J. Bradford DeLong's Blog, page 284

November 5, 2018

If you believe in the "plucking model", by which the econ...

If you believe in the "plucking model", by which the economy when "plucked" into a state below normal employment by a negative shock then returns to normal, there is not strong reason to begin a recession watch until normal employment has resumed or has almost resumed. It has. So it is time to start a "what will cause the next recession?" watch. Tim Duy says: it will not be weakness in housing. I concur: the current weakness in housing is what the Federal Reserve wants to see, and is the intended effect of its raising interest rates���a little less employment in housing construction producing a little more room for higher employment in other sectors: Tim Duy: Decision Time: "Remember the recession calls in 2016 when manufacturing rolled over? The thinking was that every time industrial production falls by 2%, a recession followed, and this time would be no different. But it was different. Those calls did not play out because the shock was largely contained to that sector; recessions stems from shocks that hit the entire economy. And even if a recession could be boiled down to a single indicator, I would pick the yield curve over housing...

#shouldread

Seth Godin: Writing for People Who Don���t Read: "Right t...

Seth Godin: Writing for People Who Don���t Read: "Right there, there���s your problem. I know you���d like to reach more people, and most people don���t read. But if you���re going to write, the only choice you have is to reach people who will choose to engage with you. Do it properly, and there���s a chance that those voluntarily literate people will tell their friends and colleagues...

...And of course, the same thing goes for trying to teach people who don���t learn, tell jokes to people who don���t laugh, and campaign to people who don���t vote. It almost always works better if you engage with people who are enrolled in the journey and then motivate them to engage with their peers...

#shouldread

#weblogging

#publicsphere

November 4, 2018

Five-Thirty-Eight: Geoffrey Skelley: House Update: Keepin...

Five-Thirty-Eight: Geoffrey Skelley: House Update: Keeping An Eye On Democratic ���Reach��� Districts: "the battleground for the House is quite large: In the Classic version of our House forecast, there are 111 districts where both parties have at least a 5 percent chance of winning, as of 8 p.m. Eastern on Nov. 3. But Republicans are defending most of these districts ��� 102 of them, in fact. So one possibility on Election Day is that Democrats end up winning a few ���reach��� districts (in which their odds of winning are greater than 5 percent but less than 35 percent). Under those conditions, Democrats are underdogs in 63 of the 102 districts Republicans are defending...

Geoffrey Skelley: Democrats Have A Chance To Win One Of The Reddest Districts In The Country: "West Virginia���s 3rd.... President Trump won the 3rd District, anchored by Huntington, by 49 percentage points, and the district���s FiveThirtyEight partisan lean1 is R+37.... Yet the election prognosticators have tagged the race as ���Lean Republican��� or even a ���Toss-up,��� and nonpartisan polls have found mixed results since the May primary.... It���s an open seat held by the presidential party... the cross-party appeal of state Sen. Richard Ojeda, the Democratic nominee, and his in-your-face populism. We know Ojeda could be a real threat because he won his state Senate district 59 percent to 41 percent in 2016, even as it backed Trump 78 percent to 19 percent.... FiveThirtyEight���s House forecast currently gives Ojeda���s GOP opponent, state Delegate Carol Miller, around a 9 in 10 chance of winning���making West Virginia���s 3rd one of the districts where our forecast most disagrees with election handicappers...

Nathaniel Rakich: Six Districts The GOP Appears To Have Abandoned���And Maybe Two More It Should : "... >...National Republicans have begun pulling their resources... because party elders believe the seat is already lost. But parties don���t always show the best judgment about these things, so we thought we would compare the seats that Republicans have given up on with the seats most likely to flip to Democrats in our model. And what we found was that Republicans are indeed picking their battles wisely.... Daily Kos Elections... six Republican-held districts that both the National Republican Congressional Committee and the Congressional Leadership Fund1 have opted out of... CA-49, IA-1, NJ-2, PA-5, PA-6th and PA-17.... The eight Republican-held districts that our model says are most likely to fall to Democrats... PA-5, PA-6, NJ-2, IA-1, PA-7, AZ-2, CA-49, PA-17.... Our model generally agrees with top Republicans��� assessments.... Two of the eight districts in our table aren���t on the Daily Kos list... AZ-2... and the PA-7... (another redrawn seat) are strong Democratic bets by our calculations���even stronger than the CA-49 and PA-17...

#shouldread #politics #statistics #acrossthewidemissouri

Scam o Rama

Scam o Rama: Quit While You're Ahead: "Another missive from Thomas Mallory, last heard from in The Flying Savimbi Brothers. Note: Just so you know: Mr. Mallory's attorney, Melanie Rourke, is possibly meaner than Lonslo Tossov. We actually edited some of her dialogue. We just felt the need. Mr. Mallory was very nice about it. Call us politically correct if you like. Just don't call us late for dinner...

...Dear Scamorama: Here it is���my masterpiece. I call it "Thomas Mallory VS Albert Abossi: Trouble A Head." It's all here, friends. An urgent plea for help. A living human head, the victim of a 'failed body transplant.' Loneliness. Friendship. Trust. Life. Betrayal. Death. Lawyers. Returns from the dead. More lawyers, Western Union, mothers who 'collarpse,' and so much more! Briefly, here is the cast: THOMAS MALLORY���A living human head, kept alive by a life support machine housed deep in the lowest sub-basement of the Biology Building at Miskatonic University in scenic Arkham, Massachusetts. The object of our scammer's dim-witted attentions...

#shouldread #acrossthewidemissouri #miskatonicuniversity #orderoftheshrill

November 3, 2018

Weekend Reading: Robert Solow: A Theory Is a Sometime Thing

Robert Solow: A theory Is a Sometime Thing: "Milton Friedman... aims to undermine the eclectic American Keynesianism of the 1950s and 1960s... goes after two... lines of thought. His first claim is that the central bank, the Fed, cannot ���peg��� the real interest rate... to undermine the standard LM curve.... The Fed can peg the nominal federal funds rate, but not the real rate...

..."These��� effects will reverse the initial downward pressure on interest rates fairly promptly, say, in something less than a year. Together they will tend, after a somewhat longer interval, say, a year or two, to return interest rates to the level they would otherwise have had" (Friedman 1968, p. 6). Now we know what ���peg��� means.... The goal, remember, is to contradict the eclectic American Keynesian... which did not, after all, require the Fed to control real interest rates forever. If the Fed can have meaningful influence only for less than a year or two, then it is surely playing a losing game, especially in view of those ���long and variable lags.��� Is that really so?...

After Paul Volcker's appointment... the real funds rate had been fluctuating around zero... rose sharply to about 5 percent and fluctuated around that level for the next six years.... This sustained 5 percentage point increase in the real funds rate was... a deliberate intervention, designed to end the ���double-digit��� inflation of the early 1970s, and it did so, with real side-effects. This chain of events could not have worked through any ���misperception��� mechanism; there was no secret about what the Volcker Fed was doing. So the Fed was in fact able to control (���peg���) its real policy rate, not for a year or two but for at least six years, certainly long enough for the normal conduct of counter-cyclical monetary policy to be effective.... The difference between ���a year or two��� and ���half a dozen years��� is not a small matter. This part of Friedman's demolition project seems to have failed as pragmatic economics, although it may have succeeded in persuading the economics profession.

The second, and even more striking, contribution of the 1968 presidential address was Friedman's introduction of the ���natural rate of unemployment��� along with the long-run vertical Phillips curve and its accelerationist implications.... I do not have to repeat Friedman's classic discussion of the consequences if the Fed (or anyone) attempts to push the actual unemployment rate below the natural rate: higher monetary growth, at first increased spending, output and employment, as prices adjust with a lag to the new state of demand. But eventually the rate of inflation, whatever it was before, increases and this gets built into expectations.... So the Fed has to create even faster monetary growth to sustain the lower unemployment rate, and you know the rest. Once again, we can imagine such a world; Friedman's claim is that we live in it.... For a brief period in the 1970s and early 1980s, this simple model seemed to do well: if you plot the change in the inflation rate against the unemployment rate (see Modigliani and Papademos 1975), you get a decent downward-sloping scatter that crosses the u-axis at a reasonably defined natural rate or NAIRU). At other times, not so much....

Olivier Blanchard (2016).... First, there is still a Phillips curve... Second, expectations of inflation have become more and more ���anchored���.... Third, the slope of the Phillips curve itself has been getting flatter, ever since the 1980s, and is now quite small. And last, the standard error around the Phillips curve is large; the relationship is not well defined in the data. Taken together, these last two findings imply that there is no well-defined natural rate of unemployment, either statistically or conceptually.... This is very different from the story told so confidently and fluently in the 1968 address.

My mind kept returning to a famous line of dramatic verse: was this the face that launched a thousand ships?... Milton Friedman's presidential address... may not have burnt the topless towers of Ilium, but it certainly helped lead macroeconomics to its current state of refined irrelevance. The financial crisis and the recession that followed it may have planted some second thoughts, but even that is not certain. A few major failures like those I have registered in this note may not be enough for a considered rejection of Friedman's doctrine and its various successors. But they are certainly enough to justify intense skepticism, especially among economists, for whom skepticism should be the default mental setting anyway. So why did those thousand ships sail for so long, why did those ideas float for so long, without much resistance? I don't have a settled answer.

One can speculate. Maybe a patchwork of ideas like eclectic American Keynesianism, held together partly by duct tape, is always at a disadvantage compared with a monolithic doctrine that has an answer for everything, and the same answer for everything. Maybe that same monolithic doctrine reinforced and was reinforced by the general shift of political and social preferences to the right that was taking place at about the same time. Maybe this bit of intellectual history was mainly an accidental concatenation of events, personalities, and dispositions. And maybe this is the sort of question that is better discussed while toasting marshmallows around a dying campfire.

#shouldread #weekendreading #monetarypolicy #monetaryeconomics #economicsgonewrong

Introducing the Sticky-Price Model: Checkpoint of Chapter 9 of Next Edition of Marty Olney's and My Macro Textbook

nbviewer: http://nbviewer.jupyter.org/github/braddelong/LSF18E101B/blob/master/Introducing_the_Sticky-Price_Model.ipynb

keynote: https://www.icloud.com/keynote/0qRLX6e9_4BiKw0vSfHxb9B7w

#MRE #Macro #flexprice

November 2, 2018

Solving the Flexprice Model: Checkpoint of Chapter 7 of Next Edition of Marty Olney's and My Macro Textbook

nbviewer: http://nbviewer.jupyter.org/github/braddelong/LSF18E101B/blob/master/Equilibrium_in_the_Flexprice_Model.ipynb

keynote: https://www.icloud.com/keynote/0eT-yTiDbnFJG75PcmVtFrsRg

keynote: https://www.icloud.com/keynote/0qCkpCxn5-A4wblAeoqJj7-GQ

#MRE #Macro #flexprice

Building Blocks of "Flexprice" Business-Cycle Macroeconomics: Checkpoint of Chapter 6 of Next Edition of Marty Olney's and My Macro Textbook

Slides, and slides and text...

nbviewer: http://nbviewer.jupyter.org/github/braddelong/LSF18E101B/blob/master/Building_Blocks_of_the_Flexprice_Model.ipynb

keynote: https://www.icloud.com/keynote/0qPkVy4AgrnNRIMq3I7HCoN-w

#MRE #Macro #flexprice

Ricardo J. Caballero: Risk-Centric Macroeconomics and Saf...

Ricardo J. Caballero: Risk-Centric Macroeconomics and Safe Asset Shortages in the Global Economy: An Illustration of Mechanisms and Policies: "In these notes I summarize my research on the topic of risk-centric global macroeconomics. Collectively, this research makes the case that a risk-markets dislocations perspective of macroeconomics provides a unified framework to think about the mechanisms behind several of the main economic imbalances, crises, and structural fragilities observed in recent decades in the global economy. This perspective sheds light on the kind of policies, especially unconventional ones, that are likely to help the world economy navigate this tumultuous environment...

...Keywords: Risk-Market Imbalances, Safe Assets, Financial Underdevelopment, Sudden Stops, Crises, Global Imbalances, Low Interest Rates, Reach-for-Yield, Recessions, Speculation, Panics, Knightian Uncertainty, Flight-to-Safety, Put-Policies, Safety Traps, Global Spillovers, Aggregate Demand, Macroprudential. Suggested Citation: Caballero, Ricardo J., Risk-Centric Macroeconomics and Safe Asset Shortages in the Global Economy: An Illustration of Mechanisms and Policies (September 18, 2018). Available at SSRN: https://ssrn.com/abstract=3253064 or http://dx.doi.org/10.2139/ssrn.3253064...

#shouldread #monetarypolicy #monetaryeconomics #finance

Up until 2000, it looks like we have an unemployment-rate...

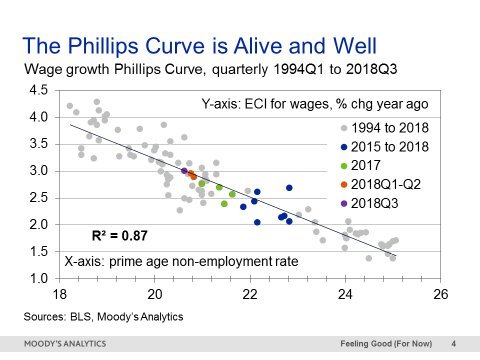

Up until 2000, it looks like we have an unemployment-rate (or vacancy-rate) adaptive-expectations price Phillips curve. Since the mid-1990s, we have a non-employment-rate static-expectations wage Phillips curve. How long before another structural shift we do not know. But right now Team Slack has the empirical evidence. And Team Slack says: the economy still has plenty of room to grow: Jay C. Shambaugh: Score One for Team Slack: "As @ModeledBehavior notes, it is not clear how long this relationship will hold, but it looks really good in 2018 (even better than in 2017). Almost impossible to argue slack is not part of wage growth story even if you don't think it is whole story:

#shouldread

#labormarket

#monetarypolicy

#phillipscurve

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers