J. Bradford DeLong's Blog, page 247

January 24, 2019

Commonwealth Club: Annual Economic Forecast

Commonwealth Club: Brad DeLong and Stephen Moore: Bank of America/Merrill Lynch Walter E. Hoadley Annual Economic Forecast | Commonwealth Club: "FRI, JAN 25 / 12:00 PM :: The Commonwealth Club :: 110 The Embarcadero :: Taube Family Auditorium :: San Francisco, 94105: With changes to taxes, trade wars with China and other countries, health care in flux, housing prices continuing to rise, continued governmental gridlock as well as international challenges to the United States, what does all of this mean for your business, your investments and the overall economy for 2019?...

#noted #forecast #publicsphere #berkeley

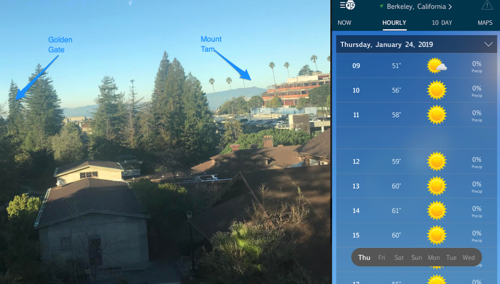

Note to Self: Time to taunt people on the other coast?

...

Note to Self: Time to taunt people on the other coast?

#berkeley #notetoself

My view has always been that (a) too many big lies were t...

My view has always been that (a) too many big lies were told by pro-"Leave the EU" advocates and that (b) too large a proportion of the pro-"Leave the EU" advocates were shady grifters sure that they would lose but who were maneuvering for political advantage���they wanted to denounce the Establishment for failing to give everybody a pet unicorn, rather than to actually take power and run a unicorn-breeding stable. My view has been that the British press committed grave malpractice in hiding (a) and (b) from the electorate. My view has been that the best way to deal with this shambles is (c) for the press to come clean and (d) hold an informed revote���and that politicians opposed to a revote given the illegitimacy of the "Leave" mandate are shady grifters, etc. The argument against a revote is that it will split the country. But the country is split already. Better to have a split more-prosperous country with a government with a genuine mandate for its policies than a split less-prosperous country with a government with a fake mandate. Martion Wolf agrees with me: Martin Wolf: The Risks of a Second Brexit Referendum Must Now Be Run: "Another vote will be divisive ���but what is happening is already splitting the country.... I can say what should happen. The answer is a second referendum.... I do not take that view with enthusiasm...

...But the unreasonable behaviour of Brexiters has left no other course. Their determination to pursue the catastrophic option of a ��� no-deal��� Brexit, rather than accept compromise, leaves no alternative to asking voters to vote again. I have never wavered in my view that Brexit is a disastrous course. The UK would be rendered impoverished and irrelevant, relative to what it would be as an influential member of the EU. The propositions of Brexiters about the golden future awaiting ���global Britain��� are fantasies. I have also never wavered in the view that referendums are a dangerous way to resolve issues, particularly when one of the options���Leave, in this case���was so undefined. It allowed Leavers to promulgate illusions and so created insuperable problems in defining the ���will of the people���....

Responsibility... rest[s] with the recalcitrance of the Brexiter fanatics. If they will not compromise, why should others? If they are determined to act as if a slight victory in the referendum gives them the right to drive the country over a cliff, then Remainers have the right to ask parliament to consult the people again. Is this, we should now ask, what they really want? I recognise the risks of another referendum. It will be very divisive. But what is happening is already divisive.... There is no such thing in a liberal democracy as a vote that cannot be reversed, once time has passed and circumstances have changed. Time has passed. We now know what the withdrawal deal looks like. A second referendum is also needed to force clarity on what no deal might mean: it would require many deals���over Ireland, for example. We must open the no-deal black box....

The big point... is that the fate of the country cannot be left in the hands of a prime minister prepared to put the unity of her party above the fate of the country and so prefer the huge risks of no deal to another referendum. Nor can the fanatical Brexiters, a minority in parliament, be allowed to dictate what Leave means. They did not campaign for such a no-deal Brexit, with all the risks it would create. On the contrary, they suggested the UK could have its cake and eat it: and so enjoy the benefits of leaving and remaining.... A second vote would allow the country to consider the real choices, not the choice between reality and fantasy made in June 2016. The referendum would be divisive. The people might still choose a no-deal Brexit. So be it. But this would at least be the product of a deliberate choice. Let us have a second vote.

#noted #orangehairedbaboons #globalization #brexit

January 22, 2019

U.S. Recession No Longer Improbable: No Longer Fresh at Project Syndicate

Project Syndicate: U.S. Recession No Longer Improbable: Over the past 40 years, the U.S. economy has spent six years in four recessions: in a downturn 15% of the time, with the odds that a current expansion will turn into a downturn within a year being one-in-eight. Of these four downturns, one���the extended downturn of 1979-82���had a conventional cause: the Federal Reserve thought inflation was too high, and so hit the economy on the head with the high interest-rate brick to stun it and induce workers to moderate their demands for wage increases and firms to cut back planned price increases. The other three have been caused by derangements in financial markets: the collapse of sunbelt Savings-and-Loans for 1991-92, the collapse of dot-com valuations in 2000-2, and the collapse of mortgage-backed securities in 2008-9.

Right now, inflation expectations appear to be well-anchored at 2%/year, with a Phillips Curve that seems unusually flat���excesses or deficiencies of production and employment from potential-output or natural-rate trends have little short-run impact on prices and wages. Right now both the gap between short-term and long-term safe interest rates and the level of short-term nominal safe interest rates are unusually low. And right now, with the recent decline in the stock market, Campbell-Shiller-like forecasts of long-run real buy-and-hold stock returns are between 4% and 4% per year���higher than their average CS-like forecast value over the past forty years.

Those are the background facts that everybody in the business of forecasting the arrival of and hedging against the possibility of the next U.S. recession must have in the front of their mind. They have several implications:

The next recession is unlikely to come as a response to an uptick in inflation that triggers a Federal Reserve shift from trend-growth-nurturing to inflation-fighting policy. Something else that triggers a downturn is highly likely to occur as visible inflationary pressures are unlikely to build in less than half a decade.

The next recession is likely to come as a result of the revelation of an unexpected weakness and an unexpected shock to financial markets that causes a sudden, sharp "flight to safety". That is one pattern that has been generating downturns since at least 1825 and the collapse of that decade's canal boom in England. That is most likely to be the active pattern now.

The financial shock will be unanticipated. Investors, speculators, and institutions are generally hedged against possible shocks that are seen by the conventional wisdom as live possibilities. It was not the collapse of the mid-2000s housing bubble but the concentration of ownership of mortgage-backed securities that killed the global economy in 2008-9. It was not the deflation of the commercial real estate bubble of the late-1990s but the failures of regulatory oversight that had lead S&Ls to gamble for resurrection that triggered the stubbornly long downturn of the early 1990s. it was not the deflation of the dot-com bubble but the magnitude of tech-and-communications earnings "overstatements" in the late 1990s that triggered the early 2000s recession.

The near-inverted yield curve, the low absolute value of nominal and real bond yields, and equity values that are now plausibly fairly-valued for the long-term tell us that financial markets in the U.S. are now pricing a recession as likely���and, to the extent that business investment committees are thinking like investors and speculators, it requires only a trigger for businesses to retrench investment spending and so bring a recession on.

If that recession begins, the U.S. government will not have the tools to fight it: the president and congress will, once again, as they have for a generation, be inept at using fiscal policy as a countercyclical stabilizer; the Federal Reserve does not have enough room to cut interest rates to do the job; and the Federal Reserve lacks the nerve and perhaps lacks the power for truly effective non-standard monetary policy moves.

For the first time in nine years, Americans and investors in America need to be prepared for not a probable but rather a not improbable economic downturn���and for the likelihood that should such a downturn come, it will be a deep and prolonged one.

#projectsyndicate #monetarypolicy #recessionwarning #highlighted

Cf.: Carmen Reinhart: The Biggest Emerging Market Debt Problem Is in America: "A decade after the subprime bubble burst, a new one seems to be taking its place in the market for corporate collateralized loan obligations. A world economy geared toward increasing the supply of ���nancial assets has hooked market participants and policymakers alike into a global game of Whac-A-Mole...

Zack Beauchamp: Brexit Vote: Theresa May���s Defeat Revea...

Zack Beauchamp: Brexit Vote: Theresa May���s Defeat Reveals the Lies Behind Brexit: "UK Prime Minister Theresa May spent months negotiating a deal with the European Union on the terms of Brexit.... The UK Parliament voted to reject the deal by a resounding 432-202 margin.... May���s tenure in office... was premised on the lie that she could work out a Brexit deal palatable to all sides. Now, in the clarifying light of this vote���s failure, it���s time to be honest.... Either the UK exits the EU without a deal by the March 29 deadline, which virtually every expert agrees would result in economic catastrophe, or else the country pulls back from the brink and decides to remain in the EU. These options aren���t what the Brexiteers promise, but it���s difficult to envision any other ones after the failure of May���s deal...

#noted #globalization #orangehairedbaboons

It was back in 1924 that it was first generally recognize...

It was back in 1924 that it was first generally recognized that diversification was the equity investor's biggest friend. A properly-diversified portfolio of equities would outperform bonds by huge amounts with very high provability over long-enough horizons. The problem is that while "diversification" might have been reasonably accomplished with ten well-chosen stocks back in the mid-twentieth century, in the past generation it has required more like fifty. And if we truly are moving into more of a winner-take all economy, in the future it may take 100: Terry Smith: Busting the myths of investment: Do equities outperform bonds?: "The degree of concentration of returns is still startling. Just five companies out of the universe of 25,967 in the study account for 10 per cent of the total wealth creation over the 90 years, and just over 4 per cent of the companies account for all of the wealth created.... The study also looks at returns decade by decade and reaches more or less the same conclusion: that the decade returns for most equities are lower than those earned by investment in Treasury bills...

...Moreover, the results have been getting worse for equity investors more recently. Of the stocks floated between 1947 and 1956, 87 per cent had higher returns than US Treasuries. This fell to 61.5 per cent for those entering from 1957 to 1966 and just 31.7 per cent of those floated from 1977 to 1986. Most alarmingly, the median stock entering the market since 1977 did not just underperform Treasuries but had a negative return. This may be attributable to the type of companies which floated in recent decades, which many have characterised as showing revenue growth, but very poor earnings. What conclusions to draw from all this? Stocks in aggregate outperform bonds, but most stocks do not and positive returns are concentrated in very few stocks. Most active investors are doomed to underperform not only the equity indices but also bonds...

#noted #finance

Fairly Recently: Must- and Should-Reads, and Writings... (January 22, 2019)

Be the Podcast You Want to See in the World!: Arindrajit Dube: "God damn it Brad now Matt Y is on board and I am seriously screwed..." So it looks like we may be doing this for real���once a week, half-hour chunks, starting out as amateur hour only. First topic: thinking about what marginal tax rates on the rich should be. What say you all?...

Three Papers and Four Graphs and Tables: The Top Marginal Tax Rate: If Arindrajit Dube and I do start our Economic Home podcast, I think that each 30 minute segment should concentrate on two or three (or four) papers and two or three (or four) graphs and tables. Our first proposed topic is the top marginal tax rate. Are these the right papers? Are these the right graphs and tables?...

By Popular Deman: What Is ���Modern Monetary Theory���?: Nevertheless, if one must choose between MMT on the one hand and the yahoos of either monetary stringency or fiscal austerity on the other, choose MMT. It is closer to being an accurate view. We do seek a circular flow of spending, production, and incomes both high enough to keep us from unnecessary unemployment and also from surprisingly and distressingly high prices and inflation. This is a modest goal. It is not something pushed out of reach by some malign and austere economic or budgetary accounting logic...

On Robert Barro's (2005) "Rare Events and the Equity Premium" and T.A. Rietz's (1988) "The Equity Risk Premium: A Solution": Our habit of using the Lucas-tree model of Lucas (1978), "Asset Prices in an Exchange Economy" as a workhorse has turned out to be a trap...

A Toast: "The Queen Over the water!"���: "The rightful president of the United States warned us before anybody else did...

Dealing with Global Warming Needs a Carbon Tax Starting Now: It would have been smart to do it 26 years ago, when Al Gore was first pushing it���and we got it through the House and fell short by two votes in the Senate: George Akerlof et al.: Economists��� Statement on Carbon Dividends: Bipartisan agreement on how to combat climate change: Global climate change is a serious problem calling for immediate national action. Guided by sound economic principles, we are united in the following policy recommendations...

Comment of the Day: Ronald Brakels: "In Australia we'd just say Lewis CK is an arsehole...

Note to Self: Enjoyed Cherryh and Fancher's Alliance Rising very much, but... I wish I had read something else this past week and had saved this for five years from now, when The Hinder Stars II, III, and... IV? would be out.... If only Jen-and-Ross-Together had been given twice the screen time, 40% rather than 20% of the book, it would have been a wonderful Happy-for-Now romance...

Project Syndicate: Unloaded for Bear: "With an extended government shutdown in the United States spooking investors, and further signs that China���s economy is slowing, market volatility has spiked in recent weeks. Worse, policymakers are ill-prepared for another economic downturn. In this��Big Picture,��Nouriel Roubini��explains how US President Donald Trump finally shattered the rosy outlook that defined market sentiment over the past two years.��Barry Eichengreen... Kenneth Rogoff... J. Bradford DeLong... Benjamin J. Cohen... Jim O'Neill��notes that engine of the global economy over the past decade���Chinese domestic consumption���may slow indefinitely, which bodes ill for a quick recovery...

C. J. Cherryh: Alliance-Union Chronology

Daniel Larison: Threat Inflation and "The Jungle Grows Back": "Damir Marusic has written an incisive review of Robert Kagan���s The Jungle Grows Back.... 'Kagan... rues the fact that... no bogeyman big enough to keep Americans focused on maintaining their preeminent position in the world exists.... Kagan therefore makes an attempt to cast first Vladimir Putin���s Russia, and then Xi Jinping���s China, as authoritarian challengers and potential threats to the American way of life...' The end of the Cold War was a calamity for many hawks because it deprived them of a sufficiently powerful and menacing adversary, and the history of U.S. foreign policy over the last three decades has been the desperate search for a suitable replacement...

Marina Hyde: Welcome to the Westminster apocalypse. Have you thought about theocracy instead?: "Here comes the affectedly shambling figure of Boris Johnson���not so much a statesman as an Oxfam donation bag torn open by a fox���who could conceivably still end up prime minister of no-deal Britain. May needed to go again to the EU 'with a high heart, fortified by the massive rejection of the House of Commons', judged Johnson, speaking as always like a Taiwanese news animation of Winston Churchill. In the meantime, 'we should be actively preparing for no deal with ever more enthusiasm'... #brexit #globalization #orangehairedbaboons

This book is fun!: Jeff Erickson: Algorithms: "'Algorithm' does not derive... from the Greek roots arithmos (������������), meaning ���number���, and algos (����������), meaning 'pain'. Rather, it is a corruption of the name of the 9th century Persianm athematician Muhammad ibn Musa al-Khwarizmi. Al-Khwarizmi is perhaps best known as the writer of the treatise Al-Kitab al-mukhtasar fihisab al-gabr wal-muqabala, from which the modern word algebra derives. In a different treatise, al-Khwarizmi described the modern decimal system for writing and manipulating numbers���in particular, the use of a small circle or sifr to represent a missing quantity���which had been developed in India several centuries earlier. The methods described in Al-Kitab, using either written figures or counting stones, became known in English as algorism or augrym, and its figures became known in English as ciphers... #reasoning

Daniel Sullivan: Econtools 0.1 Documentation

Robert Bork and his followers' belief that the test for anticompetitive behavior was whether it could be proved anticompetitive in theory beyond a reasonable doubt was poisonous. And here we see people having to argue against it again in a new context: Jonathan B. Baker and Fiona Scott Morton: Antitrust Enforcement Against Platform MFNs: "Antitrust enforcement against anticompetitive... pricing parity provisions... can help protect competition in online markets.... These contractual provisions may be employed by a variety of online platforms offering, for example, hotel and transportation bookings, consumer goods, digital goods, or handmade craft products. They have been the subject of antitrust enforcement in Europe but have drawn only limited antitrust scrutiny in the United States... #monopoly

14th Amendment: "All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the state wherein they reside. No state shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any state deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws...

If you have not already read all of the WCEG's top 12 of 2018, go read them now: Equitable Growth: Top 12 of 2018: "The effects of wealth taxation on wealth accumulation and wealth inequality.... Why macroeconomics should further embrace distributional economics.... The links between stagnating wages and buyer power in U.S. supply chains.... U.S. income growth has been stagnant. To what degree depends on how you measure it.... Income inequality and aggregate demand in the United States.... Presentation: U.S. Inequality and Recent Tax Changes.... The latest research on the efficacy of raising the minimum wage above $10 in six U.S. cities.... Competitive Edge: There is a lot to fix in U.S. antitrust enforcement today.... Labor Day is a time to reflect on reviving workers��� power in the U.S. economy.... Kaldor and Piketty���s facts: The rise of monopoly power in the United States.... How the rise of market power in the United States may explain some macroeconomic puzzles.... Puzzling over U.S. wage growth... #equitablegrowth

Wolfgang M��nchau: The Self-Fulfilling Prophecy of a No-Deal Brexit: "I believe that the probability of a no-deal Brexit is higher than you think. Much higher.... A no-deal Brexit is clearly not rational. But if you look at the incentives of each individual decision maker, you may find there are worse options than no deal for each one of them... #globalization #orangehairedbaboons

James Lenman (2000): Consequentialism and Cluelessness on JSTOR

The Twilight Zone: Cradle of Darkness

Wikipedia: Novikov Self-Consistency Principle

Dylan Matthews: The Baby Hitler Controversy, Explained: "If you woke up this morning and asked yourself, 'Would conservative podcaster Ben Shapiro travel backwards through kill and murder Adolf Hitler when Hitler was a tiny baby?', then (a) you should seek help but (b) I have an answer to your question... #moralphilosophy

Maurice LeBlanc*: The Teeth of the Tiger (Arsene Lupin) #books

Enda Kenny (2011): Cloyne Report: "Taoiseach Enda Kenny has strongly criticised the Vatican for what he said was an attempt to frustrate the Cloyne inquiry, accusing it of downplaying the rape of children to protect its power and reputation...

Brad DeLong (2007): On Robert Barro's (2005) "Rare Events and the Equity Premium" and T.A. Rietz's (1988) "The Equity Risk Premium: A Solution": Our habit of using the Lucas-tree model of Lucas (1978), ["Asset Prices in an Exchange Economy](http://links.jstor.org/sici?sici=0012- 9682(197811)46:62.0.CO ;2-I) as a workhorse has turned out to be a trap. The Lucas-tree model has neither production nor accumulation. This makes it easy to solve. But this makes its responses perverse. There are no scarce resources to be allocated among alternative uses. There are only asset prices which must move so as to make agents unwilling to try to reallocate resources. It is, I think, not surprising that an economic model in which resource allocation plays no role is a dangerous tool to use in trying to understand the world... #economicsgonewrong #finance

Wikipedia: Leonid Kantorovich #economicsgoneright

Stefan Rahmstorf: "Earth is anomalously warm, but North America is cold. A huge blob of icy Arctic air, usually corralled up north by the polar vortex, has escaped and moved south. You can check the data here: http://cci-reanalyzer.org/wx/DailySummary/#t2anom Is this becoming more common, and why?... Marlene Kretschmer... has just finished her PhD thesis... has found that over the last decades, the stratospheric polar vortex has become weaker and less stable, so Arctic air masses can escape more easily towards the North American and Eurasian continents... #globalwarming

Ed Dolan: Two Charts That Show How Ill-Prepared We Are for the Next Recession: "In both 2001 and 2007, the Fed was able to begin cutting the fed funds rate based on early indications of trouble, and still have room for maneuver. Today���s situation is not as favorable..... If a recession were to come any time soon, the deficit will quickly eclipse the 10 percent mark that it approached at the bottom of the Great Recession. Even if we accept the technical feasibility of large-scale stimulus under those conditions, it would take a Congress with a lot more political courage than the one we have now to pass a robust countercyclical package of tax cuts and spending increases under those conditions.... DeLong is right. We are not ready for the next recession...

Dani Rodrik: Where are we in the economics of industrial policies? | VoxDev: "While it is too early to suggest that research on industrial policy has taken off, these newer studies do advance our understanding of industrial policies on several fronts. We have a better sense of the economic and institutional circumstances under which industrial policy can contribute to economic development...

Robert Waldmann (2016): Dynamic Inefficiency https://delong.typepad.com/dynamicine... "Is public debt a burden?... It is possible in theory that the answer is no and that higher [initial] public debt causes permanently higher [balanced-growth path] consumption and welfare.... This is called dynamic inefficiency. The standard result from simple models is that an economy is dynamically inefficient if r is less than g where r is the real interest rate and g is the rate of GDP growth. This formula isn���t very useful in the real world, because... there is a low real interest rate on safe assets and higher rates on risky assets. The standard interpretation of ���r��� is that it refers to the ratio of total capital income to total capital.... The question of interest is whether increased public debt can cause increased welfare when the safe real interest rate rsafe is lower than g but the average return on capital r is greater than g. I think the answer is yes, so I think it is plausible that, in the real world, greater public debt will cause permanently higher welfare... #publicfinance #fiscalpolicy #equitablegrowth

The curious thing is that Rod Dreher has never had any problems despising and demonizing those who embrace what he sees as bad men and bad causes. But somehow the Trumpists���the Trumpists alone���get a get-out-of-jail-free card from him: Rod Dreher: A Yankee Franco and The Long Defeat: "Conservative Christians will embrace politically a bad man... because unlike left-wing leaders, he doesn���t despise them, and seek to demonize them.... If progressives in America push too hard, and economic conditions are just right, the years ahead may bring about an American Franco���that is to say, a right-wing authoritarian leader who demolishes democracy, and rules by decree... [and] will be popular with half the country.... I deeply wish that the mainstream left... would get a freaking grip on itself, and understand exactly what kind of demons it is calling forth... #moralresponsibility #orangehairedbaboons

Increasing attention to leverage cycles and collateral valuations as sources of macroeconomic risk seems to be very welcome. Leverage and trend-chasing are the two major sources of demand-for-assets curves that slope the wrong way: when prices drop demand falls, either because you need to liquidate in order to repay now-undercollateralized loans or because you do not want to be long in a bear market. And there is every reason to think the government need to take very strong steps to make effective demand curves slope the proper way: Felix Martin: Will there be another crash in 2019?: "One important detail is that this effect is achieved not only directly, by adjusting the cost of borrowing, but also indirectly by making assets cheaper or more expensive... #finance #macro

Really surprised that there is no evidence of boom-bust asymmetry here. I am going to have to dig into what reasonable alternatives are and how much power they have here: Adam M. Guren, Alisdair McKay, Emi Nakamura, and Jon Steinsson: Housing Wealth Effects: The long View: "We exploit systematic differences in city-level exposure to regional house price cycles... #macro #finance

Ian Dunt: Historic Defeat: May Faces Her Day of Judgement: "At the moment there is no majority for no-deal or a People's Vote. Many MPs have ruled out both. But soon they are going to have to decide which of the two they find least objectionable.��No-deal comes closer and closer.... Options are likely to whittle down until only a People's Vote is left. The question is whether enough MPs have the bravery and responsibility to prevent no-deal. We're about to find out... #orangehairedbaboons #globalization

Ian Dunt: Historic Defeat: May Faces Her Day of Judgement...

Ian Dunt: Historic Defeat: May Faces Her Day of Judgement: "At the moment there is no majority for no-deal or a People's Vote. Many MPs have ruled out both. But soon they are going to have to decide which of the two they find least objectionable.��No-deal comes closer and closer.... Options are likely to whittle down until only a People's Vote is left. The question is whether enough MPs have the bravery and responsibility to prevent no-deal. We're about to find out...

#noted #orangehairedbaboons #globalization

Really surprised that there is no evidence of boom-bust a...

Really surprised that there is no evidence of boom-bust asymmetry here. I am going to have to dig into what reasonable alternatives are and how much power they have here: Adam M. Guren, Alisdair McKay, Emi Nakamura, and Jon Steinsson: Housing Wealth Effects: The long View: "We exploit systematic differences in city-level exposure to regional house price cycles...

...Our main findings are that: 1) Large housing wealth effects are not new: we estimate substantial effects back to the mid 1980s; 2) Housing wealth effects were not particularly large in the 2000s; if anything, they were larger prior to 2000; and 3) There is no evidence of a boom-bust asymmetry. We compare these findings to the implications of a standard life-cycle model with borrowing constraints, uninsurable income risk, illiquid housing, and long-term mortgages. The model explains our empirical findings about the insensitivity of the housing wealth effects to changes in the loan-to-value (LTV) distribution, including the dramatic rise in LTVs in the Great Recession. The insensitivity arises in the model for two reasons. First, impatient low-LTV agents have a high elasticity. Second, a rightward shift in the LTV distribution increases not only the number of highly sensitive constrained agents but also the number of underwater agents whose consumption is insensitive to house prices...

#noted #macro #finance

Increasing attention to leverage cycles and collateral va...

Increasing attention to leverage cycles and collateral valuations as sources of macroeconomic risk seems to be very welcome. Leverage and trend-chasing are the two major sources of demand-for-assets curves that slope the wrong way: when prices drop demand falls, either because you need to liquidate in order to repay now-undercollateralized loans or because you do not want to be long in a bear market. And there is every reason to think the government need to take very strong steps to make effective demand curves slope the proper way: Felix Martin: Will there be another crash in 2019?: "One important detail is that this effect is achieved not only directly, by adjusting the cost of borrowing, but also indirectly by making assets cheaper or more expensive...

...When the interest rate available from the central bank falls, other, higher-yielding assets become more attractive���so their prices get pushed up. When the policy rate rises, by contrast, alternative assets look relatively less alluring���so they are sold down, until their price falls enough to entice savers back. Because borrowing at any scale depends not just on cost but on collateral, this valuation effect of monetary policy constitutes a second important channel of its effectiveness. When interest rates fall, the value of capital assets used as collateral for loans���be they shares, intellectual property, or real estate���inflates. As a result, credit becomes not only cheaper to service, but easier to access...

#noted #finance #macro

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers