Gennaro Cuofano's Blog, page 176

January 21, 2021

Story Mapping And Why It Matters In Business

Story mapping is a simple holistic approach to using stories in agile development without losing sight of the big picture. Story mapping was first introduced by Jeff Patton in 2005 and is based on the concept of user stories, or stories that communicate product requirements from the perspective of user value.

Understanding story mappingStory mapping is an engaging and collaborative activity where everyone works toward building a product backlog on a wall. This maintains a focus on users and what they are doing with a product, helping teams avoid becoming distracted by pointless feature arguments. Instead, stories are written that capture both user and business value.

By visually mapping out these user stories, teams are also able to:

Create an outline of product-user interactions.Determine which steps will deliver the most benefit to the user, andPrioritize what should be built next.Building a story mapStory mapping is a top-down approach that breaks the product vision into actionable steps that can be prioritized.

To better understand this concept, think of the basic structure of a story map as being similar to a tree. The production vision is represented by the trunk, while the large branches are goals. Smaller branches denote activities and leaves denote user stories.

Then, follow these steps.

Step 1 – Frame the journeyBefore mapping can commence, the exercise must be framed around a common goal. In other words, what does the product do? What problem is it trying to solve? Is there a specific user or target audience? What benefits will they (or the business) receive as a result of the product being built?

Step 2 – Build the story backboneThis describes the entire user story from start to finish. For someone booking a vacation rental, the first task may be signing up for account with the stay company. At the end of their user story, they may write a review for the homeowner or hotel.

To help define the story backbone, relevant experts should be asked to walk through the story step-by-step. Each member of the team should also contribute to encourage conversation around the sequence and flow of each step.

Step 3 – Identify and group activitiesActivities are defined as common themes that group steps in a user story. For the individual booking a vacation, signing up for an account may involve entering personal information and opening the confirmation email.

Step 4 – Break large tasks into subtasksIt’s important to understand that most steps are probably too big to be completed in one sprint. Therefore, they should be broken down into smaller tasks and user stories.

Cards denoting steps in the user story should be split, rewritten, and reorganised so that subtasks do not get confused or muddled.

Step 5 – Fill in the blanksHere, the project team must test for any missing tasks by having a different user persona walk through the entire user story. Teams must be observant, noting where user behaviour flow differs from what is displayed on the story map.

In filling in the blanks, teams should gather as broad a range of perspectives as possible. A UX designer will be able to offer different insights compared to a developer, for example.

Step 6 – Prioritize tasks and subtasksThis very important step involves the prioritization of tasks by moving them up or down the backbone. High-priority tasks should be kept at the top of the backbone.

Prioritization will depend on the team and their particular product. However, many businesses choose to split the map into vertical sections entitled “could”, “should”, and “must”.

Step 7 – Slice groups of tasks into iterationsBy this point, the team should have a backbone up top with a full suite of user stories grouped by activity and prioritized tasks underneath.

Iterations, or a full “slice” of what a product could do, can be seen by moving through the map from left to right. Each slice then represents a minimum viable product (MVP) that progressively adds value as development progresses.

For each slice, the team must conclude by determining what they hope to accomplish. That is, does the release contribute to broader company goals? To answer these questions, success metrics should be defined to quantify successful user behaviour.

Key takeawaysStory mapping is a holistic agile methodology where user stories are considered with respect to how they contribute to the overall user experience.Story mapping provides a graphical representation of product-user interactions. This helps project teams prioritize iterations according to the value they provide to the user and business.Story mapping is a seven step, top-down approach which uses the analogy of a tree to break the vision of a product in smaller, actionable steps.Read Next: Storyboarding, Business Analysis, Competitor Analysis, Continuous Innovation, Agile Methodology, Lean Startup, Business Model Innovation, Project Management.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post Story Mapping And Why It Matters In Business appeared first on FourWeekMBA.

Scrum At Scale In A Nutshell

Scrum at Scale (Scrum@Scale) is a framework that Scrum teams use to address complex problems and deliver high-value products. Scrum at Scale was created through a joint venture between the Scrum Alliance and Scrum Inc. The joint venture was overseen by Jeff Sutherland, a co-creator of Scrum and one of the principal authors of the Agile Manifesto.

Understanding Scrum at ScaleIt is based on many of the fundamental principles of Scrum. It also borrows concepts from complex adaptive theory, game theory, and object-oriented technology.

Fundamentally, Scrum at Scale reduces the complexity that often results when additional teams form in a typical hierarchy as a business expands. It applies the concept of scaling to teams, teams of teams, networks of teams, and so on.

The three core concepts of Scrum at ScaleScrum at Scale is a means of coordinating multiple teams based on three core concepts:

Small teams. High performing Scrum teams typically consist of three to nine people. However, Sutherland recommends Scrum@Scale teams be limited to four to five people. Smaller group sizes reduce complexity.Organization-wide scaling. Scrum at Scale advocates linear scalability. In other words, if 5 teams can complete 20 projects annually, then 10 teams should be able to complete 40 projects. Minimum viable bureaucracy (MVB). This is an agile approach where businesses maintain efficiency and consistency at scale without hindering creativity. A primary impediment to MVB is the tendency for teams to spend up to 75% of their time on zero value tasks. Bureaucracy attributed to a hierarchal management structure is another factor. Here, Sutherland’s primary intention is to reduce the time associated with decision making and execution.Components of Scrum at ScaleScrum at Scale incorporates two cycles that help multiple teams coordinate their efforts along a single path.

The traditional roles of Scrum Master and Product Owner based on competencies defined in the Scrum Guide are present. However, new roles, teams, and events have been introduced to facilitate the team of teams concept unique to Scrum at Scale.

Scrum Master CycleThe Scrum Master Cycle incorporates:

Scrum of Scrums (SOS) – a new Scrum team “responsible for a fully integrated set of potentially shippable increments of product at the end of every Sprint from all participating teams”. Scrum of Scrums teams usually consists of three to five people.Scrum of Scrums Master (SoSM) – the person responsible for removing impediments to coordination between Scrum of Scrums teams.Scaled Daily Scrum (SDS) – a new event where the Scrum Master from each team comes together to discuss impediments to Sprint Goals and identify or resolve dependencies between each team.Executive Action Team (EAT) – whose role is to remove impediments that SOS teams cannot remove because of a lack of political or financial clout.Product Owner CycleScrum at Scale also introduces new roles and concepts in the product owner role:

MetaScrum – or a group of product owners who coordinate a shared backlog that feeds a network of Scrum teams. The main function of the MetaScrum is to create a vision for a product and make it visible to the organization. The group must also create alignment and garner support for backlog implementation.Chief Product Owner – a new role for a single person who is responsible for the coordination of a single product backlog. If the MetaScrum is scaled for up to 25 teams, then another management role must be created to oversee each of the Chief Product Owners.Key takeawaysScrum at Scale is a framework where networks of Scrum teams use the Scrum guide to address complex problems while delivering the maximum value possible.Scrum at Scale incorporates three components: small teams, organizational-wide scaling, and minimum viable bureaucracy. Each component helps coordinate multiple teams.Scrum at Scale introduces several new roles, events, and teams in both the Scrum Master Cycle and Product Owner Cycle.Read Next: Business Analysis, Competitor Analysis, Continuous Innovation, Agile Methodology, Lean Startup, Business Model Innovation, Project Management.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post Scrum At Scale In A Nutshell appeared first on FourWeekMBA.

January 20, 2021

Customer Development In A Nutshell

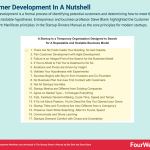

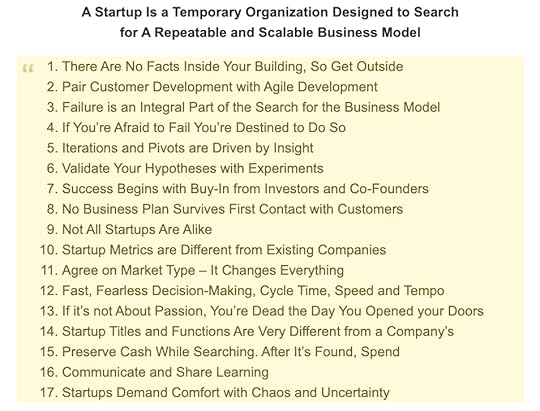

Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups.

Introducing the customer development manifesto The Customer Development Manifesto (Source: steveblank.com)

The Customer Development Manifesto (Source: steveblank.com)The customer development manifesto is the foundation of the lean startup.

Understanding customer development

Understanding customer developmentCustomer development is one of the three foundational elements of a lean start-up. However, many start-ups allocate too many resources to product or service development without first considering the needs of their target audience. Who is the ideal customer and what do features do they need? How can they be reached?

Ultimately, no product or service will ever be successful if no consumers are lining up to buy it. Even if the product in question does satisfy a need, is the size of the addressable market large enough to support it? Indeed, does the business have the ability to scale to meet demand if required?

Customer development addresses all of the above questions by discovering, testing, and validating assumptions that many organizations fail to verify.

The four steps of customer developmentCustomer development is built on the premise that the business must understand market needs and come up with multiple potential solutions. These solutions must have the capacity to be evaluated by testable hypotheses.

This is performed by implementing these four steps.

1 – Customer discoveryFirst, the vision of the start-up must form the basis of several purely hypothetical business models. Then, the hypothesis of each model should be tested and validated by understanding the needs of real or potential customers. The focus in customer discovery must remain on customer needs and not on technical features.

2 – Customer validationAs noted earlier, a product or service has to address customer needs and be viable. Customer validation is any method that allows the business to develop a predictable sales process.

Viability can be assessed by considering scalability, market fit, market size, feasibility, and repeatability. Furthermore, what is the weight of the problem? Is the product important? That is, will consumers be willing to part with money to own it? Hypotheses that fail customer validation are scrapped and the business must return to the first step.

3 – Customer creationDuring the third step, the business must create demand among end-users and direct them through the preferred sales channel. Only after initial sales are made should efforts be made to increase product awareness. This helps control the cash burn rate and ensures that start-ups avoid spending money trying to attract customers from the wrong target audience.

Of course, every market is different. Some start-ups will need to put more thought into product positioning if there is pre-existing competition.

4 – Company buildingIn the final step of the customer development process, the business moves from an exploratory and testing phase to a phase of execution.

In other words, the business must fill roles in newly created departments such as sales, marketing, customer service, and business development. This naturally leads to the business beginning to scale up, spending more money on marketing and advertising to drive sales.

With a high demand for a product or service, the business moves from a start-up to a company executing on a verified and validated model.

Key takeawaysCustomer development is a foundational element of a lean start-up involving the identification and verification of a target audience using testable hypotheses.Customer development is a means of formally validating common business assumptions such as market size, market demand, and scalability.Customer development is based on four steps that describe how an emerging start-up can transition to a fully-fledged company with a verified business model.Read Next: Lean Startup, Continuous Innovation, Design Thinking, Business Design, Value Proposition Design, Jobs-To-Be-Done.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Customer Development In A Nutshell appeared first on FourWeekMBA.

Spotify Model And Why It Matters In Business

The Spotify Model is an autonomous approach to scaling agile, focusing on culture communication, accountability, and quality. The Spotify model was first recognized in 2012 after Henrik Kniberg, and Anders Ivarsson released a white paper detailing how streaming company Spotify approached agility. Therefore, the Spotify model represents an evolution of agile.

Understanding the Spotify modelWhile it has become popular in agile development circles, Kniberg stresses that the model is less of a framework and more a unique company philosophy. In other words, the Spotify model simply represents Spotify’s view on scaling agile in a technical and cultural context.

Nevertheless, the model has received praise because it has enabled Spotify to successfully expand and scale agile. It also serves as a more attractive form of embodying cultural change, creating motivated and empowered employees through increased autonomy.

Image Credit And Copyright: engineering.atspotify.comThe seven constituents of the Spotify model

Image Credit And Copyright: engineering.atspotify.comThe seven constituents of the Spotify modelSpotify now has over 30 agile teams spread over four cities in three different time zones. To explain how the company achieved this, consider the following seven constituent parts:

Squads. Similar to Scrum teams, a squad is an autonomous and self-organized group of 6 to 12 people. Each squad has a mission and is free to choose which agile methodology it will use – whether that be Kanban, XP, or a combination of both. Each squad has an Agile Coach who improves processes and a Product Owner who clarifies the vision for the feature area. Face to face communication is encouraged and squads have direct contact with stakeholders.Tribes. A tribe is a group of multiple squads working on a related feature. Approximately 100 individuals are ideal, but some tribes may contain as many as 150 individuals. Each tribe has a leader who is responsible for creating the conditions necessary for innovation and productivity.Chapters. These are groups formed by individuals of various squads that exist within tribes. Like tribes, each chapter is led by a manager who supports individual members to achieve personal growth and overcome challenges.Guilds. A guild is an informal group of people from different tribes who share similar knowledge, tools, or practices. Guilds are similar to chapters because they maintain transparency in problem-solving and help keep work in alignment. Guilds are less formal in that anyone interested in joining can do so. But their ability to reach across an organization and exert influence is greater than the ability of chapters.Trio. A trio simply refers to a tribe that has a design, product area, and tribe leader.Alliance. An alliance is formed by three trios. Again, each alliance has a design, product, area, and tribe leader.Chief architect. The individual who defines the architectural vision, guides design and deals with issues that arise from architecture dependency. The chief architect reviews the development of new systems to ensure they avoid common mistakes. Note that the chief architect gives feedback in the form of inputs, but the final decision ultimately lies with the squad building the system.Benefits of the Spotify modelTwo of the more obvious benefits of this model include:

Less focus on the process. The Spotify model seeks to empower employees to do the best work they can in whatever way they see fit. With less of an emphasis on rigid ways of working, the organization becomes more flexible, adaptable, and productive.More autonomy. When project teams are given more autonomy, trust and accountability also increase. These values help create an environment where employees are free to share their failures as much as their successes. When a team does fail to deliver, they have a safe space to learn from their mistakes and make the necessary improvements. Spotify as a company progressed through many iterations of the Spotify model in much the same way, improving incrementally and becoming highly successful as a consequence.Key takeawaysThe Spotify model helps businesses scale agile with autonomy and purpose with a primary focus on culture and people.The Spotify model is not a framework that can be emulated but more of a company philosophy of best practices. These best practices are underpinned by seven constituent parts: squads, tribes, chapters, guilds, trios, alliances, and chief architects.The Spotify model empowers employees to deliver great results by providing an environment that is conducive to continuous improvement, flexibility, and autonomy.Read: Spotify Business Model, MLOps, AI Industry, Blockchain Economics, Cloud Business Models, C3.ai Business Model, Snowflake Business Model.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Spotify Model And Why It Matters In Business appeared first on FourWeekMBA.

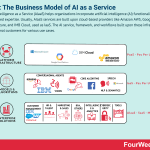

AIaaS: The New Business Model of Artificial Intelligence as a Service

Artificial Intelligence as a Service (AlaaS) helps organizations incorporate artificial intelligence (AI) functionality without the associated expertise. Usually, AIaaS services are built upon cloud-based providers like Amazon AWS, Google Cloud, Microsoft Azure, and IMB Cloud, used as IaaS. The AI service, framework, and workflows built upon these infrastructures are offered to final customers for various use cases (e.g., inventory management services, manufacturing optmizations, text generation).

Understanding Artificial Intelligence as a ServiceArtificial Intelligence as a Service allows businesses to experiment with artificial intelligence in a low risk environment and without a significant upfront investment.

AlaaS is a more recent addition to a suite of “as a service” products that help businesses maintain a focus on their core operations. It is becoming increasingly popular, with the International Data Corporation predicting that 75% of commercial enterprise applications will use AI in the coming years. As a result, large organizations such as Amazon, Google, IBM, and Microsoft all now offer AlaaS to customers.

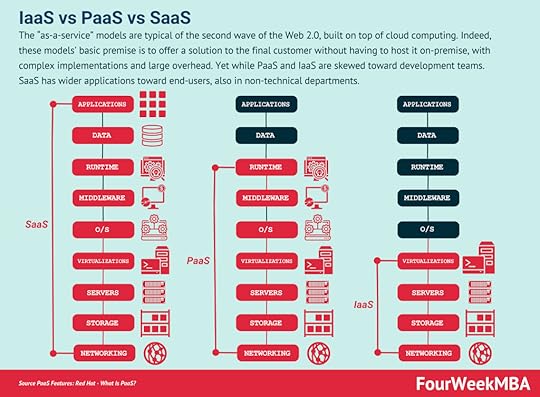

To understand this industry, it’s important to understand its various layers. Just like SaaS, built on top of IaaS, PaaS, also AIaaS, is built on top of cloud infrastructure that works as the basis for the service itself.

The “as-a-service” models are typical of the second wave of Web 2.0, built on top of cloud computing. Indeed, these models’ basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. Yet while PaaS and IaaS are skewed toward development teams. SaaS has wider applications toward end-users, also in non-technical departments. The various types of AlaaS

The “as-a-service” models are typical of the second wave of Web 2.0, built on top of cloud computing. Indeed, these models’ basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. Yet while PaaS and IaaS are skewed toward development teams. SaaS has wider applications toward end-users, also in non-technical departments. The various types of AlaaSAlaaS is a relatively broad term that can be divided into distinct types:

Cognitive computing APIs – where an application programming interface (API) developer can utilise API calls to incorporate artificial intelligence into applications. This encompasses a range of services including computer vision, knowledge mapping, and natural language processing (NLP). Each has the ability to generate business value from unstructured information.Bots and digital assistance – a very popular form of AlaaS including automated email services, chatbots, and digital customer service agents.Fully-managed machine learning services – ideally suited to non-technological organizations who desire a fully managed approach. These services invariably offer customer templates and pre-built models. For the most technologically-challenged, they also offer code-free interfaces.Machine learning frameworks – or frameworks that allow organizations to build custom models that will only handle a small amount of data.Advantages of Artificial Intelligence as a ServiceIn an increasingly automated digital world, there are a multitude of benefits to AlaaS.

Here are just a few of them:

Reduced cost. AlaaS helps small and medium-sized companies, in particular, become more profitable by minimizing outlay. Profitability increases as companies are able to avoid hiring programmers or investing in expensive machinery. Put differently, they don’t need to build, test, and implement artificial intelligence systems from scratch. Ease of use. The vast majority of AlaaS companies offer packaged products that don’t require expertise to implement. Having said that, developers from the business using AlaaS can easily tweak the product if desired.Scalability and flexibility. Some businesses will be uncertain as to whether Artificial Intelligence as a Service is right for them. This uncertainty can be alleviated by starting small and then scaling later as knowledge and confidence increase or corporate requirements change. To help facilitate the onboarding of AlaaS, many providers offer their services at a fixed rate. This increases flexibility because customers are free to pay for what they use, and no more. Ecosystem growth and integration. The most robust systems are fully integrated, but integration is hindered when artificial intelligence can only be used in a small subset of business operations. Companies such as NVIDIA and Siemens have partnered with AlaaS vendors to overcome incompatible technologies – thereby allowing product teams to increase integration, speed, and efficiency.How Does AIaaS get monetized?As the world itself explains, AIaaS gets monetized in the form of subscription/retainer that comprises the management, running and monitoring of the AI/ML Models that are used as the foundation fo the provided service.

Imagine the specific case of a company providing AI models for improving manufacturing processes. The AIaaS company will work on cleaning the data from the customer, plugging that into its AI models to generate reports, monitoring, and workflows for process optimization.

Imagine also the case of a company providing NLG (natural language generation or automatic text generations using the latest language models), which will be running, and operating those models while the customer gets as output generated pages or workflows, paid in the form of retainer.

Part of AI services will also require maintenance, or new experimental projects can be undertaken. In these cases, those can be part of the retainer or charged separately on a pay per consumption basis as MLOps.

Machine Learning Ops (MLOps) describes a suite of best practices that successfully help a business run artificial intelligence. It consists of the skills, workflows, and processes to create, run, and maintain machine learning models to help various operational processes within organizations. Key takeawaysArtificial Intelligence as a Service allows businesses to incorporate AI functionality without the requisite knowledge or experience.Artificial Intelligence as a Service can be divided into four distinct categories: cognitive computing APIs, bots and digital assistance, machine learning frameworks, and fully managed machine learning services.Artificial Intelligence as a Service offers a number of benefits to customers. AlaaS is a flexible and scalable service that reduces operating costs and is relatively simple to use. As more organizations work toward full integration, the service itself will become more efficient.

Machine Learning Ops (MLOps) describes a suite of best practices that successfully help a business run artificial intelligence. It consists of the skills, workflows, and processes to create, run, and maintain machine learning models to help various operational processes within organizations. Key takeawaysArtificial Intelligence as a Service allows businesses to incorporate AI functionality without the requisite knowledge or experience.Artificial Intelligence as a Service can be divided into four distinct categories: cognitive computing APIs, bots and digital assistance, machine learning frameworks, and fully managed machine learning services.Artificial Intelligence as a Service offers a number of benefits to customers. AlaaS is a flexible and scalable service that reduces operating costs and is relatively simple to use. As more organizations work toward full integration, the service itself will become more efficient.Read: MLOps, AI Industry, Blockchain Economics, Cloud Business Models, C3.ai Business Model, Snowflake Business Model.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post AIaaS: The New Business Model of Artificial Intelligence as a Service appeared first on FourWeekMBA.

MLOps: Machine Learning Ops And Why It Matters In Business

Machine Learning Ops (MLOps) describes a suite of best practices that successfully help a business run artificial intelligence. It consists of the skills, workflows, and processes to create, run, and maintain machine learning models to help various operational processes within organizations.

Understanding Machine Learning OpsMachine Learning Ops is a relatively new concept because the commercial application of artificial intelligence (AI) is also an emerging process.

Indeed, AI burst onto the scene less than a decade ago after a researcher employed it to win an image-recognition contest.

Since that time, artificial intelligence can be seen in:

Translating websites into different languages.Calculating credit risk for mortgage or loan applications.Re-routing of customer service calls to the appropriate department.Assisting hospital staff in analyzing X-rays.Streamlining supermarket logistic and supply chain operations.Automating the generation of text for customer support, SEO, and copywriting.As AI becomes more ubiquitous, so too must the machine learning that powers it. MLOps was created in response to a need for businesses to follow a developed machine learning framework.

Based on DevOps practices, MLOps seeks to address a fundamental disconnect between carefully crafted code and unpredictable real-world data. This disconnect can lead to issues such as slow or inconsistent deployment, low reproducibility, and a reduction in performance.

The four guiding principles of Machine Learning OpsAs noted, MLOps is not a single technical solution but a suite of best practices, or guiding principles.

Following is a look at each in no particular order:

Machine learning should be reproducible. That is, data must be able to audit, verify, and reproduce every production model. Version control for code in software development is standard. But in machine learning, data, parameters, and metadata must all be versioned. By storing model training artifacts, the model can also be reproduced if required.Machine learning should be collaborative. MLOps advocates that machine learning model production is visible and collaborative. Everything from data extraction to model deployment should be approached by transforming tacit knowledge into code.Machine learning should be tested and monitored. Since machine learning is an engineering practice, testing and monitoring should not neglected. Performance in the context of MLOps incorporates predictive importance as well as technical performance. Model adherence standards must be set and expected behaviour made visible. The team should not rely on gut feelings.Machine learning should be continuous. It’s important to realize that a machine learning model is temporary and whose lifecycle depends on the use-case and how dynamic the underlying data is. While a fully automated system may diminish over time, machine learning must be seen as a continuous process where retraining is made as easy as possible.Implementing MLOps into business operationsIn a very broad sense, businesses can implement MLOps by following a few steps:

Step 1 – Recognise stakeholdersMLOps projects are often large, complex, multi-disciplinary initiatives that necessitate the contributions of different stakeholders. These include obvious stakeholders such as machine learning engineers, data scientists, and DevOps engineers. However, these projects will also require collaboration and cooperation from IT, management, and data engineers.

Step 2 – Invest in infrastructureThere are a raft of infrastructure products on the market, and not all are born equal.

In deciding with product to adopt, a business should consider:

Reproducibility – the product must make data science knowledge retention easier. Indeed, ease of reproducibility is governed by data version control and experiment tracking.Efficiency – does the product result in time or cost savings? For example, can machine learning remove manual work to increase pipeline capability?Integrability – will the product integrate nicely with existing processes or systems?Step 3 – AutomationBefore moving into production, machine learning projects must be split into smaller, more manageable components. These components must be related but able to be developed separately.

The process of separating a problem into various components forces the product team to follow a joined process. This encourages the formation of a well-defined language between engineers and data scientists, who work collaboratively to create a product capable of updating itself automatically. This ability is akin to the DevOps practice of continuous integration (CI).

MLOps and AIaaS Artificial Intelligence as a Service (AlaaS) helps organizations incorporate artificial intelligence (AI) functionality without the associated expertise. Usually, AIaaS services are built upon cloud-based providers like Amazon AWS, Google Cloud, Microsoft Azure, and IMB Cloud, used as IaaS. The AI service, framework, and workflows built upon these infrastructures are offered to final customers for various use cases (e.g., inventory management services, manufacturing optimizations, text generation).[image error]Source: cloud.google.com

Artificial Intelligence as a Service (AlaaS) helps organizations incorporate artificial intelligence (AI) functionality without the associated expertise. Usually, AIaaS services are built upon cloud-based providers like Amazon AWS, Google Cloud, Microsoft Azure, and IMB Cloud, used as IaaS. The AI service, framework, and workflows built upon these infrastructures are offered to final customers for various use cases (e.g., inventory management services, manufacturing optimizations, text generation).[image error]Source: cloud.google.comMLOps consists of various phases built on top of an AI platform, where models will need to be prepared (via data labeling, Big Query datasets, Cloud Storage), built, validated, and deployed.

And MLOps is a vast world, made of many moving parts.

Source: cloud.google.com

Source: cloud.google.comIndeed, before the ML code can be operated, as highlighted on Google Cloud, a lot is spent in “configuration, automation, data collection, data verification, testing and debugging, resource management, model analysis, process and metadata management, serving infrastructure, and monitoring.”

The ML ProcessML models follow several steps, an example is: Data extraction > Data analysis > Data preparation > Model training > Model evaluation > Model validation > Model serving > Model monitoring.

Key takeawaysMachine Learning Ops encompasses a set of best practices that help organizations successfully incorporate artificial intelligence.Machine Learning Ops seeks to address a disconnect between carefully written code and unpredictable real-world data. In so doing, MLOps can improve the efficiency of machine learning release cycles.Machine Learning Ops implementation can be complex and as a result, relies on input from many different stakeholders. Investing in the right infrastructure and focusing on automation are also crucial.Read: AI Industry, Blockchain Economics, Cloud Business Models, C3.ai Business Model, Snowflake Business Model.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post MLOps: Machine Learning Ops And Why It Matters In Business appeared first on FourWeekMBA.

January 17, 2021

Roblox Business Model: Monetizing The Metaverse

Roblox is an online gaming platform where users can create avatars and explore various gaming experiences. Each experience will be monetized based on how its developer has structured the game. For instance, free games allow users to spend the platform’s currency, called Robux, to get specific enhancements or purchase items like clothing accessories for the avatars, simulated gestures from the Roblox Avatar Marketplace. Therefore, Roblox makes money by earning a commission on each transaction and through its internal ad network.

Origin Story Source: Roblox Financial Prospectus

Source: Roblox Financial ProspectusIn 1989 David Baszucki and Erik Cassel programmed a 2D simulated physics lab called Interactive Physics. This experience would be the foundation of what would later become Roblox.

Roblox nowadays is a platform where over thirty million people connect, play, and explore the various 3D digital world, entirely user-generated (built by independent developers). Indeed, by 2020 Roblox counts almost seven million active developers.

Roblox has over the years championed a new virtual reality category; they called “human co-experience,” a form of social interaction that combines gaming, entertainment, social media, and even toys.

This category also called metaverse is a virtual universe made of 3D virtual spaces.

This metaverse might have just become viable from an infrastructure standpoint as cloud computing, coupled with a high bandwidth internet and powerful portable devices, make it possible to build, access, and experience those virtual worlds.

Roblox platform consists of three main parts:

Roblox Client: the consumer-facing application that enables users the exploration of 3D digital worlds. Roblox Studio: the toolbox allowing developers to build, publish, and operating 3D experiences.And the Roblox Cloud: the underlying infrastructure powering both Roblox Client and Roblox Studio. Value modelRoblox value model is built around a virtual world made primarily of 3D experiences, entirely user-generated. Therefore, on the one hand, Roblox has to inspire users to join and continuously access those virtual realities.

On the other hand, Roblox also has to attract independent developers and creatives to keep building, publishing. And running their virtual experiences.

So that users will be prompted to use the Roblox currency, the Robux, developers will build viable businesses on top of those virtual realities, and Roblox as a virtual ecosystem earns a small percentage on each transaction.

Mission and vision and core valuesRoblox’s mission is to “build a human co-experience platform that enables shared experiences among billions of users.”

Roblox long-term vision is to recreate a “metaverse platform supporting a broader range of positive educational and social experiences.”

As such Roblox focuses its efforts in a few directions such as:

Fostering the community of users around the shared virtual worlds. Supporting developers on the platform in creating, building, and operating those virtual worlds. Working to make that virtual environment civil, safe, and secure to users.Therefore one crucial aspect as the platform scales is to, on the one hand, keep developers motivated and, on the other hand, making sure that the quality of those virtual experiences remains high.

Thus, Roblox five core values are structured around these needs and they are:

Respect the Community.Take the Long View.Get Stuff Done.Self-Organize. Own It. Value propositions and key stakeholdersAs a two-sided platform, with its entirely user-generated content there are two core players:

Developers/Creatives building, publishing, and operating virtual experiences via Roblox. Users experiencing the Roblox multiverse.Value proposition to usersUsers can create their avatars to explore the different virtual worlds through Roblox and engage with other users. Therefore, in terms of value propositions, the more users will have a variety of virtual experiences, an engaged community, and several ways to personalize their own virtual reality the more those will become interesting for more users.

Value proposition to Developers and CreatorsSince the virtual content on the platform is entirely user-generated, developers and creators are the platform’s most valuable users. In fact, they help the platform development in several ways:

Building virtual experiences.Building avatars and avatar items.Building tools and 3D models for other developers.These elements are the foundation of the success of the platform in the past and for future growth.

So how does Roblox incentivizes developers to create experience and creators to design avatars? Roblox focuses on developers’ and creators’ two core metrics: earnings and user engagement within the virtual experiences.

In short, as long as developers and creators will be able to earn from their work, and they will have an engaged community supporting them, the more the platform will develop.

The more developers build experiences on top of Roblox, the more it will become advanced for other developers as those joining will leverage on the toolbox built by experienced developers on the platform. At the same time, experienced developers will monetize their experience by selling their tools and models to other developers.

In that respect, Roblox monetization is built on top of two marketplaces, one for users (to buy enhancements within experiences and avatars) and for developers (to buy tools and models developed by others).

Key Business Model Highlights Roblox is a virtual reality platform, getting monetized primarily via its currency, the Robux, used to enhance virtual experiences, to buy avatars and other accessories. Roblox platform’s content is entirely user-generated, as such developers are incentivised to build new virtual experiences, tools, to enrich the platform. Roblox builds upon the concept of “human co-experience,” a form of social interaction that combines gaming, entertainment, social media, and even toys. This goes toward the concept of metaverse. Roblox distribution is primarily based on mobile platforms like Apple App Store and Google Play Store. Its revenues come primarily from the users buying Robux on the platform, developers’ purchases of tools, and the purchase of tools.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Roblox Business Model: Monetizing The Metaverse appeared first on FourWeekMBA.

Psychosizing Market Analysis In A Nutshell

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.

Introducing the Psychosizing Market AnalysisMapping the existing context or the potential context a company’s business model is developed into, is critical. Your market type will be the initial box where your company will operate. It will also be the foundation to move to larger markets, that can develop as a result of wider adoption (market development) or as a result of you taking more space within that existing market (market expansion).

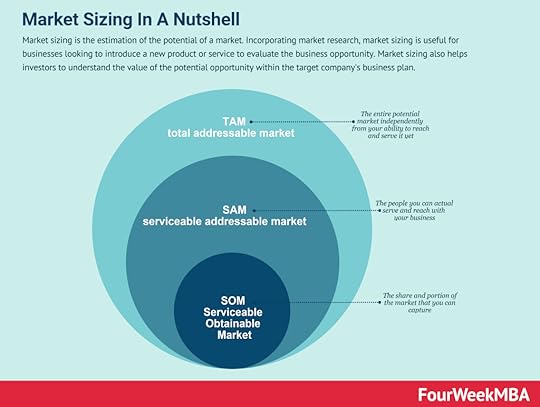

Market sizing is the estimation of the potential of a market. Incorporating market research, market sizing is useful for businesses looking to introduce a new product or service to evaluate the business opportunity. Market sizing also helps investors to understand the value of the potential opportunity within the target company’s business plan. Types of markets in Psychosizing

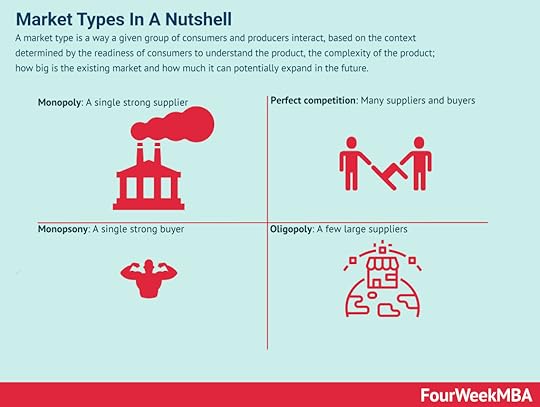

Market sizing is the estimation of the potential of a market. Incorporating market research, market sizing is useful for businesses looking to introduce a new product or service to evaluate the business opportunity. Market sizing also helps investors to understand the value of the potential opportunity within the target company’s business plan. Types of markets in PsychosizingIn traditional economics terms markets can be broken down in four main types as shown below:

A market type is a way a given group of consumers and producers interact, based on the context determined by the readiness of consumers to understand the product, the complexity of the product; how big is the existing market and how much it can potentially expand in the future.

A market type is a way a given group of consumers and producers interact, based on the context determined by the readiness of consumers to understand the product, the complexity of the product; how big is the existing market and how much it can potentially expand in the future.However, for the sake of psychosizing we want to understand how big might be the market based on the main customer types. For the sake of it, we’ll draw into the technology adoption curve, to understand the main types of customers we might have in a tech-driven economy.

In his book, Crossing the Chasm, Geoffrey A. Moore shows a model that dissects and represents the stages of adoption of high-tech products. The model goes through five stages based on the psychographic features of customers at each stage: innovators, early adopters, early majority, late majority, and laggard.Innovators

In his book, Crossing the Chasm, Geoffrey A. Moore shows a model that dissects and represents the stages of adoption of high-tech products. The model goes through five stages based on the psychographic features of customers at each stage: innovators, early adopters, early majority, late majority, and laggard.Innovators Innovators are the first to take action and adopt a product, even though that might be buggy. Those people are willing to take the risk, and those will be the people ready to help you shape your product when that is not perfect. Innovators usually represent a small niche, what we can call a microniche.

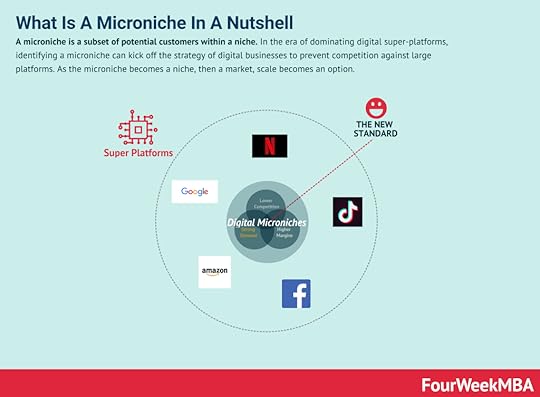

A microniche is a subset of potential customers within a niche. In the era of dominating digital super-platforms, identifying a microniche can kick off the strategy of digital businesses to prevent competition against large platforms. As the microniche becomes a niche, then a market, scale becomes an option.Early Adopters

A microniche is a subset of potential customers within a niche. In the era of dominating digital super-platforms, identifying a microniche can kick off the strategy of digital businesses to prevent competition against large platforms. As the microniche becomes a niche, then a market, scale becomes an option.Early Adopters Early adopters are among those people ready to try out a product at an early stage. They don’t need you to explain why they should use that innovation. The early adopter has already researched it, and she is passionate about the innovation behind that. In this case, early adopters will help you take advantage of a larger subset of a market, a niche.

Early majority

Early majorityThe early majority is the psychographic profile made of people that will help you “cross the chasm.” Here you move past the niche and enter into a more developed market, still small but yet with a defined customer type that goes beyond the innovator and the early adopter.

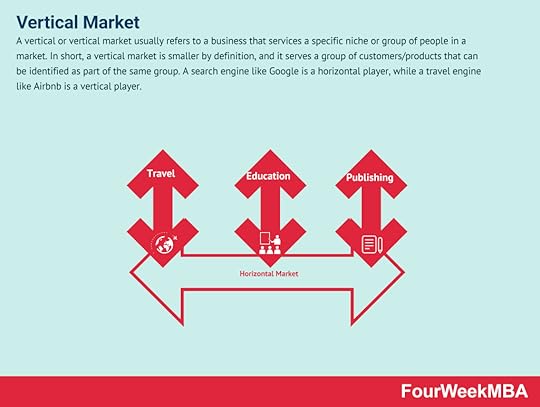

Late MajorityThe late majority kicks in only after a product is well established and it has a more skeptical approach to technological innovation and it feels more comfortable in the adoption only when a product has gone mainstream. In this case, you might be able to draw into a larger market, even though still mostly vertical. This means that there is still a primary customer type driving that market and a primary commercial use case.

A vertical or vertical market usually refers to a business that services a specific niche or group of people in a market. In short, a vertical market is smaller by definition, and it serves a group of customers/products that can be identified as part of the same group. A search engine like Google is a horizontal player, while a travel engine like Airbnb is a vertical player.Laggards

A vertical or vertical market usually refers to a business that services a specific niche or group of people in a market. In short, a vertical market is smaller by definition, and it serves a group of customers/products that can be identified as part of the same group. A search engine like Google is a horizontal player, while a travel engine like Airbnb is a vertical player.LaggardsLaggards are the last in the technology adoption cycle. While the late majority is skeptical of technological innovation, the laggard is adverse to it, unless there is a clear, established advantage in using a technology those people will hardly become adopters. Here the market size will have achieved its highest in terms of potential size, and you might be able to draw into a horizontal market, able to adapt to many commercial use cases and many potential customer types.

By definition, a horizontal market is a wider market, serving various customer types, needs and bringing to market various product lines. Or a product that indeed can serve various buyers across different verticals. Take the case of Google, as a search engine that can serve various verticals and industries (education, publishing, e-commerce, travel, and much more).Key takeaways

By definition, a horizontal market is a wider market, serving various customer types, needs and bringing to market various product lines. Or a product that indeed can serve various buyers across different verticals. Take the case of Google, as a search engine that can serve various verticals and industries (education, publishing, e-commerce, travel, and much more).Key takeawaysWe can analyze the market by using various psychographics and determine the potential market size. This model is a simplification of how real markets look like and only useful to understand the existing potential of a company’s business model a define a clear short-term strategy.

The post Psychosizing Market Analysis In A Nutshell appeared first on FourWeekMBA.

January 12, 2021

Affirm Fintech Payment Platform Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.

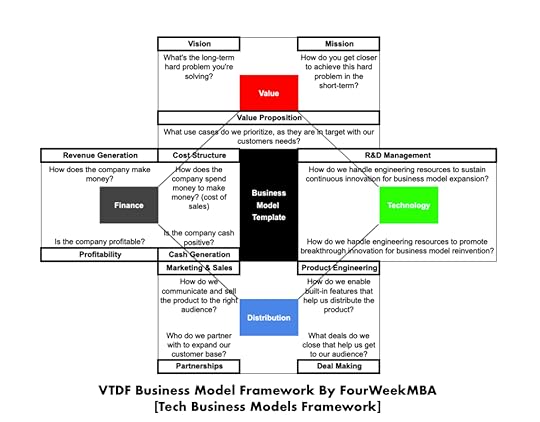

The framework used to analyze the Affirm business modelThe VTDF framework is the basis to analyze the Affirm business model.

Origin story

Origin storyMax Levchin, founder and CEO of Affirm, and former member of the PayPal team, who he had co-founded (as a software engineer) with venture capitalist Peter Thiel, saw an opportunity in the space of credit, back in 2012.

As he highlighted in the IPO prospectus, credit cards, which appeared a few decades ago, had improved from a physical standpoint (from the swipe to the chip), and yet the credit mechanism underlying it had not improved.

The opposite, it had devolved. Opaque credit fees buried into the cards’ financial statements became an opportunity for Affirm. Founded in 2012 with a mission-driven approach, where Max Levchin claims to have a built-in “moral backbone” into the way the company operates credit.

Morality here is intended as clarify and transparency in terms of fees that the consumer and merchant will pay. Thus, from there the Affirm business model was built. Therefore, technology here becomes simply a tool to make more transparent the fees due.

![[MISSING IMAGE: tm2026663d4-pg_history4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710441._SX540_.jpg) The Affirm evolution, since its inception, in 2012. Some large merchants like Peloton Expedia, Dyson, and Walmart helped the company over the years to become known and scale its operations. Peloton is as of 2020, the major contributor to Affirm’s revenues. Indeed Peloton’s partnership made up about 28% of Affirm’s total revenues in 2020.

The Affirm evolution, since its inception, in 2012. Some large merchants like Peloton Expedia, Dyson, and Walmart helped the company over the years to become known and scale its operations. Peloton is as of 2020, the major contributor to Affirm’s revenues. Indeed Peloton’s partnership made up about 28% of Affirm’s total revenues in 2020. (Image Source: Affirm Prospectus).Mission, vision, and principles

Mission : Deliver honest financial products that improve lives.

Vision : To be as ubiquitous, secure, and convenient as legacy networks, yet far more transparent, honest, and both consumer and merchant-centric.

As a mission-driven company which founding aim is to “morally restructure” (make more transparent) one of the most opaque industries, Affirm leverages technology (Fintech) to make available to consumers and merchants a point-of-sale payment solution for consumers, a merchant commerce solution, and a consumer-focused app.

Affirm’s employees like to call themselves “Affirmers” and its five core values are:

People come first.No fine print (no hidden fees or tricking statements for loans on the platform are a key element of its value proposition).It’s on us (accountability between employees and outside the company).Simpler is better.Push the envelope.Value proposition, and key customersAffirm main goal is to build a set of “honest financial products.” When the company started, just like PayPal narrowed down its market and scaled from there, it only had a “pay-over-time solution.” This became the battle horse and entry strategy for Affirm. Over the years, as more partnerships were signed and more consumers brought onboard, it expanded its suite of available applications.

Now Affirm comprises a suite of applications that go from its Pay-over-time solution, to Virtual Cards, Split Pay, Marketplace, and Savings.

![[MISSING IMAGE: tm2026663d4-pg_innov4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710442._SX540_.jpg)

The suite of applications that Affirm built over the years. It started from a pay over time application, and it scaled from there. (Image Source: Affirm Prospectus).

Affirm has two main stakeholders and customers: consumers and merchants.

Benefits of Affirm for consumersAffirm claims a few key values for consumers:

Simple, transparent, and fair (it’s spelled out how much is owed at checkout, and there are no further hidden or additional fees later on).User experience through a digital platform, that works in a few clicks for consumers.Flexibility and control (perhaps consumers set their payment schedules biweekly, 3, 6, or 12 months).

Accurate credit pricing as the company claims to outperform traditional credit models (this is one of the core tech advantages claimed by Affirm).

Consumer trust through the monitoring of the merchants’ creditworthiness.

![[MISSING IMAGE: tm2026663d4-pg_experi4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710443._SX540_.jpg)

One of Affirm’s most important value propositions is its ease of use, a smooth platform for consumers. Above an example of the workflow followed by consumers to finalize the transaction and pick a payment plan according to her/his needs. (Image Source: Affirm Prospectus).

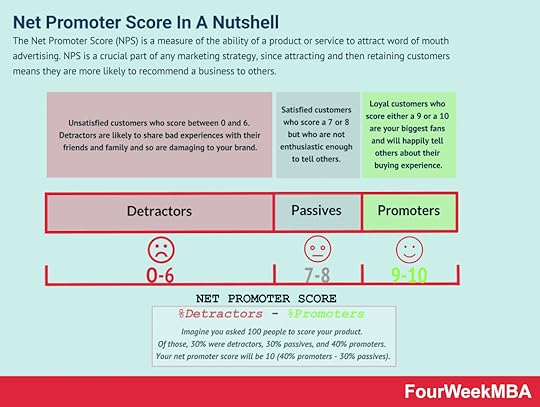

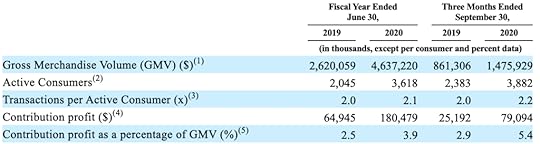

Benefits of Affirm for merchantsMore customers, higher conversion, and increased AOV, the company claims that with the option of Affirm at checkout more consumers get to the checkout and higher conversion is achieved. And this applies to higher average order value before refunds as well.Increased repeat purchase rate.Better data to inform personalized promotional strategies. Broader target market. Ease of integration. Compliance at API configuration, Affirm will handle the regulatory aspect of the loans facilitated through the platform.Customer profilingAs of September 2020, on the Affirm platform, more than 6.2 million consumers completed around 17.3 million transactions with more than 6,500 merchants with a Net Promoter Score score of 78 for the second half of 2020.

The Net Promoter Score (NPS) is a measure of a product or service’s ability to attract word of mouth advertising. NPS is a crucial part of any marketing strategy since attracting and then retaining customers means they are more likely to recommend a business to others.

While the company has over 6500 merchants on its platform, at the same time, there is a major contributor to its revenues, Peloton’s partnership. Peloton represented about 28% of Affirm’s total revenues by June 2020. Another important source of revenue for Affirm is the interest income earned from originating bank partners’ loans. When Affirm purchases the loan, it will make money from the interests earned over the consumer’s loan. Yet by 2020, approximately 15% of loan receivables related to customers residing in the state of California. This makes Affirm geographical exposure skewed toward California. The revenues skewed toward a single merchant is a risk, as to the loss of this single partnership, or perhaps a sudden reduced growth from Peloton might widely affect Affirm’s bottom line.

Technological modelAffirm’s stack of applications is all built on a cloud-first platform.

![[MISSING IMAGE: tm2026663d4-pg_techno4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710445._SX540_.jpg)

The whole Affirm infrastructure is on top of the cloud, where the company built a set of applications for data management (credit, transaction, SKU-level, merchant consumer, and fraud data). From there, a set of machine learning algorithms, combined with predictive economic models, make up the Affirm’s platform. This platform then provides merchants the API to integrate it at checkout, a set of consumer products, and internal tools.

(Image Source: Affirm Prospectus).

The main elements of Affirm’s technology are:

Fraud detection capabilities which is a built-in capability of Affirm to assess transaction fraud risk, that leverages data combined with a fraud risk model, together with other 40-80 data points.Credit check capabilities, a risk model taking five top-of-mind data points, combined with other 200 data points to assess the credit risk of new consumers.Modeling improvements to respond to changes in context, environment.Data privacy and security.As of September 2020, 47% of Affirm employees were in engineering and technology-related roles. Affirm emphasizes its role as a tech company, developing from scratch part of the platform that offers services to both consumers and merchants.

Distribution, Sales and Marketing modelsAffirm go-to-market strategy Affirm has been entering through its pay-over-time solution by expanding its merchants’ partnership. Being in the checkout of known merchants enables Affirm to become a consumer brand while getting to them via other merchants. This is a B2B2C model, whereas the more Affirm grows through merchant’s partnerships, the more it grows as a consumer brand.

And it also speeds up its adoption, as the more consumers trust Affirm as a brand, the more merchants will want to have Affirm as their main checkout option.

Affirm claimed flywheel![[MISSING IMAGE: tm2026663d4-pg_affirm4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710446._SY540_.jpg)

As more consumers join through the merchant’s checkouts, the stronger the ecosystem. And as more consumers get exposed to the Affirm brand, they will trust it as the go-to solution. Thus more merchants will want to join. That will make Affirm able to offer more products and grow the volume of transactions on the platform, to offer better data insights to the merchants and further improve the user experience. This is the claimed Affirm flywheel in action (Image Source: Affirm Prospectus).

PartnershipsMerchants’ partnership are critical for Affirm growth, both in terms of revenues and brand awareness.

The platform has over 6500 merchants, spanning across several industries.

![[MISSING IMAGE: tm2026663d4_pg-select4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710447._SX540_.jpg)

Some of the cherry-picked partnerships that Affirm has signed over the years (Image Source: Affirm Prospectus).

Since merchant partnerships are such an important part of Affirm’s growth, the company has therefore invested in merchant marketing activities, consisting primarily of providing technological support to merchants to develop tools that can help them grow their business while using Affirm’s solutions.

Multi-pronged growth strategyAffirm growth strategy moves around a few key areas:

Expand To More Higher Frequency Purchases.Expand Consumer Reach (more consumers to the network, repeat use, and new product solutions).Expand Merchant Reach.Expand to New Markets.Financial Model And Economics Of The Affirm Ecosystem![[MISSING IMAGE: tm2026663d4-pg_funds4c.jpg]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/hostedimages/1610861917i/30710448._SX540_.jpg)

The economics of an Affirm’s transaction starts with the consumer purchase. Perhaps assuming a purchase of $1000 on a Merchant connected to the Affirm’s checkout, once the consumer opts in to Affirm plan, she/he will owe $1000 + interests to Affirm. On the other side, the merchant will make $950 out of the $1000 ($50 is the fee Affirm will collect at the end of the transaction). In parallel, Affirm will send the $1000 loan + fee to the originating bank, and it will buy the loan after a few days. From there, the originating bank will send the $50 fee back to Affirm. In this way, Affirm will make money through merchant fees, consumers’ interests on the loan, and on the difference between the purchased loan from the originating bank (this amount might also be negative (Image Source: Affirm Prospectus).

As we’ll see Affirm makes money primarily via fees earned from merchants. However, when the consumer opts into the Affirm plan, if the company buys this loan from the originating bank, it will also make money from the interests earned over time. Let’s assume two scenario to understand the economics of the Affirm’s platform:

Affirm gets the merchant fee, but it doesn’t buy the originating bank’s consumer loan: In this case, Affirm will make money only from the merchant fee earned. As the consumer loan gets to the originating bank partner, the bank will pay back the fee to Affirm.Affirm gets the merchant fee, and it does buy the consumer loan from the originating bank: In this case, instead, Affirm will make money both on merchant fee and on interests maturing from the consumer loan. Indeed, as the loan is passed to the originating bank, Affirm will buy this back after a few days. Therefore, the originating bank will pay to Affirm the merchant fee. And Affirm will take over the consumer loan. This means the consumer will pay the installments directly to Affirm. It’s important to understand this dynamic as this changes the whole financial model. In fact, Affirm will anticipate the cash to the originating bank to buy the consumer loan, and it will earn it back as the consumer completes the loan payments. This results in a cash negative financial model. Where Affirm anticipates the money from the loan, it gets it back over time, with interests. As those are personal loans, they do not have any collateral, neither is guaranteed nor insured by a third-party. Therefore, any failure from the consumer to pay back Affirm will generate a large loss. It’s important that Affirm can fairly predict the consumers who will be able to repay back to loans, and therefore only purchase those with higher potential predictive scores.Revenue model

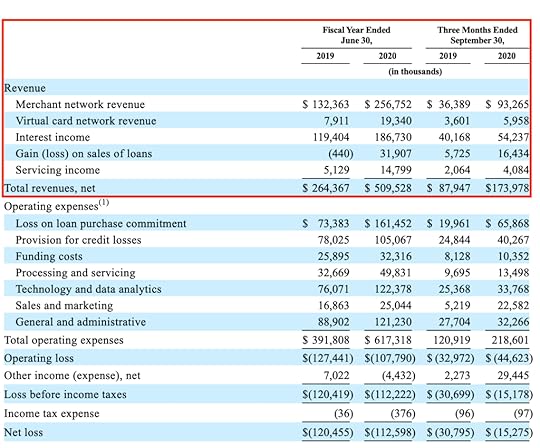

Affirm primarily makes money by collecting fees from merchants, and through the interests earned on consumers’ loans, when those are purchased from the originating bank (the bank to which the instalments are initially due by the consumer). Affirm also issues virtual cards to consumers through the app, thus making money as a portion of the interchange fee from the transaction.

Therefore the revenues can be broken down into:

Merchant network revenue collected as Affirm charges a fee on each transaction processed through the platform. In 2020, 50% of Affirm’s revenues came from the merchant network fees.Interest income earned on the loans purchased from the originating bank partner. In 2020, Affirm generated 37% of its revenue, from interest income. Virtual card network revenue for the creation of virtual debit cards used by customers at checkout which generated 4% of its total revenues in 2020.Gain (loss) on sales of loans as Affirm sells a portion of the loans purchased from the originating bank partner to third-party investors through its platform, which generated 6% of its total revenues in 2020.Servicing income for providing professional services to manage loan portfolios on behalf of Affirm’s third-party loan owners which made up 3% of its revenues in 2020.Cost structureOperating expenses primarily comprise commitment made to the originating bank partner, the provision for credit losses, funding costs, processing and servicing, technology and data analytics, sales, and marketing.

Cash Generation (or Cash Burning)Since its inception, Affirm accumulated a deficit of $462.4 million as of September 30, 2020, primarily financed through sales of equity, borrowings, and third-party loan sale arrangements.

Key Business Models HighlightsAffirm’s primary goal is to make loans and pay later solutions as transparent as possible in an industry driven by opaque gains and hidden fees. Affirm is a fintech platform entirely built on cloud infrastructure pay-later solutions to consumers at checkout and a set of other applications for both merchants and consumers. Affirm technology is based on a mixture of proprietary applications and machine learning models which aim is both to predict the ability of consumers to repay their loans (as Affirm has no collateral for the purchased loan), for consumers to have the scoring of merchants’ trust and to offer a set of additional tools to merchants and consumers.The company primarily makes money through merchants’ fees as consumers opt in the Affirm’s pay-later solution. Affirm also earns interest when it buys back the consumer’s loan from the originating bank. Affirm leverages on flywheels come from data networks, merchant partnerships, and brand recognition at the consumer level to scale up its operations.Read Next: IaaS, PaaS, SaaS, Enterprise AI Business Model, Cloud Business Models.

Read Next:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Affirm Fintech Payment Platform Business Model appeared first on FourWeekMBA.

January 11, 2021

Bimodal Portfolio Management And Why It Matters For Your Business

Bimodal Portfolio Management (BimodalPfM) helps an organization manage both agile and traditional portfolios concurrently. Bimodal Portfolio Management – sometimes referred to as bimodal development – was coined by research and advisory company Gartner. The firm argued that many agile organizations still needed to run some aspects of their operations using traditional delivery models.

Understanding Bimodal Portfolio ManagementHere, Gartner notes that “marrying a more predictable evolution of products and technologies (Mode 1) with the new and innovative (Mode 2) is the essence of an enterprise bimodal capability.”

Put differently, the enterprise does not need to choose solely between an agile approach or a traditional waterfall methodology. Both can be used interchangeably to achieve agility and stability, allowing businesses to successfully expand agile practices into other operations.

Bimodal Portfolio management principlesBimodalPfM combines principles from several existing approaches including DA, SAFe, and SfPfM.

Here are some of the more pertinent principles:

Senior management commitment. Upper management must champion the value of BimodalPfM by backing up their words with actions and not delegating their obligations to others.Alignment of governance, customer, and strategy. Active involvement of key stakeholders is encouraged, but portfolio governance must remain aligned with the wider organizational structure. Simplicity. The larger or more complex the project, the higher the chance that it will fail. Businesses should use the iterative and incremental nature of agile principles to their advantage.Flexibility. To continuously re-evaluate opportunities, decision-makers should implement a rolling wave over an annual plan. Too many organizations create an annual plan in the knowledge that major changes are likely to render it obsolete. Agility in this area reduces costs associated with delays, losses, and plan revisions.Five key components of Bimodal Portfolio ManagementWhile BimodalPfM is an effective strategy, many advocates concede that the bimodal approach can create obstacles to delivery speed.

However, these obstacles can be overcome by considering five key elements:

Dependency management. If a team with the right to prioritize its own work is dependent on others for an outcome, a dependency management strategy should be created to reduce delays. Work and delivery teams. How do teams engage with other teams across delivery methods to achieve desired outcomes? Is the process efficient? Saving time here means that teams clearly and concisely articulate the terms of engagement.Culture. In the context of BimodalPfM, culture means that staff have respect for alternative delivery models – regardless of whether they are agile or traditional. There should be more of a focus on practicality and less debate on which method is superior.Funding. Before beginning, it’s important to clarify funding agreements for work that is being shared by both models. Recognize that Project Funding and Capacity Funding are different models and as a result, require different decisions.Decision making. Agile methodologies favor de-centralized decision making which invariably challenges the centralized governance structure common in many organizations. To increase decision-making speed, it is once again important to clarify the most effective model beforehand. Furthermore, businesses should always remember that it is in their best interests to make fast and accurate decisions.Key takeawaysBimodal Portfolio Management allows a business to de-risk agile change management initiatives by utilizing a mix of agile and traditional methodologies.Bimodal Portfolio Management borrows concepts from many other agile frameworks. Primarily, BimodalPfM works best when there is complete buy-in from upper management and alignment of governance, customer, and strategy. During implementation, Bimodal Portfolio Management can create delivery speed issues. Some of these issues can be overcome by determining whether agile or traditional approaches are best suited to a particular context.Read Next: Business Analysis, Competitor Analysis, Continuous Innovation, Agile Methodology, Lean Startup, Business Model Innovation, Project Management.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post Bimodal Portfolio Management And Why It Matters For Your Business appeared first on FourWeekMBA.