Gennaro Cuofano's Blog, page 181

December 8, 2020

Lightning Decision Jam For Fast Decision-Making

The Lightning Decision Jam (LDJ) is a means of making fast decisions that provide quick direction. The Lightning Decision Jam was developed by design agency AJ&Smart in response to the inefficiency of business meetings. Borrowing ideas from the core principles of design sprints, AJ&Smart created the Lightning Decision Jam.

Understanding the Lightning Decision Jam

Indeed, many meetings consist of unstructured conversation that does not further company goals. Many other meetings are probably better discussed in a group chat or through a series of emails. In either case, attendees are often left feeling confused and generally unmotivated.

Borrowing ideas from the core principles of design sprints, AJ&Smart created the Lightning Decision Jam. These principles include:

Working together, alone.Tangible items being better than discussion.A belief that being right is not as important as getting started.Less reliance on creativity.

Indeed, the LDJ method is suited to any situation where an organization is having difficulty in defining or addressing problems. The method is also versatile. It can be used in large multinational corporations or small start-ups containing just a few people.

How to run a Lightning Decision Jam

Before beginning, an ideal team size of 4-6 people must select a moderator. A good moderator is essential in ensuring that discussions do not become unstructured or run over time.

After personnel has been decided, the LDJ can be performed by following these steps:

Start with the problems (7 minutes)

Each team member should spend 7 minutes detailing the problems or challenges encountered during the week on blue post-it notes. There must be no discussion during this process.

Present problems (4 minutes per person)

One at a time, each person should then stand up and stick the blue post-it notes to a wall or whiteboard while they give a brief description for each. To avoid running over 4 minutes, it is helpful to dedicate no more than 30 seconds to each problem.

Select problems to solve (6 minutes)

Each team member is then assigned two dots which they must then use to vote on the problems they deem the most important to solve. Again, there must be no discussion between the group.

Reframe problems (6 minutes)

Here, the moderator rewriters the top-voted problem in the form of a standardized challenge. The challenge is reframed in the “How Might We” (HMW) format to make it solvable and ensure consistency across all problems.

Consider the example of a post-it note reading “I am having difficulty keeping up with this new marketing campaign”. Rewritten in HMW format, the challenge then reads “Ensure that everyone is supported and well-informed during marketing campaigns”.

Produce solutions (7 minutes)

Without any discussion, each team member has 7 minutes to write potential solutions on green post-it notes. At this point, the focus is on quantity over quality. After the allotted time has elapsed, each member sticks their solutions on the wall.

Vote on solutions (10 minutes)

To cast votes on the most viable solutions, each team member is given six dots.

Prioritize solutions (30 seconds)

Solutions with more than two votes should be prioritized, with post-it notes containing the most dots placed near the top of the wall or whiteboard.

Decide what to execute on (10 minutes)

How much effort is required to enact each solution? A simple effort/impact matrix can be used to determine which solutions have the highest potential to be a quick fix.

To achieve this, the moderator should hold each post-it note over the matrix and ask team members to decide a final position based on its perceived effort and impact.

Turn solutions into actionable tasks (5 minutes)

Problems occupying favorable positions on the matrix are then taken off the wall or whiteboard. Then, the individual who came up with the original problem is tasked with creating an actionable plan that can be completed in 1-2 weeks.

Key takeaways

The Lightning Decision Jam allows businesses to make fast, effective decisions on high-impact problems.The Lightning Decision Jam was created in response to traditional business meetings that often result in an unstructured conversation that does not further company goals.Running a Lightning Decision Jam means following a structured, time-limited process. With an emphasis on no discussion and group consensus through voting, the LDJ team can create a clear and actionable solution quickly.

Read Next: Mental Models, Biases, Bounded Rationality, Mandela Effect, Dunning-Kruger Effect, Lindy Effect, Crowding Out Effect, Bandwagon Effect, Decision-Making Matrix.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Lightning Decision Jam For Fast Decision-Making appeared first on FourWeekMBA.

Less-Is-Better Effect In A Nutshell

The less-is-better effect was first proposed by behavioral scientist Christopher Hsee in a 1998 study. He noted in the experiment that a person giving a $45 scarf as a gift was perceived to be more generous than someone giving a $55 coat. The less-is-better effect describes the consumer tendency to choose the worse of two options – provided that each option is presented separately.

Understanding the less-is-better effect

The less-is-better effect was first proposed by behavioral scientist Christopher Hsee in a 1998 study.

In the study, Hsee noted that:

A person giving a $45 scarf as a gift was perceived to be more generous than someone giving a $55 coat.Consumers were willing to pay more for a 7-ounce scoop of ice cream that was overfilled than they were an 8-ounce scoop that was underfilled.A dinnerware set with 24 unbroken pieces was seen to be more favorable than a set with 31 unbroken pieces plus a few broken ones.

Results of the study indicated that the less-is-better effect only occurred when each option from the above examples was presented separately. When participants saw the two options together, the effect no longer applied.

Hsee noted that the less-is-better effect is explained by the evaluability hypothesis. In other words, a person who evaluates objects separately bases their evaluation on attributes that are easy to evaluate – and not on important attributes.

Implications for consumers and businesses

The most obvious implication for consumers is the higher likelihood that they will overpay for relatively low-quality items.

Conversely, they may devalue items that are more objectively valuable simply because of the context in which the products are presented. Assuming that the goal was to eat more ice cream, the larger ice cream scoop was objectively a better option. But when the larger scoop was served in a cup that it did not fill, the smaller scoop (filling a smaller cup) represented better value for money to consumers.

Marketing teams can use a lack of context to market product categories that only contain a single product. Usually, a consumer will evaluate the price or attributes of a product relative to the other products in the same range. Without this frame of reference, the business can charge a higher price and increase profit margins.

Avoiding the less-is-better effect

The less-is-better effect is a heuristic – or mental shortcut – so in avoiding it a consumer should spend more time thinking about their decisions.

This can be achieved by:

Digging deeper to determine the objective component of decision making as opposed to the subjective.Not passing judgment (good or bad) on a product in isolation. Consumers should get into the habit of being comparison shoppers to make more balanced decisions.Considering context. Wherever possible, do not dismiss products because of their perceived inferiority. In other words, does the larger ice cream scoop contain less ice cream even though it does not fill the cup?

Key takeaways

The less-is-better effect describes the irrational consumer preference for a lesser or smaller alternative when two options are presented separately.The less-is-better effect causes consumers to devalue products that are objectively more valuable by failing to consider broader contexts.The less-is-better effect can be avoided by slowing down the thinking process. Consumers should always strive for objectivity and resist the urge to pass positive or negative judgment on products in isolation.

Read Next: Mental Models, Biases, Bounded Rationality, Mandela Effect, Dunning-Kruger Effect, Lindy Effect, Crowding Out Effect, Bandwagon Effect.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Less-Is-Better Effect In A Nutshell appeared first on FourWeekMBA.

The Core Leadership Styles In The Business World

Leadership styles encompass the behavioral qualities of a leader. These qualities are commonly used to direct, motivate, or manage groups of people. Some of the most recognized leadership styles include Autocratic, Democratic, or Laissez-Faire leadership styles.

Understanding leadership styles

While there are many great leaders in the world, each leader could attribute their success to a somewhat unique blend of qualities. Some of these qualities are expressions of a leader’s personality, while others are embodied by the organization itself.

As a result, little was known about leadership styles until a 1939 study led by psychologist Kurt Lewin. In the study, Lewin identified three distinct styles:

Authoritarian leadership (Autocratic) – encompassing leaders who provide clear expectations on what needs to be done and how it should be performed. Authoritarian leaders make decisions independently and exercise total control over subordinates.

This form of leadership is suited to situations that call for rapid decision making or where the leader is the most knowledgeable person in a group. However, these decisions tend to be lacking in creativity and can cause dysfunctional, hostile environments.

Participative leadership (Democratic) – Lewin found that participative leadership was the most effective. Leaders exhibiting this style offer guidance to subordinates while encouraging member input – which tends to be of a higher quality.

Although the leader reserves the right to make the final decision, subordinates nonetheless feel engaged in the decision-making process. As a result, they are more likely to work toward company goals with commitment and passion.

Delegative leadership (Laissez-Faire) – the least productive of Lewin’s three leadership styles. Study participants tended to make unreasonable demands of the leader and did not display cooperation or the ability to work independently.

Indeed, delegative leaders mostly leave the decision-making process to group members. While this style is commonly seen in start-ups, poorly defined roles usually lead to a lack of motivation and group consensus. Without adequate leadership, subordinates lack accountability and make little progress in producing meaningful work.

Additional leadership styles

In the decades since the original Lewin study, several other leadership styles have been identified to reflect modern, dynamic businesses.

Some may deliberately choose to adopt a mix of several different styles depending on the context.

Some of the more common include:

Transformational leadership – first developed during the late 1970s and seen as one of the most effective modern styles. Leaders are typically passionate and emotionally intelligent. They have a vested interest in their subordinates and the company as a whole. They also tend to delegate important tasks and inspire others with infectious enthusiasm. Bill Gates and the late Steve Jobs exemplify the transformational leadership style.Transactional leadership – where subordinates obey their leader on the proviso that they are compensated for doing so. Job satisfaction is typically low under transactional leadership because compensation can be removed for non-compliance. Many experts view this form of leadership as a management style because the focus is on short-term tasks. Some military commanders and professional sports coaches use transactional leadership.Pacesetter leadership – the most effective at delivering fast results. Pacesetter leaders focus on setting high-performance standards and hold subordinates accountable for achieving goals. Given the motivational nature of the style, it is better suited to fast-paced, high-pressure environments where employee energy needs to be high. Former General Electric CEO Jack Welch is a great example of pacesetter leadership. Welch believes that leaders need to focus on setting a good example and be obsessed with efficiency.

Key takeaways

Leadership styles encompass certain behavioral qualities that are used to motivate or manage subordinates. Leadership styles were first studied by psychologist Kurt Lewin in 1939. The results of his study found that leadership could either be authoritative, participative, or delegative in nature.Leadership styles have evolved since the original study to encompass modern businesses that may need to exhibit more than one leadership style. Transformational leadership, embodied by Bill Gates and Steve Jobs, is widely regarded as one of the most effective.

Read Next: Organizational Structure.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post The Core Leadership Styles In The Business World appeared first on FourWeekMBA.

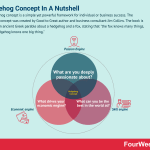

Hedgehog Concept In A Nutshell

The hedgehog concept is a simple yet powerful framework for individual or business success. The hedgehog concept was created by Good to Great author and business consultant Jim Collins. The book is based on an ancient Greek parable about a hedgehog and a fox, stating that “the fox knows many things, but the hedgehog knows one big thing.”

Understanding the hedgehog concept

In the parable, the fox attempts to catch the hedgehog using a variety of strategies that fail. Ultimately, the fox is defeated because the hedgehog does one thing well: defend itself.

In business, Collins argues that a business is more likely to succeed by devoting its resources to one big thing. In the next section, we will look at how a business can determine what that big thing is.

The three circles of the hedgehog concept

The hedgehog concept is based on three circles. Each of the three circles begins with a question:

What are you deeply passionate about? In the first circle, a business should define its core values to identify work that inspires them. Deep passion is important in building an authentic and sustainable brand. What can you be the best in the world at? Determine what the business can do better than any other competitor. Does the business have unique resources or capabilities? Perhaps it has access to economies of scale? Defining a competitive advantage means that an organization must also identify its weaknesses. In so doing, the business avoids spending time on money on initiatives that will never succeed.What drives your economic engine? That is, where is a business adept at generating revenue? Examples of revenue generation include products, services, and other resources. Whatever the driver, it must have a measurable and sustainable impact on cash flow and profits.

After completing the three circles, the business must identify where each overlaps. It is here that the hedgehog concept in the form of a central company vision will be located.

Consider the example of a company that is passionate about innovation and sustainability in third world countries. Through economies of scale, the company can manufacture solar panels at a lower cost than competitors. Although primarily operating in the UK, the company also has contacts in certain charitable organizations with a presence in Africa.

Therefore, a potential hedgehog concept may involve selling cheap and affordable electricity units to the African population. Utilizing bulk orders, the solar panel company works passionately toward its goals while still making a profit.

In summary, businesses should note that the hedgehog concept does not provide a blueprint for becoming the best at something. Instead, it gives insight into what a business could be best at given the common, intersecting information in each of the three circles.

Key takeaways

The hedgehog concept provides a simple yet clear focus for business success, allowing it to devote resources to a single unifying vision.The hedgehog concept is represented by three intersecting circles. Each circle asks important questions that help a business identify passions that are profitable and result in a competitive advantage.The hedgehog concept does not provide a concrete strategy on how an organization might realize success. But it does illustrate the potential benefits of a business adopting hedgehog concept principles.

Read Next: Mental Models, Biases, Bounded Rationality, Mandela Effect, Dunning-Kruger Effect, Lindy Effect, Crowding Out Effect, Bandwagon Effect.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework, BCG Matrix, GE McKinsey Matrix, Kotter’s 8-Step Change Model.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Hedgehog Concept In A Nutshell appeared first on FourWeekMBA.

Halo Effect In Nutshell

The halo effect is a cognitive bias where the overall impression of a business, brand, or product influences how people feel and think about them. The halo effect was coined by psychologist Edward Thorndike in a 1920 study where military commanders were asked to rate subordinates based on several characteristics.

Understanding the halo effect

Thorndike wanted to know if the positive rating of one characteristic could result in the positive rating of another. In other words, could a subordinate judged as having great leadership skills also rate favorably for loyalty or independence?

Thorndike discovered a high correlation between certain attributes, with physical attractiveness one of the key drivers of the halo effect. For this reason, the effect is sometimes called the “what is beautiful is also good” principle.

While the study found a high correlation between certain characteristics, the halo effect says that any connection between them is unrelated and has no basis in logic.

The halo effect in business and marketing

In business, the halo effect can be seen in consumer favoritism toward a product range. If a consumer has a positive experience with one product, then it is likely to influence their experience with another product from the same organization.

Business websites also suffer from the negative halo effect, where one negative characteristic causes broader negative sentiment. In a study analyzing poor-quality search results that didn’t follow a logical order, the consumer concluded that the company product range and customer service were similarly low quality.

At the product level

The visual design of a product is also a major determinant of a positive or negative halo effect – even when design features have no bearing on product effectiveness.

The effect is also seen in app design, with a study finding that the shade of yellow chosen for an app login screen had significant implications for the user experience. Those who found the shade to their liking tended to rate the app as more reliable, secure, and intuitive.

At the brand level

In the case of Apple, the halo effect creates the right conditions for successful product expansion. The success of the iPod paved the way for the iPhone and iPad and importantly, compensated for the teething problems that these products experienced.

At the corporate level, socially responsible program initiatives can soften the impact of negative consumer perception if the organization later receives bad press.

Astute businesses can also leverage the power of endorsements at the product and organizational level to influence external brand perception.

Key takeaways

The halo effect describes the tendency for a consumer to form an overall impression of a brand or product based on one unrelated trait.The halo effect has both a positive and a negative component. A business can use the positive component to build brand equity but easily have that equity eroded by a low-quality website.Apple has used the halo effect to their advantage to successfully manage product expansion and subsequent public brand perception.

Read Next: Biases, Bounded Rationality, Mandela Effect, Dunning-Kruger Effect, Lindy Effect, Crowding Out Effect, Bandwagon Effect.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Halo Effect In Nutshell appeared first on FourWeekMBA.

December 7, 2020

What Is The Kelly Criterion And Why It Matters In Business

The Kelly criterion is a formula-based approach to investing and gambling. For each investment or bet, the individual allocates funds as a percentage of the entire portfolio. The Kelly criterion was created by researcher John Kelly in 1956 as a means of analyzing long-distance telephone signal noise. In more recent times, the formula has been adopted by the gambling and investment industries as means of wise resource allocation to a bet or investment.

For example:

A blackjack player determining how much of their bankroll to wager on the next hand.A stock investor deciding on the percentage of their portfolio that should be devoted to speculative resource stocks.A real-estate investor questioning how much of their portfolio to devote toward condominiums in Miami Beach.

In each example, the goal of the gambler or investor is to grow their capital.

According to the Kelly criterion, the amount of money invested should be proportional to the knowledge of the bet or investment itself.

Key components of the Kelly criterion formula

The Kelly criterion is expressed by the formula:

[image error]

Here:

f* = the total percentage of wealth that should be risked.p = the historical probability of a win. Ideally, the p-value needs to be above 0.50 or 50%.b = the decimal odds minus 1, otherwise known as the amount that could potentially be won or lost. For investors, calculate the b value by dividing the total number of trades yielding a positive amount by the total number of trades.q = the probability of failure (i.e. 1-p).

When interpreting the f* value, multiply it by 100 to get the percentage of total funds that should be risked. For example, if f* = 0.17 then the total percentage of funds allocated should be 17%.

Kelly criterion limitations

Earlier, it was stated that knowledge of the bet was proportional to the amount of money invested in that bet.

This begs the question: how is knowledge obtained and what does it constitute?

The Kelly criterion defines knowledge as the perceived edge, itself defined as a betting advantage gained from exploiting bookmaker margins or possessing proprietary knowledge.

However, it is important to note that the formula is not foolproof. While it does define the point of maximum portfolio growth, the f* value is calculated from real-world probabilities that are best estimates only. Invariably, factors that influence the probability of winning are complex, obscured, or hard to define.

To reduce variance, many choose to estimate returns that are 30 to 50% of the calculated f* value. This is known as a safety margin, where risks are assumed to be higher than stated.

Other limitations of the Kelly criterion include:

A focus on growth stocks. As growth stock profits are continually re-invested to encourage exponential growth, Kelly’s formula favors growth stock investors. Investors wishing to make smaller, more consistent income-stock profits may find the model too aggressive.Higher margin for error. Given that the f* value is the point of maximum potential growth, a figure only slightly higher brings substantially more risk, variance, and decreased profit. This means that undisciplined gamblers or investors prone to greed could suffer larger losses by ignoring the stated f* value.

Key takeaways

The Kelly criterion is a mathematical formula that guides gambling and investment decisions by way of risk-managed resource allocation.The Kelly criterion argues that the background knowledge of an investment or bet is directly proportional to the amount of money that should be allocated.While useful in a variety of scenarios, the Kelly criterion is nevertheless based on mostly unquantifiable probabilities that increase variance. As a result, a conservative approach to calculating investment percentages should be taken.

Read Next: Biases, Bounded Rationality, Mandela Effect, Dunning-Kruger Effect, Lindy Effect, Crowding Out Effect, Bandwagon Effect.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post What Is The Kelly Criterion And Why It Matters In Business appeared first on FourWeekMBA.

Google Effect In A Nutshell

The Google effect is a tendency for individuals to forget information that is readily available through search engines. During the Google effect – sometimes called digital amnesia – individuals have an excessive reliance on digital information as a form of memory recall.

Digital Amnesia And Google Effect

The effect is attributed to the advent of the internet and search engines, with the latter using sophisticated algorithms to deliver accurate and instantaneous information to users.

Cell phones have also played an important role. With ready access to hundreds or even thousands of cell phone numbers, there is less need to commit them to memory. The popularity of photo and video sharing platforms has also been significant. Users of platforms such as Instagram and Snapchat are intentionally using still and moving images as a substitute for actual memories.

Essentially, the Google effect is a cognitive bias.

This bias suggests that people are better at remembering where to access stored information (and how to retrieve it) than they are remembering the information itself. This is because the human brain does not prioritize the storing of information that it can easily access later.

Implications of the Google effect

The Google effect has several negative implications for individuals and the wider society. Some of these include:

Shallow and superficial engagement with the world. While information is readily available, it is not being committed to memory and used in everyday contexts. Shortening attention spans are further reducing the amount of information that can be memorized and applied to real-world situations.Low-quality information. Search engines store vast amounts of information, but much of it is low quality. Those who rely on this information to make decisions often lack critical thinking skills and intelligence.Poor mental health. Several studies have linked an increasing dependency on digital information with anxiety, poor cognitive task performance, and a lack of social skills.Access vulnerability. Information stored online is always vulnerable to cyberattacks, power outages, and hard drive failure. All have the potential to restrict access to information or in some cases, erase it.

Potential benefits of the Google effect

In a study by Yale University, students who were able to cross-reference their knowledge on a certain topic with Google were shown to have more confidence. As a key driver of educational success, confidence derived from the Google effect was seen to be crucial.

Further studies have shown that students were better able to locate peer-reviewed references for use in assignments. Although retention was lacking, knowing where to find and then synthesize reputable information may encourage memorization and critical thinking skills.

Key takeaways

The Google effect is a psychological phenomenon that describes the individual tendency to forget information available online.The Google effect has several negative implications for individuals. Chief among them are somewhat disengaged and uninformed interactions with the world. Mental health may also suffer as reliance on digital information increases. The Google effect does some limited benefits. Studies have shown that the easy retrieval of peer-reviewed research encourages university students to think critically and commit more information to memory.

Read Next: Biases, Bounded Rationality, Mandela Effect, Dunning-Kruger Effect, Lindy Effect, Crowding Out Effect, Bandwagon Effect.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Google Effect In A Nutshell appeared first on FourWeekMBA.

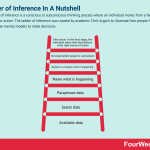

Ladder of Inference In A Nutshell

The ladder of inference is a conscious or subconscious thinking process where an individual moves from a fact to a decision or action. The ladder of inference was created by academic Chris Argyris to illustrate how people form and then use mental models to make decisions.

Understanding the ladder of inference

Mental models encapsulate assumptions and generalizations and are unique to everyone. They explain why two people can witness the same event but experience it in two vastly different fashions.

Fundamentally, the ladder of inference encourages informed decision making based on fact and not on personal biases that characterize mental models.

By acting without bias, the individual or business experiences growth. Indeed, the ladder is often equated with the cycle of growth, where completion of each cycle results in improvement based on continuous learning.

Climbing the rungs of the inference ladder

The ladder of inference can be thought of as a visual representation of the decision-making thought process.

Seven rungs exist, with each rung representing one of the seven stages of thinking.

Let’s look at each stage:

Stage 1 – available data. At the bottom of the ladder exists information about the reality and facts of daily life. This includes everything from the body language of a colleague to the results from a marketing campaign. Stage 2 – select data. Given the richness and abundance of available data, people cannot pay attention to all of it simultaneously. Instead, mostly subconscious choices are made regarding what data is selected and what data is ignored.Stage 3 – paraphrase data. In the third stage, the individual adds meaning to the data based on unique past experiences, values, beliefs, or biases. Often, there is no consideration regarding whether the meaning applied is valid or true.Stage 4 – name what is happening. Here, the individual names the situation based on a combination of interpreted fact and personal assumptions.Stage 5 – explain or evaluate what is happening. Having just explained what is happening, the individual then seeks to explain why it is happening. This is performed by considering a list of causal theories that are judged as either good or bad according to the individual’s values.Stage 6 – develop beliefs based on conclusions. These beliefs then shape future judgments in scenarios with similar contexts. The classic example is an employee who is consistently late to work in the belief that they will not be reprimanded by management. This belief then leads the employee to be late to meetings and other formal engagements.Stage 7 – take action. In the final stage, the individual takes what they believe is the right course of action. Of course, their actions are always based on beliefs and assumptions.

Using the ladder of inference to make better decisions

Many assume that the ladder of inference is a systematic guide to making better decisions. However, the ladder merely outlines the natural thought process that every individual experiences.

To improve decision making, an individual must know where they sit on the ladder and adjust accordingly. Perhaps counterintuitively, it is preferable to occupy the lower rungs of the ladder or descend where possible.

An individual who tends to paraphrase data (Stage 3) to their detriment should be more selective about the data they select from their environment (Stage 2). An individual who tends to select data to suit their own agenda (Stage 2) should consider incorporating a broader subset of available data (Stage 1).

In both cases, the individual is encouraged to question the validity of their assumptions and beliefs. This helps them break free of the reflexive loop – where assumptions and beliefs impact the data that will be selected in similar future scenarios. This can often lead to a toxic cycle where actions are reinforced by limited or flawed information and vice versa.

Key takeaways

The ladder of inference describes how people form and sustain mental models in the decision-making process.The ladder of inference has seven rungs, with each rung representing a particular stage of decision making based on personal assumptions, beliefs, or biases.The ladder of inference is not intended to provide advice on optimal decision making. Instead, it allows individuals to identify where their process is flawed and move down the ladder to correct it.

Read Next: Biases, Bounded Rationality, Mental Models.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Ladder of Inference In A Nutshell appeared first on FourWeekMBA.

December 6, 2020

Lewin Change Model Vs, Kotter 8-Step Change Model

Both are management tools whose aim is to help companies deal with change. Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kotter’s 8-step change model helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

[image error]Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

[image error]Harvard Business School professor Dr. John Kotter has been a thought-leader on organizational change, and he developed Kotter’s 8-step change model, which helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

Read Next: Lewin’s Change Management, Kotter’s 8-Step Change Model.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework, BCG Matrix, GE McKinsey Matrix.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Lewin Change Model Vs, Kotter 8-Step Change Model appeared first on FourWeekMBA.

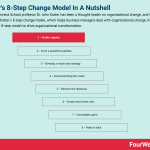

Kotter’s 8-Step Change Model In A Nutshell

Harvard Business School professor Dr. John Kotter has been a thought-leader on organizational change, and he developed Kotter’s 8-step change model, which helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

Understanding Kotter’s 8-step change model

The model was developed by Harvard Business School professor Dr. John Kotter, a notable thought-leader on organizational change.

Kotter recognized that change was difficult for some businesses, especially for those that had been in operation for some time. But he also knew that change was an important factor in a business remaining viable, no matter how much success they had enjoyed in the past.

Big change in an organization is usually the result of bold and courageous leadership, which we will discuss in the next section.

The eight steps of Kotter’s change model

Kotter created his model after witnessing how leaders led their organizations during periods of transformation.

These are the eight steps that will help a business navigate this transformation:

1 – Create urgency

The most significant changes occur because of urgency. For example, urgency might result from a string of negative reviews or the emergence of a powerful competitor. Whatever the scenario, it is important to present change as the solution to a problem.

To feel compelled to act, management must be notified of a problem in advance with convincing evidence or support from key stakeholders.

2 – Form a powerful coalition

This can be achieved by identifying the key playmakers in an organization. Who are the individuals that hold the power in decision making?

In the search to form a coalition, representatives should seek out influential people with a broad range of experience or skillsets.

3 – Develop a vision and strategy

Key decision-makers will only get behind an initiative for change if they can understand the reasons for doing so. Therefore, the vision for change must be clear, concise, and well presented.

It should also:

Reflect the core values of the business or identify new core values.Contain a mission statement.Detail a logical and feasible change strategy.

4 – Communicating the vision

Presenters should not be afraid to sell the vision to decision-makers if required to do so. They must present their vision with confidence and conviction. In other words, they must truly believe that their strategy will be successful.

Wherever appropriate, relate the strategy for change to pre-existing company values. Address any concerns from the audience publicly in a calm and empathic manner.

5 – Remove the obstacles

Individuals are often the greatest obstacles to change. Identify those most resistant to change and work collaboratively to address any concerns. Then, reward or recognize those who were open to change from the very beginning.

6 – Create short-term wins

Early in the change process, short-term wins are crucial to building momentum and confidence. This is particularly true of large changes with long timelines because people can become disheartened at the prospect of the job ahead of them.

Again, incentivization is useful for those who meet and continue to achieve short-term wins.

7 – Consolidate gains

Consolidation means building on quick wins through expansion and repetition. Each win should be analyzed to determine areas for possible improvement.

Subsequent goal-setting should also strike a balance. Each goal must be slightly more ambitious than the last without causing employee disenfranchisement.

8 – Make it stick

Making a change stick means that it becomes part of company culture. This process can take years and usually involves mistakes or employee turnover along the way.

To ensure that management cannot revert to the status quo, change success stories should be regularly highlighted. Employee contributions should also continue to be celebrated and rewarded where appropriate.

It is also essential that a business knows what it stands for before recruiting. This allows HR managers to instill core values into new employees from day one.

Key takeaways

Kotter’s 8-step change model helps decision-makers adapt to transformational change.Kotter’s 8-step change model was developed by leading management consult Dr. John Kotter. By observing organizations undergoing transformation, he identified that leadership ultimately determined the likelihood of change.Kotter’s 8-step change model advocates urgency, stakeholder engagement, and a clear vision as important preliminary change driving ingredients. Change must then be communicated to leadership convincingly so that a plan rewarding short and long-term wins can be implemented.

Read Next: Lewin’s Change Management.

Related Strategy Concepts: Go-To-Market Strategy, Marketing Strategy, Business Models, Tech Business Models, Jobs-To-Be Done, Design Thinking, Lean Startup Canvas, Value Chain, Value Proposition Canvas, Balanced Scorecard, Business Model Canvas, SWOT Analysis, Growth Hacking, Bundling, Unbundling, Bootstrapping, Venture Capital, Porter’s Five Forces, Porter’s Generic Strategies, Porter’s Five Forces, PESTEL Analysis, SWOT, Porter’s Diamond Model, Ansoff, Technology Adoption Curve, TOWS, SOAR, Balanced Scorecard, OKR, Agile Methodology, Value Proposition, VTDF Framework, BCG Matrix, GE McKinsey Matrix.

Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business Models

The post Kotter’s 8-Step Change Model In A Nutshell appeared first on FourWeekMBA.