Gennaro Cuofano's Blog, page 20

September 10, 2025

The Architecture of Ambition

Microsoft–OpenAI’s Original Partnership Design (2019–2023)

Between 2019 and 2023, Microsoft and OpenAI built one of the most ambitious alliances in modern technology. Structured around capital, compute, and distribution on one side, and models, research, and talent on the other, the partnership was designed as a closed loop of mutual value creation.

It worked—until it didn’t. To understand why, we need to revisit the architecture of the deal itself.

Phase 1: The Initial Alignment (2019–2020)July 2019: Microsoft invests $1B in OpenAI.Terms:Azure becomes OpenAI’s exclusive cloud provider.Microsoft secures an exclusive GPT-3 license (2020).Revenue sharing continues until Microsoft recoups its investment.What Microsoft BroughtCapital: $13.75B cumulative by 2023, providing OpenAI the cash runway to build frontier models without commercial pressure.Infrastructure: Azure’s cloud capacity, essential for training massive GPT models.Distribution: Enterprise channels—Office, GitHub, and eventually Bing.What OpenAI BroughtModels: The GPT series, rapidly becoming the gold standard in generative AI.Research: Breakthroughs in scaling laws, RLHF, and model alignment.Talent: A cluster of the world’s top AI researchers, an asset Microsoft couldn’t replicate in-house.The architecture was elegant: capital + compute + distribution flowed from Microsoft; models + research + talent flowed from OpenAI.

Phase 2: Mutual Value Creation (2020–2023)This loop of exchange created explosive early success.

Exclusive leverage for Microsoft. With GPT-3 locked up under exclusive license, Azure differentiated itself from AWS and GCP. No other hyperscaler could offer GPT-powered solutions.Commercial acceleration for OpenAI. Instead of building distribution alone, OpenAI plugged directly into Microsoft’s enterprise base. GitHub Copilot became the first viral coding assistant; ChatGPT’s popularity fed directly into Azure demand.Symbiosis in infrastructure scaling. Every dollar OpenAI spent training models went through Azure. Every new model released by OpenAI increased Microsoft’s product stickiness.The partnership terms—mutual exclusivity, revenue sharing, cloud lock-in—ensured short-term alignment. Both companies had strong incentives to deepen the integration.

Why the Architecture Was Always FragileOn paper, this design looked unbreakable. In practice, it contained structural contradictions.

Mutual dependence breeds mutual suspicion.OpenAI relied on Microsoft’s infrastructure and cash.Microsoft relied on OpenAI’s talent and IP.Both sides understood this dependence was temporary—the moment either could reduce reliance, they would.Exclusive models vs. open ambition.For Microsoft, exclusivity on GPT-3 was a moat.For OpenAI, exclusivity was a constraint—it limited adoption and tied the company’s fate too tightly to a single vendor.Revenue-sharing vs. independence.Microsoft wanted to recover investment through OpenAI’s revenues.OpenAI wanted to scale as a global platform, not as Microsoft’s captive tenant.Different time horizons.Microsoft’s focus: near-term enterprise monetization.OpenAI’s focus: long-term AGI development.These priorities were never fully compatible.The partnership worked while OpenAI was resource-constrained. Once alternatives emerged (CoreWeave, SoftBank, Apple, etc.), the fragile balance began to crack.

The Architecture as a Case StudyThe Microsoft–OpenAI partnership reveals how AI alliances differ from traditional tech partnerships.

In cloud or SaaS, lock-in works. Customers rarely abandon platforms.In AI, lock-in is temporary. Compute can be rented elsewhere; talent is mobile; models improve rapidly.This explains why, by 2024–2025, OpenAI diversified away from Azure, and Microsoft shifted toward Anthropic and others. The original architecture was not built for permanence—it was built for acceleration.

Lessons for Strategic AlliancesThe closed loop of value creation accelerates growth—but shortens lifespan.Mutual exclusivity creates powerful synergies in the short run.But once both sides grow strong enough, exclusivity becomes suffocation.Infrastructure and models are inherently misaligned.Infrastructure players (Microsoft, AWS, GCP) want volume and neutrality.Model developers (OpenAI, Anthropic, Mistral) want independence and distribution optionality.Distribution is the ultimate arbiter.Microsoft’s real moat was never GPT—it was Office, Windows, GitHub, Bing.OpenAI’s moat was never Azure—it was ChatGPT as a consumer interface and API adoption.Whoever controls the end-user experience ultimately controls the economics.Investor ImplicationsThe Microsoft–OpenAI architecture shows the limits of “exclusive AI alliances” as long-term strategies.

For hyperscalers: Don’t expect permanent exclusivity with model providers. The best outcome is temporary differentiation.For model companies: Partnerships are accelerators, not destinies. Independence requires diversification of infrastructure and distribution.For investors: The value chain will fragment. Short-term value may accrue in exclusive alliances, but long-term power flows to whoever controls distribution and workflow integration.A Blueprint for Future AlliancesIf this partnership was The Architecture of Ambition (2019–2023), then the post-2023 era represents The Architecture of Divergence.

The early deal shows how to structure capital-for-IP partnerships in AI’s formative years.The later unraveling shows the inevitability of realignment once both sides mature.Future alliances (Google–Anthropic, Apple–OpenAI, Amazon–Anthropic) will likely follow the same arc:

Initial alignment (capital + compute traded for models + talent).Deep integration (exclusive rights, co-development).Strategic divergence (once dependency risks outweigh benefits).ConclusionThe Microsoft–OpenAI alliance was never meant to be permanent. It was an architecture of ambition: a temporary structure that allowed both sides to accelerate far beyond what they could achieve alone.

Microsoft gained an AI halo and early enterprise distribution edge.OpenAI gained survival, scale, and the resources to reach AGI-level R&D.By 2023, both sides had extracted the maximum mutual value. By 2025, the architecture had dissolved, replaced by broader webs of alliances.

The lesson is simple: in AI, partnerships are accelerants, not moats. The real power lies not in exclusivity but in distribution control and independence.

The post The Architecture of Ambition appeared first on FourWeekMBA.

September 9, 2025

Market Structure Dynamics: From Co-opetition to Consolidation

Industries rarely stand still. They evolve along a predictable trajectory, shifting from emerging markets with blurred boundaries to growth markets defined by battles for dominance, and eventually into mature markets dominated by consolidation. Understanding this path — and recognizing where a sector currently sits — is one of the most reliable ways to anticipate competitive outcomes.

This framework outlines three distinct phases: Emerging Market → Growth Market → Mature Market, each with its own dynamics, opportunities, and strategic risks.

Phase 1: The Emerging MarketIn the early stages, boundaries are blurred. Nobody is entirely sure where the market begins or ends, or which business models will dominate. Companies experiment, pivot, and often straddle multiple niches simultaneously.

Key DynamicsCo-opetition dominates. Rivals cooperate as much as they compete, because survival requires shared infrastructure, standards, and legitimacy.Shared standards emerge. To expand adoption, players often collaborate on interoperability. This explains the prevalence of open-source collaborations, joint consortia, or alliances in early industries.Unstable differentiation. Products look similar, use cases are overlapping, and firms compete more on vision than execution.ExamplesEarly AI (2018–2022): LLM research was shared openly, models were released on arXiv, and competition was blurred by collective excitement.Early Blockchain (2016–2020): Dozens of protocols, overlapping use cases, and partnerships between rivals to establish legitimacy.In this stage, the winners are those who define the standards that the rest of the ecosystem aligns with — even if monetization lags behind.

Phase 2: The Growth MarketAs adoption increases, boundaries begin to harden. Segments are defined, companies differentiate more clearly, and the dual path emerges: firms must either compete directly for market share or merge strategically to accelerate scale.

Key DynamicsDefined Segments. Players now occupy clear categories (e.g., model providers vs. application layer vs. infrastructure providers).Market share battles. Growth is no longer about evangelism but about displacing rivals.Dual path: compete or merge. Some firms double down on competition, while others find greater advantage in strategic mergers or alliances.ExamplesElectric Vehicles (2020–2025): Tesla established the premium EV category, while Chinese automakers fought for scale. Partnerships on batteries and charging infrastructure emerged alongside intense price wars.AI (2023–2025): OpenAI, Anthropic, Google, and Meta are now in fierce competition, but also exploring co-opetition — e.g., shared lobbying efforts, funding alliances, or even customer distribution overlaps.This stage is marked by intense capital requirements. Firms that cannot raise or spend aggressively often get acquired.

Phase 3: The Mature MarketEventually, industries consolidate. Boundaries become clear, dominant players entrench themselves, and smaller rivals are either absorbed or relegated to niches.

Key DynamicsConsolidation dominates. Market share concentrates in a handful of leaders.Fewer, larger dominant players. Scale advantages and network effects make survival difficult for standalone challengers.Strategic defensibility. The focus shifts from growth to protecting moats: distribution control, ecosystem lock-in, and regulatory capture.ExamplesTelecommunications: Once a fragmented field of local operators, now consolidated into national and regional giants.Cloud Infrastructure: AWS, Azure, and Google Cloud now dominate; smaller providers serve only niches.Mature markets often appear “boring” from the outside but are highly profitable for incumbents. Strategic competition is less about innovation and more about defending positions through regulation, acquisitions, and customer lock-in.

Cross-Phase PatternsThe transition from one phase to another is not linear. Industries may stall, regress, or fragment under shocks like regulation, technological shifts, or geopolitical disruption. Still, some consistent patterns emerge:

Standards → Segments → Scale. Each phase builds the foundation for the next. Standards enable segments; segments drive battles for dominance; scale cements consolidation.Capital intensity rises over time. Emerging markets reward speed and creativity. Growth markets reward fundraising and execution. Mature markets reward political influence and operational efficiency.Strategic options narrow. In emerging markets, companies can pivot endlessly. In mature markets, strategic moves are constrained by entrenched boundaries.Strategic ImplicationsFor Emerging PlayersFocus on defining standards or ecosystem positions rather than immediate monetization.Pursue co-opetition aggressively — credibility and adoption matter more than hoarding IP.The goal: survive long enough to ride the transition into growth.For Growth PlayersChoose your path: Compete fiercely for market share or merge strategically to gain scale. Straddling both paths often leads to failure.Prepare for capital burn. Growth markets are cash-intensive and unforgiving.The winners here become the consolidators of the mature phase.For Mature PlayersShift from product focus to ecosystem defense. Control distribution, data, and regulation.Exploit scale economics. Margins and stability come from scale, not innovation.Anticipate adjacent disruption. Mature markets are stable until they’re blindsided by new entrants from adjacent fields.Today’s AI Industry in ContextBy this framework, AI has clearly moved from emerging (2018–2022) into the growth phase (2023 onward).

Emerging phase: open-source collaboration, blurred categories, and heavy co-opetition.Growth phase today: OpenAI vs. Anthropic vs. Google vs. Meta vs. xAI, with huge fundraising rounds, price wars in APIs, and strategic partnerships (e.g., Microsoft-OpenAI, Amazon-Anthropic).The dual path is visible:

OpenAI and Anthropic are competing directly for model dominance.Smaller players (Mistral, Cohere) may either consolidate or get acquired.Infrastructure giants (Microsoft, Amazon, Google) act as both partners and potential acquirers.Looking forward, AI will inevitably move toward maturity and consolidation — a handful of scaled players controlling compute, data, and distribution — unless a new disruptive wave (e.g., open-source AGI, geopolitical fragmentation) reshuffles the trajectory.

ConclusionThe Market Structure Dynamics framework shows that industries evolve through three predictable stages: Emerging (co-opetition), Growth (compete/merge), and Mature (consolidation). Each phase has its own playbook.

For executives and investors, the critical skill is recognizing which phase the industry is in now. Misreading the stage leads to fatal errors: spending like it’s a growth market when standards aren’t set, or fighting for share in a market already locked into consolidation.

In AI today, we are in the messy middle: boundaries are forming, market share battles rage, and consolidation is on the horizon. The companies that navigate this transition successfully will define the next decade of technology leadership.

The post Market Structure Dynamics: From Co-opetition to Consolidation appeared first on FourWeekMBA.

From Co-opetition to Merger: The Arc of Strategic Convergence

In fast-moving industries, competitors often find themselves in a paradoxical relationship: forced to cooperate in order to survive, yet competing fiercely for market dominance. This dance between rivalry and collaboration is captured in the concept of co-opetition. Over time, such arrangements can deepen, evolving into strategic partnerships, and in some cases, full mergers. Understanding this trajectory — and the forces that push companies along it — is critical for anticipating industry consolidation.

The Continuum: From Co-opetition to IntegrationThe framework identifies three broad stages:

Co-opetition (Selective Collaboration)Companies remain competitors, but cooperate in narrowly defined areas where collaboration creates value neither could achieve alone.Example: two tech firms sharing a common open-source standard while competing in product markets.Strategic PartnershipCooperation expands to include shared resources, intellectual property, or joint ventures.The relationship is still arm’s length, but integration deepens as trust and interdependence grow.Integration & MergerCompanies move from shared projects to unified operations and strategy.The merger is not just financial; it reflects strategic inevitability.Example: when complementary players realize combined scale or capabilities create a defensible market leader.This path is not automatic — many co-opetitive relationships remain stuck at selective collaboration. But when external and internal drivers align, movement toward merger accelerates.

Drivers of Deepening CooperationFour structural forces push companies along the continuum.

1. Complementary StrengthsWhen two companies possess distinct but complementary competencies, cooperation naturally creates synergy.

Example: a hardware company with manufacturing scale partnering with a software company with unique algorithms.The overlap is low, but the synergy is high — making collaboration attractive.As dependency deepens, strategic logic often shifts from “why cooperate” to “why not integrate fully?”

2. Market PressureExternal threats from larger competitors often drive rivals into each other’s arms.

Facing a dominant platform, smaller players may collaborate to ensure survival.In AI today, we see mid-tier startups partnering defensively against hyperscaler dominance.Market pressure compresses timelines — collaboration becomes less optional and more existential.

3. Innovation AccelerationPooling R&D resources accelerates development cycles.

Alone, each firm may lack the scale to fund frontier innovation. Together, they can de-risk and accelerate.For instance, in biotech and pharma, joint research ventures often lay the groundwork for eventual mergers.Innovation-driven co-opetition often sets the stage for eventual consolidation once proof-of-concept matures.

4. Scale AdvantagesCost efficiencies and expanded reach make deeper integration compelling.

Shared distribution, joint procurement, or co-marketing can reduce costs.Over time, these shared economies make full merger more efficient than ongoing coordination.Scale is often the tipping point: once shared efficiencies outweigh the transaction costs of independence, merger becomes the rational outcome.

The Strategic Arc: Increasing Joint Value CreationAs companies move from selective collaboration to full integration, joint value creation increases.

At the co-opetition stage, value is narrow, often confined to standards or small shared projects.At the strategic partnership stage, value grows through shared resources, joint ventures, and innovation.At the merger stage, value creation reaches its peak, as duplication is eliminated and capabilities are fully integrated.The curve is not linear: value creation accelerates sharply once integration passes a critical threshold. This explains why many industries suddenly experience waves of consolidation — once the economic logic tips, mergers cascade.

Risks and Frictions Along the PathWhile the logic of deeper cooperation is compelling, barriers often prevent co-opetition from evolving into merger.

Cultural ResistanceRival firms often underestimate how deeply cultural identity is tied to independence. Integration may destroy as much value as it creates if not managed carefully.Regulatory Scrutiny

Governments may block mergers that eliminate competition, especially in industries like tech and telecom where network effects risk monopoly.Power Asymmetry

If one company perceives itself as stronger, it may resist deeper integration, preferring to “outlast” rather than merge. This often delays or derails consolidation.Execution Risk

Even when strategic logic favors merger, execution failures — from IT integration to leadership disputes — can erode expected synergies.

These frictions explain why many co-opetitive relationships remain in limbo, never advancing to full integration.

Modern IllustrationsTech Industry:Cloud providers sometimes collaborate on open-source initiatives while battling fiercely for enterprise contracts. These collaborations may evolve into joint ventures but rarely full mergers due to antitrust risk.Automotive & EV:

Automakers are increasingly partnering on battery technology and charging infrastructure. Market pressure from Tesla and Chinese EV makers is accelerating deeper alliances. The logic for eventual mergers is growing.Pharmaceuticals:

Drug development partnerships often begin as co-opetition — joint trials or co-marketing agreements — and later result in mergers once breakthrough drugs validate the strategic synergy.Strategic TakeawaysCo-opetition is not weakness; it’s strategy.

Companies engage in selective collaboration not despite rivalry, but because rivalry alone cannot deliver survival or scale.The inflection point is market pressure.

External threats are the single strongest catalyst pushing firms from partnership toward merger.Innovation accelerates integration.

The more capital-intensive and uncertain the innovation frontier, the more likely firms will pool resources.Scale cements consolidation.

Once shared efficiencies outweigh the benefits of independence, full merger becomes almost inevitable.Conclusion

The path from co-opetition to merger is not a straight line, but a spectrum shaped by structural forces. Complementary strengths make collaboration attractive. Market pressure compresses timelines. Shared innovation accelerates integration. And scale advantages eventually make merger the rational outcome.

Understanding where an industry sits along this continuum is critical for anticipating consolidation waves. In AI, energy, and biotech, we may already be seeing early signs: today’s selective collaborations could well be the precursors to tomorrow’s mega-mergers.

The post From Co-opetition to Merger: The Arc of Strategic Convergence appeared first on FourWeekMBA.

Google’s Strategic Evolution (2024–2030+): From Search Fortress to Autonomous Futures

For over two decades, Google has been the undisputed king of search, turning queries into the most profitable advertising engine in history. But as AI reshapes digital infrastructure, Google faces its most critical decade since its founding. The Defend–Attack–Transform–Create framework highlights how Google plans to protect its core while pursuing new frontiers.

Current State: Defend and Attack (2024–2025)Defend: The Search FortressGoogle’s first imperative is to defend its cash engine: search. Despite shifting consumer behaviors and AI-driven competition, search still underpins Google’s revenue model, generating over 80% of Alphabet’s profits. The defense pillars are clear:

Search Market DominanceGoogle retains over 90% market share in global search, making it the default starting point for billions of queries daily.Core User Base

Google’s ecosystem (Search, Gmail, Maps, YouTube, Android) ensures billions of active users stay within its orbit.Ad Revenue Model

Search ads remain one of the most lucrative business models ever created, converting intent into revenue with unmatched precision.Search Infrastructure

Decades of investment in indexing, ranking, and personalization mean Google’s infrastructure is both unmatched and deeply entrenched.

In this phase, defense is existential: protect the moat while preparing for a post-search era.

Attack: The AI OffensiveDefense alone won’t secure Google’s future. The company must aggressively attack emerging markets where rivals like OpenAI, Microsoft, and Anthropic are moving fast.

Key attack initiatives include:

Gemini AI LaunchPositioned as Google’s flagship AI model, Gemini is central to maintaining relevance in the generative AI race. Its integration across Workspace, Search, and Android aims to re-anchor users in Google’s ecosystem.500M Users Target

Unlike Microsoft’s enterprise-first AI strategy, Google is aiming for scale. By reaching half a billion users quickly, it hopes to replicate the adoption flywheel that made Gmail and Chrome ubiquitous.DeepMind Integration

After years of operating semi-independently, DeepMind’s research pipeline is now tightly integrated into Google’s AI strategy. This accelerates the flow of breakthroughs into consumer and enterprise products.AI Research Pipeline

Google continues to invest in frontier research (multimodal models, robotics, healthcare AI), ensuring it stays competitive at the cutting edge.

The attack phase is about speed and visibility: Google cannot afford to lag behind AI-native challengers.

Future State: Transform and Create (2026–2030+)Transform: Scaling Infrastructure into PlatformsOnce defense stabilizes and attack gains traction, Google must transform its assets into platform-scale businesses that outlast search dependency.

Waymo Platform ScaleWaymo has quietly become the most advanced autonomous driving system, already operating robo-taxis in select cities. Scaling this into a global platform could redefine Google’s role in transportation.EMMA Integration

EMMA (Enterprise Multi-Modal AI) represents Google’s attempt to standardize AI infrastructure for enterprise use. By offering vertical solutions across industries, Google aims to replicate AWS-like stickiness.Maps Technology

Google Maps is not just navigation; it is a spatial data platform. Integrating Maps with AI unlocks logistics, urban planning, AR navigation, and autonomous systems.AI Infrastructure Build

With TPU hardware, custom data centers, and global cloud reach, Google aims to remain a foundational AI infrastructure provider. Its challenge is not technological capacity, but ensuring enterprise adoption at scale.

Transformation is about converting assets into platforms, moving beyond products into ecosystems that others must build on.

Create: Building the Post-Search GoogleThe final horizon is creation: new revenue streams and market positions that define Google’s identity in the 2030s.

Autonomous FutureWaymo’s full deployment could make Google not just a software player, but a central orchestrator of autonomous transport systems.New Revenue Streams

Subscription services, AI-driven enterprise platforms, and data monetization beyond ads could rebalance Google’s revenue model.Market Leadership 2030+

By embedding AI into infrastructure, Google aims to secure a leadership position not just in consumer apps, but in the backbone of the digital economy.Full Transportation Platform

If Waymo scales, Google could operate a transportation platform as significant as Android or Search — an ecosystem with trillions in downstream value.

Creation represents Google’s shot at reinvention. Just as it once transformed from a search engine into an ad empire, it now seeks to evolve into an AI-and-transportation powerhouse.

Strategic TensionsWhile the map looks clean, Google’s evolution faces deep tensions:

Cannibalization vs ProtectionAI-driven search (via Gemini) risks cannibalizing traditional search ads. Google must balance defending revenue with enabling innovation.Consumer vs Enterprise

Google has always been consumer-first, but AI revenue will largely come from enterprise adoption. Competing with Microsoft requires a cultural shift.Research vs Commercialization

DeepMind has world-class breakthroughs, but monetization has lagged. Google must accelerate translation from lab to product.Platform vs Product

Transforming Maps and Waymo into platforms requires ecosystem buy-in — something Google has historically struggled with outside of Android.Lessons from the FrameworkDefend the cash engine, but don’t overprotect it.

Google must protect search while being willing to disrupt it before others do.Attack with scale, not just sophistication.

Capturing 500M users with Gemini is about raw adoption, echoing the Gmail and Chrome playbooks.Transform assets into platforms.

Maps, Waymo, and TPU infrastructure must evolve into foundational ecosystems that others depend on.Create new horizons beyond ads.

Transportation, AI infrastructure, and autonomous ecosystems are Google’s next trillion-dollar bets.Conclusion

Google’s strategic evolution is a balancing act between defense and reinvention.

In the short term, it must protect its ad empire and rapidly scale Gemini.In the mid term, it must transform Waymo, Maps, and AI infrastructure into platforms.In the long term, it must create a post-search identity — one where Google is not defined by ads, but by its role in orchestrating autonomous systems and AI infrastructure.The critical year is 2025: the inflection point where Google either proves it can evolve beyond search — or risks being remembered as the company that couldn’t escape its own fortress.

The post Google’s Strategic Evolution (2024–2030+): From Search Fortress to Autonomous Futures appeared first on FourWeekMBA.

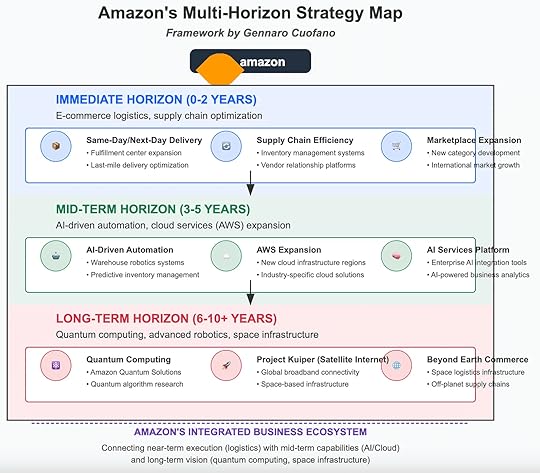

Amazon’s Multi-Horizon Strategy Map: From Logistics to Space Infrastructure

Amazon’s rise is often told as a story of relentless e-commerce growth and customer obsession. But the deeper truth is that Amazon has mastered multi-horizon integration: executing in the short term with brutal efficiency, while layering in mid-term bets that became profit engines (AWS), and planting long-term seeds in frontier technologies like quantum computing and space infrastructure.

The Multi-Horizon Strategy Map makes clear that Amazon’s playbook is not about sequential moves, but about building reinforcing horizons where each layer funds and strengthens the next.

Immediate Horizon (0–2 Years): E-Commerce Logistics and Supply Chain OptimizationAmazon’s immediate horizon is its foundation: efficient logistics, rapid fulfillment, and supply chain mastery. While AWS and Prime drive profits, it is the relentless execution in this horizon that sustains Amazon’s consumer dominance.

Key initiatives include:

Same-Day/Next-Day DeliveryAmazon continues to expand fulfillment centers, automate last-mile delivery, and experiment with drones and autonomous vehicles. Speed is not just a feature — it’s a competitive moat that drives customer loyalty.Supply Chain Efficiency

Amazon invests in inventory management systems, predictive demand forecasting, and AI-driven vendor management platforms. These tools allow Amazon to operate at scale without drowning in complexity.Marketplace Expansion

By onboarding millions of third-party sellers, Amazon amplifies its product catalog without carrying proportional inventory risk. International expansion further compounds this effect, cementing Amazon’s status as a global retail backbone.

The immediate horizon is Amazon’s cash engine and credibility builder. It keeps the consumer base locked in and funds the audacious bets in the horizons that follow.

Mid-Term Horizon (3–5 Years): AI-Driven Automation and Cloud ExpansionThe mid-term horizon is where Amazon converts operational scale into technological dominance.

Key initiatives include:

AI-Driven AutomationAmazon is automating warehouses with robotics and predictive inventory management. These systems reduce labor costs, speed fulfillment, and generate proprietary datasets — reinforcing both e-commerce and AWS.AWS Expansion

Amazon Web Services is the crown jewel of Amazon’s mid-term horizon. By building new infrastructure regions and vertical-specific solutions (healthcare, government, finance), AWS deepens enterprise stickiness and captures global digital transformation.AI Services Platform

Amazon is embedding AI directly into its cloud offerings, from machine learning APIs to generative AI services. This positions AWS as not just infrastructure, but a complete platform for enterprise AI adoption.

The mid-term horizon is Amazon’s profit engine. AWS delivers the margins that consumer retail lacks. More importantly, it creates the infrastructure backbone that Amazon can leverage for even bolder long-term bets.

Long-Term Horizon (6–10+ Years): Quantum, Space, and Frontier InfrastructureAmazon’s long-term horizon is where ambition outpaces most corporate imagination. Here, the company is building frontier infrastructure — technologies that may not pay off for a decade, but that could define the next industrial era.

Key initiatives include:

Quantum ComputingThrough Amazon Braket and quantum algorithm research, Amazon is positioning itself as a gatekeeper for enterprise quantum adoption. Quantum capabilities could eventually be woven into AWS, creating a next-generation computational moat.Project Kuiper (Satellite Internet)

Amazon is investing heavily in satellite broadband to compete with SpaceX’s Starlink. Beyond connectivity, Kuiper strengthens AWS by expanding reach into emerging markets, rural areas, and eventually, space-based commerce.Beyond Earth Commerce

In the furthest horizon, Amazon envisions supply chains extending into space: logistics infrastructure for off-planet industries, asteroid mining, or space-based data centers. While speculative, this horizon reflects Amazon’s philosophy: infrastructure first, commerce follows.

The long-term horizon is Amazon’s survival hedge. If commerce and cloud commoditize, Amazon still owns the deepest layers of future infrastructure.

Amazon’s Integrated Business EcosystemAmazon’s horizons are not siloed; they are woven into a single system:

Immediate horizon (logistics) ensures Amazon’s consumer dominance and generates massive operational data.Mid-term horizon (AWS + automation) monetizes that data, delivers high margins, and provides enterprise infrastructure.Long-term horizon (quantum + space) builds new infrastructure layers that AWS and e-commerce can eventually ride on.Amazon’s genius is in how these horizons reinforce each other: logistics → cloud → frontier infrastructure. Each horizon expands the surface area of the next, creating a compounding effect across decades.

Risks and ChallengesWhile Amazon’s horizons look seamless, each layer faces structural risks:

Immediate horizon risks: Rising labor costs, regulatory scrutiny on anticompetitive behavior, and environmental concerns about rapid delivery.Mid-term horizon risks: Fierce cloud competition (Microsoft, Google), AI commoditization, and political constraints on global data sovereignty.Long-term horizon risks: Kuiper may lag SpaceX; quantum computing timelines remain uncertain; space logistics could prove commercially premature.The question is not whether Amazon can build these technologies, but whether it can commercialize them faster than competitors or regulators can constrain them.

Strategic LessonsInfrastructure-first strategy compounds advantageAmazon always builds infrastructure before monetizing it. Fulfillment centers before Prime, cloud before AI, satellites before global connectivity.Horizons are stacked, not sequential

Amazon doesn’t wait for one horizon to finish before starting another. Instead, it overlaps them, ensuring continuity of growth and compounding.Profit pools fund frontier bets

Retail funds AWS; AWS funds Kuiper and quantum. Each profit engine subsidizes the next strategic horizon.Narrative as capital magnet

Amazon uses long-term visions — from space commerce to AI platforms — to attract investors and talent who want to build the future, not just run warehouses.Conclusion

Amazon’s Multi-Horizon Strategy Map reveals a company that plays not just in markets, but in time horizons.

In the short term, Amazon dominates logistics and e-commerce.In the mid term, AWS and automation create unmatched infrastructure moats.In the long term, Amazon seeds frontier bets in quantum, space, and post-planetary commerce.The brilliance of Amazon’s strategy lies in its integration. Each horizon reinforces the others, ensuring survival in the present, dominance in the medium term, and relevance in the far future.

This is not simply strategy — it is time arbitrage at scale. Amazon monetizes today while building tomorrow, ensuring that when the future arrives, it is already positioned at the center of it.

The post Amazon’s Multi-Horizon Strategy Map: From Logistics to Space Infrastructure appeared first on FourWeekMBA.

Tesla’s Multi-Horizon Strategy Map: From EVs to Humanoid Robots

Tesla is one of the rare companies that embodies true multi-horizon integration—managing immediate execution, mid-term strategic positioning, and long-term visionary bets in a single, coherent ecosystem. The company’s strategy is not just about cars or batteries; it is about building a sustainable energy and AI-driven ecosystem that compounds value across decades.

The Multi-Horizon Strategy Map reveals how Tesla sequences its ambitions: optimize production today, expand technological moats tomorrow, and redefine industries in the long run.

Immediate Horizon (0–2 Years): EV Production Efficiency and ScalingTesla’s survival and credibility depend on execution in the immediate horizon. The company must continue to prove that it can scale EV production efficiently while reducing costs.

Key initiatives include:

Manufacturing OptimizationTesla is expanding Gigafactories, refining production line automation, and relentlessly driving down unit costs. The company’s manufacturing philosophy—vertical integration, simplified design, and software-defined production—provides resilience against supply chain shocks.Vehicle Portfolio Expansion

New models such as the Cybertruck and the upcoming “Model 2” (a more affordable EV) aim to broaden Tesla’s market reach. Expanding the vehicle lineup is essential to maintaining demand across diverse segments, from luxury buyers to mass-market adopters.Battery Production Scaling

Tesla is scaling its 4680 cell production, aiming for vertical integration across the supply chain. Batteries remain the bottleneck of the EV industry, and Tesla’s ability to control this constraint directly impacts cost competitiveness and profitability.

Immediate horizon success is existential. If Tesla falters here, the long-term vision collapses. Yet the company cannot stop at production; the next horizon is where real strategic differentiation emerges.

Mid-Term Horizon (3–5 Years): Energy, Autonomy, and AI EcosystemThe mid-term horizon is where Tesla transforms from an EV manufacturer into a broader energy and AI platform company. This is the bridge between today’s cash flow and tomorrow’s dominance.

Key initiatives include:

Energy Storage SolutionsTesla is scaling Powerwall and Powerpack systems, with Megapack deployments already serving grid-scale energy needs. By coupling solar and storage, Tesla positions itself as a backbone provider for renewable energy infrastructure.Full Self-Driving Technology (FSD)

Tesla’s most controversial and ambitious mid-term bet, FSD, is built on a vision of autonomy powered by data scale and neural networks. With FSD v12+, the company is refining end-to-end AI models while scaling the Dojo supercomputer. Success here would unlock the world’s largest autonomous vehicle fleet.AI & Software Ecosystem

Tesla increasingly views vehicles as software-first machines. Over-the-air updates, firmware integration, and AI training infrastructure make Tesla cars not static products, but evolving platforms. Each vehicle is both a revenue-generating asset and a data node feeding the AI ecosystem.

The mid-term horizon is Tesla’s strategic pivot. It transforms the company from a carmaker into a vertically integrated AI + energy enterprise. But the real leap comes in the long horizon.

Long-Term Horizon (6–10+ Years): General-Purpose Robotics and HumanoidsTesla’s most ambitious horizon lies in robotics. Elon Musk has repeatedly emphasized that the Tesla Bot (Optimus) could eventually surpass the car business in economic value.

Key initiatives include:

Tesla Bot (Optimus)Designed as a general-purpose humanoid robot, Optimus targets manufacturing and service applications first. By leveraging Tesla’s AI expertise, manufacturing processes, and battery technology, Optimus represents an attempt to industrialize robotics at scale.Autonomous Urban Mobility

Tesla’s robotaxi vision aims to transform transportation into a service platform. Instead of selling cars, Tesla could operate fleets of autonomous vehicles, capturing recurring revenue from transportation-as-a-service.AI & Robotics Ecosystem

Over time, Tesla aims to build an integrated AI learning platform and robot operating system. This could extend Tesla’s reach beyond transportation and into labor markets, logistics, and household robotics.

The long-term horizon is where Tesla positions itself not just as a carmaker or energy company, but as an AI + robotics infrastructure provider. If successful, this shift could redefine the company’s valuation, pushing it far beyond automotive multiples.

Tesla’s Integrated EcosystemWhat makes Tesla’s multi-horizon strategy unique is integration. Each horizon reinforces the others:

EV production (Horizon 1) generates cash flow and operational scale.Energy + AI bets (Horizon 2) create durable moats and new revenue pools.Robotics + autonomy (Horizon 3) open entirely new markets.The strategy compounds because Tesla aligns all horizons under a single mission: accelerating the world’s transition to sustainable energy and AI-driven systems.

Unlike traditional automakers, Tesla does not treat vehicles, energy, and robotics as separate business units. They are different expressions of the same integrated ecosystem, sharing technology, data, and infrastructure.

Risks and Execution ChallengesTesla’s multi-horizon strategy is bold, but not guaranteed. Each horizon faces structural challenges:

Immediate horizon risks: Production delays, quality issues, and competitive EV price wars.Mid-term horizon risks: Autonomy remains unproven, with regulatory pushback and technical limitations still unresolved.Long-term horizon risks: Robotics may prove technically infeasible or commercially premature for mass adoption.The critical question is whether Tesla can generate enough short-term cash flow to sustain long-term bets without overextending.

Strategic LessonsHorizon sequencing matters: Tesla funds radical bets (robotics) with near-term execution (EV scaling). The order is critical: without execution, vision is worthless.Vertical integration compounds advantage: By controlling batteries, AI chips, software, and manufacturing, Tesla reduces bottlenecks across horizons.Narrative drives capital: Tesla’s long-term vision attracts investors, enabling funding for ambitious bets even before commercial proof emerges.The ecosystem mindset wins: Tesla’s strength is not in one product but in connecting horizons into a system where progress in one reinforces the others.ConclusionTesla’s Multi-Horizon Strategy Map reveals a company playing a different game. While traditional automakers focus narrowly on vehicles, Tesla integrates energy, autonomy, and robotics into a single strategic arc.

In the short term, Tesla must master production scaling.In the mid term, it must prove energy and AI capabilities.In the long term, it aims to redefine labor and transportation itself.This is not incremental strategy—it is systemic ambition. If Tesla executes across horizons, it won’t just dominate the EV market. It will reshape industries as diverse as energy, logistics, and robotics.

The lesson for strategists is clear: true advantage comes not from choosing one horizon, but from orchestrating all three into a single, compounding ecosystem.

The post Tesla’s Multi-Horizon Strategy Map: From EVs to Humanoid Robots appeared first on FourWeekMBA.

The Goldilocks Zone of AI Autonomy: Not Too Much, Not Too Little, Just Right

In astronomy, the Goldilocks Zone is that perfect distance from a star where liquid water can exist – not too hot, not too cold, just right for life. AI has its own Goldilocks Zone: the sweet spot of autonomy where systems are independent enough to be useful but controlled enough to be safe. Too little autonomy and AI is just expensive automation. Too much and it becomes ungovernable. Finding this zone isn’t just optimal – it’s existential.

In astronomy, the Goldilocks Zone is that perfect distance from a star where liquid water can exist – not too hot, not too cold, just right for life. AI has its own Goldilocks Zone: the sweet spot of autonomy where systems are independent enough to be useful but controlled enough to be safe. Too little autonomy and AI is just expensive automation. Too much and it becomes ungovernable. Finding this zone isn’t just optimal – it’s existential.

The Goldilocks Zone principle reveals why most AI fails: we consistently miss the autonomy sweet spot. Companies either build systems so restricted they’re useless or so autonomous they’re dangerous. The perfect balance exists, but it’s narrow, dynamic, and different for every application.

The Autonomy SpectrumThe Five Levels of AI AutonomyLike self-driving cars, AI systems exist on an autonomy spectrum:

Level 0 – No Autonomy: Human does everything, AI assists

Spell checkers, grammar toolsSimple recommendationsPassive information displayLevel 1 – Assistance: AI helps but human controlsCopilot systemsSuggestion enginesEnhanced searchLevel 2 – Partial Autonomy: AI acts, human supervisesEmail auto-responsesContent moderationBasic customer serviceLevel 3 – Conditional Autonomy: AI operates independently within boundsTrading algorithmsInventory managementScheduled operationsLevel 4 – High Autonomy: AI self-manages, human intervenes rarelyAutonomous vehicles (specific conditions)Lights-out manufacturingSelf-healing systemsLevel 5 – Full Autonomy: AI operates without human involvementTheoretical AGIFully autonomous agentsSelf-directed systemsMost successful AI lives in the Level 2-3 Goldilocks Zone.The Danger Zones

Too little autonomy (Level 0-1):

Expensive human labor with AI overheadSlow processes requiring constant inputLimited value creationUser frustration from micro-managementToo much autonomy (Level 4-5):Uncontrolled behavior and emergent risksAccountability vacuums – who’s responsible?Cascading failures without human circuit breakersValue misalignment with human goalsWhy the Goldilocks Zone MattersThe Value Creation Curve

Value doesn’t scale linearly with autonomy:

Low Autonomy: Minimal value (expensive human augmentation)

Goldilocks Zone: Maximum value (optimal human-AI collaboration)

High Autonomy: Negative value (risk exceeds benefit)

The curve is an inverted U – value peaks in the middle.

The Trust ParadoxUsers have contradictory desires:

Want AI to “just handle it” (high autonomy)Want to maintain control (low autonomy)Want to trust but verify (impossible combination)The Goldilocks Zone resolves this paradox: enough autonomy to be magical, enough control to be trustworthy.The Liability Landscape

Legal systems aren’t prepared for autonomous AI:

Low Autonomy: Clear human responsibility

Goldilocks Zone: Shared responsibility models emerging

High Autonomy: Legal vacuum, undefined liability

Companies in the Goldilocks Zone can insure and indemnify. Outside it, they can’t.

Finding Your Goldilocks ZoneDomain-Specific ZonesDifferent applications have different zones:

Creative Work (Level 1-2):

AI generates optionsHumans select and refineNever fully autonomousExample: Midjourney, ClaudeFinancial Trading (Level 3):Operates within strict parametersHuman-set boundariesKill switches mandatoryExample: Algorithmic tradingCustomer Service (Level 2-3):Handles routine queriesEscalates complex issuesHuman oversight availableExample: Intercom, Zendesk AIMedical Diagnosis (Level 1):AI suggests, doctor decidesNever autonomous treatmentLegal requirement for human oversightExample: Radiology AIThe Dynamic Nature of the Zone

The Goldilocks Zone moves over time:

Technology Maturity: As AI improves, zone shifts toward more autonomy

Regulatory Evolution: New laws change acceptable autonomy

User Comfort: Familiarity increases autonomy tolerance

Incident Impact: Failures shift zone toward less autonomy

What’s “just right” today is “too much” or “too little” tomorrow.

The Contextual BoundariesThe zone depends on context:

High-Stakes Decisions: Less autonomy

Medical treatmentLegal judgmentsFinancial investmentsHiring decisionsLow-Stakes Operations: More autonomyContent recommendationsPlaylist generationRoute optimizationSpam filteringStakes determine the zone.The Engineering of Goldilocks AIThe Control Architecture

Building systems in the zone requires:

Graduated Autonomy:

Start with low autonomyGradually increase based on performanceAutomatic rollback on errorsDynamic adjustment mechanismsHuman Circuit Breakers:Override capabilitiesPause functionsAudit trailsIntervention pointsBounded Operations:Clear operational limitsDefined decision spacesExplicit constraintsMeasurable boundariesThe Feedback Loops

Maintaining the zone requires constant adjustment:

Performance Monitoring:

Track autonomy levelMeasure error ratesMonitor edge casesDetect driftUser Feedback:Comfort level assessmentTrust metricsSatisfaction scoresIncident reportsAutomatic Adjustment:Reduce autonomy on errorsIncrease autonomy on successSeasonal adjustmentsContext-aware modificationThe Safety Mechanisms

Staying in the zone requires safety systems:

Graceful Degradation:

Reduce autonomy under uncertaintyFall back to human controlMaintain partial functionalityPrevent catastrophic failureExplainable Boundaries:Clear communication of limitsTransparent autonomy levelUnderstandable constraintsPredictable behaviorThe Business of the Goldilocks ZoneThe Competitive Advantage

Companies in the zone outperform:

Too Little Autonomy Competitors:

Higher efficiencyBetter scalingLower costsFaster operationToo Much Autonomy Competitors:Higher trustLower riskBetter complianceMore adoptionThe zone is the sweet spot of competitive advantage.The Pricing Power

Goldilocks positioning enables premium pricing:

– Perfect balance commands premium

Risk mitigation justifies costTrust enables subscription modelsReliability reduces churnCustomers pay for “just right.”The Market Segmentation

Different segments have different zones:

Innovators: Want more autonomy

Early Adopters: Comfortable with current zone

Early Majority: Want less autonomy

Late Majority: Minimal autonomy only

Laggards: No autonomy acceptable

Success requires serving multiple zones simultaneously.

The Risks of Missing the ZoneThe Automation ParadoxToo much autonomy creates brittleness:

Normal Operation: Everything works perfectly

Edge Case: System fails catastrophically

Human Operators: Lost skills, can’t intervene

Result: Worse than no automation

Air France 447 crashed partly due to automation dependency.

The Tedium TrapToo little autonomy creates tedium:

Human Monitors: Watching AI constantly

Alert Fatigue: Too many false positives

Disengagement: Humans stop paying attention

Result: Worst of both worlds

Tesla Autopilot accidents often involve inattentive human monitors.

The Accountability VacuumAmbiguous autonomy creates confusion:

Unclear Responsibility: Who’s in charge?

Decision Paralysis: Neither human nor AI acts

Blame Games: Finger-pointing after failures

Result: Systematic dysfunction

Next-generation AI will have dynamic zones:

Self-Adjusting Autonomy:

Recognizes own limitationsRequests human input when uncertainBuilds trust through successReduces autonomy after errorsContext-Aware Boundaries:Different autonomy for different usersSituational adjustmentRisk-based modificationCultural adaptationThe Negotiated Zone

Humans and AI will negotiate autonomy:

Explicit Contracts: Define autonomy boundaries

Dynamic Renegotiation: Adjust based on performance

Trust Building: Gradual autonomy increase

Shared Learning: Both adapt together

Everyone gets their own Goldilocks Zone:

Individual Preferences: Custom autonomy levels

Learning Curves: Gradual comfort building

Risk Tolerance: Personalized boundaries

Cultural Factors: Localized autonomy norms

Start Conservative: Begin with less autonomy

Earn Trust Gradually: Increase based on success

Build Override Mechanisms: Always allow human control

Communicate Clearly: Make autonomy level transparent

Monitor Constantly: Track zone effectiveness

Know Your Zone: Understand optimal autonomy for your context

Test Boundaries: Carefully explore zone edges

Plan for Adjustment: Zones will shift

Train Humans: Maintain intervention capability

Document Decisions: Record autonomy choices

Define Zone Boundaries: Clear autonomy limits by domain

Require Gradual Progression: No jumping to high autonomy

Mandate Override Capabilities: Human control requirements

Create Liability Frameworks: Clear responsibility assignment

Adaptive Regulation: Rules that evolve with technology

The zone emerges from fundamental tensions:

Efficiency vs Control

Innovation vs Safety

Speed vs Accuracy

Automation vs Accountability

The zone is where these tensions balance.

The Wisdom of ModerationAncient philosophy meets modern AI:

Aristotle’s Golden Mean: Virtue lies between extremes

Buddhist Middle Way: Avoid both indulgence and asceticism

Goldilocks Principle: Not too much, not too little

The zone is where wisdom lives.

Key TakeawaysThe Goldilocks Zone of AI Autonomy teaches crucial lessons:

1. Perfect autonomy exists but is narrow – Most AI misses the zone

2. The zone is dynamic – It moves with context and time

3. Different applications have different zones – No universal answer

4. Value peaks in the middle – Not at the extremes

5. Success requires constant adjustment – The zone must be maintained

The winners in AI won’t be those pushing maximum autonomy (too dangerous) or minimal autonomy (too limited), but those who:

Find their perfect zoneBuild systems that stay thereAdjust as the zone shiftsServe multiple zones simultaneouslyHelp others find their zonesThe Goldilocks Zone isn’t a compromise or settling for less – it’s the optimal point where AI delivers maximum value with acceptable risk. The challenge isn’t building more autonomous AI or more controlled AI, but building AI that’s just right.In the end, the most successful AI will be like Baby Bear’s porridge – not too hot, not too cold, but just right. The wisdom lies not in extremes but in finding that perfect balance where humans and machines work together in harmony, each doing what they do best.

The post The Goldilocks Zone of AI Autonomy: Not Too Much, Not Too Little, Just Right appeared first on FourWeekMBA.

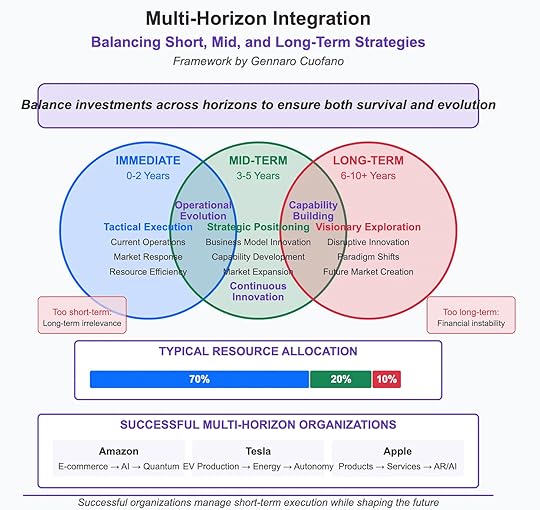

Multi-Horizon Integration: Balancing Short, Mid, and Long-Term Strategies

Every successful company must solve the same paradox: how to survive the present while preparing for the future. Too much focus on the immediate term creates irrelevance as new technologies and markets emerge. Too much focus on the long term creates financial fragility, as the company starves its core operations. The solution is not to choose one horizon over the other, but to integrate all three—short, mid, and long-term strategies—into a coherent system of execution.

This is the logic of multi-horizon integration: a discipline for balancing today’s tactical execution, tomorrow’s strategic positioning, and the distant future’s visionary bets.

Horizon 1: Immediate (0–2 Years)The immediate horizon is about tactical execution. Companies need to keep the lights on, meet current market demands, and optimize operations.

Key features:

Current operations must run efficiently.Market responses must be agile to capture short-term opportunities.Resource allocation is heavily weighted here—about 70% of total resources.The risk of neglecting this horizon is obvious: without short-term survival, there is no future. But the opposite risk is equally dangerous: becoming trapped in perpetual firefighting mode, mistaking efficiency for strategy. Companies that obsess over the immediate term risk long-term irrelevance, because optimization without evolution simply accelerates obsolescence.

Horizon 2: Mid-Term (3–5 Years)The mid-term horizon is about strategic positioning. Here, companies move beyond efficiency to invest in business model innovation, capability development, and market expansion.

This horizon bridges execution and exploration. It ensures that a company does not just run operations but evolves them into stronger competitive positions. Strategic positioning involves:

Building capabilities that compound advantage.Innovating business models to capture more value.Entering adjacent markets where current infrastructure provides leverage.Typical allocation here is around 20% of resources—enough to fuel evolution without starving today’s core.

The mid-term horizon is often the hardest to manage. It lacks the urgency of Horizon 1 and the visionary appeal of Horizon 3. Yet it is the most decisive. Companies that fail here get disrupted. Those that succeed lay the foundation for enduring relevance.

Horizon 3: Long-Term (6–10+ Years)The long-term horizon is about visionary exploration. Companies must make bets on disruptive innovations, paradigm shifts, and future market creation.

This is not about predicting the future with certainty—it’s about building options for multiple futures. Investments in Horizon 3 often feel speculative, but they are necessary to avoid being blindsided by systemic shifts.

Typical allocation is 10% of resources, but this small share carries outsized significance. Without Horizon 3, companies risk being overtaken by startups or incumbents who dared to imagine—and invest in—the next paradigm.

The challenge is balance: too much emphasis on long-term moonshots creates financial instability, while too little leads to decay when markets inevitably change.

The Integration ChallengeManaging these three horizons requires discipline across two tensions:

Time allocation vs. capital allocation:Short-term execution consumes resources, but long-term bets require patience. Companies must constantly rebalance as market conditions change.Exploration vs. exploitation:

Horizon 1 exploits existing systems for maximum efficiency. Horizon 3 explores entirely new possibilities. Horizon 2 must integrate both—renewing the core while experimenting at the edges.

Successful companies treat the three horizons as an interdependent system, not isolated silos. Tactical wins fund mid-term investments, which create the capabilities that enable long-term breakthroughs.

Case Studies in Multi-Horizon StrategyAmazonAmazon exemplifies multi-horizon integration.

Horizon 1: E-commerce optimization, logistics efficiency, customer service.Horizon 2: Marketplace expansion, Prime subscription, AWS cloud scaling.Horizon 3: Bets on AI, Alexa, robotics, quantum computing.By maintaining balance, Amazon avoided the trap of short-term retail margins while building long-term infrastructure plays. Its 70/20/10 allocation ensured survival and evolution simultaneously.

TeslaTesla’s story shows how to stretch across horizons under extreme risk.

Horizon 1: Vehicle production efficiency, cost reduction.Horizon 2: Expansion into energy storage, charging infrastructure.Horizon 3: Autonomous driving, humanoid robotics.Tesla demonstrates that Horizon 3 bets can shape market perception, even before they are fully realized. Investors buy into Tesla’s long-term vision, giving it the financial oxygen to sustain Horizon 1 struggles.

AppleApple mastered the sequencing of horizons.

Horizon 1: Continuous refinement of products (iPhone, Mac).Horizon 2: Expansion into services (App Store, Apple Pay, Apple Music).Horizon 3: Bets on AR/AI and new computing paradigms.Apple shows that disciplined short-term execution funds massive long-term R&D bets. The App Store turned Horizon 1 devices into Horizon 2 recurring revenue streams, which in turn finance Horizon 3 explorations into AR/AI.

Strategic LessonsBalance prevents collapseCompanies skewing too short-term suffer long-term irrelevance. Those skewing too long-term risk immediate financial instability. Balance is survival.Horizon 2 is the pivot

The mid-term horizon, often neglected, is the true battleground. Business model innovation and capability development ensure a company evolves rather than ossifies.Vision attracts capital

Horizon 3 bets not only prepare for the future but also signal ambition, attracting talent, partners, and investors.The integration edge

The real advantage is not excelling in one horizon but integrating all three. This creates a structural rhythm—today’s wins fuel tomorrow’s positioning, which unlocks future markets.Conclusion

Multi-horizon integration is the difference between companies that burn bright and fade, and those that sustain relevance for decades.

Horizon 1 ensures survival through tactical excellence.Horizon 2 ensures evolution through strategic positioning.Horizon 3 ensures transcendence through visionary bets.The discipline lies in balancing resource allocation, time horizons, and strategic priorities. Companies like Amazon, Tesla, and Apple prove that survival and evolution are not competing goals—they are mutually reinforcing when managed across horizons.

The lesson is simple but unforgiving: neglect one horizon, and the system collapses. Master all three, and the company not only survives—it shapes the future.

The post Multi-Horizon Integration: Balancing Short, Mid, and Long-Term Strategies appeared first on FourWeekMBA.

Amazon’s Optimal Scalability Journey

When people think of Amazon, they usually see the end state: a trillion-dollar company spanning e-commerce, cloud computing, media, devices, and physical retail. But the real lesson in Amazon’s success is how it scaled. Amazon didn’t explode into all markets at once—it followed a disciplined path of tight feedback loops, low-cost error environments, and incremental niche expansion. This journey is a case study in optimal scalability, showing how structural discipline beats brute force.

Stage 1: Books (1995) — The Low-Cost ExperimentAmazon’s first niche, books, was not chosen at random. Books had low cost of error and tight feedback loops built into the system.

Every purchase generated a clear data point.Reviews and ratings provided immediate consumer feedback.Errors (wrong titles, shipping delays) were inexpensive compared to industries like apparel or electronics.This allowed Amazon to “fail fast and cheaply.” Mistakes weren’t catastrophic, and every correction improved the system. By starting narrow, Amazon built its data foundation and customer trust.

Stage 2: Electronics (1998) — Expanding to Adjacent NichesOnce the feedback loop for books was solid, Amazon moved into electronics, a category with higher margins but also higher complexity.

Here, the principle of incremental expansion to adjacent niches came into play. Electronics carried more risk—returns were costlier, warranties mattered—but Amazon already had the logistics, payment systems, and customer trust to handle the leap.

This was scalability in motion: Amazon didn’t reinvent itself. It extended existing capabilities to a new domain, proving the power of compounding infrastructure.

Stage 3: Marketplace (2002) — Scaling Through OthersThe Marketplace launch was a turning point. By enabling third-party sellers, Amazon multiplied product variety without multiplying inventory risk.

Sellers carried the cost of stocking and experimentation.Amazon collected data and commissions while expanding selection.Customer reviews kept the feedback loop tight, ensuring trust.This was optimal scalability at its finest. Amazon leveraged external participants to scale breadth while keeping its own risks low. Feedback loops remained clear, errors were mostly absorbed by sellers, and Amazon captured the data advantage.

Stage 4: AWS Cloud (2006) — Turning Internal Feedback into External BusinessAWS is often seen as an unrelated bet, but it followed the same scalability logic.

Amazon had already built massive infrastructure for its own operations—servers, storage, compute. Feedback loops came from internal performance metrics, which highlighted inefficiencies. By productizing these systems, Amazon entered an entirely new industry with validated demand.

Internal teams acted as the first feedback loop.Scaling to external customers was incremental.Metrics were precise: uptime, latency, cost savings.AWS scaled optimally because it wasn’t speculative. It was an extension of internal capabilities into an adjacent market.

Stage 5: Prime and Media (2010) — Tightening the Consumer FlywheelWith Prime, Amazon added a subscription layer that deepened its feedback loop.

Free shipping encouraged higher-frequency purchases, generating more data.Video and media added engagement time, sharpening Amazon’s understanding of preferences.The subscription model reduced churn, creating a reliable feedback mechanism for consumer loyalty.Errors were low-cost (a disappointing show, a late delivery), and the feedback was constant. Prime turned Amazon from a store into an ecosystem.

Stage 6: Alexa and Devices (2015) — Expanding into Voice AnalyticsBy the mid-2010s, Amazon moved into voice devices, embedding itself in consumer behavior.

Alexa provided always-on feedback loops through voice interactions.Errors (misunderstandings, wrong commands) were tolerated because expectations were low.Each interaction improved Amazon’s natural language models.The scalability principle was the same: start with a low-stakes environment, build trust, and improve iteratively. Voice wasn’t just a gadget—it was another data channel feeding Amazon’s broader ecosystem.

Stage 7: Physical Retail (2023) — Closing the LoopAmazon’s move into physical retail was not about competing with Walmart head-to-head. It was about omnichannel data integration.

Combining online and offline data created tighter consumer profiles.Errors in retail were manageable (out-of-stock, checkout friction).Feedback loops came from both digital signals and in-store behavior.By now, Amazon’s expansion principle was crystal clear: use data-driven feedback loops to absorb risk while entering adjacent markets.

Core Principles of Amazon’s ScalabilityAmazon’s journey illustrates four key principles that generalize across industries:

Tight feedback loops and clear metricsBooks → Sales and reviews

AWS → Performance metrics

Prime → Churn and engagementLow cost of errors

Start in domains where mistakes don’t kill trust (books, digital media).Incremental expansion to adjacent niches

Electronics → Marketplace → AWS → Media → Devices → Retail.Measure before expanding widely

Each move was validated with data before going global.Strategic InsightsScalability is structural, not accidental. Amazon engineered environments where errors were cheap and feedback was abundant. That allowed it to out-iterate competitors.Data accumulation compounds. Each expansion generated new data types—reviews, seller data, performance metrics, subscription behavior, voice analytics. This compounding data advantage became Amazon’s moat.Adjacency beats diversification. Amazon didn’t jump randomly into new markets. It scaled horizontally through adjacencies where existing infrastructure gave it an edge.Feedback loops beat one-off bets. The secret isn’t making one brilliant move—it’s building a structure that keeps producing new opportunities.Conclusion

Amazon’s scalability journey shows the playbook for sustainable growth.

Begin with a narrow, low-cost-of-error domain.Build tight feedback loops that compound improvement.Expand incrementally into adjacent niches, leveraging existing capabilities.Measure relentlessly, letting data dictate the pace of expansion.This is why Amazon succeeded where others failed. Most companies chase scale by brute force—burning cash on expansion without feedback discipline. Amazon scaled by engineering for optimal scalability, turning each niche into a stepping stone toward global dominance.

The lesson for founders and strategists is clear: scale is not about ambition, it’s about structure. Build feedback-rich environments, minimize the cost of error, and let compounding systems do the heavy lifting.

The post Amazon’s Optimal Scalability Journey appeared first on FourWeekMBA.

AI Product Scalability Principles

The success of an AI product rarely hinges on raw model performance. Instead, scalability emerges from the structural dynamics of cost of error and feedback loop quality. The AI Product Scalability Principles framework breaks this down into four distinct types—each with unique characteristics, success factors, and strategies. This analysis clarifies why some AI applications spread explosively while others stagnate, even with strong technology behind them.

1. Optimal ScalabilityKey Characteristics

Low cost of errorTight feedback loopsClear metricsNarrow use caseThis is the quadrant where AI achieves explosive growth. Errors are inexpensive, so users can tolerate imperfection while the system learns. Feedback loops are immediate and data-rich, driving compounding improvement. Narrow use cases sharpen product-market fit and make progress visible.

Examples

Recommendation engines like TikTok’s For You feed.Voice assistants correcting speech recognition errors in real time.Generative AI for content creation where user edits act as direct feedback.Success Factors

Rapid iteration: constant deployment of small improvements.Data-driven decisions: metrics guide product design, not intuition.Cost-efficient scaling: cheap data collection and model refinement.Strategy

Start here whenever possible: this quadrant maximizes scalability potential.Establish measurement systems early, so every interaction becomes fuel for feedback.Takeaway

Optimal scalability products dominate markets because they compound improvements naturally. The system thrives on scale—the more it’s used, the better it gets, creating a flywheel effect.

Key Characteristics

Low cost of errorLoose feedback loopsLimited measurementAmbiguous causalityThis quadrant represents products with medium scalability. Mistakes are cheap, but learning is inefficient. Feedback signals are weak or delayed, slowing improvement. Progress often relies on proxy metrics that may not capture true success.

Examples

Early chatbots that lacked clear success signals.AI-powered marketing tools where attribution is murky.Consumer personalization systems with limited user engagement data.Success Factors

Forgiving environment: errors don’t destroy trust.Room for experimentation: flexibility in design allows for discovery.Potential for breakthrough once feedback mechanisms improve.Strategy

Invest in better measurement systems—find sharper proxies for user intent.Create tighter feedback mechanisms (e.g., user rating systems, A/B testing, synthetic feedback environments).Takeaway

This quadrant is a launchpad. Products that migrate from constrained to optimal scalability often unlock explosive growth. The key lies in engineering feedback structures rather than waiting for model improvements alone.

Key Characteristics

High cost of errorTight feedback loopsControlled environmentsClear performance metricsHere, scalability is possible, but growth is managed carefully due to high stakes. Errors carry significant cost—legal, financial, or reputational—but strong feedback systems ensure that each mistake drives structured improvement.

Examples

Medical imaging AI trained against labeled datasets with known outcomes.Fraud detection systems in financial institutions.Predictive maintenance for industrial equipment.Success Factors

Managed risk: errors contained within safety nets.Structured improvement: every failure is tracked, analyzed, and used to refine the system.Reliable outcomes: consistent performance builds trust in critical environments.Strategy

Prove reliability in controlled settings first (e.g., pilot programs, sandboxes).Gradually expand the domain of application as confidence builds.Takeaway

Controlled scalability produces slow but durable adoption. Products in this quadrant often dominate regulated or mission-critical industries where reliability matters more than speed.

Key Characteristics

High cost of errorLoose feedback loopsAmbiguous causalityComplex environmentsThis is the dead zone of AI commercialization. Errors are costly, but the system lacks mechanisms to improve efficiently. Feedback is too weak or delayed, and causality is unclear. The result is stagnation: technically impressive prototypes that never translate into scalable businesses.

Examples

Fully autonomous vehicles in open-world environments.Robotic surgery systems lacking real-time corrective loops.General-purpose humanoid robots operating in unconstrained contexts.Success Factors

At best, these systems work in niche or custom settings, with heavy human oversight.They are suited for high-touch services rather than mass-market deployment.Strategy

Break the problem into smaller domains: instead of full autonomy, target constrained environments (e.g., warehouse robotics, highway-only autonomy).Create artificial feedback loops: use simulation, digital twins, or synthetic data to accelerate learning.Takeaway

Non-scalable products absorb billions in R&D without delivering sustainable returns. The only path forward is reframing the domain into smaller, safer, and feedback-rich problems.

The AI Product Scalability Principles framework clarifies why certain AI products succeed while others languish.

Optimal Scalability: The natural winners—low cost of error, tight loops, runaway growth.Constrained Scalability: Medium scalability—fix the feedback problem to unlock potential.Controlled Scalability: High-stakes environments—growth through trust, reliability, and structure.Non-Scalable: Dead ends without reframing—break problems into smaller domains or stagnate.For builders, the lesson is simple: don’t just build better models. Build better feedback architectures. For investors, the lesson is sharper: don’t chase demos—chase domains where the structure of scalability aligns with the cost of error.

In the end, scalability isn’t a technical outcome. It’s a structural one. Products that master this structure will dominate the AI economy.

The post AI Product Scalability Principles appeared first on FourWeekMBA.