J. Bradford DeLong's Blog, page 430

November 20, 2017

Monday Smackdown: Republican Whoppers on Tax "Reform" from Politicians, Non-Technocrats, and Technocrats Edition...

How did we get here?

First, where are we?

Matthew Yglesias: If the GOP tax plan is so good, why do they lie so much about it?: "Democratic programs may or may not be... good idea[s], [but] the bills they write that they say will expand the provision of social services in the United States really do expand the provision of social services...

...Not so... with the Republican plan....

Trump ran on promising a middle-class tax cut.... At the beginning of the month, Trump was on the same page, saying.... Treasury Secretary Steve Mnuchin made an unambiguous promise that there would be ���no absolute tax cut for the upper class���.... Trump went so far as to phone up a group of Senate Democrats to tell them, ���My accountant called me and said, 'You're going to get killed in this bill.������ This is all a bunch of lies.... Rather than own up to the reversal and defend it on the merits, Trump���s team is now engaging in bizarre deflections....

A telling thing about the cavalcade of lies Republicans are telling about taxes is the party can���t quite get its story straight as to what the policy agenda even is here. They are telling deficit hawks that the bill is fiscally responsible... revenue-neutral in the long term. They're telling others that... PAYGO... will be suspended, and the bill won���t really lead to the automatic cuts in Medicare and other programs that, by law, will result from its passage. They���re telling some people the middle-class tax hikes written into the Senate bill will never be enacted... the opposite of what they���re telling deficit hawks. So then some Republicans are telling some deficit hawks that the follow-up to the tax bill will be a return to entitlement reform....

The good news���if you���re inclined to see it as good news���is that Trump is a huge liar, so you can always hope it���s someone other than you who���s going to get betrayed...

I guess we are allowed to use the "lie" word now, are we not?

As to how we got here, let me turn the microphone over to Fritz Hollings:

Senator Howard Baker, the majority leader, sat right down there at that first desk and he shrugged his shoulders and said: "This is a riverboat gamble..."

The thing about a "riverboat gamble", is that if it goes wrong, you tell your counterparty that you need to get the money from your room, and then you jump overboard in the dark and swim to shore.

The time was 1981. Howard Baker was then characterizing the 1981 Reagan tax cut that he was shepherding through the Senate.

It worked���in a "riverboat gamble" sense. As a policy, it was a disaster: no acceleration of economic growth, a significant increase in wealth inequality and degradation of opportunity, and the first of the dollar cycles that devastated America's manufacturing market share. But the Republican Party was able to swim to shore, collect campaign donations and win seats, and leave the Democrats to pilot the riverboat through the snags.

Ever since, that has been the strategy of the Republican Party: make riverboat gambles. Tell bigger and bigger whoppers about them until they get called to account by the media and by the electorate���and then, with the post-2010 gerrymander and rise of Fox News, by that not general election but primary electorate.

If America is going to remain great, they will have to be called to account. And the only bright future for America is one in which the Republican Party is now on the same slow-motion track to long-term electoral defeat that then-governor Pete Wilson set the California state Republican Party on back two decades ago.

But, in the meantime, here we are, in the cycle of bigger and bigger whoppers. This serves as a good example:

Scott Lemieux: "I Am Sick And Tired Of People Saying That Utah Does Not Share A Border With Belgium": "At the Senate Finance Committee...

...Sherrod Brown said some indisputably true things about the Republican plan to increase taxes on many non-affluent people to massively cut taxes for the extremely affluent:

I think it would be nice just tonight to just acknowledge that this tax cut is really not for the middle class; it���s for the rich. And that whole thing about higher wages, well, it���s a good selling point, but we know companies don���t just give higher wages���they don���t just give away higher wages just because they have more money. Corporations are sitting on a lot of money. They are sitting on a lot of profits now���I don���t see wages going up...

In response, Orrin Hatch said something indisputably irrelevant:

I come from the poor people, and I have been here working my whole stinking career for people who don���t have a chance, and I really resent anybody who says I���m just doing this for the rich���give me a break. Listen I have honored you by allowing you to spout off here, and what you���ve said is not right���. I come from the lower middle class originally. We didn���t have anything, so don���t spew that stuff on me. I get a little tired of crap...

It���s worth watching the video at the link; the pitch of furious indignation Hatch works himself into because someone pointed out that a tax cut for the rich is a tax cut for the rich is striking. And note that he does not say anything substantive about the bill, because he can���t���he talks about his background. I believe this is what we call a tell. No matter how much spittle Hatch emits, it doesn���t change the fact that he���s trying to ram a massive tax cut for the rich paid for on the backs of the poor through Congress...

Are there any economists out there saying that this is, policywise, a good idea? If there are economists of note and reputation who are taking the plunge, the natural place to find them is among the former Republican CEA chairs. So let's take a look:

On the side of reality, we have Alan Greenspan and Greg Mankiw:

Alan Greenspan: "Economically, it's a mistake to deal with sharp reductions in taxes now. We are premature on fiscal expansion, whether it's tax cuts or expenditure increases. We've got to get the debt stabilized before we can even think in those terms..." (Nov 10)

Greg Mankiw: "The business tax plan being promoted by President Trump, and its close cousin released by House leadership this week, start with a good idea but then descend into an unworkable mess. Fortunately, the flaws can be fixed, if policymakers are willing to be bold.... O.K., O.K., I know that I have now come a long way from the Trump plan. And I know that, given the dysfunction in Washington, what I am proposing is a political nonstarter right now..." (Nov 3)

On the side of silence, we have Ben Bernanke, Harvey Rosen, and Michael Boskin...

On Team Riverboat Gambler, we have Eddie Lazear, Glenn Hubbard, and Martin Feldstein:

Eddie Lazear: "Will it boost the economy enough to cover most of the revenue cost? And will it help the middle class? The answer to both questions is yes, although some key changes can make achieving these goals likelier..." (Oct 16)

Glenn Hubbard: "Economists��� technical fouls of each other on the tax basketball court make good copy. But a hole-in-one of the wage increase the CEA report describes is what should grab the attention of congressional tax writers..." (Nov 6)

Martin Feldstein: "I have long been a deficit hawk.... An extra 1.5 trillion dollars of debt.... But I believe the advantages of corporate tax reform outweigh the adverse effects of the relatively small debt increase... raise the capital stock by 5 trillion dollars within a decade, causing annual national income to rise by 500 billion dollars..." (Nov 5)

There are, I believe, three important errors in Feldstein.

First, he says "causing annual national income to rise..." But that is wrong. The right phrase, in his analytical framework, is "causing annual domestic product to rise..." The difference is that a lot of the increase in domestic product he counts on from increased investment is not an increase in the income of Americans, is not an increase in national income. My first reaction was that half of it is an increase in the incomes of foreigners. Paul Krugman's second reaction was that two thirds of it is an increase in the incomes of foreigners. Long experience has taught me that, whenever I disagree with Paul, he is probably right.

If Paul is wrong, the effect of this first error is to lower the assessment of the boost to Americans' annual incomes from 500 billion to 170 billion dollars.

The second error is that Feldstein assumes that the tax cut on already built and installed capital is 100% a cut that flows out of the Treasury and into Americans' pockets. It doesn't. Steve Rosenthal estimates that 70 billion dollars of it flows into foreigners' pockets each year. The effect of this second error is to further lower the assessment of the boost from 170 down to 100 billion dollars a year.

The third error is that Feldstein's calculation assumes that the bill is deficit neutral, and thus that the 200 billion dollars a year in extra corporate retained earnings it produces is free to be devoted to increased corporate investment without countervailing factors. But, later on, he notes that the proposal involves "an extra 1.5 trillion dollars of debt" over the next decade. That is a subtraction from the funds available for investment. Remove that 10% return on the investment displaced from national income, and so we are down not to 170 billion dollars but to -50 billion dollars as the annual change in national income.

And, of course, not all of extra retained earnings will go to boosting investment. If we trust the CEO Council event that led to White House advisor Gary Cohn "ask[ing] sheepishly, 'Why aren���t the other hands up?'���, A bunch will go to stock buybacks. A bunch will go to cash hoards and acquisitions. Some will not flow into retained earnings at all but go to dividends. Those wealth flows will boost elite consumption, rather than investment.

We are definitely in minus territory for economic growth here. And we are definitely in minus territory even without noting that Feldstein's framework is already pretty far on the optimistic side as far as the economic benefits of low capital taxation are concerned. As Matthew Yglesias noted, you might get such a boost from:

a tax plan that was specifically designed to reduce taxation of new investments.... But most corporate profits are... the result of activities undertaken in the past.... A broad cut... is a windfall for what in tax policy jargon is called ���old capital,��� as well as for monopoly and quasi-monopoly rents and various other things that have nothing to do with incentivizing new investment...

And if we do note that a corporate tax cut is badly targeted���and a passive passthrough even worse targeted���as an investment incentive, we are in very negative territory as far as likely effects on economic growth are concerned.

And Feldstein's arguments are the only game in town for supporters of the Trumpublican plans. Lazear, Hubbard, the Tax Foundation where Greg Leiserson has been correcting their modeling are all basically Feldstein with or without various bells and whistles.

Two of eight calling it a "mistake" and an "unworkable mess" is great. Three being quiet is OK���but, Harvey and Mike, ex-CEA chairs do not have the privilege of being silent on important policy questions and, Ben, although perhaps it would be better if ex-Fed chairs were to restrict their comments to monetary and financial policy, there is no such rule in operation.

But three offering support, even qualified support, is disappointing. I realize it is asking a lot to ask people who have spent their lives playing for Team Republican to cross the aisle���especially since they (rightly) believe that their principal societal value as is moderating technocratic voices within the Republican Party's internal discussions, and they fear (rightly) that they put that at risk by failing to support the Republican Party's legislative priorities. Marty gets a pass for having been very brave in stressing the dangers of the riverboat gambles in the early 1980s.

But may I please ask Glenn and Eddie to come over to the side of technocracy here?

Must-Read: Matthew Yglesias: If the GOP tax plan is so go...

Must-Read: Matthew Yglesias: If the GOP tax plan is so good, why do they lie so much about it?: "Democratic programs may or may not be... good idea[s], [but] the bills they write that they say will expand the provision of social services in the United States really do expand the provision of social services...

...Not so... with the Republican plan.... Trump ran on promising a middle-class tax cut.... At the beginning of the month, Trump was on the same page, saying.... Treasury Secretary Steve Mnuchin made an unambiguous promise that there would be ���no absolute tax cut for the upper class���.... Trump went so far as to phone up a group of Senate Democrats to tell them, ���My accountant called me and said, 'You're going to get killed in this bill.������ This is all a bunch of lies.... Rather than own up to the reversal and defend it on the merits, Trump���s team is now engaging in bizarre deflections....

A telling thing about the cavalcade of lies Republicans are telling about taxes is the party can���t quite get its story straight as to what the policy agenda even is here. They are telling deficit hawks that the bill is fiscally responsible... revenue-neutral in the long term. They're telling others that... PAYGO... will be suspended, and the bill won���t really lead to the automatic cuts in Medicare and other programs that, by law, will result from its passage. They���re telling some people the middle-class tax hikes written into the Senate bill will never be enacted... the opposite of what they���re telling deficit hawks. So then some Republicans are telling some deficit hawks that the follow-up to the tax bill will be a return to entitlement reform....

The good news���if you���re inclined to see it as good news���is that Trump is a huge liar, so you can always hope it���s someone other than you who���s going to get betrayed...

Comment of the Day: Joe B: Six Faces of Right-Wing Chain-...

Comment of the Day: Joe B: Six Faces of Right-Wing Chain-Forging Economist James Buchanan...: "It seems to me that you need to provide some concrete examples of being "struck by the contrast". Where in the text, exactly, do Farrell and Teles bend over backward to be fair to Buchanan and unfair to MacLean?..."

Fair question...

Let's look at: Henry Farrell and Steven Teles: When Politics Drives Scholarship...

Let's go to paragraph six, in its entirety:

MacLean also has a tin ear for how libertarians and public choice economists actually think and argue. Reading the book provides the impression that MacLean is like an anthropologist trying to explain a culture that she has never encountered directly, even though it can be found a short distance from her own office building. Much of her evidence is correspondence with Buchanan���s donors, evidence that is inherently problematic on its own as a guide to underlying intent, as anyone who has ever communicated with a donor can confirm...

Actually, few academics lie to their donors. For one thing, it's wrong to lie. For another, lying to your donors is an easy way to get a reputation as, well, a liar���and with a community that you very much want to trust your bona fides. To claim that Buchanan simply did not mean what he wrote to Darden and Koch is definitely leaning far over backwards. Correspondence with donors is no more inherently problematic than any other evidence.

Farrell and Teles's claim at the top of the paragraph���that "MacLean... has a tin ear for how libertarians and public choice economists actually think and argue..." is, I think, more complicated to evaluate. I want to say: yes... and no. MacLean cites, as evidence of continuity between neoconfederacy���hell, pre-confederacy���and public choice, this:

Alexander Tabarrok and Tyler Cowen: The Public Choice Theory of John C. Calhoun: "'Who will join me in offering to make a small contribution to the Texas Nationalist Party? Or to the Nantucket Separatists?' James Buchanan [1987, 274]...

...Abstract: We treat John C. Calhoun as a precursor of modern public choice theory. Calhoun anticipates the doctrine of public choice contractarianism as developed by Buchanan and Tullock and expands this approach in original directions. We consider Calhoun's theory of why democracy fails to preserve liberty and Calhoun's suggested constitutional reform, rule by unanimity. We also draw out parallels between Calhoun and Hayek with regard to theories of social change and Hayek's analysis of "why the worst get to the top." The paper concludes with some remarks on problems in Calhoun's theory...

I believe that Farrell and Teles would say that MacLean miscites The Public Choice Theory of John C. Calhoun���that it is an explanation of Calhoun's "valid and interesting contributions" about how to use quasi-unanimity���"concurrent majorities"���to keep a stable majority from "oppressing" a stable minority, rather than a declaration of allegiance to the white supremicist cause, rather than a genuine declaration of intellectual allegiance and filialship.

The article does not contain the words "Black", "African", or "African-American" anywhere. It contains the word "slavery" in three places:

"The Jackson presidency, in particular, marked a turning point... a massive increase in Presidential power as illustrated by the Mayville Road veto...and Jackson's war against the Second Bank of the United States. Calhoun observed these events in conjunction with increases in government spending, employees, revenues raised through the tariff, a press funded and operated by the newly formed political parties. This growth in federal power would have been enough to disquiet Calhoun, but in addition Calhoun saw that the North and South were becoming increasingly separated over the issue of slavery..."

"A shift in political power to the large and rapidly growing North and an increasing feeling in the North that compromise over slavery was impossible. The Civil War would not have surprised Calhoun..."

"Calhoun furnishes only weak ethical foundations for his advocacy of the concurrent majority.... This lack of ethical foundations shows up in Calhoun's defense of slavery, which continues to hurt his reputation and draw attention from his more valid and interesting contributions. A modern revision of Calhounian political theory should consider a more consistent ethical base..."

I read this piece as Tyler and Alex engaged in epater le bourgeoisie. But the dog-whistle is definitely there: the vibe is definitely one of southern white oppression of Blacks much less important than the federal government as a threat to the property and liberty of southerners. This vibe is a standard part of how "libertarians and public choice economists actually think and argue". Is MacLean's the tin ear in hearing it? Or are Farrell and Teles's ears tin in failing to hear it? In paragraph 7 Farrell and Teles write that "MacLean���s account lacks what Clifford Geertz recognized as the essential cultural background to understand what a statement or document means in context". But too much "contextualization" leads to a study of fish that makes no mention of the water in which they swim.

On to paragraphs 8 and 9!:

MacLean, for example, is careful to note that there is no evidence that Buchanan was any more racist than other white Southerners of his generation. Still, she argues that the entire school of public choice emerged as a response to the Supreme Court���s decision in Brown. She claims that Buchanan looked at Brown as an example of coercion by Northern liberals who demanded the right to tell Southern whites how to run their society. For example, in analyzing a letter Buchanan sent to the president of UVA, requesting funds for a new center, MacLean extrapolates his words to give us her interpretation of his reasoning: he wanted to ���fight��� the Northern liberals who looked down on Southern whites like him, by ���us[ing] the center to create a new school of political economy and social philosophy.��� The center would have a ���quiet political agenda: to defeat the ���perverted form��� of liberalism that sought to destroy their way of life, ���a social order,��� as he described it, ���built on individual liberty,��� a term with its own coded meaning.���

The problem with MacLean���s claims about Buchanan���s underlying motivations���and Steinbaum���s gloss on them���is that they are her own interpolation rather than directly grounded in the source material she provides. MacLean does not back up her contention that the foundation of Buchanan���s entire school of public choice was motivated in his white Southern resentment of Yankee intervention with textual evidence. Instead, the reader has to rely on her belief that ���individual liberty��� had a coded meaning for Buchanan and the president whom he was writing to. This is a decidedly slender reed to support such a massive claim...

Are Farrell and Teles seriously claiming that, to an upper-class white pro-segregation (or, perhaps, anti-"involuntary"-integration) Virginian of the 1950s, a key part of one's "individual liberty" was the liberty to oppress African-Americans? Remember: in this decade Rand Paul claimed that he would have voted against the 1964 Civil Right Act because of its "pubic acommodation" title:

All persons shall be entitled to the full and equal enjoyment of the goods, services, facilities, privileges, advantages, and accommodations of any place of public accommodation, as defined in this section, without discrimination or segregation on the ground of race, color, religion, or national origin...

It's not a slender reed.

As I have said a number of times: I think MacLean gets a lot wrong. But to claim that "individual liberty" for Buchanan in the 1950s did not include at its core the right to do what you wanted with your property, and that the right to do what you wanted with your property included at its core the right to exclude Blacks from your lunch counter���well, as I said, hermeneutics of suspicion toward MacLean, hermeneutics of charity toward Buchanan.

Should-Read: Peter Lindert: The rise and future of progre...

Should-Read: Peter Lindert: The rise and future of progressive redistribution: "There has been a blossoming of research into fiscal incidence by income class...

...This column combines century-long histories for Britain and South American countries with previous research to offer a global history of government income redistribution. Contrary to some allegations, the shift towards progressivity in government budgets over the last 100 years has not been reversed since the 1970s. The rise in inequality since the 1970s therefore appears to owe nothing to a net shift government redistribution toward the rich...

November 19, 2017

Should-Read: Jo Mitchell: Dilettantes Shouldn���t G...

Should-Read: Jo Mitchell: Dilettantes Shouldn���t Get Excited: "The Freshwater version of the model concluded that all government policy has no effect and that any changes are driven by an unexplained residual...

...The more moderate Saltwater version, with added Calvo fairy, allowed a rediscovery of Milton Friedman���s main results: an expectations-augmented Phillips Curve and short-run demand effects from monetary policy. The model has two basic equations....

The first... aggregate demand... based on an... assumption about how households behave in response to changes in the rate of interest. Unfortunately, not only does the equation not fit the data, the sign of the main coefficient appears to be wrong. This is likely because, rather than trying to understand the emergent properties of many interacting agents, modellers took the short-cut of assuming that the one big person assumed to represent the economy would simply replicate the behaviour of a single textbook-rational individual���much like assuming that the behaviour of an ant colony would be the same as that of one big textbook ant. It���s hard to see how one can make an argument that this has advanced knowledge beyond what you could glean from a straightforward Keynesian or Modigliani consumption function....

[The second,] the Phillips Curve... appears to have once again broken down....

More complex versions of the model do exist, which purport to capture further stylised macro relationships beyond the standard pair. This is done, however, by adding extra degrees of freedom ��� justified as essentially arbitrary ���frictions��� ��� and ��and then over fitting the model to the data. The result is that the models are pretty good at ���predicting��� the data they are trained on, and hopeless at anything else.

30 years of DSGE research have produced exactly one empirically plausible result���the expectations-augmented Phillips Curve. It was already well known. There is an ironic twist here: the breakdown of the Phillips Curve in the 1970s gave the Freshwater economists their breakthrough. The breakdown of the Phillips Curve now���in the other direction���leaves DSGE with precisely zero verifiable achievements.

Christiano et al.���s paper is welcome in one respect. It confirms what macroeconomists at the top of the discipline think about those lower down the academic pecking order ��� particularly those who take a critical view. They have made public what many of us long suspected was said behind closed doors...

November 18, 2017

Greg Leiserson Has Been on Fire This Fall...

Attracting him a very great move by http://equitablegrowth.org, I must say...

Greg Leiserson has been killing it on tax policy this late summer and fall, most notably with The Tax Foundation���s score of the Tax Cuts and Jobs Act. But there is lots more good stuff as well:

Greg Leiserson (2017-11-09): The Tax Foundation���s score of the Tax Cuts and Jobs Act: "First, the Tax Foundation appears to incorrectly model the interaction between federal and state corporate income taxes, thus overstating the effect of statutory rate cuts. Second, the Tax Foundation appears to treat the estate tax as a nondeductible annual property tax paid by businesses, which results in inflated estimates of the effect of repealing the tax. Appropriately addressing the issues raised in this note could reduce the Tax Foundation���s estimate of the increase in GDP that would result from the legislation to 1.9 percent���a reduction of roughly half���even if there are no other issues with the Tax Foundation���s estimates...."

Equitable Growth (2017-11-10): Statement on status of Tax Foundation response to Equitable Growth critique: "The Tax Foundation has since acknowledged that the interaction between federal and state corporate income taxes in its model is incorrect and stated that the flaw will be addressed. Accordingly, the organization reduced its projected growth figure for the Tax Cuts and Jobs Act. We appreciate the Tax Foundation���s prompt attention to this issue. Leiserson has provided additional technical assistance to help with the changes to the model necessary to correct the problem..."

Equitable Growth (2017-11-06): Research on Tap: Promoting equitable growth through tax reform: "Jason Furman... Melissa Kearney... Greg Leiserson..."

Jason Furman and Greg Leiserson (2017-11-01: The real cost of the Republican tax cuts: "They���ll require spending cuts, or tax increases in other areas. Either could hurt many American families..."

Greg Leiserson (2017-10-19): The ���Unified Framework��� is a proposal for two new wasteful tax expenditures: "Judged against this true comprehensive income tax hypothetical, a sharply lower tax rate on corporate income would be appropriately viewed as a tax expenditure because the lower corporate rate would provide a preferential rate of tax for income earned by corporations compared to other sources of income such as wages..."

Greg Leiserson (2017-09-21): U.S. tax cuts for the rich won���t deliver gains for everyone: "In the special case of revenue-neutral reform���an ostensible target for current reform efforts in Congress���distribution tables capture the primary gains from increases in economic efficiency in their estimates of changes in after-tax income..."

Greg Leiserson (2017-09-21): Issue brief: If U.S. tax reform delivers equitable growth, a distribution table will show it: "Focusing on changes in economic output... ignores the potential for tax reform to have different impacts for people up and down the income ladder... overstates the economic gains from reform.... The greater risk in the coming months is not that distribution tables will understate the gains from tax reform, but rather that distribution tables will overstate the gains of reform and understate its regressivity if policymakers turn to tax cuts rather than tax reform and include a slate of temporary policies such as a one-time tax on overseas profits..."

Greg Leiserson (2017-09-14): Issue brief: What is the federal business-level tax on capital in the United States?: "Cutting the statutory tax rates on business income would do relatively little to encourage additional investment and thus have relatively little effect on growth, even before considering the effects of increased deficits resulting from the rate cuts or additional policies to offset that cost..."

Greg Leiserson (2017-08-17): In defense of the statutory U.S. corporate tax rate: "Fixation on the corporate tax rate is unfortunate and misguided. Business tax reform should be primarily about the tax base, not the tax rate. Treating the statutory rate as the key element of reform will inevitably result in a more expensive, more regressive, and less economically beneficial (if not actively harmful) reform than one that focuses on the tax base..."

Greg Leiserson (2017-06-15): It���s no surprise that the Kansas tax cut experiment failed to create jobs: "Claims of supply-side growth from tax cuts on business profits rely on the idea that... cutting statutory business tax rates would meaningfully reduce the effective tax rate on an incremental investment such that the tax cut causes businesses to increase investment... [and] the deficits resulting from the tax cuts would need to be small enough that they increase businesses��� cost of capital by less than the reduction resulting from the lower tax rate..."

Must-Read: I think Greg is right here: on their own terms...

Must-Read: I think Greg is right here: on their own terms the Tax Foundation's calculations look to be twice as big as they ought to be���and, as you know, everybody else involved has very large doubts about whether one should take the Tax Foundation's calculations as proper professional estimates:

Greg Leiserson: The Tax Foundation���s score of the Tax Cuts and Jobs Act: "First, the Tax Foundation appears to incorrectly model the interaction between federal and state corporate income taxes...

...Second, the Tax Foundation appears to treat the estate tax as a nondeductible annual property tax paid by businesses, which results in inflated estimates of the effect of repealing the tax. Appropriately addressing the issues raised in this note could reduce the Tax Foundation���s estimate of the increase in GDP that would result from the legislation to 1.9 percent���a reduction of roughly half���even if there are no other issues with the Tax Foundation���s estimates.... Critical assessment of the Tax Foundation���s analysis is particularly warranted, as some legislators have suggested that they might consider dynamic scores from organizations other than the nonpartisan Joint Committee on Taxation���the traditional source of nonpartisan estimates of congressional tax proposals���in determining the budgetary effects of the legislation.

This note does not attempt a complete assessment of the Tax Foundation model, which would be impossible without greater knowledge of the equations that make up the model. The criticisms raised in this analysis are based on inspection of publicly available estimates and documentation, as well as communication with Tax Foundation staff...

Must-Read: Brink Lindsey: Further thoughts on libertarian...

Must-Read: Brink Lindsey: Further thoughts on libertarian anti-democracy: "Further thoughts by Will on libertarian anti-democracy���s effect on the GOP...

...and a thread with a few thoughts of my own https://niskanencenter.org/blog/libertarian-origins-libertarian-influence-ruling-american-right/. In Will���s telling, libertarian property rights absolutism moralizes and thereby strengthens other sources of antipathy to democracy on the right. I think that���s right and important, but there���s another channel of influence I want to focus on. It goes like this: property rights absolutism -> ���taxation is theft��� -> tax-supported governments are illegitimate and indistinguishable from organized crime -> delegitimizing ���the state��� and exposing its criminality are therefore a necessary precondition for a truly free society.

Buying into this leads straight to ���the worse, the better��� nihilism. Anything that reduces public confidence in their rulers is a good thing. Declining trust in government (i.e., in democracy) is celebrated as a move in a libertarian direction.

Most self-described libertarians share this mindset to a substantial degree. Such thinking is most pronounced among anarchist libertarians���who, I believe, now dominate the libertarian rank and file thanks to the Ron Paul movement and the Mises Institute. When you think this way, you have no reason to defend the norms and institutions of liberal democracy, since they���re what���s standing between you and Libertopia. Getting policy right is all that matters, getting it the right way matters not at all. This kind of thinking badly compromises your intellectual defenses against authoritarian demagogues. If they get some important policies right, who cares if they���re trashing norms and institutions?

And if they���re corrupt, ignorant, incompetent thugs, well that���s OK���so much the better by revealing the true nature of the state!

Such thinking helps explain how so many libertarians and small-government conservatives ended up supporting or going along with Trump. In this channel, the key move is rejecting the liberal democratic state as illegitimate. Most libertarians get to this point via property rights absolutism, aka ���natural rights.��� But there are other routes. This clarifies why @bryan_caplan and Jason Brennan are what Will calls ���culturally libertarian��� even though they reject absolute prop rights. Both also reject the legitimacy of the state, which puts them in qualitatively different space from Hayekian classical liberals.

The Page Which All Discussion of the Trumpublican Tax... "Reform"? "Cut"? "Giveway"? Should Start from...

Information from the very sharp Eric Toder: The House Ways and Means Tax Bill Would Raise the National Debt to 123 percent of GDP by 2037: "The Tax Policy Center estimates that the House Ways and Means Committee���s version of the Tax Cut and Jobs Act (TCJA)...

...over the first decade... increases the deficit by 1.7 trillion dollars.... Between 2028 and 2037, the TCJA would reduce net receipts by 1.6 trillion dollars and add 920 billion dollars in additional interest costs. Over the entire 20-year period, the combination of reduced revenues and higher interest payments would raise the federal debt held by the public by 4.2 trillion dollars...

This is based on:

the baseline economic and budget estimates in the Congressional Budget Office���s (CBO) March, 2017 long-term and June, 2017 updated 10-year budget projections...

But, of course, if the Trumpublican plan is passed, the best forecast of how the economy would evolve would not be the baseline CBO spring 2017 projections, but would be different. How different, and in which direction?

The best way to explain what professional economists think is to follow turn-of-the-twentieth-century British economist Alfred Marshall and divided the analysis up into four "runs", each of which corresponds to a different forecast horizon, and in each of which the dominant economic factors at work are different. Call these the "short run", "medium run", "long run", and "very long run". And be aware that this separation is a heuristic device to aid in understanding. In the real world, all of the factors are operating all at once over time, so that even in the "short run" it is the case that "long run" factors will have a (small) influence. Moreover, the "runs" do not always come in sequence: sometimes the "long run" is right now.

With that caveat, the "runs" are:

The "short run", usually of zero to four years. In the short run, the economy is not or is not necessarily at "full employment". Production can be below or above the current value of its sustainable productive potential, and changes in policy can either kick spending down (in which case production falls, unemployment rises, and inflation slows), or kick spending up (in which case production rises, unemployment falls, and inflation speeds up). Over the short run these effects of policy changes on the level of production, employment, and inflation are the dominant impacts.

The "medium run", usually of one to fifteen years, in which price levels and standard policy reactions have had time to adjust and so match production to the economy's sustainable potential and match inflation to its generally-expected value, but in which there has not yet been time for stocks of productive resources to substantially adjust to policies. Over this medium run, the dominant effects of policy changes are on the division of production and spending between consumption, investment, government purchases, and net exports, plus the concomitant effect of those shifts in the distribution of production on the medium-run rate of economic growth.

The "long run", typically of ten to thirty years, in which stocks of productive resources have adjusted to changed incentives. Price levels and standard policy reactions have adjusted and matched production to potential and inflation to expectations. Adjustment has taken place so that government budget and international balance conditions are no longer out of whack with unsustainable deficits or surpluses. Shifts in the distribution of production have raised or lowered relative resource stocks so that they are no longer changing relative to the economy. s a result, in the long run the value of the economy���s productive potential has jumped up or down relative to its previous baseline growth path.

The "very long run", in which demographic and technological change factors that determine not jumps up or down in the level of sustainable productive capacity but rather the evolution of the economy over generations.

What are the likely effects of the Trumpublican plan, if implemented, in these four "runs"?

First, there is no short run argument that the bigger government deficits produced by Trumpublican plan will boost the economy. In order for a plan that increases deficits to boost the economy, three things would have to all be true:

The larger deficits must either generate more purchases of goods and services directly���by the government buying more stuff���or get more purchasing power into the hands of people who have a high propensity to spend extra cash because they feel short of cash. The Trumpublican plan gets many into the hands of the rich, who do not feel short of cash.

Production in the economy must be low relative to sustainable potential, so that extra spending actually does put workers without jobs to work in factories currency standing idle. Right now it looks as though the economy is close to if not at its sustainable potential���but there is an ongoing debate about that.

The Federal Reserve must believe that production in the economy is low relative to sustainable potential. It must, then, be willing to cry "Havoc!", and let slip the dogs of a higher-pressure economy. Right now the Federal Reserve is certain that the economy is very near to if not at "full employment", and will respond quickly and thoroughly by raising interest rates in order to keep spending on the path it currently envisions.

All of (1), (2), and (3) would have to be true together for there to be a correct argument that the Trumpublican plan would boost economic growth in the short run. (1) and (3) are certainly false. (2) is probably false.

We can, in this case, neglect the short run analysis. It is not there in this case.

Nevertheless, if it were there���if (1), (2), and (3) were true or were to become true���a tax cut would boost production. This short-run argument is completely standard. I see it, for example, on page 319 of my copy of N. Gregory Mankiw: Macroeconomics (9th edition) http://amzn.to/2zelfc2:

Second, the medium run argument is that the Trumpublican tax ct for the rich will not boost but rather be a drag on the economy. It raises the budget deficit by about 0.7% of GDP. That means that private savings that would have gone to finance private investment spending are diverted to the government instead. That deficit increase shifts about 0.5%-points of production out of investment spending, decreases net exports by about 0.2%-points of production, and raises consumption���elite, upper-class consumption, for the rich are the ones to whom the money is flowing���by 0.7%-points of production.

This medium-run argument is completely standard. I see it, for example, on page 74 of my copy of N. Gregory Mankiw: Macroeconomics (9th edition) http://amzn.to/2zelfc2:

The 0.5%-point fall in investment in America will slow economic growth by about 0.05%-point per year: we would lose 10 billion dollars a year of economic growth each year over the next ten years. That would leave real production in a decade some 100 billion dollars a year less���about 1000 dollars a year less per family���than in the baseline forecast. In an economy current currently producing 20 trillion dollars worth of goods and services a year, that would not not an economy-shattering deal. But 1000 dollars a year less in income per family���0.5% lower real production in a decade���would hurt: it would be a poke in the eye with a sharp stick.

Third, the long run argument is that the Trumpublican plan could boost the economy by inducing more investment. It cuts taxes on profits from passive investments, making investing in them more, well, profitable. Thus money should flow in, and some of that money will be used to build buildings and install machines to make workers more productive. This could happen: the right assessment of this argument is "it depends". For one thing, in the long run the plan is simply one part of the change in the economy and in incentives that the Trumpublican plan will set in motion. The government budget must add up properly in the long run, and so in any long run analysis the tax cuts for the rich must be balanced either now or in the future by spending cuts or tax increases for the non-rich, and those would have their own effects on incentives and thus on productivity. For another thing, who would the increased profits flow to, and who would benefit from increased productivity?

It is possible to roughly and approximately sketch out this long run argument in another standard framework, set out by Paul Krugman in Leprechaun Economics, With Numbers. Assume that we start with an economy with (as the U.S. economy has) 150 million workers, producing 20 trillion dollars of national income each year with the assistance of 80 trillion dollars of capital. Assume further that the pre-corporate-tax rate of return on capital is some 10.0% per year. With a corporate tax rate of 35%, that would give us an after-tax rate of return on capital of 6.5% per year.

Now cut the corporate tax rate to 20%. That would give us an after-tax rate of return on capital of 8% per year if investment and thus the capital stock were to not rise in response to this increase in profitability. But in the long run investment and the capital stock would rise. By how much? Three considerations appear dominant:

Domestic savings are simply not responsive to rates of return. Lots of economists have looked at the question, hoping to find that increases in profitability call forth increases in domestic savings and thus in investment. They haven't found much.

The U.S. is a huge chunk of the world economy. Figure that changes in after-tax rates of return in the United States drag the required rate of return in the rest of the world up or down in its wake by about 1/3 as much.

International capital does chase higher rates of return. But investors in other countries have a limited desire to commit their wealth far away: there is "home bias". Figure that half of the gap between changes in rest-of-the-world and U.S. returns is closed by international flows of investment.

Take these three considerations into account, and figure that in the long run the after-tax rate of return would fall by about 1/3 of the initial gap between the 6.5% rate before the tax cut and the 8.0% rate after the tax cut. So foreign investment would flow into the United States and push up the capital stock and productivity until the after-tax rate of return were 7.5%���which means that in the long run the pre-tax rate of return on capital would fall to 9.3% from 10%, a proportional decline of 1/14.

As a rule of thumb, to reduce the rate of return on capital by 1/14 requires an increase in the capital stock of 1/14. But only about half total valued capital is machines and buildings: the rest is market power and market position, intellectual property, and other economic quasi-rents. With 40 trillion dollars of machines and buildings, a 1/14 increase is about 3 trillion additional dollars worth of investment and capital.

That extra 3 trillion of capital would boost total annual production by about 300 billion dollars. Of that 300 billion dollars, 225 billion would flow to the foreigners who provided the investment, leaving a 75 billion dollar boost to Americans' national income���an 0.35% boost. I would be inclined to then double that number: there are valuable benefits to having more investment and more capital, as workers successfully bargain for a share of economic rents created and as more investment strengthens and makes more productive our communities of engineering practice. If I were working for the CEA or the Treasury, I would be comfortable claiming an 0.7% boost in the long run to national income from this tax cut as long as the other changes in policy that made the government's accounts add up were something (like, say, a carbon tax) that did not impose their own drag on economic growth and well-being (as, say, spending cuts would.

But the medium run effects would still be there in the long run. We would thus have a -0.5% from the medium run; an +0.7% from the long run; and whatever costs would be imposed on the economy by government-budget-adding-up. That looks like a wash to me.

And, fourth, the very long run effects? Those are highly speculative: nobody is confident that they have the right approach to modeling those. I tend to be on the side of those who believe that making the American distribution of income more unequal is harmful to entrepreneurship, enterprise, and growth. A richer superrich are a more politically powerful superrich. Economic growth comes from creative destruction. And in creative destruction it is the current superrich who are creatively destroyed���and thus they use their power and influence to try to block beneficial change. But such arguments are not ones you can take home.

That is the economic analysis of the Trumpublican plan, in basic and approximate form. Everybody serious and professional who is doing an analysis winds up with these pieces:

A short run near-zero negligible effect.

A medium run drag on the economy from higher deficits the cumulates to around 0.5% of national income.

A possible���but far from certain and maybe not even likely���boost to national income (if there is no drag from the other, currently unspecified policy shifts that arrive with the Trumpublican plan in the long run) of about the same magnitude.

Very long run effects that we do not have a handle on.

If anyone tries to sell you estimates of the impact that differ very much���by orders of magnitude���from those I have just given above, there is something wrong with their model and their analysis. Politely, it is "non-standard". Impolitely...

Plus, of course: it would be a tax cut for the rich���and by the fact that things add up, a tax increase on and a reduction in useful government services flowing to the nonrich. How big would these effects be? We have estimates from the Center on Budget and Policy Priorities:

Chye-Ching Huang, Guillermo Herrera, and Brendan Duke: The Bill���s Impact in 2027: "By 2027... the JCT tables show...

...The highest-income groups would still get the largest tax cuts as a share of after-tax income. Millionaires, for example, would see a 0.6 percent ($16,810) increase... the bill���s permanent corporate tax cuts would primarily flow to wealthy investors and highly paid CEOs and other executives.

Every income group below 75,000 dollars would face tax increases, on average. For example, households between 40,000 and 50,000 dollars would see a 0.6 percent (310 dollar) decline in their after-tax incomes. Many millions more families would face a tax increase in 2027 than in 2025 due to the expiration of such provisions as the increases in the Child Tax Credit and standard deduction. Further, the effect of the chained CPI would grow over time as it would fall further and further behind the tax code���s current measure of inflation...

And the CBPP has a very good track record on these matters.

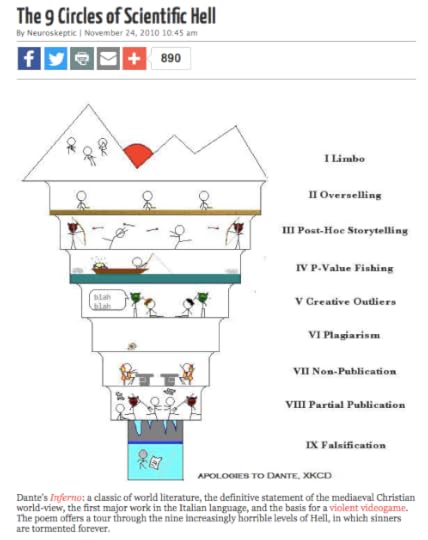

Weekend Reading: The 9 Circles of Scientific Hell

Neuroskeptic (2010): The 9 Circles of Scientific Hell: "Dante���s Inferno: a classic of world literature, the definitive statement of the mediaeval Christian world-view, the first major work in the Italian language, and the basis for a violent videogame...

...The poem offers a tour through the nine increasingly horrible levels of Hell, in which sinners are tormented forever.

But Dante lived before the era of modern science. I thought I���d update his scheme to explain what happens to those guilty of various scientific sins, ranging from the commonplace to the shocking.

Bear in mind that Dante���s Hell had a place for everyone, and it was only Christ���s intervention that saved anyone from it; even ���good��� people went to Hell because everyone sins. But they are still sins. Likewise, very few scientists (and I���m certainly not one of them) would be able to avoid being condemned to some level of this Inferno��� but, that���s no excuse.

First Circle: Limbo: ���The uppermost circle is not a place of punishment, so much as regret. Those who have committed no scientific sins as such, but who turned a blind eye to it, and encouraged it by their awarding of grants and publications, spend eternity on top of this barren mountain, watching the carnage below and reflecting on how they are partially responsible������

Second Circle: Overselling: ���This circle is reserved for those who exaggerated the importantance of their work in order to get grants or write better papers. Sinners are trapped in a huge pit, neck-deep in horrible sludge. Each sinner is provided with the single rung of a ladder, labelled ���The Way Out���Scientists Crack Problem of Second Circle of Hell���

Third Circle: Post-Hoc Storytelling: ���Sinners condemned to this circle must constantly dodge the attacks of demons armed with bows and arrows, firing more or less at random. Every time someone is hit in some part of their body, the demon proceeds to explain at enormous length how they were aiming for that exact spot all along.���

Fourth Circle: P-Value Fishing: ���Those who tried every statistical test in the book until they got a p value less than 0.05 find themselves here, an enormous lake of murky water. Sinners sit on boats and must fish for their food. Fortunately, they have a huge selection of different fishing rods and nets (brandnames include Bayes, Student, Spearman and many more). Unfortunately, only one in 20 fish are edible, so they are constantly hungry.���

Fifth Circle: Creative Use of Outliers: ���Those who ���cleaned up��� their results by excluding inconvenient data-points are condemned here. Demons pluck out their hairs one by one, every time explaining that they are better off without that hair because there was something wrong with it.���

Sixth Circle: Plagiarism: ���This circle is entirely empty because as soon as a sinner arrives, a winged demon carries them to another circle and forces them to suffer the punishment meted out to the people there. After their 3 year ���post��� is up, they are carried to another circle, and so on������

Seventh Circle: Non-Publication of Data: ���Here sinners are chained to burning chairs in front of desks covered with broken typewriters. Only if they can write an article describing their predicament, will they be set free. Each desk has a file-drawer stuffed full of these, but the drawers are locked.

Eighth Circle: Partial Publication of Data: ���At any one time exactly half of the sinners here are chased around by demons prodding them with spears. The demons choose who to chase at random after ensuring that the groups are matched for age, gender, height and weight. Howling desert winds blow a constant torrent of articles announcing the success of a new program to enhance participation in physical exercise ��� but with no mention of the side effects.���

Ninth Circle: Inventing Data: ���Here Satan himself lies trapped forever in a block of solid ice alongside the worst sinners of all. Frozen in front of their eyes is a paper explaining very convincingly that water cannot freeze in the environmental conditions of this part of Hell. Unfortunately, the data were made up.���

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers