Gennaro Cuofano's Blog, page 187

November 19, 2020

What Is Backcasting And Why It Matters In Business

Businesses use backcasting to plan for a desired future by determining the steps required to achieve that future. Backcasting is the opposite of forecasting, where a business sets future goals and works toward them by maintaining the status quo.

Understanding backcasting

Inevitably, backcasting will prompt every business executive to ask themselves one question:

”Where do I want this business to go, and how does it get there?”

Here, it’s important to reiterate that backcasting does not involve predicting the future. Rather, the approach endeavors to figure out how a desirable future can be attained. At the company level, backcasting encourages stakeholders to think creatively and imagine all possible scenarios.

Indeed, it was creative thinking that resulted in Henry Ford inventing the mass-produced motor car. Ford was compelled to act because horses – the primary means of transport at the time – were producing large amounts of manure in cities all over the world.

Businesses in the horse transport industry might have suggested lighter carriages or faster horses. However, Ford envisaged a future without horses where people would move around by private motorized transport. History will show that horse transport ceased soon thereafter, but the important point is that Ford created a future goal and worked backwards to figure out how he might achieve it.

A typical framework for the backcasting process

There is no designated framework for implementing the backcasting process, but it is often associated with the ABCD method. Originally developed as a tool for businesses to move toward sustainability, it has now been adapted for general use.

The ABCD framework has 4 components:

Assessment. What industry-specific trends might impact an organization? Is there technology still in the prototype phase which might go into full production? In the assessment component, businesses must assess their role in the industry and develop ambitious goals and visions.Baseline assessment. This details how well a business is currently equipped to meet its vision. Does it have proprietary technology? Does it have a pipeline of future projects? What about a sound and sustainable business model? It’s important to gain clarity on these questions because they will drive future innovation.Creative solutions. Now that a future strategy has been defined, it’s time to brainstorm ideas to make the future a reality. Many successful ideas for innovation come from employees and not from the board level. However, if the required expertise does not exist within the business then a joint venture or recruitment drive should be considered.Devise a plan. There are certain steps that any business can take for immediate impact, but these are mostly short term. Long-term projects or major changes of direction within a company need similarly long-term goals. In industries with a high rate of technological development, lean product development with constant iteration and adaptation is a worthy strategy.

Key takeaways

Backcasting involves working backward from a desired future to determine the steps needed to get there.Backcasting helps businesses stay relevant in a rapidly changing world by encouraging creative thinking and innovation.Backcasting is based on the ABCD component framework. This gives businesses a holistic view of their operations and the industry as a whole before they develop a plan detailing future growth.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is Backcasting And Why It Matters In Business appeared first on FourWeekMBA.

What Is The Barnum Effect And Why It Matters In Business

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

Understanding the Barnum effect

The classic example of the Barnum effect at work lies in daily horoscopes, where vague and very general statements provide advice for individuals of a particular star sign. The advice is of course equally applicable for individuals in the other 11 signs.

In modern business, the Barnum effect can be seen in digital companies such as Facebook, Spotify, and Netflix. Each incorporates “recommended for you” type features to give the illusion of a tailored product, but these features are based on broader demographic and behavioral data.

Psychologist Bertram R. Forer called the Barnum effect the “fallacy of personal validation” because consumers love to be complimented. Importantly, they trust compliments as being truthful – even if they are false in the sense that they apply to a large number of people.

Ultimately, businesses that flatter their consumers in some way tend to reap the highest rewards. This is because consumers who experience validation are easily influenced and this can be exploited to drive sales.

Benefits of the Barnum effect in business and marketing

The Barnum effect has implications for how a business engages with its consumers and creates a lasting relationship. Primarily, this is achieved by making consumers feel as if they are personally interacting with a brand. In turn, this increases brand loyalty and increases customer retention.

In marketing, the effect will be almost invisible to most people. But it is very often found in:

Production recommendations and curated lists – think Amazon and its recommendations found on Kindle, Prime Video, and on its e-commerce site.Promotional banner advertisements on product websites – often seasonal in nature or targeted toward specific genders, enthusiasts, or upcoming events.Persuasive sales copy that speaks to the specific pain points a consumer is experiencing.

The Barnum effect and exploiting cognitive biases

It’s important to note that businesses using the Barnum effect are not preying on people for monetary gain.

Instead, they are simply tapping into a tendency for consumers to filter the extraordinary amount of information they are bombarded with daily. Cognitive biases help this filtering because invariably, consumers only respond to personally meaningful information. Or, in the case of the Barnum effect, information that flatters or validates.

Businesses should always remember that these biases occur with or without the presence of marketing. There is nothing to be lost by marketing agencies telling consumers what they want to hear, which makes them feel more valued as a result.

Key takeaways:

The Barnum effect occurs when an individual believes that generic information applicable to a wide audience only applies to themselves.Businesses can use the Barnum effect to connect with their customers on a personal level. This increases brand loyalty and customer retention.The Barnum effect can be used in virtually any marketing campaign where consumers need to feel valued. In their search for this validation, they use cognitive biases to filter out impersonal information – and this can be exploited with clever marketing.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is The Barnum Effect And Why It Matters In Business appeared first on FourWeekMBA.

What Is Base Rate Fallacy And Why It Matters In Business

The base rate fallacy occurs when an individual inaccurately judges the likelihood of a situation occurring by not considering all relevant data.

Understanding the base rate fallacy

The base rate fallacy is based on a statistical concept called the base rate. In simple terms, it refers to the percentage of a population that has a specific characteristic.

For example:

The base rate of office buildings in New York City with at least 27 floors is 1 in 20 (5%).The base rate of global citizens owning a smartphone is 7 in 10 (70%).The base rate of left-handed individuals in a population is 1 in 10 (10%).

Regardless of the statistic, the base rate fallacy describes the tendency for an individual to discount existing (base rate) information in favor of new information. In discounting base rate information, the individual is contravening the fundamental rules of evidence based logical reasoning.

These fallacies are common in the finance industry, where investors buy or sell shares based on irrelevant and irrational information. This causes many investors to overreact to fluctuating market conditions, despite the availability of base rate statistics.

For example, a listed company may display consistent, historical growth that has contributed to significant base rate data. Here, the data may show that the company’s share price appreciates at the rate of 35% per year.

If investors ignore this information and decide to sell on a very occasional red day, they are operating under the base rate fallacy. In other words, they have not considered the fundamental aspects of the company or the fact that share price appreciation is very rarely linear.

Avoiding the base rate fallacy

To avoid the base rate fallacy, individuals and businesses should:

Pay more attention to base rate information. This includes research and due diligence.Understand that past performance or behavior is not a valid predictor of future performance or behavior.Consider individual segments of their target audience during product development. While a business might get excited about adding a new feature to its product range, it must first consider what percentage of their customers would find value in it.Always segment using A/B testing to ensure that they are optimizing for base rate information. This increases qualified leads in the target audience, resulting in higher conversion rates.Refrain from making statistical inferences in marketing campaigns. Many consumers have difficulty interpreting data and others simply don’t have the time or patience. In any case, such inferences can be misleading because they fail to address the baseline data for individual consumers. Instead of making unsubstantiated claims, it’s more effective to detail how a product or service solves a problem the consumer is experiencing.Make a commitment to not revert to effortless, automatic ways of thinking. Before each decision is made, the probability of a given event occurring should be rigorously assessed.

Key takeaways:

The base rate fallacy describes a tendency to erroneously predict the likelihood of an event without considering all relevant data.Base rate fallacies are common in the finance industry when investors fail to incorporate historical data into the future movement of share prices.The base rate fallacy can occur in any situation where inferences are made about data. Therefore, businesses need to be vigilant in their operations, product development, and marketing communications.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is Base Rate Fallacy And Why It Matters In Business appeared first on FourWeekMBA.

What Is Bikeshedding And Why It Matters In Business

Bikeshedding is a metaphor that describes the tendency for individuals to spend a disproportionate amount of time on trivial matters – often at the expense of more important ones.

Understanding bikeshedding

Bikeshedding is based on Parkinson’s Law of Triviality, named after British author and historian Cyril Northcote Parkinson.

In his description of the law, Parkinson used the example of a committee meeting discussing ways to finance three projects:

A £10 million nuclear power plant.A £350 bike shed.A £21 annual coffee budget.

The meeting starts with members discussing nuclear energy, but most are ill-informed and the project seems too complex to facilitate meaningful discussion. The committee then moves on to the bike shed and since many ride to work, there is more animated discussion regarding its financing. Lastly, the coffee budget is discussed. Everyone drinks coffee, so the colleagues spend the rest of the meeting talking about their favorite blends and the allocation of just £21.

At the conclusion of the meeting, nothing of significance has been achieved.

Parkinson summed up the results of the meeting by defining his law. Parkinson’s Law of Triviality states that the amount of time devoted to a task is inversely proportional to its importance. In other words, organizations devote large amounts of time to tasks that bear little significance to their bottom line.

Indeed, bikeshedding is a pervasive and well-entrenched problem in most businesses. A seemingly infinite amount of time is spent replying to emails and sitting in meetings that don’t seem to accomplish much. Ultimately, these somewhat menial tasks consume resources that could be better directed to major projects with a greater potential to move the company forward.

Common examples of bikeshedding in business

Although most commonly associated with meetings, bikeshedding can occur in other scenarios, including:

Depth of experience – where a board of directors spends more time discussing executive compensation than it does dealing with potentially damaging risks to their organization.Creativity and charisma – where employees spends time on creative projects or social media to the detriment of important financial or operational duties.Broken window theory – where a business may complain about finding suitably qualified employees instead of addressing poor company culture or a lack of appropriate remuneration.

Strategies for avoiding bikeshedding

Many advocate purpose as an essential ingredient in combating bikeshedding.

In the context of business meetings, purpose means that:

Discussions are focused around a shared or common vision.Meetings are attended by those with relevant expertise. Personnel with little background knowledge should not be invited. They will have nothing of note to contribute and often distract those who do, impeding progress.A person is tasked with leading the committee and making a final determination. Leadership is vital because leaders decide how important a given project is and by extension, how much time or resources should be allocated. Leaders can also set time limits on decisions so that progress is made.

Key takeaways:

Bikeshedding is based on Parkinson’s Law of Triviality, which states that the amount of time given to a task is inversely proportional to its overall importance.Bikeshedding is common in business. It has the potential to hinder major project development and diverts resources away from tasks crucial to company viability.Bikeshedding in meetings can largely be avoided by ensuring that those in attendance have the requisite experience. Leaders can also be appointed to assist in decisions being made that align with company goals and visions.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is Bikeshedding And Why It Matters In Business appeared first on FourWeekMBA.

What Is The Bottom-Dollar Effect And Why It Matters In Business

The bottom-dollar effect describes a tendency among consumers to dislike purchases that exhaust their remaining budget. If a consumer spends the last $50 in their bank account on dinner at a restaurant with friends, they may enjoy good food and good company. But after the meal, they feel dissatisfied because the meal has exhausted the last of their funds. Here, the negative emotions associated with running out of money have been applied to the meal itself. This is known as the bottom-dollar effect.

Understanding the bottom-dollar effect

Money management is a vast subject, but in a perfect world, purchasing decisions should be made with rational logic. However, consumers experience the bottom-dollar effect because they tie emotions to money. They feel temporarily elated when purchasing something they want and then despondent when the money has left their account. Despondency, as we have seen, is most pronounced when bank account balances run close to zero.

Three types of mental accounting in the bottom-dollar effect

Consumers maintain three mental “accounts” when considering or managing purchases:

Current income – income or cash in a bank account.Current assets – including homes, investments, emergency funds, and other less liquid assets.Future income – including retirement income, promotions, and expected windfalls such as inheritance.

It’s important to note that exposure to the bottom dollar effect is highest in the current income model and lowest in the future income model. This is because consumers facing fund exhaustion will use funds from their current income and in some circumstances, will also sell assets.

Future income is the least affected for reasons which will be explained in the following sections.

The bottom-dollar effect in marketing

Marketing teams who understand the bottom-dollar effect can use it to their advantage.

With an understanding that people associate negativity with fund exhaustion, they can time marketing messages to coincide with periods where consumers have greater access to funds.

For businesses endeavoring to attract new customers, this is particularly salient. They do not want the first interaction a consumer has with their brand to be a negative one.

Periods that businesses should target include:

Friday and Saturday, before consumers have had a chance to exhaust discretionary weekend funds.Payday.End of financial year, where many receive tax refunds.

Research published in the Journal of Consumer Research has validated these spending periods by linking them with the mental accounting mentioned in the previous section. The study found that the bottom-dollar effect increases as the effort required to earn money increases.

Importantly, the bottom-dollar effect decreases as the gap between budget exhaustion and replenishment decreases. In other words, consumers experience less pain when spending their last few dollars if they know replenishment is imminent.

How can businesses use these insights? It begins with deep research into buyer personas. The most successful marketers will segment their target audience according to specific characteristics such as earning capacity, frequency, and spending habits.

Key takeaways:

The bottom-dollar effect involves consumers associating negative experiences with purchases that exhaust their funds.The bottom-dollar effect is an emotional response to money management. It has no basis in rational, logical decision-making.Businesses can use the bottom-dollar effect in marketing campaigns to target buyers at different stages of the buying journey. Ultimately, this will be determined by the recency or availability of funds in their bank account.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is The Bottom-Dollar Effect And Why It Matters In Business appeared first on FourWeekMBA.

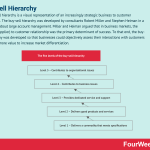

What Is The Buy-Sell Hierarchy And Why It Matters In Business

The buy-sell hierarchy is a visual representation of an increasingly strategic business to customer relationship. The buy-sell hierarchy was developed by consultants Robert Miller and Stephen Heiman in a 2005 book about large account management. Miller and Heiman argued that in business markets, the business (supplier) to customer relationship was the primary determinant of success. To that end, the buy-sell hierarchy was developed so that businesses could objectively assess their interactions with customers and create more value to increase market differentiation.

The five levels of the buy-sell hierarchy

With these insights, a business will also understand how its customers perceive them. Indeed, Miller and Heiman make mention of the fact that it is the customer who decides which level the relationship occupies – not the business itself.

The buy-sell hierarchy is represented by five levels. As a business moves through each level of the hierarchy, it moves from selling a product to making an important strategic contribution to customer business operations.

Progressing through the levels of the hierarchy, other variables decrease, including:

Price sensitivity, or the tendency to seek the best price.Competition.The relative importance of product or service features.

Here is a more detailed look at each level.

Level 1 – Delivers a commodity that meets specifications

On the first level, the customer considers a business to be one of many they purchase from. Businesses who offer non-specific consumer goods and staples occupy this level, as their products or services do not vary significantly from the offerings of competitors.

As a result, there is little to no relationship between business and customer. Price and availability are likely to be the biggest determinants in whether the arrangement continues.

Level 2 – Delivers good products and services

Here, customers view a business as a supplier of good (without being great) products. Businesses have gone some way to understanding customer needs by selling products that deliver real benefits.

However, good products are easily imitated by competitors and in abundance, good products simply become the industry standard. Without constant innovation, the relationship runs the risk of falling back to the first level.

Level 3 – Provides dedicated service and support

On level three, a business has earned the right to be seen as the provider of excellent products or services by going the extra mile for consumers.

A classic example can be seen in hosting providers. At level 2, the hosting provider may provide a shared hosting plan with email support. At level 3 however, the company may offer a faster server with 24/7 phone support and a dedicated customer service representative.

Level 4 – Contributes to business issues

Miller and Heiman suggest that the difficulty in moving from level three to level four is akin to “crossing a chasm.”

At this point, customers make an explicit connection between their success and the products or services a supplier offers. This is only possible when a business takes the time to build trust through a deep understanding of customer problems. Ultimately, the business is rewarded since consumers at this level are unlikely to purchase from a competitor.

Level 5 – Contributes to organizational issues

At level 5, the business is an expert in its industry and can accurately anticipate customer problems before they occur. In some cases, the supplier may assist in developing corporate strategy while simultaneously improving its position in the industry.

The business provides strategic value to the customer in addition to the more obvious financial value, and a partnership may develop as a result. With the mutually beneficial relationship in place, the transactional value of the arrangement is less important so long as the relationship is in the customer’s best interests.

Key takeaways:

The buy-sell hierarchy is a visual means of assessing the strength of the business (supplier) to customer relationship.The buy-sell hierarchy was developed for applications in large account management to enable suppliers to strengthen customer relationships and develop a competitive advantage.The buy-sell hierarchy features five levels. As businesses move through the hierarchy, relationships built on trust and collaboration take precedence over exact pricing and product features.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is The Buy-Sell Hierarchy And Why It Matters In Business appeared first on FourWeekMBA.

Bye-Now Effect And Why It Matters In Business

The bye-now effect describes the tendency for consumers to think of the word “buy” when they read the word “bye”. In a study that tracked diners at a name-your-own-price restaurant, each diner was asked to read one of two phrases before ordering their meal. The first phrase, “so long”, resulted in diners paying an average of $32 per meal. But when diners recited the phrase “bye-bye” before ordering, the average price per meal rose to $45.

Understanding the bye-now effect

The bye-now effect is a relatively new cognitive bias that is based on two core components.

The first and perhaps most obvious is that the words “buy” and “bye” are homophones. That is, they are words with a different spelling and meaning that have the same pronunciation.

The second component is the concept known as priming – where consumers are exposed to one piece of information that influences their response to subsequent information. In combination, these components result in homophone priming. Here, the brain cannot ignore the alternate meaning of a homophonic word.

The buy-now effect, consumer behavior, and marketing

In a study that tracked diners at a name-your-own-price restaurant, each diner was asked to read one of two phrases before ordering their meal. The first phrase, “so long”, resulted in diners paying an average of $32 per meal. But when diners recited the phrase “bye bye” before ordering, the average price per meal rose to $45.

The results of this study found that the bye-now effect makes consumers buy more, even when links between homophonic words are non-existent. Further studies have also found that consumers who are distracted or multitasking are also prone to the effect. When consumers are presented with large amounts of information, the brain becomes overloaded and uses shortcuts to decipher the meaning of individual words. Thus, the words “buy” and “bye” are interpreted to mean the same thing.

Businesses who are building a brand can use the buy-in now effect to their advantage. One real-world example is the weight-loss drug Alli –pronounced the same as “ally” – implying that the drug is a useful friend in the weight loss journey.

In another hypothetical example, consider a resort hotel company called Beech & Son. In this case, the buy-in effect may automatically generate the positive associations of holidaying with a brand despite the lack of supporting evidence.

Limitations of the buy-in effect

Potentially damaging to a brand. The strength of the buy-in effect can also be its biggest weakness. “Sam & Ella’s Chicken Palace” is a real-world restaurant where consumers might associate the owners’ names with salmonella.Lack of profitability. Research has found that low-skilled readers are most susceptible to the effect. This may limit the ability to attract consumers with purchasing power.Does not work for uncommon associations. While many consumers will associate the word “ewe” with “you”, it is much more unlikely that the word “you” will be associated with “ewe”.

Key takeaways:

The buy-now effect is a cognitive bias where consumers think of the word “buy” when they read the word “bye”.The buy-now effect is comprised of two components that distort cognitive thinking: homophones and priming. In this situation, the overloaded brain automatically makes an association with the alternate meaning of a homophonic word.The buy-now effect can be used to build a brand by generating positive associations with a product or service. Nevertheless, some words have the potential to damage a brand if not chosen carefully.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Bye-Now Effect And Why It Matters In Business appeared first on FourWeekMBA.

November 18, 2020

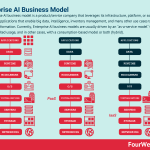

Enterprise AI Business Model

An Enterprise AI business model is a product/service company that leverages its infrastructure, platform, or software to provide applications that enable big data, intelligence, inventory management, and many other use cases to drive digital transformation. Currently, Enterprise AI business models are usually driven by an “as-a-service model” that gives unlimited usage, and in other cases, with a consumption-based model or both (hybrid).

Enterprise AI Business Models Case Studies

[image error]Sumo Logic is a cloud-based Continuous Intelligence platform, based on a subscription revenue model, serving primarily customers from IT departments, development, and security, both from small organizations and enterprise, leveraging on self-serving digital channels for new customers’ acquisition, coupled with inside and field sales representative to expand the adoption of the platform.

[image error]Palantir is a software company offering intelligence services from governments and institutions to large commercial organizations. The company’s two main platforms Gotham and Foundry, are integrated at the enterprise-level. Its business model follows three phases: Acquire, Expand, and Scale. The company bears the pilot costs in the acquire and expand phases, and it runs at a loss. Where in the scale phase, the customers’ contribution margins become positive.

[image error]Unity is a platform for 3D content development, free for companies below $100K in revenues, and subscription-based for companies beyond that. It also makes money on a revenue-share basis with its Operate Solutions helping creators monetize their 2D and 3D content across several platforms. Unity also generates revenues through revenue-share arrangements with strategic partners and within its Asset Store marketplace.

[image error]Snowflake is a cloud-based platform whose vision is to enable organizations to have seamless access to explore, share, and unlock data value. With the mission to break down data silos. The company runs through a consumption-based revenue model, enhanced by its professional services. Primarily an enterprise solution, Snowflake leverages on direct sales.

Another example of an Enterprise AI company, C3.ai, which leverages its proprietary technology to build a “model-driven architecture” that offers final customers the ability to use its SaaS products at the enterprise level. In this way, C3.ai can drive faster deployment and testing of enterprise projects for its customers/users, thus preventing the overhead and typical time-consuming execution timelines for enterprise projects.

Another example of an Enterprise AI company, C3.ai, which leverages its proprietary technology to build a “model-driven architecture” that offers final customers the ability to use its SaaS products at the enterprise level. In this way, C3.ai can drive faster deployment and testing of enterprise projects for its customers/users, thus preventing the overhead and typical time-consuming execution timelines for enterprise projects. (Image Source: C3.ai Prospectus)

IaaS vs PaaS vs SaaS As Primary Enablers Of AI Enterprise Business Models

[image error]The “as-a-service” models are typical of the second wave of the Web 2.0, built on top of cloud computing. Indeed, these models’ basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. Yet while PaaS and IaaS are skewed toward development teams. SaaS has wider applications toward end-users, also in non-technical departments.

Read Next: IaaS vs PaaS vs SaaS

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Enterprise AI Business Model appeared first on FourWeekMBA.

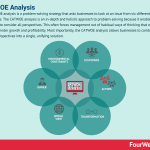

What Is The CATWOE Analysis And Why It Matters In Business

The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.

Understanding the CATWOE analysis

In business, a significant impediment to problem-solving lies in the perception of the problem itself.

Key stakeholders will perceive the problem differently and as a result, will come up with different solutions.

Consider the example of a plastics factory with an inefficient, loss-making production process. An investor in the facility might seek to sell off the investment to recoup costs. Employees may suggest automation or other improvements to increase efficiency. Community groups may recommend expansion to drive more sales and stave off possible redundancies.

The six perspectives of the CATWOE analysis

Customers (clients)

Customers and clients are stakeholders for whom the system or process exists. They usually benefit from the result of a process or suffer when it changes. In other words, they are the potential winners and losers of a given solution.

Actors

Actors are those who implement changes in a system or process as part of a solution. Often, actors will be employees, suppliers, or agencies. What is the impact of a solution on these actors, and how might they react? What role will they need to play to implement the solution?

Transformation

How does the problem transform business operations? In the case of the plastics facility, how do production inefficiencies impact logistics, distribution, and profit margins? What adjustments to processes or procedures will need to be made once a solution is found?

World view

What is the justification for the transformation of the system or process? What is the wider impact of any solution and what issues may it cause? Is the particular problem going to cause chronic and widespread damage, or is it more localized and short-lived?

This stage of the analysis is important because it requires that each problem is considered equally – regardless of any opinions on real or perceived discrepancies in severity.

Owner

Owners describe any individual who must necessarily take ownership of the problem. Were they part of the problem to begin with? If not, can they be part of the solution?

Assigning ownership of a problem is also important because it increases employee buy-in and motivation.

Environment constraints

Lastly, each problem should be judged according to the realistic probability that it can be overcome.

Environmental constraints are impediments that may hinder or prevent solutions from being implemented to a process. This includes legal issues, competition, financial regulation, and a lack of available resources or project scope.

Key takeaways

The CATWOE analysis is a holistic approach to problem-solving that considers a range of different perspectives.CATWOE is an acronym that stands for: customers, actors, transformation process, worldview, owners, and environmental constraints. Each has a unique perspective on a single problem and each must be fairly and equally considered.To successfully implement solutions within an organization, the CATWOE analysis advocates rigorous justification, employee empowerment, and awareness of potential constraints.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is The CATWOE Analysis And Why It Matters In Business appeared first on FourWeekMBA.

Butterfly Effect And Why It Matters In Business

In business, the butterfly effect describes the phenomenon where the simplest actions yield the largest rewards. The butterfly effect was coined by meteorologist Edward Lorenz in 1960 and as a result, it is most often associated with weather in pop culture. Lorenz noted that the small action of a butterfly fluttering its wings had the potential to cause progressively larger actions resulting in a typhoon.

Understanding the butterfly effect

Businesses can leverage the butterfly effect by incorporating small positive actions that have significant positive consequences. These changes have the potential to bring benefits that far exceed the large sums of money a business spends attracting customers.

How is this achieved? Where should a business focus its efforts?

Using the butterfly effect to nurture relationships

Businesses are about people and success is reliant on strong relationships between employees, customers, and other stakeholders.

Let’s take a look at each group in more detail.

Employees

Richard Branson once said that employees come first, not clients. If employees are taken care of first, then they will naturally take care of the clients.

Common sense says that treating employees badly leads to an ineffective workforce. What’s more, employees are more likely to treat consumers badly who are then encouraged to take their business elsewhere.

Businesses should take the time to compliment their staff while also encouraging them to compliment each other. Indeed, the small action of complimenting one person has the potential to spread good vibes across the organization very quickly. In turn, a positive culture develops which is passed on to the consumer.

Customers

Customers are the lifeblood of a business, but countless organizations have frustrating customer service centers where it is difficult to talk to a real person.

Customer complaints are inevitable. While many complaints are perhaps illegitimate, many others provide valuable insights on how a company can raise their standards. The small action of responding to each complaint with grace and empathy leaves a lasting impression on the customer and ensures they walk away with a positive experience.

Stakeholders

Publicly listed companies make the mistake of treating their shareholders with disdain. Announcements are vague, infrequent, or deliberately worded to conceal bad results.

These companies must remember that many stakeholders are part owners in the company and treat them accordingly with open and transparent communication. Other stakeholders such as suppliers, distributors, and the community should also be subject to small, positive actions that strengthen relationships.

Butterfly effect best practices

Small actions are the foundation of the butterfly effect. Most are related to having a positive attitude, including:

Being a good role model. Leaders are the most obvious candidates, as their words and actions rub off on subordinates. However, every employee can be a good role model by treating others with appreciation, positivity, and gratitude.Leaving personal issues at home. Personal issues that cause stress should never be brought into a work environment. When stressed individuals treat others with contempt, the butterfly effect can take effect but with negative consequences.Paying it forward. Some argue that this is vital to the butterfly effect in business, and for good reason. Small acts of kindness – without the expectation of reciprocity – can create a chain of small actions that lead to something substantial.

Key takeaways

The butterfly effect in business describes the potential for small actions over time to yield much larger positive results.People are the most important aspect of the butterfly effect in business. Employees, customers, and other stakeholders must be appreciated for their respective roles in maintaining operational viability.To embrace the butterfly effect mentality, a positive attitude is key. Managers and employees alike must become role models for positivity by leaving personal issues at home and paying good vibes forward.

Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Butterfly Effect And Why It Matters In Business appeared first on FourWeekMBA.