Gennaro Cuofano's Blog, page 182

December 6, 2020

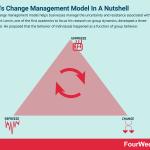

Lewin’s Change Management Model In A Nutshell

Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

Understanding Lewin’s change management model

No business is immune to change in the rapidly changing global marketplace of today. While change is certainly not a new concept, many organizations nevertheless fail to implement change management strategies.

To help provide a framework for change, social psychologist Kurt Lewin developed a three-stage model. Lewin was one of the first academics to research organizational development and group dynamics. He proposed that the behavior of an individual in response to change was a function of group behavior.

From his research, Lewin also noted that the model should evaluate two core ideas:

The change process in organizational contexts.How the status-quo might be challenged to facilitate effective change.

Lewin wanted his model to be easily implemented with minimal disruption to business operations. He also wanted to explain how change might be permanently adopted.

The three stages of Lewin’s change management model

Each of Lewin’s three stages is vital in successfully instituting change. They describe the nature and implementation of change and common obstacles that result.

Stage 1 – Unfreeze

The unfreezing stage involves readying a business for change by ensuring that all staff understand its importance.

Four important steps characterize the first stage:

Gauge the need for change. A Current State Analysis (CSA) can be performed to determine what needs to change and why. This will mean challenging and then breaking down the status quo, which may require difficult conversations. Existing behaviors or practices will need to be revisited and then revised.Gather support from key management personnel or interested stakeholders.Develop a strategy for communicating change. The strategy should be a vision that aligns with company goals or objectives where applicable. Above all, the strategy needs to be persuasive.Manage doubt and uncertainty. Some will inevitably oppose change, but a framework such as the Force Field Analysis can make it less intimidating by assessing a list of pros and cons.

Stage 2 – change

By the second stage, most individuals have thawed out and ready to move toward a future desired state.

Nevertheless, many will feel uncertain and apprehensive about the transition process. To manage employees during this critical juncture, consider these tips.

Leadership should clearly communicate the benefits of change, both for the individual and the business.A regular meeting should be held to address concerns and provide support where necessary. This dismisses hearsay which can run rampant through a department and cause panic.Appropriate action should be role-modeled by management, who should also design quick wins to empower and motivate employees toward appropriate action.

Stage 3 – Refreeze

The goal of the final stage is to ensure that change is incorporated into the organizational culture.

Ultimately, all staff must consider the change as the new status quo. Otherwise, there is potential that they revert to old habits.

To counteract this, businesses should:

Link new changes into broader company culture through the identification of change supporters and change barriers.Brainstorm methods of sustaining change long term. This can be done through incentivization and regular performance evaluation. Leadership should also be highly visible in promoting change as a means of influencing group dynamics and behavior.Provide formal and informal training and support to employees who are finding it particularly difficult to adjust.

Key takeaways

Lewin’s change management model provides a simple yet effective framework for businesses wishing to institute change.Lewin’s change management model argues that the capacity for change in an individual is strongly influenced by group dynamics. As a result, the model has a strong focus on the role of leadership during the change process.Lewin’s change management model describes three stages common to most change processes. Businesses can use the three stages to remove the status quo, guide employees through the transitional process, and then ensure that implemented changes become part of organizational culture.

Read Next: Kotter’s 8-Step Change Model

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework, BCG Matrix, GE McKinsey Matrix.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Lewin’s Change Management Model In A Nutshell appeared first on FourWeekMBA.

The Mandela Effect And Why It Matters In Business

The Mandela effect is a phenomenon where a large group of people remembers an event differently from how it occurred. The Mandela effect was first described in relation to Fiona Broome, who believed that former South African President Nelson Mandela died in prison during the 1980s. While Mandela was released from prison in 1990 and died 23 years later, Broome remembered news coverage of his death in prison and even a speech from his widow. Of course, neither event occurred in reality. But Broome was later to discover that she was not the only one with the same recollection of events.

Causes of the Mandela effect

Opinion is divided on the exact cause of the Mandela effect, but some doctors believe it is a form of confabulation – or “honest lying”.

Here, a person creates a false memory to fill in gaps in their memory. They are not, as some believe, creating memories to lie or deceive.

Some researchers posit that individuals use confabulation to piece together what they believe is the most likely sequence of events. This is because the events described in many Mandela effect cases are quite close to what actually transpired.

False memories

A simpler explanation for the effect lies in a person’s inability to remember events accurately.

This may occur when facts become distorted because of the passage of time. Crime eyewitnesses are often unable to recall certain subtle details of a crime, which may lead to gap-filling.

The “memefication” of the internet is also a contributor. Users are free to alter sayings, logos, or images and then harness the ability of the internet to spread misinformation rapidly.

Examples of the Mandela effect

The frowning Mona Lisa

Many art admirers insist that the subject of Leonardo da Vinci’s painting is frowning, even though she is clearly smirking.

Researchers believe that the tendency for artworks of that period to feature frowning subjects has led people to form inaccurate memories.

Monopoly Man

The mascot of the popular board game Monopoly is often thought to be wearing a monocle.

Upon closer inspection, however, the mascot is not wearing a monocle. It is thought that people confuse the Monopoly mascot with the Planters peanut company mascot, Mr. Peanut.

Life is like a box of chocolates

In the oft-quoted movie Forrest Gump, many assume that Tom Hanks utters the line “Life is like a box of chocolates.”

However, the actual line is “Life was like a box of chocolates.” Emphasis added.

Tank man

During the 1989 Tiananmen Square protests, it is sometimes assumed that the unidentified man who stands in front of a tank was run over and killed.

This is despite video evidence to the contrary showing the man being detained and led away from the scene after a brief confrontation.

Key takeaways

The Mandela effect refers to a scenario where a large group of people believes an event occurred when it did not.The Mandela effect may be caused by several factors. The most likely is the process of confabulation, where an individual harmlessly fabricates information to fill gaps in their memory.The Mandela effect was named after a mistaken belief that Nelson Mandela had died in prison. Today, the effect has been described in everything from movie lines to company mascots and world events.

Read Next: BCG Matrix, GE McKinsey Matrix, Ansoff Matrix.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post The Mandela Effect And Why It Matters In Business appeared first on FourWeekMBA.

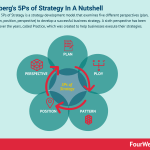

Mintzberg’s 5Ps of Strategy In A Nutshell

Mintzberg’s 5Ps of Strategy is a strategy development model that examines five different perspectives (plan, ploy, pattern, position, perspective) to develop a successful business strategy. A sixth perspective has been developed over the years, called Practice, which was created to help businesses execute their strategies.

Understanding Mintzberg’s 5Ps of Strategy

Mintzberg’s 5Ps of Strategy was created by Canadian management scientist Henry Mintzberg.

He recognized that in dynamic business environments, a simplistic approach to strategy development was unlikely to deliver success. The strategy may be reasonably effective one day and then useless the next.

To ensure that a strategy is adaptable and has longevity, it must be multidimensional and consider many perspectives.

The five perspectives of Mintzberg’s strategy

Following is a look at each of the five perspectives that Mintzberg identified as being crucial to success:

Plan – what course of action will the business take to realize its future goals? Businesses should hold brainstorming sessions to identify goals and determine how they might be achieved. A plan can then be created by using a SWOT or PESTLE analysis. A sound strategic plan is essential because it is the foundation of the four subsequent perspectives.Ploy – Mintzberg argues that the strategy should discourage, divert, or influence competitors. For example, a tech company might patent certain inventions to discourage competitor products from entering the market. A business must use strategic ploys to stay one step ahead of the competition. But they should not become so focused on competitors that they lose sight of their own strategy.Pattern – the previous two perspectives encourage businesses to look forward. However, recognizing a pattern is about looking to the past and determining what has worked well. A restaurant that is known for its specialty seafood should not try to develop a competitive advantage elsewhere. Rather, it should double down on what it does best. It is also important to note that while plans are intended strategy, patterns are realized strategy and may be unintentional. In some cases, a business will need to seek out emerging patterns in its operations and then develop a strategy for each.Position – how does the business want to portray itself in the market? What target audience or niche should it occupy to gain a competitive advantage? What is the USP and how does it relate to brand strength? Porter’s Diamond and Porter’s Five Forces are useful market force analyses.Perspective – how does the business perceive the world? What is the “personality” of the business? Perspective should be shared by all members of the organization who are united in common thinking and behavior. For this reason, many equate perspective with culture. For example, a company that has a culture of risk-taking and innovation should base its strategy on highly innovative products and services.

The sixth perspective of Mintzberg’s strategy

While the five perspectives of Mintzberg’s strategy create a multidimensional strategy, some argue that they are too descriptive. That is, they do not offer guidance on how these perspectives might be implemented.

In response, a sixth perspective called Practice was created to help businesses execute their strategies. This can be achieved in several ways:

Embodying the strategy, or the physical performance of actions that help the business grow. Streaming services such as Netflix and Prime Video embodied their original content strategies by purchasing studios to create new television shows.Sensing the strategy through one of the five senses. When Coca-Cola released its Coke Zero Sugar beverage to market, the consumer backlash to the awful taste was immense. It is difficult to imagine that Coca-Cola tasted the drink (or its strategy) before release.Keeping the strategy in the present. Many strategies suffer when leaders look too far into the past or conversely, too far into the future. Intel’s strategy of developing future technology led to the company neglecting the present issue of product security. Sony’s focus on past consistency has resulted in repeated mistakes in the Spiderman franchises and in three generations of PlayStation. In both examples, the strategy was based on the intangibility of the past and future. Strategies that are instead based on the reality of the present save businesses from becoming distracted.

Key takeaways

Mintzberg’s 5Ps of Strategy is a strategy development framework that incorporates five key perspectives.Mintzberg’s 5Ps of Strategy argues that one-dimensional strategies are unreliable from one day to the next because they do not adapt to dynamic markets.Mintzberg’s 5Ps of Strategy sometimes includes a sixth perspective: practice. Practice enables a business to implement an effective strategic plan by remaining present and undistracted.

Read Next: BCG Matrix, GE McKinsey Matrix.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Ansoff Matrix.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Mintzberg’s 5Ps of Strategy In A Nutshell appeared first on FourWeekMBA.

December 5, 2020

BCG Matrix Vs. GE Matrix

Both are strategic frameworks developed to device a product development strategy. Through a model where companies look to prioritize products that can turn into high market shares and high margins businesses, the BCG does that. The GE Matrix focuses on prioritizing products with a high industry attractiveness and a high competitive strength of the business unit.

[image error]In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

[image error]

[image error]The GE McKinsey Matrix was developed in the 1970s after General Electric asked its consultant McKinsey to develop a portfolio management model. This matrix is a strategy tool that provides guidance on how a corporation should prioritize its investments among its business units, leading to three possible scenarios: invest, protect, harvest, and divest.

Read Next: BCG Matrix, GE McKinsey Matrix.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Ansoff Matrix.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post BCG Matrix Vs. GE Matrix appeared first on FourWeekMBA.

BCG Matrix Vs. Ansoff Matrix

Both matrices help organizations assess how to build their product portfolio. The BCG Matrix focuses on creating a success sequence, where new products can be turned into stars (high growth and high market shares products) and cash cows in the longer term (high market shares, low margin industries). The Ansoff matrix assesses how to build a product portfolio based on whether to work on existing/new products or existing/new markets.

[image error]In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

[image error]

[image error]You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.

Read Next: BCG Matrix, Ansoff Matrix.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post BCG Matrix Vs. Ansoff Matrix appeared first on FourWeekMBA.

Blue Ocean Strategy Vs. Stuck In The Middle

The blue ocean strategy is a theory that states companies can gain a competitive advantage by creating whole new markets through value innovation (so-called blue oceans) where competition doesn’t exist yet. Stuck in the middle is a scenario from Porter’s Generic Strategies, where for lack of focus or differentiation a company finds itself in a place where it lacks strategic advantage.

[image error]A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

[image error]In his book, “Competitive Advantage,” in 1985, Porter conceptualized the concept of competitive advantage, by looking at two key aspects. Industry attractiveness, and the company’s strategic positioning. The latter, according to Porter, can be achieved either via cost leadership, differentiation, or focus.

[image error]

Read Next: Blue Ocean Strategy, Porter’s Generic Strategies.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Blue Ocean Strategy Vs. Stuck In The Middle appeared first on FourWeekMBA.

Blue Ocean Strategy Vs. Five Forces

The blue ocean strategy is a theory that states companies can gain a competitive advantage by creating whole new markets through value innovation (so-called blue oceans) where competition doesn’t exist yet. Porter’s five forces is a model that looks at five core forces to assess the completion in a given marketplace.

[image error]A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

[image error]Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forces

Read Next: Blue Ocean Strategy, Porter’s Five Forces.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Blue Ocean Strategy Vs. Five Forces appeared first on FourWeekMBA.

Bootstrapping Vs. Venture Capital

Bootstrapping is an organic process of growing a business by gaining customers who provide the funding needed to start-up and grow. Venture capital is the opposite, where the company gets initial funding from investors who believe in one’s idea. Bootstrapping is effective for companies operating in established and existing markets, with lower entry barriers. Where venture capital is more suited when companies need to develop whole new markets, there are no customers ready to finance it. A hybrid approach also works in newly formed markets, where a company can gain initial traction through bootstrapping and later on get funding allocated for growth.

[image error]An entry strategy is a way an organization can access a market based on its structure. The entry strategy will highly depend on the definition of potential customers in that market and whether those are ready to get value from your potential offering. It alls starts by developing your smallest viable market.

[image error]The general concept of Bootstrapping connects to “a self-starting process that is supposed to proceed without external input.” In business, Bootstrapping means financing the growth of the company from the available cash flows produced by a viable business model. Bootstrapping requires the mastery of the key customers driving growth.

[image error]In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

[image error]When entering the market, as a startup you can use different approaches. Some of them can be based on the product, distribution, or value. A product approach takes existing alternatives and it offers only the most valuable part of that product. A distribution approach cuts out intermediaries from the market. A value approach offers only the most valuable part of the experience.

Read Next: Bootstrapping, Venture Capital.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Bootstrapping Vs. Venture Capital appeared first on FourWeekMBA.

Bundling Vs. Unbundling

Bundling is the process of combining multiple products or services within a unique offering. Unbundling is the opposite; it consists of taking one part of an offering (often the most valuable) and provide it as a stand-alone product and service at a more reasonable price. Bundling is usually effective as an expansion strategy, as more products and services are added. Unbundling instead works well as a market entry strategy. The newcomer can take only the part of an incumbent offering, break it apart, and offer that as a lower-priced alternative to quickly gain traction.

[image error]Bundling is a business process where a series of blocks in a value chain are grouped to lock in consumers as the bundler takes advantage of its distribution network to limit competition and gain market shares in adjacent markets. This is a distribution-driven strategy where incumbents take advantage of their leading position.

[image error]Unbundling is a business process where a series of products or blocks inside a value chain is broken down to provide better value by removing the parts of the value chain that are less valuable to consumers and keep those that in a period in time consumers value the most.

[image error]An entry strategy is a way an organization can access a market based on its structure. The entry strategy will highly depend on the definition of potential customers in that market and whether those are ready to get value from your potential offering. It alls starts by developing your smallest viable market.

[image error]When entering the market, as a startup you can use different approaches. Some of them can be based on the product, distribution or value. A product approach, takes existing alternatives and it offers only the most valuable part of that product. A distribution approach, cuts out intermediaries from the market. A value approach offers only the most valuable part of the experience.

Read Next: Bundling, Unbundling.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Bundling Vs. Unbundling appeared first on FourWeekMBA.

Growth Hacking Vs. Growth Marketing

Growth hacking is a sub-set of a growth marketing strategy, and at the same time, it goes beyond that. Indeed, growth hacking is primarily focused on achieving growth by leveraging product development/engineering, data analysis, and marketing tactics. A growth hacking strategy can be framed as part of a wider and effective growth marketing strategy.

[image error]Growth hacking is a process of rapid experimentation, coupled with the understanding of the whole funnel, where marketing, product, data analysis, and engineering work together to achieve rapid growth. The growth hacking process goes through four key stages of analyzing, ideating, prioritizing, and testing.

[image error]A marketing strategy is the “what” and “how” to build a sustainable value chain framed for a target customer. A powerful marketing strategy needs to be able to manufacture desire, amplify the underlying value proposition, and build a brand that feels unique in the mind of its customers.

[image error]Customer segmentation is a marketing method that divides the customers into sub-groups, that share similar characteristics. Thus, product, marketing, and engineering teams can center the strategy from go-to-market to product development and communication around each sub-group. Customer segments can be broken down in several ways, such as demographics, geography, psychographics, and more.

Read Next: Growth Hacking, Marketing Strategy.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis.

More Strategy Tools: Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Growth Hacking Vs. Growth Marketing appeared first on FourWeekMBA.