J. Bradford DeLong's Blog, page 248

January 22, 2019

The curious thing is that Rod Dreher has never had any pr...

The curious thing is that Rod Dreher has never had any problems despising and demonizing those who embrace what he sees as bad men and bad causes. But somehow the Trumpists���the Trumpists alone���get a get-out-of-jail-free card from him: Rod Dreher: A Yankee Franco and The Long Defeat: "Conservative Christians will embrace politically a bad man... because unlike left-wing leaders, he doesn���t despise them, and seek to demonize them.... If progressives in America push too hard, and economic conditions are just right, the years ahead may bring about an American Franco���that is to say, a right-wing authoritarian leader who demolishes democracy, and rules by decree... [and] will be popular with half the country.... I deeply wish that the mainstream left... would get a freaking grip on itself, and understand exactly what kind of demons it is calling forth...

...I see our American Christian future, coming at us fast, and it scares me.... Look at Ireland. It was no dictatorship, but the Catholic Church nevertheless enjoyed a place of overwhelming privilege and power in Irish society, until pretty much the day before yesterday. And now, the faith has to a great degree collapsed. How did it happen? And where to go next for Irish Catholics? That is a story I will be learning about over these next couple of days in Dublin...

#noted #moralresponsibility #orangehairedbaboons

Robert Waldmann (2016): Dynamic Inefficiency: "Is public ...

Robert Waldmann (2016): Dynamic Inefficiency: "Is public debt a burden?... It is possible in theory that the answer is no and that higher [initial] public debt causes permanently higher [balanced-growth path] consumption and welfare.... This is called dynamic inefficiency. The standard result from simple models is that an economy is dynamically inefficient if r is less than g where r is the real interest rate and g is the rate of GDP growth...

...This formula isn���t very useful in the real world, because... there is a low real interest rate on safe assets and higher rates on risky assets. The standard interpretation of ���r��� is that it refers to the ratio of total capital income to total capital.... The question of interest is whether increased public debt can cause increased welfare when the safe real interest rate rsafe is lower than g but the average return on capital r is greater than g. I think the answer is yes, so I think it is plausible that, in the real world, greater public debt will cause permanently higher welfare...

https://delong.typepad.com/dynamicinefficiency-2.pdf

#noted #publicfinance #fiscalpolicy #equitablegrowth

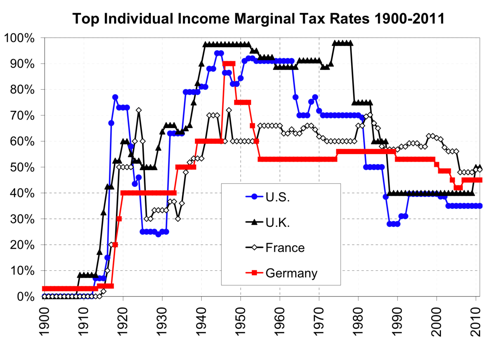

Three Papers and Four Graphs and Tables: The Top Marginal Tax Rate

If Arindrajit Dube and I do start our Economic Home podcast, I think that each 30 minute segment should concentrate on two or three (or four) papers and two or three (or four) graphs and tables. Our first proposed topic is the top marginal tax rate. Are these the right papers? Are these the right graphs and tables?

Thomas Piketty, Emmanuel Saez, and Stefanie Stantcheva (2011): Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities

Emmanuel Saez and Stefanie Stantcheva (2016): Generalized Social Marginal Welfare Weights for Optimal Tax Theory

Alan J. Auerbach and Kevin Hassett (2015): Capital Taxation in the Twenty-First Century

Thomas Piketty, Emmanuel Saez, and Stefanie Stantcheva (2011): Optimal Taxation of Top Labor Incomes: A Tale of Three Elasticities: "A model where top incomes respond to marginal tax rates through... (1) the standard supply-side channel... the tax avoidance channel, [and] (3) the compensation-bargaining channel through efforts in influencing own-pay setting.... The first elasticity (supply side) is the sole real factor limiting optimal top tax rates. The optimal tax system should be designed to minimize the second elasticity (avoidance) through tax enforcement and tax neutrality... in which case the second elasticity becomes irrelevant. The optimal top tax rate increases with the third elasticity (bargaining) as bargaining efforts are zero-sum in aggregate..... There is a strong correlation between cuts in top tax rates and increases in top 1% income shares since 1975, implying that the overall elasticity is large. But top income share increases have not translated into higher economic growth, consistent with the zero-sum bargaining model. This suggests that the first elasticity is modest in size and that the overall effect comes mostly from the third elasticity. Consequently, socially optimal top tax rates might possibly be much higher than what is commonly assumed...

Emmanuel Saez and Stefanie Stantcheva (2016): Generalized Social Marginal Welfare Weights for Optimal Tax Theory: "Evaluat[ing] tax reforms by aggregating money-metric losses and gains of different individuals using 'generalized social marginal welfare weights.' Optimum tax formulas take the same form as standard welfarist tax formulas.... Weights directly capture society���s concerns for fairness without being necessarily tied to individual utilities. Suitable weights can help reconcile discrepancies between the welfarist approach and actual tax practice, as well as unify in an operational way the most prominent alternatives to utilitarianism.... There is no social-welfare objective primitive.... Instead, our primitives are generalized social marginal-welfare weights which represent the value that society puts on providing an additional dollar of consumption to any given individual. These weights directly reflect society���s concerns for fairness.... We define a tax system as locally optimal if no small reform is desirable... Slides

Alan J. Auerbach and Kevin Hassett (2015): Capital Taxation in the Twenty-First Century: "To the extent that labor income inequality is the underlying source of overall inequality, it is hard to see why the appropriate policy response is a wealth tax, rather than, for example, an increase in the progressivity of labor income taxes, as indeed Piketty and his collaborators have proposed (Piketty, Saez, and Stantcheva 2014). It may well be true that the growing inequality of labor income is leading to a grow- ing concentration of capital ownership. Even so, the underlying factor driving inequality would be the dispersion of labor income...

#fiscalpolicy #publicfinance #economicshomepodcast #equitablegrowth

January 21, 2019

By Popular Demand: What Is ���Modern Monetary Theory���?

What Is ���Modern Monetary Theory���?

Ever since the Great Depression it has been settled doctrine in the nations of the North Atlantic that the government has a responsibility to keep the macroeconomy in balance: The circular flow of spending, production, and incomes should be high enough to keep there from being unnecessary unemployment while also being low enough so that prices and inflation are not surprisingly and distressingly high.

To accomplish this, governments use fiscal policy���the purchase of goods and services, the imposition of taxes, and the provision of transfer payments���and monetary policy���the provision by the central bank to the system of those liquid assets called ���money��� and its consequent nudging up and down of interest rates and asset prices���to attempt to keep the circular flow of spending, etc., in balance with the economy���s sustainable productive potential at the expected rate of inflation .

Modern Monetary Theory says (1) that that is all there is to worry about, and (2) that fiscal policy should play the principal role in this balancing process.

Is there excessive unemployment? Then the government should boost its purchases and cut its taxes. How will we know that we have gone too far in doing this? Rising inflation will tell us���when we see the whites of rising inflation���s eyes, Then will be the time to cut purchases and raise taxes.

Are there rational worries that the interest payments on the outstanding national debt are too high? Then, Modern Monetary Theory says, expand the money supply to push down interest rates and so make it possible for the government to refinance its debt on sustainable terms.

Does that monetary expansion threaten to cause excess inflation? Then deal with that stress the normal way a government following Modern Monetary Theory deals with incipient inflation: cut government purchases and raise taxes until the macroeconomy is back in balance.

This is the macroeconomic policy management gospel that Abba Lerner preached during and after World War II under the name of ���Functional Finance���. It is a good gospel���much better than the ravings of those yahoos who nearly a decade ago denounced Ben Bernanke for debauching the currency and risking an explosion of inflation via quantitative easing. It is a god gospel���much better than the ravings of those yahoos, including President Obama, who said nearly a decade ago that the United States government needed to freeze spending because it needed to tighten its belt just as American households had been forced tighten theirs.

In most ways, Modern Monetary Theory���Functional Finance���is just macroeconomic common sense:

We do not like high unemployment.

We do not like excessive inflation.

Thus the government should make it its first priority to use its tools of economic management so that we do not experience either.

And maybe the government needs to be a little bit clever in how it uses fiscal and when and how it uses monetary policy to keep the task of financing the national debt from becoming an undue or even an unsustainable burden.

So what can go wrong with MMT?

Three things can go wrong:

MMT implicitly assumes that the debt market is efficient���that if the government debt gets on an unduly burdensome and unsustainable path, we will see that immediately in high interest rates. If that is not true, the government and the economy can face one hell of a mess should a bubble in government bond prices develop and then collapse. Cf. Greece.

MMT implicitly assumes that wealth-owners react rapidly when they see trouble ahead���that when investors conclude that the government cannot or will not balance its books without ultimate high inflation, inflation will jump immediately.

MMT implicitly assumes that extra financial leverage generated by the high values of collateral assets does not serve as a significant source of risk���that it is only on a small scale that investors will borrow foolishly just because they can.

If any of these three implicit assumptions are false, then policies that are good according to MMT can be bad in reality: Interest rates low enough to make financing government debt easy may generate an economy prone to financial collapse and disaster. Today���s inflation may not be a good enough warning sign of long run fiscal policy unsustainability. Collapses in government bond bubbles may generate ���sudden stops��� that require extremely rapid fiscal adjustment that the political system cannot face.

Nevertheless, if one must choose between MMT on the one hand and the yahoos of either monetary stringency or fiscal austerity on the other, choose MMT. It is closer to being an accurate view. We do seek a circular flow of spending, production, and incomes both high enough to keep us from unnecessary unemployment and also from surprisingly and distressingly high prices and inflation.

This is a modest goal. IOt is not something pushed out of reach by some malign and austere economic or budgetary accounting logic.

#macro #monetaryeconomics #monetarypolicy #fiscalpolicy #highlighted

January 20, 2019

Brad DeLong (2007): On Robert Barro's (2005) "Rare Events...

Brad DeLong (2007): On Robert Barro's (2005) "Rare Events and the Equity Premium" and T.A. Rietz's (1988) "The Equity Risk Premium: A Solution": Our habit of using the Lucas-tree model of Lucas (1978), ["Asset Prices in an Exchange Economy](http://links.jstor.org/sici?sici=0012- 9682(197811)46:62.0.CO ;2-I) as a workhorse has turned out to be a trap. The Lucas-tree model has neither production nor accumulation. This makes it easy to solve. But this makes its responses perverse. There are no scarce resources to be allocated among alternative uses. There are only asset prices which must move so as to make agents unwilling to try to reallocate resources. It is, I think, not surprising that an economic model in which resource allocation plays no role is a dangerous tool to use in trying to understand the world...

#noted #economicsgonewrong #finance

Dylan Matthews: The Baby Hitler Controversy, Explained: "...

Dylan Matthews: The Baby Hitler Controversy, Explained: "If you woke up this morning and asked yourself, 'Would conservative podcaster Ben Shapiro travel backwards through kill and murder Adolf Hitler when Hitler was a tiny baby?', then (a) you should seek help but (b) I have an answer to your question...

#noted #moralphilosophy

Wolfgang M��nchau: The Self-Fulfilling Prophecy of a No-D...

Wolfgang M��nchau: The Self-Fulfilling Prophecy of a No-Deal Brexit: "I believe that the probability of a no-deal Brexit is higher than you think. Much higher.... A no-deal Brexit is clearly not rational. But if you look at the incentives of each individual decision maker, you may find there are worse options than no deal for each one of them...

...For Mrs May, the very worst outcome would be to end up with no Brexit at all. For Mr Corbyn, a no-deal Brexit might be the best opportunity for an early general election. For Mr Varadkar, nothing would be more humiliating than to compromise on the backstop.... I see no realistic chance of the UK holding a second referendum. I am not convinced that parliamentarians have the gumption for it. It has been easy for them to hide behind the meaningless assertion of taking no deal off the table. But to actually do this, they will have to revoke Article 50, or agree to a deal they dislike. If they vote down the deal again on January 29, we would be mad to rule out a no-deal Brexit...

#noted #globalization #orangehairedbaboons

January 17, 2019

A Toast: "The Queen Over the water!"���

Davis X. Machina: A Toast: "The Queen over the water!"

#moralresponsibility #orangehairedbaboons #acrossthewidemissouri

Dealing with Global Warming Needs a Carbon Tax Starting Now

It would have been smart to do it 26 years ago, when Al Gore was first pushing it���and we got it through the House and fell short by two votes in the Senate: George Akerlof et al.: Economists��� Statement on Carbon Dividends: Bipartisan agreement on how to combat climate change: Global climate change is a serious problem calling for immediate national action. Guided by sound economic principles, we are united in the following policy recommendations...

...A carbon tax offers the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary. By correcting a well-known market failure, a carbon tax will send a powerful price signal that harnesses the invisible hand of the marketplace to steer economic actors towards a low-carbon future.

A carbon tax should increase every year until emissions reductions goals are met and be revenue neutral to avoid debates over the size of government. A consistently rising carbon price will encourage technological innovation and large-scale infrastructure development. It will also accelerate the diffusion of carbon-efficient goods and services.

A sufficiently robust and gradually rising carbon tax will replace the need for various carbon regulations that are less efficient. Substituting a price signal for cumbersome regulations will promote economic growth and provide the regulatory certainty companies need for long- term investment in clean-energy alternatives.

To prevent carbon leakage and to protect U.S. competitiveness, a border carbon adjustment system should be established. This system would enhance the competitiveness of American firms that are more energy-efficient than their global competitors. It would also create an incentive for other nations to adopt similar carbon pricing.

To maximize the fairness and political viability of a rising carbon tax, all the revenue should be returned directly to U.S. citizens through equal lump-sum rebates. The majority of American families, including the most vulnerable, will benefit financially by receiving more in ���carbon dividends��� than they pay in increased energy prices...

List of signatories here: https://www.clcouncil.org/

George Akerlof, Robert Aumann, Angus Deaton, Peter Diamond, Robert Engle, Eugene Fama, Lars Peter Hansen, Oliver Hart, Bengt Holmstr��m, Daniel Kahneman, Finn Kydland, Robert Lucas, Eric Maskin, Daniel McFadden, Robert Merton, Roger Myerson, Edmund Phelps, Alvin Roth, Thomas Sargent, Myron Scholes, Amartya Sen, William Sharpe, Robert Shiller, Christopher Sims, Robert Solow, Michael Spence and Richard Thaler are recipients of the Nobel Memorial Prize in Economic Sciences. Paul Volcker is a former Federal Reserve chairman. Martin Baily, Michael Boskin, Martin Feldstein, Jason Furman, Austan Goolsbee, Glenn Hubbard, Alan Krueger, Edward Lazear, N. Gregory Mankiw, Christina Romer, Harvey Rosen and Laura Tyson are former chairmen of the president���s Council of Economic Advisers. Ben Bernanke, Alan Greenspan and Janet Yellen have chaired both the Fed and the Council of Economic Advisers. George Shultz and Lawrence Summers are former Treasury secretaries.

#globalwarming #highlighted

Harry Brighouses: Marina Hyde Competition: "Yesterday���s...

Harry Brighouses: Marina Hyde Competition: "Yesterday���s Marina Hyde... contains... 'voluminously overcoated Jacob Rees-Mogg, who still resembles an 11-year-old Jacob Rees-Mogg sitting on Nanny���s shoulders for a nursery game called Disaster Capitalist���s Bluff'... affectedly shambling figure of Boris Johnson���not so much a statesman as an Oxfam donation bag torn open by a fox'... One sentence descriptions, please, of politicians who are unsuited to office, in the style of Marina Hyde...

#noted #orangehairedbabonns

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers