help financial advisors like you turn content into conversions. From strategy to execution, we’ll help you create the foundational, value-driven, and conversion content that attracts and nurtures your ideal clients—day and night.

Book a strategy call with our team to learn how we can help you build a content system that works while you sleep.

Because the future of your practice shouldn’t rely on cold calls and crossed fingers.It should run on smart strategy, consistent value, and clients who come to you pre-sold and ready to move forward. And now you can get back to doing what you do best: serving your clients.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content  How Advisors Can Use Video To Stand Out (Webinar)

How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Register The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential

The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

READ MORE Redefine Your Newsletter & Unleash Your Potential With Video

Redefine Your Newsletter & Unleash Your Potential With Video Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

READ MORE FAQs What is an agency sales machine?An agency sales machine is a content-driven system that works around the clock to attract and warm up leads for your firm—so prospects arrive pre-sold, informed, and ready to work with you.

How does an agency sales machine help financial advisors grow their practice?By creating valuable, targeted content, an agency sales machine builds trust and authority before the first meeting. It shortens the sales cycle and increases conversion rates by answering client questions up front.

Do I need to be a full-time content creator to build an agency sales machine?Not at all. An effective agency sales machine can start with just a few high-impact content pieces a month—blog posts, videos, or emails—that consistently provide value and move prospects toward action.

What kind of content powers a successful agency sales machine?The best agency sales machines run on three types of content: foundational content (like your website and core messaging), ongoing value content (like blogs or videos), and conversion-focused content (like guides and checklists).

Why is building an agency sales machine better than traditional sales methods?Traditional sales rely heavily on cold calls and repetitive meetings. An agency sales machine works 24/7 to build trust, educate prospects, and bring in qualified leads—freeing up your time and increasing your efficiency.

The post How to Turn Your Content Into a 24/7 Sales Team for Your Firm appeared first on Indigo Marketing Agency.

April 22, 2025

Financial Services SEO

When it comes to financial services SEO, your digital presence is critical to attracting new clients and long-term success.

But with Google’s latest AI-powered search updates, the rules for ranking well in search results are changing fast. If your website isn’t optimized for these updates, you risk losing visibility—and potential clients.

The team here at Indigo Marketing Agency know the importance of healthy financial advisor websites for growing financial planning businesses. Why? Because that’s what we eat and breathe, day in and day out. And we have years of experience helping our clients win!

Learn more about our financial advisor websites and financial services SEO today.

Updates That Impact Financial Services SEO

Updates That Impact Financial Services SEOGoogle is rolling out significant changes to how it ranks websites, and AI is at the center of it all.

These updates prioritize:

High-quality, authoritative content over generic, AI-generated material.User experience and engagement metrics, ensuring that searchers find relevant and valuable content.E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) as a core ranking factor.

What does this mean for financial advisor websites? If your website relies on outdated SEO strategies or low-quality AI-generated content, your rankings could drop. To remain competitive, you need a customized, human-optimized content strategy that aligns with Google’s evolving algorithms.

Read: Protect Your Rankings: Navigating AI Content Risks in 2025

What’s Changing in Google’s AI Update?Google’s AI-powered search engine now better understands search intent, context, and content quality.

Key changes include:

AI-Generated Snippets: Google is refining how it generates featured snippets, pulling from high-quality sources rather than content farms or AI-written blogs.Better Spam Detection: Google is cracking down on low-value, repetitive, or purely AI-generated content that lacks originality or depth.Stronger Focus on Engagement Metrics: Websites that keep visitors engaged and provide useful, well-structured content will rank higher.

With these updates, Google is shifting toward prioritizing content that is genuinely helpful to users. This means that financial advisors who have relied on quick, AI-generated content or outdated SEO tactics may see a decline in their rankings.

Instead, those financial advisor websites that focus on high-quality, original content and user engagement will benefit the most from these changes.

The Risks of AI-Generated Content for Financial Services SEOWhile AI tools like ChatGPT can produce content quickly, Google’s updates make it clear that generic, AI-written blogs aren’t a shortcut to better rankings for financial advisor websites.

Here’s why relying on AI content could backfire:

Lack of Personalization: AI-generated content often lacks unique insights and the personal touch that Google favors.Duplicate Content Risks: Many AI-generated pieces are similar, reducing originality and causing Google to flag content as duplicate or low-value.Lower Engagement Metrics: Visitors may quickly leave pages with generic content, signaling to Google that the page isn’t valuable.Missed Connection with Readers: AI-generated content tends to be informational but lacks the human experience and authority that resonates with potential clients.

Google’s AI update reinforces that content should be written for users first, not search engines.

This means that blog posts, website copy, and other content should showcase real expertise, provide value, and engage visitors in a meaningful way.

Why Human-Optimized Financial Services SEO MattersCustom, expert-written content is the key to SEO success in this new landscape.

Google prioritizes:

Original, Insightful Content: Thought leadership pieces, case studies, and in-depth articles that demonstrate your expertise.SEO Best Practices: Optimized headlines, structured content, and strategic keyword use to improve rankings.User Engagement: Well-crafted blogs and website pages that keep visitors engaged and lead them to take action.

To stay ahead, financial advisors should focus on creating content that directly addresses their audience’s concerns, offers expert analysis, and builds trust.

Google’s AI update rewards financial advisor websites that provide detailed, user-friendly information backed by experience and expertise.

How Indigo Marketing Agency Enhances Financial Services SEOAt Indigo Marketing Agency, we specialize in helping financial advisors navigate these SEO changes with:

SEO-Optimized Websites: Designed to rank well, convert visitors, and establish your authority.Custom, Human-Written Content: Our expert writers craft engaging, high-value content tailored to your audience.Ongoing SEO Strategy: We continuously monitor Google updates to ensure your website stays competitive.Performance Tracking & Adjustments: We track SEO performance and make necessary adjustments to ensure long-term success.

Our team understands the financial industry and how to craft content that not only meets Google’s AI-driven ranking factors but also connects with potential clients.

From creating keyword-rich blog posts to optimizing service pages, we ensure that financial advisors (and financial advisor websites) stay visible online.

Free SEO Audit for Financial Advisor WebsitesWant to see how your website is performing under Google’s new AI rules? We’ll analyze your SEO health and provide actionable recommendations to improve your rankings.

A strong digital presence is more important than ever, and with Google’s evolving AI updates, staying ahead requires a strategic approach. Let us help you create an SEO-driven website that not only ranks well but also attracts and converts your ideal clients.

Book a free consult call today to future-proof your online presence and attract more clients!

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content  How Advisors Can Use Video To Stand Out (Webinar)

How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Register The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential

The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

READ MORE Redefine Your Newsletter & Unleash Your Potential With Video

Redefine Your Newsletter & Unleash Your Potential With Video Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

READ MORE FAQs How does Google’s AI update impact financial advisors’ websites?Google’s AI update prioritizes high-quality, authoritative content and user engagement. Websites with outdated SEO tactics or AI-generated content may experience lower rankings. Advisors need custom, expert-written content to remain competitive.

Why is AI-generated content risky for SEO?AI-generated content often lacks originality, personalization, and depth. Google favors content that demonstrates real expertise and provides unique value to users. Relying on AI-generated blogs may result in lower engagement and decreased rankings.

What type of content performs best under Google’s AI-driven algorithm?Content that is insightful, original, and user-focused ranks best. Case studies, thought leadership articles, expert analysis, and well-structured website pages optimized for search intent perform well under the new algorithm.

How can financial advisors improve their SEO rankings?Advisors should focus on producing high-quality content, optimizing their websites for search intent, and maintaining a strong engagement strategy. Partnering with an SEO-focused marketing agency can help ensure long-term success.

How can Indigo Marketing Agency help advisors stay ahead of Google’s AI updates?Indigo Marketing Agency specializes in creating SEO-driven websites and thought-leadership content tailored to financial advisors. We track Google’s algorithm changes and adjust SEO strategies to ensure advisors maintain strong rankings and visibility.

The post Financial Services SEO appeared first on Indigo Marketing Agency.

March 28, 2025

Key Elements of Successful Financial Advisor Website Design

You know the power of a positive first impression. And prospects’ initial impression of your company is typically based on your website. Particularly for financial advisors, website design quality is of utmost importance—it’s a digital showroom of what your company can offer to the individuals and families who will trust you with their hard-earned wealth.

In addition to highlighting your professionalism and trustworthiness, successful financial advisor website design must also communicate your special knowledge and value offer. It’s a delicate balancing act, but it can be done.

Let’s take a look at the core elements of effective website design.

User ExperienceA significant influence on website design is user experience (UX)—essentially, how visitors engage with your website and how easy it is for them to accomplish their objectives. An effective and thoughtful financial advisor website design optimizes the user experience by increasing engagement and encouraging conversions.

Here are the essential ingredients for enabling a positive user experience:

Intuitive navigation: Make it easy for people to navigate and quickly locate the information they need.Fast loading time: Verify your website loads effectively and quickly by optimizing the pictures and code.Easy contact details: Make it simple for website visitors to get in touch with you via phone, email, or web form.Accessibility: Confirm people with disabilities can access your website.Mobile-friendliness: Optimize your website for desktop computers, smartphones, and tablets.

Take a look at the smartphone displays of recent websites we designed:

Content and Value

Content and ValueThe user experience and conversion rate of your financial advisor website design success is greatly influenced by the value of the content and the style of the website. Here’s a list of essential building blocks.

Targeted content: Adapt your custom content to diverse types of audiences with varying objectives.Clearly stated calls to action: Provide specific instructions for what you would like visitors to do next, such as downloading content or getting in touch with you for a consultation.Engaging and informative content: Routinely show off your thought leadership and provide insightful details about your services, financial philosophies, and market research. Conversion-focused: The best way to attract your ideal customers is by designing a custom website that concentrates on converting leads into clients.Efficient information access: The best way to display large sections of information is with accordion format. Accordion format shows a list of headings layered on top of one another. These headings can expose or hide related material when clicked (or in response to keyboard input or screen-reading software).

Here’s some examples of the accordion format we designed for three our clients:

Branding and Trust

Branding and TrustFinancial advisors’ websites are impacted by branding and trust in a big way, affecting everything from the look and feel of the design to the content and user experience.

Key components of successful website branding and design:

Professional and uniform design: Implement a consistent brand identity, easy navigation, and excellent imagery on all pages.Credibility and proficiency: Clearly and concisely highlight your qualifications, certifications, and experience.Testimonials and customer reviews: To gain the trust of prospective customers, highlight positive comments and success stories.

Take a look at these examples of websites we designed that showcase positive feedback from our clients’ customers:

Compliance and Security

Compliance and SecurityFinancial advisor website design is heavily influenced by compliance and trust, impacting both the content and user experience as a whole.

Here’s how to gain trust through compliance:

Adhere to regulations: Verify that your website conforms with FINRA, FTC, SEC, and other pertinent laws.Use strong data security: Use safe encryption and authentication to safeguard customer information and privacy.Make your terms of use and privacy policy clear.Get Started TodayThe process of designing a website never ends. Owners of successful websites consistently monitor user activity, examine data, and implement custom changes in response to new information. The goal is to keep potential customers consistently drawn to and engaged with your website.

Ready to boost your online presence and engagement with prospects through a successful website?

Contact us today to schedule a financial advisor website design consultation and discover how your website can (and should) be a high-quality representation of your company.

The post Key Elements of Successful Financial Advisor Website Design appeared first on Indigo Marketing Agency.

March 24, 2025

AI for Financial Advisors

Artificial intelligence (AI) for financial advisors has evolved beyond just automating tasks to becoming a strategic asset. And it is especially relevant in the context of the Great Wealth Transfer.

AI-powered tools are transforming various facets of advisory businesses, including client engagement, portfolio management, compliance, and more.

Still relying on manual processes for client communication, research, or scheduling? It’s time to consider how AI can streamline your workflow, enhance decision-making, and free up more time for high-value client relationships.

Financial advisors who stay ahead of this growing trend stand to attract the lion’s share of clients due, in part, to their increased efficiency and capacity—which allows them to serve their clients better. On the other hand, advisors who fall behind stand to lose big.

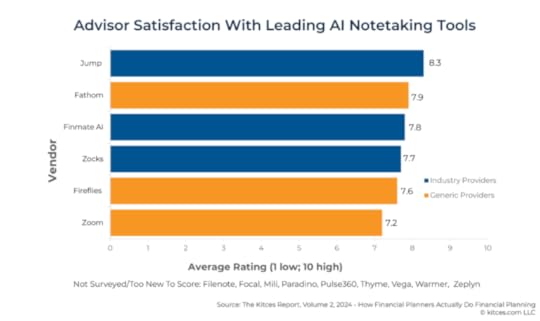

You may be wondering if these AI tools for financial advisors are just more shiny objects unfocused advisors like playing with. But here’s a chart that tells a different story:

This chart can be found in Michael Kitces’ article about AI tools.

Now let’s take a look at some of the most important AI tools for financial advisors you should consider to boost your competitive advantage, win more clients, and deliver better service and results.

AI Tools for Financial Advisors to Streamline Your BusinessClient Engagement & Workflow AutomationJump AI: Automates client communication, meeting summaries, and follow-ups.Zocks: An AI-driven CRM and client engagement platform.Advisor360 + Parrot AI: Transcribes, summarizes, and stores client meetings in CRM systems.Morgan Stanley’s AI @ Morgan Stanley Debrief: Assists advisors in dictating and summarizing meetingsMerrill’s AI-Powered Scheduler: Reduces appointment setup time by 18 minutes per clientPortfolio & Market AnalysisMorningstar Direct Advisory Suite: AI-powered research, portfolio analysis, and client proposal generationTIFIN @ Work: Provides AI-driven insights for wealth managers to identify client needsBlack Ore’s Tax Autopilot: Delivers AI-supported tax preparation and wealth management insightsAI-Enhanced Client Review ProcessesZeplyn: Developed AI-powered tools that significantly streamline the client review process. By reducing meeting preparation and documentation time from an hour to just 5-10 minutes, advisors can allocate more time to personalized client interactions and strategic planning. AI-Powered Meeting AssistantsJocks and Jung: Offers AI-driven meeting assistants that automate tasks like note-taking and follow-ups. For instance, Cambridge Investment Research reported saving over 40,000 hours for their advisors by integrating these assistants—highlighting major strides in efficiency when adopting AI. AI-Driven Marketing PlatformsCatchlight: Utilizes AI to analyze and enrich lead data, helping financial advisors focus on prospects with the highest conversion potential. By integrating with existing CRM systems, it provides actionable insights to prioritize outreach efforts effectively. Saifr: Offers AI-assisted content creation tools designed to ensure compliance with financial regulations. It helps advisors draft marketing materials that adhere to industry standards, reducing the time spent on compliance reviews. SmartAsset’s SmartAdvisor: A lead-generation platform connecting financial advisors with potential clients. It uses AI to match advisors with prospects based on specific criteria, streamlining the client acquisition process. LeadGenius: Combines AI with human intelligence to identify and communicate with targeted sales leads. It gathers data from various sources to build comprehensive lead profiles, aiding advisors in personalized marketing efforts. Conversica: Provides AI-driven virtual assistants that engage with leads through email, chat, and SMS. These assistants automate initial outreach and follow-ups, ensuring timely and personalized communication with prospects. Content Creation & MarketingJasper.ai: An AI-powered writing assistant that generates compliant, brand-aligned contentMicrosoft Copilot: An AI writing and analysis assistant for financial planning in Word, Excel, and CRM integrationsFinancial Planning & ComplianceFP Alpha TAX: Provides AI-driven tax projections and Roth conversion strategies CogniCor’s AI Solutions: Offers a virtual assistant that automates compliance tasks and client inquiriesChatGPT (Enterprise): Used by advisors for research, document drafting, and financial plan generation Download Your Free Compliance Best Practices Guide for Financial Advisor Blogs How AI Helps You Prepare for the Great Wealth TransferThe $84 trillion Great Wealth Transfer is happening now. Over the next two decades, trillions will shift from Boomers to Millennials and Gen Z. To stay competitive, advisors need to:

Optimize client communication: AI-powered CRMs and chatbots ensure seamless, personalized client engagement.Improve investment decisions: AI-driven market analysis helps identify trends and tailor data-backed investment strategies.Simplify compliance & reporting: AI tools help document decisions and automate compliance workflows.Scale advisory services: AI automates time-consuming tasks so you can serve more clients without sacrificing quality.Start Leveraging AI for Financial Advisors TodayYou don’t have to overhaul your entire tech stack overnight. Start with one AI tool that addresses your biggest bottleneck—whether it’s scheduling, client research, or portfolio analysis.

Want to see how AI for financial advisors can transform your business?

Learn more about Indigo Marketing Agency. We focus ONLY on helping financial advisors manage their messaging and implement comprehensive marketing strategies that generate high-quality leads and clients.

Explore the different levels of service offered with our Total Marketing Packages to get help implementing powerful marketing while freeing up your time to focus on clients.

Let’s talk. Book a strategy session today.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content  How Advisors Can Use Video To Stand Out (Webinar)

How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Register The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential

The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

READ MORE Redefine Your Newsletter & Unleash Your Potential With Video

Redefine Your Newsletter & Unleash Your Potential With Video Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

READ MORE FAQs How can AI improve client engagement for financial advisors?AI-powered tools for financial advisors streamline client communication by automating meeting summaries, follow-ups, and CRM updates. This ensures timely and personalized interactions, helping advisors build stronger relationships while saving time.

What are the best AI tools for workflow automation in financial advisory firms?include Jump AI for automating client communication, Zocks for AI-driven CRM management, and Merrill’s AI-Powered Scheduler, which reduces appointment setup time. These tools help advisors manage tasks efficiently and focus on high-value client interactions.

How does AI assist in portfolio management and market analysis?AI-driven platforms like Morningstar Direct Advisory Suite and TIFIN @ Work analyze market trends and provide actionable investment insights. These tools help financial advisors make data-backed decisions and tailor investment strategies for their clients.

Can AI help financial advisors with compliance and documentation?Yes, AI tools like CogniCor’s AI Solutions and Saifr automate compliance tasks, ensuring financial materials adhere to industry regulations. AI also helps with document drafting and reporting, reducing manual work and minimizing compliance risks.

How does AI support financial advisors in preparing for the Great Wealth Transfer?AI optimizes client communication, enhances investment decision-making, simplifies compliance, and enables advisors to scale their services. By leveraging AI tools, financial advisors can efficiently manage the increasing demand for wealth management services from younger generations.

Sourceshttps://wealthtechtoday.com/2025/03/10/the-great-ai-awakening-7-technology-trends-from-the-t3-2025-conference/ https://www.financial-planning.com/list/favorite-ai-tools-in-wealth-managementhttps://www.investmentnews.com/wealth... https://www.financial-planning.com/news/merrill-morgan-stanley-on-simple-ai-tools-for-every-financial-advisorhttps://www.thinkadvisor.com/2025/02/...https://www.businesswire.com/news/home/20250305091906/en/Jump-Selected-as-an-Official-Technology-Provider-for-Osaic%E2s-Network-of-Financial-Professionalshttps://osaic.com/articles/osaic-forms-strategic-relationship-with-zocks-to-provide-their-financial-professionals-access-to-an-ai-driven-edge-in-productivity

The post AI for Financial Advisors appeared first on Indigo Marketing Agency.

March 20, 2025

Financial Advisors Communicating About Market Volatility

As financial advisors, you’re well aware that so far the 2025 financial market has been more unpredictable than a toddler. One moment, they’re giggling with delight; the next, they’re in full meltdown mode because a sock won’t cooperate.

But despite the turbulence, history suggests that what we’re seeing may not be a sign of impending disaster.

What Story Does History Tell?For context, Phil Blancato, chief market strategist at Osaic, points out that while the S&P 500’s 6.1% drop in the first 48 trading days of the year marks its worst start since 2020, such declines are not unprecedented.

He went on to argue, “Since 1928, there have been 17 years with similar drops, and 10 of those years ended positively. A notable example is 2003, when the S&P 500 reversed an 8.6% early-year loss to finish up 26.4%.”

So, it’s safe to say that April has historically seen market shifts, but the volatility makes financial advisory clients anxious nonetheless.

Why Proactive Communication MattersIf there’s one thing more unpredictable than the markets, it’s human emotion.

When clients see red numbers flashing across their screens, their instinct is often to panic, pull out of investments, or assume the worst.

That’s where financial advisors come in!

Right now, your clients don’t just need portfolio management; they need perspective. They need to hear from you. Silence can feel like neglect, and in uncertain times, that’s the last thing you want your clients to associate with your services.

By proactively communicating, you’re doing three things:

Reinforcing your value: Clients don’t just hire you to manage assets; they hire you to provide guidance in both good times and bad.Providing reassurance: Sometimes all a client needs to hear is that downturns are normal and history suggests recovery.Preventing emotional decision-making: If a client sells at the bottom due to fear, they lock in losses rather than riding out the wave, which financial advisors know all too well.

Here’s what I know, if you’re not talking to your clients, someone else is—whether it’s the media, a doomsday influencer, or their neighbor who suddenly thinks they’re an investment expert. It’s better that they get insight from you.

Financial advisor Jeff McClean of Solidarity Wealth shares some insight into how he keeps his clients updated in turbulent times:

Our approach is straightforward: It is not a hard-and-fast rule, but if my partners and I each get 3+ calls/texts in a 24-hour period around “what’s happening with the markets,” then we know the angst or nervousness is increasing. And I have always thought that if 3 people reach out, there’s probably 3x as many thinking the same thing. So it is best to be proactive and get ahead of concerns to save us from fielding 3x as many calls. Proactive market communication saves so many calls/emails/texts. As you will notice too, we made sure our most recent volatility email went out on Friday, March 7th. We really wanted something out before the weekend when clients have more time to think and digest the market or economic news that way our thoughts/narrative were already in their inbox.

Read: Marketing for Financial Advisors: 5 Trust-Building Strategies

The Right vs. Wrong Way to Talk About VolatilityHow you communicate about market shifts matters just as much as whether you communicate at all.

The wrong way?

Leading with panic-inducing statements like:

“The market is crashing! Brace yourselves!”“This could be the next 2008—buckle up.”“We’re in uncharted territory.”

The right way? Acknowledge the volatility, provide historical perspective, and remind clients of the bigger picture:

By framing your messaging with confidence and perspective, you reinforce trust instead of fueling uncertainty.

Would you like another real-life example? Here’s another financial advisor like you that writes timely articles to share with his clients.

Proactive communication doesn’t have to mean individually calling every client after a bad trading day (though high-touch clients may appreciate that).

Instead, scalable content marketing allows you to keep all your clients informed without spending all day answering emails.

Consider these content strategies:

Weekly or monthly emails: A simple market update with your reassuring perspective keeps clients from panicking over daily fluctuations.Blog posts: These establish you as a thought leader and give clients a resource to turn to when they have questions.Social media posts: Even short LinkedIn or X updates can remind clients you’re present, engaged, and monitoring the situation.

When clients feel informed, they feel confident. And confident clients are more likely to stick with their financial advisor rather than jumping ship out of fear.

How Indigo Marketing Agency Helps

How Indigo Marketing Agency HelpsHere’s the challenge: As a financial advisor, your expertise is in guiding clients—not writing blog posts or crafting market updates. And that’s okay. That’s where we come in.

At Indigo Marketing Agency, we create custom content that speaks in your voice, helping you keep clients informed without spending hours writing each week.

From email sequences to blog posts and social media content, we ensure your clients hear from you consistently—without you lifting a finger.

Since we specialize in providing marketing services ONLY for financial advisors, all our content is compliant and engaging to audiences of RIAs.

Learn more about our Total Marketing Packages today.

Get a Free Strategy Call for Custom ContentIf you want to keep your clients engaged and reassured but don’t have time to write, let’s talk.

We’ll create custom content that sounds like you, reinforces your expertise, and helps you retain clients.

Book a free strategy call today, and let’s craft a client communication plan that keeps your business strong—no matter what the market does next.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started

90%

90% New website visitors vs. returning visitors

Read Case Study

50%

50% Increase in email click-through rate

Read Case Study

44%

44% Increase in website traffic

Read Case Study

21%

21% Website traffic from organic sources

Read Case Study

73%

73% Website traffic from organic sources

Read Case Study

20%

20% Website traffic from personal blog content

Read Case Study FAQs Why is proactive communication important for financial advisors during market volatility?Clients look to their advisors for guidance, especially in uncertain times. Proactively communicating reassures them, prevents emotional decision-making, and reinforces the advisor’s value. Silence can lead to unnecessary panic or clients seeking unreliable sources for advice.

How should financial advisors talk about market volatility without causing panic?Advisors should acknowledge the market’s fluctuations but provide historical context and a long-term perspective. Instead of using alarmist language, they should focus on past market recoveries and emphasize that volatility is a normal part of investing.

How can content marketing help financial advisors retain clients?Regular emails, blog posts, and social media updates keep clients informed, reducing their anxiety and reinforcing trust in their advisor. When clients feel confident and educated, they’re more likely to stay with their advisor rather than making impulsive investment decisions.

What if financial advisors don’t have time to write market updates or blogs?That’s where Indigo Marketing Agency comes in. We create custom, client-facing content that reflects the advisor’s voice and expertise, allowing advisors to focus on managing portfolios and client relationships instead of writing.

How can financial advisors get custom content for their clients?Advisors can book a free strategy call with our team to discuss their communication needs. The agency will craft a personalized content plan to keep clients informed and engaged without adding extra work to the advisor’s plate.

The post Financial Advisors Communicating About Market Volatility appeared first on Indigo Marketing Agency.

March 19, 2025

Best Ad Practices That Work for Marketing Financial Advisor Services

One of the most surefire ways of growing a business fast and keeping a steady stream of leads coming in is with advertising. The major media platforms, like Meta, LinkedIn, and Instagram, make money from advertisers. So they want you to be successful when you advertise with them.

The only downer is that too many small business advertisers lose money on ads. To win with marketing your financial advisor services, all you need is a simple list of best practices that help you connect with your audience and get them to take action.

With well-crafted, high-converting ads marketing your financial advisor services, you will attract the right audience and keep your schedule booked with highly qualified leads.

Indigo Marketing Agency helps financial advisors get more clients with our complete marketing and advertising services.

This quick video covers some simple steps financial advisors can take to fix your ad marketing strategy:

1. Be Clear, Not CleverMany financial advisors struggle to generate leads because their ads lack clarity, simplicity, and a compelling call to action. If you want to run ads that actually work, follow these three proven best practices.

When crafting ad copy, clarity should always come before creativity. Financial services can be complex in the mind of our audience, and if potential clients have to decode your message, they’ll keep scrolling.

Action Steps: Use simple, direct language that immediately communicates the value of your services. Avoid industry jargon or overly technical terms that might confuse your audience. Instead of a headline like “Optimize Your Wealth Portfolio for Maximum Returns,” try something easier to comprehend like: “Grow Your Retirement Savings Faster.” Keep your headline straightforward so it grabs attention quickly.Example:Instead of: “Financial freedom is just a strategy away—find out how to make your money work for you.”Try: “Get a Free Financial Plan—Start Building Wealth Today”A clear ad will always outperform one that tries to be too complex, clever, or vague.

2. Keep it SimpleSimplicity is key when it comes to ad copy. Studies show that ads written at a third-grade reading level perform significantly better than complex messaging.

Why? Because people scroll quickly and don’t have time to decipher complicated language.

Action Steps: Keep sentences short and to the point. Write as if you’re talking to a friend, not an investment banker. Use bullet points or numbered lists to break down information. Stick to a single, focused message per ad.Example: Instead of writing something like: “With our advanced wealth management strategies, we help high-net-worth individuals maximize tax-efficient investments while securing generational wealth.” Try using shorter, more common words like: “We help you save money on taxes and grow your investments. Book a free call today.”By making your message clear and digestible, you’ll increase engagement and conversion rates.

3. Always Include a Strong Call to Action (CTA)Many financial advisors run marketing ads without a clear next step, leaving potential clients unsure of what to do. Every ad needs a specific and actionable CTA that tells the audience exactly what to do next.

Action Steps: Use action-oriented language like “Download Now,” “Book a Free Call,” or “Get Your Guide.” Make your CTA stand out visually with buttons or bold text. Clearly state what will happen after the person takes action. (e.g., “Book a free call and get a custom financial strategy.”) Test different CTAs to see which one drives the most engagement.Example:Instead of: “We provide expert financial advice to help you plan for retirement.”

Try this: “Book a Free 15-Minute Call to Plan Your Retirement Strategy Today!”

CTA Ideas for Marketing Financial Advisor Services: “Download Your Free Retirement Planning Guide” “Schedule a Free Investment Strategy Call” “Claim Your Free Financial Health Check” “Watch Our Free Training on Tax-Saving Strategies”By making it easy for people to take the next step, your ads will drive more conversions.Read: Mastering the Call to Action: A Guide for Financial Advisors

Bonus Tips for Ads That Convert1. Use Eye-Catching Visuals Use high-quality images or short videos to grab attention. Avoid stock photos that look generic; use real people or graphics that relate to financial success. Test different color schemes and layouts to see what works best.2. Target the Right Audience Use Meta, LinkedIn, or Google Ads to target specific demographics. Focus on high-intent keywords like “financial planner near me” or “retirement savings help.” Retarget website visitors with ads to stay top-of-mind.3. Test and Optimize Regularly Run A/B tests on different headlines, CTAs, and images. Track metrics like click-through rates (CTR) and conversion rates. Adjust your ad strategy based on what performs best.The Bottom LineMarketing your financial advisor services with ads is not a matter of being clever, flashy, or overly creative. Running successful ad campaigns happens with clear and straightforward ads that have a strong call to action.

By focusing on these key principles, you’ll attract more leads, drive higher engagement, and ultimately convert more prospects into clients.

Indigo Marketing Agency can help you build a top-to-bottom marketing and ad strategy that grows your practice faster. Learn more about our Total Marketing Package options here.

If you need help crafting high-converting ads that expand your reach, let’s talk! Book a consult call to learn more about how we can help you grow your practice faster and with less stress.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started

90%

90% New website visitors vs. returning visitors

Read Case Study

50%

50% Increase in email click-through rate

Read Case Study

44%

44% Increase in website traffic

Read Case Study

21%

21% Website traffic from organic sources

Read Case Study

73%

73% Website traffic from organic sources

Read Case Study

20%

20% Website traffic from personal blog content

Read Case Study FAQs What is the most important factor in making financial advisor ads effective?The most important factor is clarity. Ads should be clear, not clever, meaning they should use simple and direct language that quickly communicates the value of your services. Potential clients scroll fast, so your message needs to be immediately understandable.

At what reading level should financial advisor ads be written?Studies suggest that ads should be written at a third-grade reading level. This may seem overly simple, but keeping the language easy to understand helps ensure that more people quickly grasp your message and take action.

Why is a call to action (CTA) so important in financial advisor ads?A strong call to action (CTA) tells potential clients exactly what to do next—whether that’s booking a consultation, downloading a free guide, or signing up for a webinar. Without a clear CTA, even interested prospects may not take the next step.

How can I balance simplicity with demonstrating my expertise?You can keep your ads simple and clear while occasionally sharing educational content that showcases your expertise. For example, run straightforward lead-generation ads but also post insightful blog articles or videos to establish credibility.

What are the key elements of a high-converting ad for financial advisors?A successful financial advisor ad should include:

A clear message that immediately states what you offerSimple language to ensure easy understandingA compelling call to action guiding the next stepOccasional expert content to build trust and authorityThe post Best Ad Practices That Work for Marketing Financial Advisor Services appeared first on Indigo Marketing Agency.

March 17, 2025

Financial Advisor Marketing Services Client Success Story

You might think our niche in financial advisor marketing services has a small audience. But did you know there are more than 241,225 financial advisors currently employed in the United States?

That’s a dizzying amount of competition! The question that must be asked:

How are you supposed to stand out and attract clients to work with you in a sea of sameness?

That’s the question Iván Mendoza of Mendoza Private Wealth asked himself.

Instead of going it alone, Iván made a wise decision in turning to Indigo Marketing Agency because our marketing services are specifically focused on growing financial advisor firms.

Eyes on GrowthIván turned to Indigo with clear goals.

He wanted to stand out from the competition in his niche market and create a market position of one. He wanted to stay top-of-mind with clients and prospects, knowing this would help more people come “off the fence” and become clients.

The Indigo team wanted to ensure that the content created for Iván would:

Reach more people and boost awareness of his brand.Maximize engagement with his target audience.Offer tons of value that leaves viewers wanting more.Video Marketing Services for Financial AdvisorsThat’s why the Indigo team recommended video marketing.

Many advisors hesitate to step in front of the camera, unsure of how video marketing can impact their business. But Mendoza was game.

He immediately got to work, following the recommended script for crafting winning video content. And he wasn’t disappointed. Iván got immediate results.

Power of Video Marketing for RIAsIván, like many financial advisors, knew the importance of client communication but had never used video as part of his marketing strategy.

However, with the guidance of Indigo Marketing Agency, he stepped out of his comfort zone, recorded his first market update video, and saw instant success.

His video, which provided a timely analysis of 2024’s market trends, featured clear insights, engaging charts, and a strong call to action.

It was strategically released at the start of the year—when clients and prospects were particularly interested in market updates and investment strategies.

On-Demand Webinar: How Advisors Can Use Video To Stand Out

Immediate Impact: Iván’s Success Story

Immediate Impact: Iván’s Success StoryThe results were almost instant. Within an hour of sending his video to his email list and sharing it across social media, Iván received:

A call from a client with compliments and additional questions, allowing him to strengthen the relationship and provide even more valueAn email from a center of influence with great feedback, opening the door for future collaborationsA $5 million fit meeting booked with a long-time prospect, potentially leading to a significant business opportunityThese results highlight the power of using video as a financial advisor. They also speak to the power of outsourcing your financial advisor marketing services to Indigo Marketing Agency and maximizing our team’s help to integrate video content effectively.

The right message, delivered at the right time, can lead to immediate engagement, strengthened relationships, and even new business opportunities.

How Indigo Marketing Agency Made It Easy

How Indigo Marketing Agency Made It EasyOne of the biggest reasons financial advisors hesitate to use video is the perceived complexity of planning, recording, and distributing content. These concerns are valid for most financial advisors, and they are the biggest roadblocks to implementing this strategy consistently.

The good news is, that’s exactly why smart financial advisors turn to Indigo Marketing Agency!

Iván didn’t have to figure it all out on his own; the Indigo team provided:

Script development to ensure a clear and compelling messageProfessional editing to enhance engagement and credibilitySeamless distribution across email, social media, and other marketing channelsWith this support, Iván was able to focus on his expertise while Indigo handled the technical and strategic aspects of video marketing. This partnership ensured his content was polished, professional, and delivered maximum impact.

Why Video Marketing Works for Financial AdvisorsVideo marketing is becoming an essential tool in financial advisor marketing services, offering unique benefits such as:

Building trust and credibility: Seeing and hearing an advisor creates a personal connection that written content alone can’t achieve.Enhancing engagement: Video content is more likely to capture attention and keep viewers engaged compared to text-based communication.Increasing conversion opportunities: A well-crafted video with a strong call to action encourages viewers to take the next step, whether that’s booking a meeting or reaching out with questions.For Iván, implementing video marketing led to immediate results, proving its effectiveness in driving engagement and business growth.

Are You Ready to See Results Like Iván?If you’re a financial advisor looking to elevate your marketing strategy, Indigo Marketing Agency’s financial advisor marketing services can help.

Our Total Marketing Packages offer robust marketing solutions for busy financial advisors to put their firm on the fast track to growth and success.

Whether you need guidance on creating compelling video content, professional editing, or a seamless distribution plan, our team is here to support you every step of the way.

Don’t let hesitation hold you back—take the first step toward a more effective marketing strategy by learning about our marketing services for financial advisors like you.

Ready to start creating videos that drive real results, just like Iván?

Schedule a FREE strategy session today and let’s craft your success story together!

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content  How Advisors Can Use Video To Stand Out (Webinar)

How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Register The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential

The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

READ MORE Redefine Your Newsletter & Unleash Your Potential With Video

Redefine Your Newsletter & Unleash Your Potential With Video Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

READ MORE FAQs Why should financial advisors use video marketing?Video marketing helps financial advisors build trust, engage clients, and stand out in a competitive market. It allows for clear communication, personal connection, and increased conversions compared to text-based content.

How quickly can I see results from using video in my marketing?Results can happen fast! Iván Mendoza saw immediate engagement within an hour of sending out his first market update video—leading to client conversations, valuable feedback, and a $5 million prospect meeting.

What if I don’t know what to say or how to create a video?That’s where the Indigo Marketing Agency helps! We provide script development, professional editing, and seamless distribution, so you can focus on your expertise while we handle the rest.

How does video marketing fit into my overall financial advisor marketing strategy?Video complements your existing marketing by enhancing client communication, boosting engagement on social media, and making your emails more impactful. It’s a powerful way to stay top-of-mind with clients and prospects.

How do I get started with Indigo Marketing Agency’s financial advisor marketing services?Simple! Reach out to us today for a free strategy session. We’ll help you develop a video marketing plan that drives real results—just like Iván’s success story.

The post Financial Advisor Marketing Services Client Success Story appeared first on Indigo Marketing Agency.

March 10, 2025

Social Media Mistakes Financial Advisors Make (And How to Fix Them)

Did you know that 73% of marketers think their social media marketing efforts have been either somewhat or very effective for their business?

Financial advisors know social media marketing is effective, so they post.

So what’s the problem?

Far too many see little to no results. You might be getting likes and comments, but the goal is to turn those interactions into new leads and clients.

If that’s not happening for you, you’re probably making one or more common social media mistakes—and they could be costing you real business.

The good news?

A few small changes can turn your social media into a client-generating machine.

Real-Life Advisor Crushing it on Social MediaBefore we dive into what NOT to do, let’s take a look at one Indigo client who’s doing all the RIGHT things.

Joe Dowdall isn’t just posting on social media—he’s using it as a tool to educate, engage, and convert prospects into clients. His recent LinkedIn video is a perfect example of how financial advisors can leverage social media to generate leads.

Instead of just talking about taxes in retirement, Joe presents a clear problem (overpaying taxes) and an actionable solution (his free video series on tax planning through retirement).

What makes his approach work?

A strong hook: He immediately addresses a common pain point: “Worried about taxes eroding your retirement savings?”Clear value: He outlines exactly what viewers will learn, making it easy for them to see the benefits.Compelling CTA: He offers two ways to engage: watching the video series or downloading the free e-guide.

By giving his audience a specific next step, Joe isn’t just driving engagement—he’s building a list of warm leads who are actively interested in tax planning.

And he’s not doing it alone—Joe partners with Indigo Marketing Agency to create high-converting social media content that turns followers into clients.

If you’re posting but not seeing real results, you might be making one of the common social media mistakes we see all the time. Let’s break down what’s holding advisors back—and how to fix it.

Mistake #1: Posting Without a Clear Call to ActionMany financial advisors post valuable content but never guide their audience on what to do next. If you’re not telling prospects the next step, they won’t take it.

Every post should have a clear call to action (CTA) that moves potential clients closer to working with you. Instead of just providing information, tell them what to do next. That might mean encouraging them to book a discovery call, send a direct message, or download a free resource.

For example, instead of ending a post with “Tax planning is important for retirement,” you could say, “Want to make sure your tax strategy is optimized for retirement? Let’s chat—send me a message.” (And include a meeting link!) The difference is subtle, but the second approach gives people a clear next step.

Read more: Mastering the Call to Action: A Guide for Financial Advisors

Mistake #2: Engaging Only in the Comments (Not the DMs)Likes and comments are a great start to interacting with your audience on social media, but if you’re not moving conversations to direct messages (DMs), you’re missing opportunities. A comment on your post signals interest, but most people won’t take action unless you take the lead.

Instead of just thanking someone for their comment, continue the conversation in a private message. If someone engages with your post about retirement planning, send a quick DM: “Thanks for engaging! What’s your biggest challenge when it comes to planning for retirement?” This opens the door for a real conversation that could lead to a new client.

LinkedIn voice messages can also be an effective way to personalize outreach. Many advisors see higher response rates when using voice messages instead of text because they feel more personal and less like a sales pitch.

Mistake #3: Talking Too Much About YourselfMany financial advisors focus their content on their firm, their services, and their process. But the reality is, potential clients don’t care about that; they care about their own financial challenges.

A common mistake is posting something like, “We provide comprehensive financial planning for professionals and business owners.” That might be true, but it doesn’t speak to the client’s needs. A better approach would be: “Are you confident your retirement savings will last? Here’s how to stress-test your plan.”

Shifting your content to focus on the problems your audience faces—and how you solve them—makes your posts more engaging and effective. Use the word “you” more than “I” to make your content feel personal. And when possible, share real client success stories (anonymized, of course) to illustrate the impact of your advice.

Mistake #4: Posting Inconsistently (or Too Much at Once)If you post once every few months, you’re practically invisible. If you post 10 times in one week and then disappear for a month, you lose trust. Inconsistent posting makes it harder to build brand recognition and stay top-of-mind.

The best strategy is to post consistently but not excessively. Aiming for two to three posts per week is a good balance. Using a content calendar can help you stay on track and ensure you never scramble for ideas.

Snag a FREE Marketing Calendar here!

Another way to stay consistent is by repurposing your best content. If you wrote a great LinkedIn post that got engagement, turn it into an email newsletter or a short video. That way, you maximize your reach without constantly creating new content from scratch.

Mistake #5: Ignoring LinkedIn Connection Requests & MessagesIf you’re getting inbound connection requests on LinkedIn but not engaging with them, you’re missing opportunities. And if you do respond but only with a generic “Thanks for connecting!” message, you’re not making the most of those interactions.

Instead of a canned response, start a conversation. When someone connects with you, ask them what made them interested in your profile. If they’re engaging with your content, ask them about their biggest financial challenge. The goal is to turn passive connections into real conversations that lead to business.

Checking your LinkedIn inbox daily ensures you don’t let warm leads go cold. A simple follow-up message a few days after the initial connection can also help keep the conversation going.

Mistake #6: Posting Canned Content Instead of Being Authentic

Mistake #6: Posting Canned Content Instead of Being AuthenticMany financial advisors rely on generic, pre-written social media content or only share links to industry articles. While this might seem like a quick way to stay active on social media, it often feels robotic and forgettable.

Clients want to know who you are, what you believe, and why they should trust you. That means sharing personal insights, stories, and experiences. A simple “day in the life” post or a behind-the-scenes look at how you help clients can be far more engaging than another industry news update.

Videos and pictures also help make your content feel more personal. A short video explaining a common financial mistake or a picture from a recent client meeting (without revealing details) adds authenticity to your brand.

You may like this: Why Financial Advisors Should Embrace Video Content

Mistake #7: Not Being Social on Social MediaSocial media isn’t just about posting—it’s about engaging. If you only focus on your own content and never interact with others, you’re missing a major opportunity to build relationships.

Commenting on clients’ and prospects’ posts shows you support them. Engaging in LinkedIn discussions positions you as a thought leader. Sharing and reacting to industry news keeps you visible in your network.

Even on days when you’re not posting, taking a few minutes to like, comment, and message people in your network helps keep your name in front of potential clients. The more you engage and the more you show up in feeds, the more opportunities you create to get clients!

How to Turn Social Media Into a Client-Generating MachineManaging social media for financial advisors takes time and strategy. If you’re struggling with consistency, engagement, or content creation, outsourcing your social media management can help you stay on track without the hassle.

A strong social media strategy includes:

Posting consistently (2-3 times per week)Engaging with followers through comments and DMsSharing authentic, client-focused contentRunning LinkedIn messaging campaigns to connect with ideal prospectsDid you know that all of the above, and a lot more, is exactly what Indigo Marketing Agency does ONLY for financial advisors, to help them grow their businesses?

Explore our all-inclusive Total Marketing Package options here.

Our tiered service offerings ensure you’ll find the perfect match for your marketing needs, whether you’re just starting to enhance your online presence or ready to implement advanced advertising strategies.

Prefer a personalized, 1-on-1 chat about your growth marketing plan? We’re here for you! Book a free consultation call now.

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content

Schedule Your Free Marketing Strategy Call Today Let’s find out what’s working—and what’s not—when it comes to your marketing. Get Started Check Out Our Related Video Content  How Advisors Can Use Video To Stand Out (Webinar)

How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Register The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential

The Power of Financial Advisor Videos: 3 Reasons Being on Camera Is Essential At Indigo Marketing Agency, we help financial advisors embrace the evolving marketing landscape by utilizing custom video content. Read on for three reasons why you should incorporate video into your marketing strategy and how the Indigo team can help.

READ MORE Redefine Your Newsletter & Unleash Your Potential With Video

Redefine Your Newsletter & Unleash Your Potential With Video Connecting with your clients is of the utmost importance. But it can be really challenging in today’s digital age with all the noise. How are you supposed to stand out from the crowd?

READ MORE FAQs Why isn’t my social media generating new clients?If you’re getting likes and comments but not seeing new leads, you might be making key mistakes like not including clear calls to action, only engaging in comments (instead of DMs), or focusing too much on yourself rather than your audience’s needs. Social media should guide potential clients through a journey, not just provide information.

How often should financial advisors post on social media?Consistency is key. Posting two to three times per week is ideal—it keeps you visible without overwhelming your audience. Avoid posting in bursts and then disappearing, as this can hurt credibility and engagement. A content calendar can help maintain a steady flow of posts.

What type of content works best for financial advisors?Client-focused content performs best. Instead of talking about your firm and services, address common financial concerns your audience faces. Share insights, success stories, and actionable tips. Authentic content—such as personal stories, behind-the-scenes posts, and videos—also builds trust.

How can financial advisors use LinkedIn to attract clients?LinkedIn is a powerful tool, but engagement is just as important as posting. Respond to comments, send DMs to engaged users, and personalize connection requests. Don’t just collect contacts—start meaningful conversations that can lead to new business.

How can I make my social media strategy more effective without spending hours on it?A strong strategy includes a mix of consistent posting, engagement, and authentic content. Repurposing existing content, using scheduling tools, and outsourcing social media management can help save time while keeping your strategy effective. If you need expert help, outsourcing to a marketing agency that specializes in financial advisors can ensure you stay consistent and strategic without the hassle.

The post Social Media Mistakes Financial Advisors Make (And How to Fix Them) appeared first on Indigo Marketing Agency.

March 8, 2025

Marketing for Financial Advisors: 5 Trust-Building Strategies

Growing a business as a financial advisor requires having a solid marketing plan, executing it effectively, and refining it based on feedback and data.

Let’s explore five top marketing strategies that can help financial advisors earn the trust of their target audience and expand their practices.

1. Focus on Brand MessagingYour brand messaging is the foundation of your marketing efforts. A clear, compelling message communicates what you do, who you help, and how you make a difference. Unfortunately, many financial advisors struggle to craft website content that is both personal and optimized for search engines (SEO).

When Scott Melbrod, founder of Taxable Wealth came to us, he needed help with brand messaging and a complete marketing game-plan. After working with us for some time, he reported back to us with the experience of being swamped with prospect calls and new clients for his practice. Read the full case study here.

What worked for Scott? First, we designed his website and crafted strong messaging that targeted the needs of his audience.