Gennaro Cuofano's Blog, page 277

October 30, 2015

A conversation with Stephen Covey

Do you have a life mission? If not, don’t worry! You are like 90% of the people around you. Did you spend most of your life doing, achieving, and running after goals? If the answer is affirmative, do you know where you are headed? Or are you like most of the people walking through Manhattan? If you are familiar with “the city” you should know how hard is to find people who walk just for the pleasure of walking. In Manhattan people never stops; NYC is the city that never sleeps, always busy, running after something… But, what is that something they are looking for? Many of them may say: “we want more money, more time, more things”. Of course, common wisdom says that more is better, but is it? Having things apparently is good. Although, when you focus solely on having your vision of the future becomes blurry until you forget what you were really looking for. Why do people forget what they are looking for? Mainly due to the lack of a philosophy of life. Why should you care about philosophy when the world spins at the speed of light? I know you may think: “here you go, another philosopher of modern times trying to have me believe that philosophy can have any impact on my life”. Unfortunately I am not a philosopher and I am not here to teach you anything about life. What I can do instead is to report history and facts about philosophy and how this influenced generations of successful individuals to become thought leaders.

To be or to have? That is the question

There are two ways to approach life: One way is just go with the flow, do not ask yourself any question about existence and give all for granted.

A second way of living would be to ask yourself questions about existence, life and the world around you. In this circumstance you will look at the world that surrounds you with mesmerized eyes. You will think how incredible the feats of nature are. Although you may never know the reason you are here, you can still appreciate life in its entireness.

Which one of the two ways of living you think would make you happier?

If you picked the latter, then you are in favor of having a philosophy of life, whatever it is. Indeed, having a philosophy of life it means asking oneself questions about existence and finding your own answers. There is not right or wrong but just the way that fits most your way of being. In addition, philosophy allows you to have a grand framework. Rather than be like a “candle in the wind” that suddenly moves at each wind’s blow, a philosophy of life makes you still, poised, peaceful, a person of character! How? Well, philosophy gives you the life’s principles according to which you will face any situations, small or big, urgent or not with consistency and rationality.

Stephen Covey and modern philosophy of life

For the first time in modern times Covey built a framework for “a philosophy of life”. While Carnegie gave us a framework on “how to deal with friends and influence people”, Graham gave us a framework on “how to invest”; Napoleon Hill gave us a framework on “how to attract riches”. Stephen Covey instead focused on “how to live”.

Who is Stephen Covey?

Stephen Covey was born in 1932 in Salt Lake city, Utah. After earning a Bachelor of Science degree in business administration from the University of Utah, an MBA from Harvard University, and a Doctor of Religious Education (DRE) from Brigham Young University. Stephen Covey wrote the “7 habits of highly effective people”. His book became a best seller in no time. The principles stated in Covey’s book are not his invention but natural laws (Bio). Stephen Covey’s masterpiece “The 7 habits of highly effective people” is the outcome of an in-depth study of success literature published in US since 1776.

How do you approach life?

Let me tell you the story of two friends of mine. They were twin brothers: Tony and Albert. They had the same parents, they lived in the same town and they knew the same people. Tony grew up to become the mayor, the person who helped and inspired hundreds of people to improve their life. Albert, instead, became a corrupt individual, he always tried to fool and take advantage of other people. Tony had tried to save his brother Albert, but with no success. I always wondered how is this possible? If they had the same DNA and apparently the same life experience up to a certain point in their life, how could it be that one became a leader and the other a despicable person? Although both brothers seemed to have experienced the same things they formed two completely different personalities. How is it possible?!

Do we all see in the same way?

The answer to this question popped to my mind when I eventually read Covey’s “7 habits”. I remembered of the day when we were kids, at the park. We were all learning how to ride a bike. Tony was excited the whole time and although he fell many times, he stood up and eventually became very good at it. Albert, instead, at the first fall, gave up and went home moaning about the fact that he would never be able to ride a bike in his life. Therefore even though they were living the same experience, they gave to those experiences a different meaning. This is the power of perspective! But how was it possible that twin brothers, with the same life, the same parents had such a different perspective on life? I later found out they had different role models. While Tony followed Grandpa Tony approach to life, Albert instead followed Grandpa Al approach to life.

How a name can influence one’s destiny (or how we make ourselves to believe that a name can determine our destiny)

It is incredible to me how a name can influence our existence (). Although a name is just name, we convince our-self that they embed personalities and for some reasons we must follow the destiny attributed to it. Tony and Albert believed that names were determining. Since they brought their grandparents’ first names they “had” to follow their footsteps. But what was the difference in life’s approach of Grandpa Tony compared to Grandpa Al? As I later discovered Grandpa Tony had what Covey defines a “character ethic” approach. Grandpa Al instead followed a “personality ethic” approach. Indeed, Grandpa Tony had a framework or principles that guided him through life. For example, Grandpa Tony did not care about people’s judgment. He would only do things based on his wisdom and judgment. Grandpa Al instead, used persuasion techniques. For example, he cared so much about people’s judgment that he would do anything to impress them. Therefore, Grandpa Al would use a different “façade” according to the situation at hand. In the long run, this approach to life created a lot of stress in his life. It should not surprise you though that Grandpa Al died at age 60, with heart attack. On the other hand Grandpa Tony lived a fulfilling life, always helping his community. Still today people remembers him as a compassionate man, always ready to help. He never let others influence his judgment about right or wrong.

Do you have a map?

Indeed, according to Covey each individual has a different map of the world. Actually the effectiveness of your map will determine how fulfilling your life will be.

Imagine you are going from point A to point B and someone gave you a map to reach point B. You walk for few hours around the block and suddenly you find yourself again at point A. What had just happened? You look at the map and you realize that point B for the person who gave you the map is instead point A according to your perspective. There is not right or wrong since from that person perspective his starting point was your point B, therefore his map was going from B to A. This example introduces us to an important point: First, having a realistic map of the world is crucial. Second, in many cases there is not right or wrong but just the perspective by which individuals looks at the world. You may say things like: “my map is the right one” or “other people are the problem” or “most people don’t understand”. In those cases you are just deceiving yourself. Have you ever wondered why are we able to see crystal clear the shortcomings of other people and be completely blind about ours? Are you the kind of person who looks at the problem and think: “It’s their fault” or “they don’t get it”. If you are, please stop, because you are using the wrong map to get by in this world. Most of us believe to be objective, but are we really? When facing a problematic situation can you understand the other person’s perspective? This leads us to another crucial concept: “paradigm shift”.

Are you able to see from different perspectives?

How many times you heard statements such as: “They never get it” or “They are always wrong”

One day I was walking through the streets in Rome. The city is full of history and each step you take brings with it thousand of years of history. In a paradisiacal place like that armory and love should reign. Although this is not always true: one day I noticed an accident amid a biker and a car driver. Fortunately they were both fine, nonetheless they were animatedly arguing about who did what. The biker would say: “you passed with red light” and the car driver would reply: “you were going at 60 on a 35 speed limit street!” And this was going on for many minutes while traffic on the road was building up. The hilarious part is that when I got back from my walk (over one hour after) they were still arguing. In addition, due to the accident there was a traffic jam and the cops could not seem to stop the two people arguing for who was right or wrong. Of course, they were both right and both wrong. The biker was right in saying that the car driver passed when the light was already orange but he did not admit that he was speeding up. On the other hand, the car driver was right about the biker speed but he did not admit that the traffic light was going toward red. In that moment I realized how crucial perspective is! In many circumstances there is not right or wrong but different angles at which you can look at a particular situation.

Why is it so hard to understand others who think differently from us?

Why then, we don’t use different perspectives to better understand each other? it turns out that is not easy and it implies what Covey calls a “paradigm shift” (term used by Thomas Kuhn in The Structure of Scientific Revolutions). Think what happened in the 16/17th century, when people believed that the earth was at the center of the universe. Of course they were not wrong if you considered their perspective. They were looking at the world through their senses. They could see that the stars in the sky looked like small dots. In addition they could not feel the earth moving beneath their feet. Therefore they assumed that the earth was static and the sun moved around it. Even when Galileo Galilei introduced the telescope and it was clear that the earth was not at the center of the universe people still couldn’t see! Why? Because to see they had to change their perspective, they had to shift their paradigm. Everything they believed up to that point was wrong and they could not accept it. It was easier for some people to believe something wrong and live their life in ignorance rather than accept the truth. But how can we shift paradigm? One way would be to challenge our assumptions about life. If you catch yourself always thinking to be right this may be a signal. Shifting paradigm and developing a better understanding of the world around brings us to the next concept: dependence toward interdependence.

Become independent first and then lead others

Have you ever heard someone saying, “I want to be a recluse”? Of course not! Humans are social animals. We are wired to live with others, be influenced by and influence others. Often I can hear people saying things like: “I want to change the world”; “I want to inspire people”. In our imagination we all seem to have what it takes to succeed. But do we really? It has been shown that we usually overvalue our leadership skills and fall in what are called “ego traps”. (The Most Common Ego Traps)

One of the main reasons of this misinterpretation is due to our habit of looking for an answer outside ourselves. We tend to think that the problem is always somewhere else. This leads to what Covey calls “dependence”. Covey discriminates between three kinds of persons: “Dependent people need others to get what they want. Independent people get what they want through their own effort. Interdependent people combine their own efforts with the efforts of others to achieve their greatest success”. Therefore, Covey’s 7 habits is a path comprised of 6 habits that will get you from dependence to interdependence and a last habit to spin, rinse and repeat. The first three habits: be proactive, begin with the end in mind, put first things first will get you from dependence to independence (private victory). The last three: think win-win, seek first to understand then to be understood, synergize will get from independence to interdependence (public victory). The last habit “sharpen the saw” is about renewing oneself periodically.

What advice would Covey give to you?

If Stephen Covey had to give you an advise he would go through all the habits he taught and applied in the course of his life. Let’s see briefly each habit and how you can apply it:

Be proactive. As a human being you have the capability to redirect and control your impulses. When a stimulus comes in your way you don’t have to respond right away. Quite the contrary, you can become aware and then respond. When you increase the gap between stimulus and response that is when you develop “freedom to chose”. The control over your own impulses is crucial. Indeed, in late 1960s and 1970s Stanford psychologist Walter Mishel tested what is called “the marshmallow experiment”. In this experiment a marshmallow was given to kids in an empty room with no games or distractions. The kids were told that if they waited for 15 minutes more they would have received an additional marshmallow. This exercise was used to determine the willpower and “delayed gratification” ability of each kid. It turns out that those who waited for the second marshmallow had less troubles in life compared to those ones who did not. Why? Those ones who were not able to wait were more inclined to develop addictions or commit criminal acts. This is due to the lack of self-control and ability to keep distractions away while focusing on what’s more important. (The Marshmallow Experiment)

Thereby focus is crucial. If you will focus most of your time watching TV and moaning about the global economic crisis, the wars, the government and so on you will become a miserable person. If instead, you will put most of your effort on family, work, friends (all the things on which you have influence) you will be way happier. How to start working on your area of influence? Change your bad habits in good ones. Determine which kind of person you want to be and act upon that (work on your be versus have).

Begin with the end in mind. Take a deep breath, clear your mind and let’s get ready for a practice that will change your life. Imagination is a powerful force in our life and if you never used it, it is time to start. Let the past go and start molding your own future. Let me ask you this: do you have a vision for your life? You don’t? Realize that you are building a house without a project, how long you think it will last? Therefore it is time to find your vision. How? Picture yourself on your death’s bed. What are the things that you would regret the most about life? Once found out go on and act upon them. Let me tell you an incredible story: in early 1990s Internet phenomenon was just starting. New companies emerged and by the end of the decade the only fact that a company was including in its name .com would make its market valuation skyrocket. In 1994, Jeff was a Wall Street guy. After graduation from Princeton in computer science and electrical engineering, Jeff landed a job on Wall Street. His career in Wall Street was pretty lucrative. One day Jeff was surfing the web and he was stunned by a statistic about Internet usage. According to this statistic the web usage was growing at a staggering 2,300% per month! In that moment Jeff had the “Eureka moment”: he wanted to start his own web company. But how? What to do? And Why to leave his lucrative job? Eventually he left a safe job for a risky (almost impossible) venture. In addition, he did not have idea of what kind of product to sell or what kind of venture to start, he went for it anyway. How did he decide? Jeff used his imagination. He imagined to be eighty years old, narrating the story of his own life. How would have he felt if he didn’t try this venture? Would have he regretted it? The answer was yes he would have regretted it. Eventually that is how Jeff Bezos made up his mind and he became Amazon.com founder. (How Jeff Bezos Started Amazon)

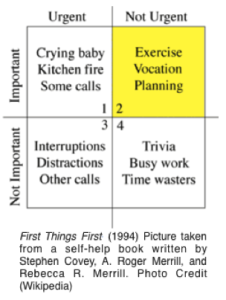

Put first things first. If you did the exercise described in the previous point, you should have now a clear vision of where your life is headed. You created the project of your life. Now it is time to build upon it. Start doing things that will get you closer to your vision. How? Stephen Covey offers an amazing tool called “the management matrix”. Covey discriminates between two group of things: the important or not important and the urgent and not urgent. According to those classification the time management matrix is comprised of four quadrants. In Quadrant I all activities that are urgent and important, such as crises, pressing problems and deadlines. In the Quadrant II all activities that are important but not urgent such as: prevention, relationship building, planning and so on. In the Quadrant III there are activities that are not important but urgent such as: interruptions, some e-mails, some calls and so on. In the Quadrant IV activities, which are not urgent and not important such as: busywork, some mail, time wasters and so on. Your matrix will look like the following:

Can you guess why the second quadrant has been highlighted? Because this is the Quadrant where you must focus the most. Indeed, if you spend too much time in Quadrant I you will burn yourself out. If your focus is on Quadrant III and IV you will end up being totally dependent from others, your life will be worthless and futile. If you instead organize your agenda around Quadrant II this will give you vision, perspective, balance and so on. Start now to reorganize your schedule accordingly. You can see a sample at this link Covey’s weekly worksheet.

Toward Public Victory

The next three crucial steps to go toward interdependence are:

Think win/win. This step will have you develop the habit of cooperation. If you are not familiar with negotiation check out William Ury Getting to Yes.

The final objective is to create value for both parties in the transaction not only for you. Although Covey goes further and he formulates the so called “Win/Win or no Deal”.

Seek first to understand then to be understood. This Habit is about “stopping to use techniques and start using empathy”. There is no way you can build long-lasting relationship in life and business if people around you sense duplicity. (Getting to Yes with Yourself – William Ury). This is really about trying to understand people who think differently compared to you. One good way to practice this Habit is to think of a person that really freaks you out. Found it? Imagine having a pleasant conversation with that person, and agreeing with him/her. You must not fake it but really feel how that person feels, internalize his feelings until you can finally know that person for the first time. If you do so according to Covey you will go from transactional to transformational relationships.

Renewal: be ready to renew yourselfer periodically.

Why should you follow Covey’s principles?

Let me tell you another story. I cannot promise is the last I will tell you since I love stories but I will make it short. I know a person who worked very hard all his life long to reach all the objectives he had. Since childhood teachers told his parents he would not be able to be as good as his older brother and he was doomed to mediocrity. The problem was that our friend did not like school and did not see value in things he was learning there. Although one day as kid he realized that he had to be successful in school if he wanted to reach his goals in life. Therefore, he went on, earned his master degree in Economics and an MBA from a prestigious European university. Considering that this person was coming from a poor family it was a great achievement. Not happy though he pushed further until he got a job in California for an important tech company. He worked his tail off until he was promoted to become a manager at a very young age, the first European manager to earn such honor. I cannot tell who this person is but when I asked him: “how did you make it?” He surprisingly confessed: “When I was just seventeen I found, by chance, a copy of Covey’s book, and it became my bible. I never stopped implementing the 7 habits throughout my life!”.

As Victor E. Frankl would say “success must ensue, and only does so as the unintended side effect of one’s dedication to a cause greater that oneself or as the by product of one’s surrendered to a person other than oneself”.

SUGGESTED READING:

October 28, 2015

READING LIST

The Enlightened Accountant – Accounting Revealed in 100 Pages

Security Analysis: Sixth Edition, Foreword by Warren Buffett – Benjamin Graham, David Dodd

How to Win Friends & Influence People – Dale Carnegie

How to Stop Worrying and Start Living – Dale Carnegie

The Autobiography of Andrew Carnegie and the Gospel of Wealth – Andrew Carnegie

Emotional Intelligence: Why It Can Matter More Than IQ – Daniel Goleman

Focus: The Hidden Driver of Excellence – Daniel Goleman

October 23, 2015

A Conversation with Daniel Goleman

One question that always puzzled me is: “How to determine whether a person is intelligent?”. I have to confess that I really did not know the answer to that question, until recently. But that inquiry brings us to a deeper one: “how can we measure intelligence?”. The most common metric (IQ) has been a cause of frustration and discomfort for many who found out not to be as smart as they thought. But how reliable is IQ in measuring overall intelligence? Is it fair to say that a person with a low IQ will be condemned to an unsuccessful life? This leads us to the source of all misunderstandings: Can intelligence and therefore success be relegated to a standardized test such as the IQ?

Two very smart guys

Let me tell you the story of two very “smart” guys: Jeffrey and Kenneth.

Jeffrey was born in 1953, in Pittsburg, Pennsylvania. Second, of four kids, since childhood hour he showed to be smarter than other youngsters. This became evident when Jeffrey was finally admitted to the Southern Methodist University in Dallas where he received full scholarship and eventually studied business. After graduation and working for a while with a Houston bank, Jeffrey was sent to Harvard Business School graduating in the top 5% of his class (Bio).

Kenneth was born in 1942, in Tyrone, a small town in Missouri, as only child. As child Kenneth showed to be very smart as well. He worked his tail off by delivering newspapers and mowing lawns. Subsequently he earned a degree in economics from University of Missouri and not satisfied yet, he earned a PHD in economics from University of Houston in 1970 (Bio).

What did they have in common?

They were both very smart, successful and wanted to make a lot of money. Their paths crossed when Kenneth hired Jeffrey as consultant (while working at Mckinsey and Co). Kenneth’s company operated in the utility industry and it was one of the biggest and most successful corporations in US. Kenneth was impressed by Jeffrey’s performance and eventually he hired him as CEO of the Capital & Trade Resources of the corporation (the main division of the company). Jeffrey’s career was so successful that by 1997 he was nominated CEO of the whole company. Only Kenneth retained a more powerful role within the organization. It would have been great if the story ended there, but let’s see what happened next!

The story unraveled

Kenneth and Jeffrey were two very smart individuals, with MBAs and PHDs, and very high IQs, therefore destined to success. Jeffrey and Kenneth were not the only smart guys in the company. Ever since Jeffrey became CEO, top graduates were hired to run the company’s operations. The company became so successful that Kenneth and Jeffrey were everywhere: from business magazines to finance newspapers. Their reputation in Wall Street grew rapidly. How did the company grow so fast? Jeffrey had the brilliant idea to use market to market accounting. It means that the company was valuing its assets at market value instead of historical cost. For example, when the company invested in new plants although profit wasn’t made yet they could already show its future estimated profits on the balance sheet. And if the acquired plant did not produce any profit in the future, the company created ad hoc off balance sheet financial vehicles to hide the losses. Therefore the company balance sheet was kept always “clean” from losses. Those complex operations allowed the company to keep a high rating, while not risking a dime. But were all those operations legal? As it turned out they were not. Indeed, when the operations became too complex the company could not hide them anymore, and the financial situation became unbearable. When voices spread that the company had billions lost in those operations it became one of the greatest scandals in American history. The company was Enron and the two protagonists of the story were: Jeff Skilling and Kenneth Lay. They were “the smartest guys in the room”. In 2006 both Jeff and Kenneth were convicted for fraud and became the most evident case of how smart people can do stupid things.

Does a Nobel Prize keep you away from troubles?

Let me tell you the story of LTCM (Long-term Capital Management), a hedge fund who eventually collapsed by taking too much risk. LTCM was funded by Robert C. Merton in 1993 and had in its board Myron S. Scholes. Who are they? Both Merton and Scholes were Nobel Prizes, awarded in 1997, just one year before LTCM collapsed. You might think “why is this relevant to our story?” Well, the LTCM firm was founded through the idea that a formula (they won the Nobel Prize thanks to this formula), could win in all financial circumstances. That formula actually worked for a couple of years, until 1997. During that year the firm lost a staggering $4.4bln and had to be bailed out by other institutions (When Genius Failed – The Rise and Fall of Long-Term Capital Management)

Is it possible that two Nobel Prizes, among the smartest persons on planet, were not able to foresee the risk involved in their operations? Maybe they did understand the risk rationally but not emotionally. But if that is the case can we still define those people intelligent? Of course, they are among the people with highest IQ in the world. What is the other aspect of intelligence that goes beyond IQ? Emotions. Indeed, emotions can hijack the intelligence of an individual. Daniel Goleman calls it “EI” or “Emotional Intelligence”. Although the term “Emotional Intelligence” was used for the first time by psychologists John Mayer and Peter Salovey, Goleman was the one who formulated a systematic approach to EI.

Who is Daniel Goleman?

Daniel Goleman is an international psychologist who eventually became popular through the book “Emotional Intelligence”. He was born in Stockton, California, in 1946. After getting a scholarship to Harvard, he studied clinical psychology. After that Goleman continued his studies in India and Sri-Lanka where he started to study the implications of meditation practices on stress reduction. He then joined the New York Times in 1984 but soon he realized that the topic of emotional intelligence required his attention, until the book on the subject came about and sold more than 5 million copies worldwide.

What is Emotional Intelligence (EI)?

How many times you found yourself doing something you promised it wouldn’t happen again? Such as saying something in public you were not supposed to say, falling again in an old bad habit that you were trying to abandon. In all those cases the reason we fall back into the trap is because we lack Emotional Intelligence, or “the capacity to assert self-control, persistence and most of all to motivate oneself”. Why is it so difficult to change our bad habits or behaviors? Try to stop and think for few seconds how many times you burst in anger and treated people around you badly. Then, just half-hour later you regret what you did. Why don’t we stop such behaviors in the moment they are happening? Well, because we lack Emotional Intelligence, or the ability to understand what we are feeling in a particular moment. In other words, if you are having a dispute with your family and suddenly you are about to “lose your mental” how can you avoid that? While you talk or listen try to analyze your internal mental state, assess your body sensations and if you detect some feelings of discomfort get out of the dispute for half-hour. This time will give you the chance to clear your mind and let the cortisol (an hormone released during stressful situations) to be absorbed by the organism; therefore making you more relaxed. Of course, this is just one situation you may face in life, but the point is that EI requires a lot of mindfulness and ability to see oneself from the outside. It is almost like you are inside your head while you react to something and on the other hand you are someone else, looking at yourself from the outside! Does it sound crazy? I know it sounds overwhelming and It is not easy since a lot of practice is required. Thereby the next natural question is: why would I waste my time doing so when I could be studying technical staff? Let me answer…

Correlation between IQ and career success

Of course you can spend your whole life studying hard and acquiring technical skills that will make you more successful when it comes to your career advancement. But will they? As shown in many researches IQ scores have a weak correlation with occupational success. Instead, cognitive ability (EI) resulted a much more reliable predictor of job performance (IQ correlation with success). In few words the IQ without the EI does not get you anywhere. And the reason is pretty simple: do you remember the stories at the beginning of the article? Enron and LTCM are just extreme examples of lack of Emotional Intelligence. If you compare two individuals, one with a higher IQ and lower EI and another with a lower IQ but high EI should not surprise you if the second individual will become more successful in life. Why? Intelligence in standard terms (IQ) gets completely wiped out by emotions. Unless, EI is developed.

Why do we feel emotions such as anger and fear?

Evolutionary speaking those emotions make perfect sense. Imagine a homo sapiens two hundred of thousand years ago, in a jungle. He is about to be attacked by a prehistoric tiger weighting around 150kgs. Fear strikes, his body freezes (to allow hiding) hormones are flooded so that the body will be in a state of max alert and he gets ready for the fight or flight response. Think of all the times you heard a noise in the middle of the night, something fell, your heart rate increased, you froze. On the other hand your brain started to scan all the possible scenarios: is it a bird? Is it a thief? In other words emotions are a defensive mechanism used by our organism to face dangerous situations. Indeed, for example when anger strikes your heart rate increases, the blood is pumped faster and toward areas of the body such as our hands. In turn this gives you the chance to defend yourself allowing the energies to flow where needed the most. If this makes sense when it comes to situations of real danger, it can become counterproductive when it comes to social situations. Think of an argument with a co-worker where your anger mounts to the point that you almost physically attack him/her. What just happened to you? Why you could not control that reaction? Another example: last time you spoke in public your hands sweated and you could barely open your mouth or move your tongue to articulate a word. How to control that? To answer we have to dig deeper and ask: Why do emotions are triggered faster than thoughts? But to answer this question we must understand how our brain works.

Our brain is an evolutionary machine

In our head we have an evolutionary machine. What does it mean? Think of when you bought an I-phone for the first time. In the package you found the phone ready to be used. The software is already installed and all I-phones come with the same configuration. On the other hand to make it work properly you need to install apps. The apps make your I-phone more functional. Therefore, what will differentiate one I-phone to the next are the apps installed on it. For example, one I-phone will have ten apps, another twenty and of course the one with more apps has a higher functionality. I know it may sound very simplistic but the point is that when humans come to life they have all the same “package”: our brain (software). Then later in life we start to learn many things such as how to talk, walk and so on (apps). Once reached the mature stage we are able to learn several languages or to play several musical instruments. Those “upgrades” can be assimilated to an I-phone with more apps on it. Keep in mind though that to preserve the functioning of your I-Phone you must upgrade the software first otherwise all the apps installed will be worthless. The same applies to our brain. You can learn all the skills you want, but to be very effective you must learn how to control your emotions first (upgrade your software). Then it will make more sense to go on and learn 10 languages or to play 10 musical instruments (apps).

The next thing to figure out is how our brain evolved. It turns out that our brain evolved gradually; in other words it evolved one layer at the time. Modern brain has three main layers or systems: reptilian, limbic and neo-cortex. The reptilian brain is the oldest therefore it evolved before the other layers. Indeed, that part of the brain controls vital functions such as breathing, body temperature, heart rate, and balance. The limbic system evolved subsequently and it is the part related to emotions and memory. The neo-cortex, the last to evolve played a key role in thoughts, consciousness processes, language and so on.

What triggers emotions?

The limbic system is the part that plays a key role when it comes to emotions. And evolutionary speaking emotions are important for survival. In addition, emotions are crucial because they allow us to form memory. Indeed, if we dig deeper you will see in the limbic system two main parts: the amygdala and the hippocampus. Those parts are linked and the activation of the amygdala becomes crucial to allow the hippocampus to form memories to be stored in our brain. In addition the amygdala is like a human alarm. Indeed, it signals all the situations that may be “important” to the hippocampus, which in turn stores those memories for future purposes. The issue is that the amygdala continuously scans the surroundings. Therefore, if it gets over-activated it may become dysfunctional. Think of a paranoid person that sees danger anywhere. Well, this person’s amygdala is over-stimulated. Think of your car’s alarm that is too sensitive and gets armed all the time someone passes few feet away from the car. How to control emotions? One way to control your emotions is to tame the amygdala. In other words to make sure you do not get hijacked by it. How to do so? It comes very handy our neo-cortex area: in particular the left pre-frontal cortex. That is the part related to consciousness, thought and language. Many researches showed that an increased activity in this area of the brain inhibits the amygdala; therefore it keeps it under control. Taming the amygdala is not that easy at first and the reason stands in the fact that the signals that arrive from the outside world, such as sounds, vision and so on are acknowledged first by the amygdala, then by other areas of the brain. That happens because the neural pathways that connect our body to our brain travels faster toward the amygdala that is situated closer to our body, compared to the neo-cortex area. When those outside stimuli trigger the amygdala they generate impulses one must learn to control in order to avoid emotional reactions. Fur such reason controlling one-self is crucial to Emotional Intelligence.

Stop victimizing yourself: it is counterproductive!

One way to develop Emotional Intelligence is to learn how to use a productive self-talk. How many times you did something wrong and you ended up saying “I always make the same mistakes” “I am a failure” or “It is always my fault”. If you do use such kind of self-talk is time to STOP. This is the kind of self-talk that allows the amygdala to dominate within your brain, reinforcing itself from time to time until the other parts of the brain become totally numb. One key to change self-talk is to actually change the perception about things. Anyone knows that if you take two persons looking at a glass of water half empty and half full, the optimist will see the full half and the pessimist the empty half. In realty none of them is right or wrong, their perception is different. To change your perception about things you must be aware and conscious throughout your day. Think of how many times you get caught in thoughts totally unrelated to the situations you are facing. For example, you see an object, such as a pen that for some reason reminds you of a person that few days before treated you badly. You are swept by that thought that leads to another thought and so on until you become so angry and nervous, although you were having a nice day. That train of thoughts must be stopped if you want to keep a positive mood throughout the day. But to do that you must be aware, or be able to “think about your thoughts and keep them on track”. Indeed, the emotional brain unfortunately is indiscriminate; it creates links between memories that are not rational or controlled. If you let your emotional brain run undisturbed this will bring most of the time to unpleasant emotions and feelings. How to stop it? Use your consciousness and understand what is happening in background. In other words ask yourself: is it rational what I am thinking? Is this thought useful to the situation I am facing now? Those questions will help activating the prefrontal cortex, while inhibiting the amygdala.

Three advises from Daniel Goleman

Daniel Golamen through his writings suggest us to be very careful to many aspects of our personalities such as: self-awareness, personal dictions making, managing feeling, handling stress, empathy and so on. In addition he would remind us three aspects that are crucial:

Know thyself: start to become aware of your thought processes. In any moment of your day, from the smallest errand to the important meeting try to keep track of your own thoughts. For example, if your boss is mad at you and you start sensing a feeling of fear that kicks in start to tell yourself “I am sensing fear”, such an exercise can be very helpful to detach you from the actual situation and train your left prefrontal cortex to act. Do not let the amygdala dictate your life!

Master thyself: Once you become good at understanding your feelings start to work on your impulses. In other words, if there is any bad habit that is making you a slave, try to become aware of it, and gradually develop “the capacity to resist that impulse to act” instinctively.

Temperament is not destiny: keep in mind that you choose. Of course, your emotional troubles are coming from long time ago, most probably when you were just a kid. On the other hand that does not imply that your personality determines your destiny. Quite the opposite, choose the qualities you would like to have and start implement them now! (see Warren Buffet on How to develop character )

Start practicing Emotional Intelligence

If you are one of those people who think that emotions cannot be controlled I hope this article changed your mind. In Daniel Goleman’s book: “Emotional Intelligence” you will find useful information that will help you to reduce stress, to reduce impulses and to create more self-awareness. It is your turn to dedicate sometime of your day to nurture the rational side of your brain. The most important take away from this article is that “you can choose”. Don’t get me wrong, not all emotions are bad! It is amazing to experience positive emotions such as love, compassion, and joy. On the other hand, if you let yourself be taken by negative emotions such as hatred, envy and anger you are limiting your life. In today’s world where social medias are intended to make us look perfect and happy, people post nice pictures, funny moments, and exotic trips. It seems almost like unhappiness does not exist. Unfortunately if you dig deeper there is another realty, completely different from what appears in surface. Repeat yourself this mantra “I am not alone, I am not different, I am like any other human being, I am facing the same problems other people are facing or that others already faced”. Once you recite this mantra, your perspective will shift. You will no longer see yourself as the “victim” and suddenly a new world will open to your eyes. Therefore, to be successful in life and business:

Stop personalizing, victimizing and blaming yourself or others. Take charge for your life now:

“The most powerful man is the one who has himself in his power” Seneca.

SUGGESTED READING:

October 21, 2015

The Four Week MBA won the award for Best Udemy Authors in Business Finance

October 9, 2015

The Six Most Important Lessons You Can Learn from the Intelligent Investor Ben Graham

Credit Image: Wikipedia Commons

If you listen to one of many Warren Buffet’s speeches on the success, you will learn invaluable lessons. In one of the many Buffet’s appearances, he says that success is more than pure intellect or energy. Accordingly, Buffet believes that integrity is the mother of all qualities, and any man can develop it. Indeed, he let us play a little game: “let’s think for a moment that you have the right to buy 10% of one of your classmates for the rest of his/her life, and you had an hour to think about it. What are you going to do? Are you going to have your friends take an IQ test?” Warren Buffet doubts it. “Are you going to pick the one with the best grades?” He doubts it too. According to Warren Buffet, you would pick the one who is humble, who gives credits, who is altruist… In few words the one who shows good leadership qualities. Then, Warren Buffet makes us assume the opposite scenario: “Imagine you had to go short 10% on someone in your class” (it means you would make money if your friend fails in life). “Who would you pick? Would you pick the person with the lowest IQ? Or the person with the lowest grades?” Again, Warren Buffet doubts it. He believes you would choose the person who turns you off the most; the dishonest person, the one who cuts corners, who does not give credits to others. In few words, Warren Buffet message is: “It doesn’t matter how smart you are, what is your IQ score, if you lack leadership skills you won’t be successful in life and therefore, in business.” (check out Six Life and Investing Principles from Warren Buffet)

The Top Seven Biases Any Investor Should be Aware | Smart Investing 101

Why is Buffet’s speech relevant to this conversation?

Buffet was Benjamin Graham’s protégée. Of the many people who played a significant role in Buffet’s life, Graham is the one who most contributed to his business acumen. Indeed, when Buffet was still young and inexperienced, he found in Graham’s books “Intelligent Investor” and “Security Analysis” the foundation of his business success. Chapters 8 and 20 of the book, struck Buffet so much that he followed those principles throughout his life like a religious man would follow the Bible. Graham and Buffet proposed an alternative view on investing. One that goes against common wisdom for which “you must be super smart to be successful in investing.” Instead, Graham and Buffet say that you must have another form of intelligence to master investing: the Emotional Intelligence. (check out Six Life and Investing Principles from Warren Buffet)

Who is Benjamin Graham?

Benjamin Graham was born on 1894, in London, although his family soon moved to New York when Graham was a year old. His father died when Graham was still a kid, and he lived with his mother almost in poverty. Nonetheless, Graham made it through Columbia, and after a brilliant academic path, he soon joined Wall Street. Graham was so successful that after few years he was already running his investment firm.

How did he succeed?

Benjamin Graham became the father of value investing. Value investing starts from the assumption that Mr. Market (That’s how Graham called the Stock Exchange) is wrong most of the time. It means that most of the stocks listed there are either undervalued or overvalued. What sounds a marginal assertion today was revolutionary at the time. Indeed, at the beginning of the 20th century, the stock exchange was considered at same way of the “Oracle of Delphi,” infallible. And lucky investors were considered “Gods” rather than man. In such scenario, the great depression sounded more like a divine punishment of the gods. Rather than a simple financial crisis that could be handled. Graham ability stood in his analytical framework. This framework consists primarily of dissecting companies’ balance sheets to find those who are undervalued.

What makes Graham’s framework so cool?

Anyone can follow it. Just one condition, as Warren Buffet says in “Intelligent Investor” (revised edition by Jason Zweig): “you need the ability to keep emotions from corroding that framework.” No man is immune to feelings, as reported by Jason Zweig: the same Isaac Newton went broke because he couldn’t keep his emotions in check and got swept by the “irrational exuberance” of the market. As the story goes, Newton in 1720 owned shares in the South Sea Company, the hottest stock in England at the time. Newton sold his stock for an astonishing 0 return. Now you might think that one of the greatest physicists in human history would stop there and be happy with what he earned. Unfortunately for our hero, this is not how the story ended. Newton thrilled, by the upward stock trend, jumped in again and bought it at a much higher price, losing $20,000 (more than $3million in today’s money). Now, you might say: “If Newton was not successful in investing, why would I?”

Speculator vs. Investor

Before investing even one dime in stock is crucial to understand the difference between speculation and investment. Indeed, the speculator is the one who invests with a very short-term horizon, trying to predict the erratic future market fluctuations. Are you so smart to be able to predict how the trend will be in the future? The truth is that statistically, you won’t be able to do that. The same Graham who was a market guru performed just 2.5% above the market return. Do you think you would be able to do better? If your answer is “yes” then you are deluding yourself. Anywhere today you find people telling you how they got rich quickly through daily trading. Although some of them got reach through speculation, statistically the success rate is meager (around 3.5%, see Daily Trading Success Rate). The investor instead is the one who has a much longer perspective and looks at the company’s balance sheet to base his decision. Warren Buffet suggests applying as much due diligence to the stock you buy as you would do when buying something critical. Think for a second the time we spend on researching the new car to purchase or the new smartphone. Why when it comes to stock investing, we approach it almost with the “slot machine player” mindset?

Our brain is not wired to handle money

As it turns out, our brains take quite other routes when it comes to money. Psychologically, our mind has not been wired for handling money. For such reason, we struggle so much (see Our Brain is not wired to handle money). Also, when it comes to stock, it seems like we own nothing. In particular today, with the new sophisticated systems, anyone can buy shares with one click. Thereby, before approaching the market ask you: Do I understand how this business works? Would I keep this stock for my entire life? Is the financial position of this company strong enough? These three simple questions can keep you away from troubles afterward. Speculating is neither right or wrong but just what it is. Therefore, if you are classified as speculator keep always in mind that you are betting against the market, in the same way, the guy who bets horses, thus expect to lose all your money. If instead, you are an investor, you can set your expectations, so that the capital will be safe and also you will receive a satisfactory return. What is an adequate return? Do not expect to become reach in one day, one year or ten. But if you are patient enough you might get rich, since your return will compound. Also, by reinvesting your dividends, you will have tax advantages. In conclusion, according to Graham, the speculator tries to anticipate and profit from market fluctuations. The investor instead looks for “suitable securities at suitable prices.” Are you a speculator or investor?

What advice would Benjamin Graham give you?

Assuming that you want to be an intelligent investor, Graham would tell you:

1. Do not look at market fluctuations.

Instead, focus on understanding the business you are buying. In one case only the investor must look with an eagle eye at Mr. Market: “when it is entirely off.”In few word, when Mr. Market overvalues a stock that the intelligent investor owns; or if its market value irrationally exceeds its book value, then it is time for the rational investor to sell and benefit from market irrationality. Conversely, if a stock is extremely underpriced compared to its book value, the intelligent investor will “shop at a discount.” Why do we wait entire months for “Black Friday” to have discounts on clothes and when it comes to stock investing we neglect those “discounts”? The best deals are found in times of irrationality; the intelligent investor knows that, and he does not follow the crowd, neither buys what is fashionable at the time.

2. Do not waste your time at forecasting how the Market will perform in the future.

You might get lucky once and make a lot of money. Although, this will lead to catastrophe. Why? Well, if you are like the average speculator, after jackpotting from your lucky forecast, you will convince yourself to be a “Market guru” and to have understood how the Market works. In this moment of ultimate delusion, you will increase the stake, go “all in” and lose it all. You are warned, the intelligent investor “knows that he knows nothing” about future market movements. If you forget this basic principle, you will be easily deceived and doomed to failure.

3. Do not be fooled by the management.

The intelligent investor knows that good management is as important as analyzing the books. He must apply the same metrics used when valuing his returns when looking at the management’s performance over the years.

If the catalog of “Do Not” is not enough, Graham would give you the list of “Do”

4. Know what you are doing and know your business.

In few words, stop spending hours of your day watching business channels and reading the newspaper. Focus instead, on analyzing balance sheets and management of the organizations you want to invest in. Also, examine them at least with the same degree of due diligence you would use if you had to buy a new car or a new house.

5. Master your inner game.

Build your emotional strength, and do not listen to the continuous flow of information that is produced to “make noise.” “Know thyself,” understand how you feel, which emotional reactions you have when investing. Only by studying yourself you can master the world around you. Change your perception of the world, and suddenly the world will seem a different place.

6. Master your circle of competence.

Focus 100% of your brain power on things you understand and let the rest go. Warrant Buffet has followed this principle all his life long. He never put a dime in tech stocks because he could not understand them. That does not imply tech stocks must always be ignored, by your investment. However, ask yourself: do I know how this business works?

Why should I follow Graham’s principles?

Well, there is no particular reason to implement those laws, besides the fact that everything you tried did not work. If you are stuck at investing, and you need a successful system, then there is no hurt in trying those principles.

How to keep emotions from sabotaging our success in investing.

Each time you lose money investing, don’t fool yourself into thinking: “I am a particular case”“none feels like I do” and “I have been such a failure all my life, and I will always be.” That is a deception your brain is constructing to make you feel the “victim.” Biologically speaking it is true that each human being is different in some way; since our, DNA has so many possible arrangements for any person on earth. On the other hand, though, when it comes to psychological processes we are all the same. We all follow more or less the same thought patterns; although none will tell you what he is thinking; quite the opposite. In any case, start to understand your thought patterns when investing and laugh at the voices that try to deceive you. But keep in mind:

MASTER YOUR INNER GAME, EVEN BEFORE YOU INVEST A DIME

To read more about investing check out Six Life and Investing Principles from Warren Buffet)

SUGGESTED READING:

Do you want to become a financial analyst? Don’t know where to start?

Check out our resources here.

If you are new to finance grab a copy of the new Book, “Enlightened Accountant: Accounting revealed in 100 pages.” Available both in printed and e-book format!