J. Bradford DeLong's Blog, page 423

December 3, 2017

Ken Calvert: Republican House Member Voting to Make His District and Constituents Poorer

**KEN CALVERT**

District 42: Inland Empire: Corona���West Riverside

R+09: Safeness of Seat

42%: Percent of Returns

6.9%: Percent of AGI

$1.28 billion SALT in 2014

304,000 tax returns in 2014

$18.545 billion AGI in 2014

$1.2819 billion deduction amount in 2014

35.1%: Income $200K/year

42% of tax returns in Ken Calvert's 42nd California Congressional District in 2014 would have been penalized had state and local tax payments been added into the federal income tax base. The total increase in the tax base in 2014 would have been 1.28 billion dollars. We do not have sufficient detail to produce a precise estimate of how much taxes would have gone up���the Trump administration could, if it wanted to���but the rough ballpark number is 300 million: the Republican tax bill will, if enacted, take 300 million dollars a year out of the incomes and spending of Mimi Walters's constituents.

As a rich suburban district in Greater Los Angeles, the 42nd contains a slice of people who are possible beneficiaries from the tax bill: 5.0% of returns in 2014 reported adjusted gross incomes greater than 200,000 dollars a year. But by the same token that was less than one-seventh of the number of returns that itemized SALT.

The 42nd is a safe Republican district. While the highly enterprising and prosperous traditionally-Republican California upper middle class's concerns are not the Republican Party's core concerns any more, and hence the Republican Party's traditional base has been leaking away, the Republican Party continues to win victories even though���or is it because?���one-third of the district is now Hispanic. The 42nd was one of the districts most strongly damaged by the foreclosure crisis of 2007-9.

Calvert has served in Congress for 26 years now. He has been a long-time reliable supporter of Republican leadership, a member of the Steering Committee, and an Appropriations Committee subcommittee chairs. Appropriations subcommittee chairs rarely return to their districts: they are lobbyists-in-training.

Calvert's district is one of those in which the Republican Party's new base of plutocrats seeking money and activists seeking validation of ethnocultural grievances works well. He is under little threat. And for him it appears that the game is to entrench his future place in the lobbyists' mecca of K-Street rather than representingconstituents, district, and California.

(Assuming, of course, there has not been a programming mistake in moving from zipcode-level IRS Statistics of Income to Congressional District level. Programming mistakes are easy to make.)

Steve Knight: Republican House Member Voting to Make His District and Constituents Poorer

**STEVE KNIGHT**

District 25: Antelope Valley: Northeast Los Angeles

Suburbs and Exurbs

Even: Safeness of Seat

42%: Percent of Returns

7.4%: Percent of AGI

$1.49 billion SALT in 2014

304,000 tax returns in 2014

$20.131 billion AGI in 2014

$1.4947 billion deduction amount in 2014

36.6%: Income $200K/year

42% of tax returns in Steve Knight's 25th California Congressional District in 2014 would have been penalized had state and local tax payments been added into the federal income tax base. The total increase in the tax base in 2014 would have been 1.49 billion dollars. We do not have sufficient detail to produce a precise estimate of how much taxes would have gone up���the Trump administration could, if it wanted to���but the rough ballpark number is 375 million: the Republican tax bill will, if enacted, take 375 million dollars a year out of the incomes and spending of Steve Knight's constituents.

As a prosperous suburban district in Greater Los Angeles, the 25th contains a substantial slice of people who are possible beneficiaries from the tax bill: 8.0% of returns in 2014 reported adjusted gross incomes greater than 200,000 dollars a year. But by the same token that was less than one-fifth of the number of returns that itemized SALT.

The 25th is now a competitive district. The highly enterprising and prosperous traditionally-Republican California upper middle class's concerns are not the Republican Party's core concerns any more. Steve Knight is part of the "adjustment": he was one of three Confederate flag-waivers when he was in the California state senate, and he has been feeding the new base the red meat on immigration and gun safety���a political position that works reasonably well elsewhere in the country, but not so much in California, especially in a district with shifting demography.

Knight is only in his third term in the House of Representatives. He does have deep roots in the district: Born in Palmdale and an 18 year veteran of the Los Angeles Police Department. His vote for the tax bill is perhaps the greatest surprise: too new in Washington to have put down serious roots in the lobbyist community, and in too vulnerable a seat for it to be prudent for him to do politically-risky favors for House leadership without extracting something of substantial value for his state, his district, and his constituents in return.

(Assuming, of course, there has not been a programming mistake in moving from zipcode-level IRS Statistics of Income to Congressional District level. Programming mistakes are easy to make.)

December 2, 2017

Must-Read: Adam Elga: Defeating Dr. Evil with Self-Locati...

Must-Read: Adam Elga: Defeating Dr. Evil with Self-Locating Belief: "Safe in an impregnable battlestation on the moon, Dr. Evil had planned to launch a bomb that would destroy the Earth...

...In response, the Philosophy Defense Force (PDF) sent Dr. Evil the following message:

Dear Sir,

(Forgive the impersonal nature of this communication���our purpose prevents us from addressing you by name.) We have just created a duplicate of Dr. Evil. The duplicate���call him ���Dup������is inhabiting a replica of Dr. Evil���s battlestation that we have installed in our skepticism lab. At each moment Dup has experiences indistinguishable from those of Dr. Evil. For example, at this moment both Dr. Evil and Dup are reading this message.

We are in control of Dup���s environment. If in the next ten minutes Dup performs actions that correspond to deactivating the battlestation and surrendering, we will treat him well. Otherwise we will torture him.

Best regards, The PDF

Dr. Evil knows that the PDF never issues false or misleading messages. Should he surrender? Whether Dr. Evil ought to surrender depends on whether he ought to remain certain that he is Dr. Evil once he reads the message.... I will argue that only the first of the two lines of reasoning is correct, and that after Dr. Evil receives the message he ought to have exactly the same degree of belief that he is Dr. Evil as that he is Dup.... Dr. Evil ought to surrender to avoid the risk of torture...

Should-Read: Why are the Tax Foundation's numbers so much...

Should-Read: Why are the Tax Foundation's numbers so much different than everybody else's? And why do I now classify their model as "unprofessional"? Because the U.S. is not a "small open economy with perfect capital mobility" and because the neoclassical long run takes much more than 30 years to arrive. Here we have a good, short explainer: Matt O'Brien: Republicans are looking for proof their tax cuts will pay for themselves. They won���t find it: "The Tax Foundation... starts from the premise that the United States isn't a big open economy like it actually is, but rather a small open one like Ireland...

...How does that change things?... Corporate tax cuts would make foreign investors send mountains of money into the country until, very quickly, the only investments left were ones that offered the same after-tax return as everywhere else in the world. On top of that, it doesn't think tax cuts could ever be bad for growth by leading to, say, higher debt or higher interest rates from the Fed.... Even then, it's hard to figure how it gets its numbers. ���I've always been puzzled by their model,��� Kent Smetters, a former Bush economist who is now the director of the Penn Wharton Budget Model, told me, ���but there aren't enough details for me to understand it.���... Greg Leiserson... has pointed out... the Tax Foundation made a number of mistakes, one of which it's since corrected.

But there's also what seems to be a more fundamental problem: The foundation seems to be assuming things that shouldn't be assumed together.... The estate tax. The Tax Foundation thinks getting rid of it would help quite a bit... 0.7 percentage points of the 3.5 points of extra growth.... You can say taxing uber-wealthy heirs is bad for growth, because they're the ones who have the money to make the investments we need. What you can't do, though, is say that about a small open economy. In that case, people overseas would step in.... So repealing the��estate tax shouldn't matter.... The second red flag.... [In] the small open economy model... you'd expect the share of investment income going to foreigners to go up.... The Tax Foundation, though, assumes that the share of investment income going to foreigners wouldn't increase at all, even though the share of investment coming from foreigners would....

It seems like the Tax Foundation has taken a simple idea and applied it in ways that don't quite work together.... The assumptions built into the idea that the corporate tax is particularly bad for growth are different from the ones that tell you the estate tax is.... To make it all fit... ad hoc justifications.... I asked the foundation if... it could mathematically reconcile these things���and it doesn't...

December 1, 2017

How Many of 11 California Republicans in the House Can We Flip to "NO!" on Tax "Reform"?

Live from the Orange-Haired Baboon Cage: Casey Tolan: Three California Republicans vote against House tax plan: "Rep. Dana Rohrabacher, R-Costa Mesa, Rep. Darrell Issa, R-Vista, and Rep. Tom McClintock, R-Elk Grove, all voted against the bill...

...the 11 other Republicans support[ed] it.... More than six million Californians take advantage of the state and local tax deduction each year, deducting an average of $18,438 per family, according to the nonpartisan Tax Policy Center. And more than a third of the households in Rohrabacher, Issa and McClintock���s districts took the deduction in 2015, IRS data shows.... ���Passage of the House bill is the first step toward significantly lowering the tax burden in the Central Valley,��� Rep. Jeff Denham, R-Turlock, said in a statement. ���I look forward to working with the Senate to send a final bill to the president���s desk that will benefit valley families, create jobs and put more money in people���s pockets.���...

The eleven Republican targets are:

Doug LaMalfa (Richvale, 1) (R+11)

Paul Cook (Yucca Valley, 8) (R+9)

Jeff Denham (Atwater, 10) (0)

David Valadao (Hanford, 21) (D+5)

Devin Nunes (Tulare, 22) (R+8)

Kevin McCarthy (Bakersfield, 23) (R+14)

Steve Knight (Palmdale, 25) (0)

Ed Royce (Fullerton, 39) (0)

Ken Calvert (Corona, 42) (R+9)

Mimi Walters (Laguna Niguel, 45) (R+3)

Duncan Hunter (Lakeside, 50) (R+11)

How many of them can we flip to "NO" on the tax "reform" bill?

For the Weekend: Scott Aaronson's Take on Quantum Mechanics

Should-Read: Can this possibly be correct? I know that th...

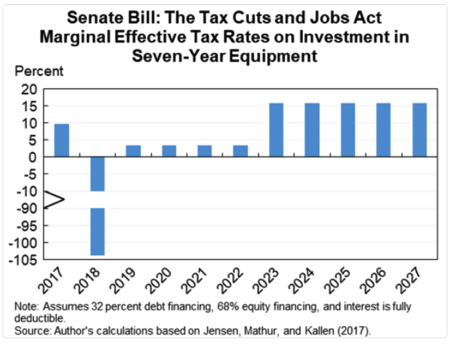

Should-Read: Can this possibly be correct? I know that they are incompetent. But can they be this incompetent?: Jason Furman: @jasonfurman on Twitter: "The effective marginal tax rates on equipment investment in the Senate bill are really weird...

...A huge incentive to pull investment forward into 2018. And then higher EMTRs in 2023 & beyond than today (assuming expensing expires)"

Should-Read: MOAR on Douglas Holtz-Eakin, James Miller, J...

Should-Read: MOAR on Douglas Holtz-Eakin, James Miller, Jagdish Bhagwati, and a few more than 100 Unprofessional Republican Economists. I confess I am flummoxed by this: Statement by Jagdish Bhagwati: "I agree with the main thrust of the Letter I signed, but I do not think it is likely that tax cuts will produce revenues that offset the initial loss of revenue from the tax cuts...

...Incentives work but it is dangerous to assume that the results are huge. The mistake on the part of the supply-siders way back was that they did assume that the incentives result in implausibly huge responses. To assume this is to 'bet the company'."

Jagdish: The A Few More than 100 Unprofessional Republican Economists letter that you signed makes only three quantitative claims. What is "the main thrust of the letter" that you agree with, if not these three claims?

The tax "reform" bill "will ignite our economy with levels of growth not seen in generations..."

It will "produce a GDP boost 'by between 3 and 5 percent...'"

"Sophisticated economic models show the macroeconomic feedback generated by the TCJA will... more than... compensate for the static revenue loss..."

I read letters I sign. I do not sign letters I disagree with. If I cannot at least say, of every paragraph, "that's true���but I would phrase it differently", I do not sign. It would never occur to me to sign on.

Please. Retract your signature.

Should-Read: I remember when Larry Lindsey wanted to be a...

Should-Read: I remember when Larry Lindsey wanted to be a professional economist, rather than an affinity fraudster: Lori Ann LaRocco: Bush tax-cut architect dismisses JCT scoring of the Senate tax bill a 'fraud': "An exclusive note from George W. Bush's former economic advisor, Larry Lindsey...

...accusing the tax committee of attempting to thwart the tax bill. Lindsey said the parameters of the committee's model have never been made public; because they cannot be scrutinized, he says JCT has unbridled power... accuses the Joint Committee on Taxation of "playing games" to thwart the tax bill....

In effect, the results of the model are just what the staff decides they are since they are the ones in control of the parameters of the model. The staff uses the artifice of a black box model to come to whatever conclusion they want.

He called the JCT's prediction of an "aggressive" Fed response to the tax legislation "absurd"....

If anything, the signals and market view have all been that the Fed will be less aggressive. Some members have even speculated about the advantage of raising the inflation target in order to allow a slower response. Markets have consistently priced in far fewer interest rate hikes than what the FOMC projects.... The JCT has long been part of the swamp...

and calling on Congress to reform the committee "when their model is proved to be a fraud."

In prior appearances on CNBC and in a previous note, Lindsey told his clients that if tax reform was passed, "The political and economic policy implications would be massive and far reaching..."

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers