J. Bradford DeLong's Blog, page 241

February 2, 2019

Weekend Reading: Tren Griffin: A Dozen Things I���ve Learned from Charlie Munger about Capital Allocation

Tren Griffin: A Dozen Things I���ve Learned from Charlie Munger about Capital Allocation:

���Proper allocation of capital is an investor���s number one job.��� Capital allocation is not just the number one job of an investor but of anyone involved in any business. This is a core part of why��Buffett and Munger say that being an investor makes you a better business person and being a better business person makes you a better investor. Making capital allocation decisions is core to any business, including a hot dog stand. Everyone must decide how to deploy their firm���s resources. Michael Mauboussin and Dan Callahan describe the core task in allocating capital simply: ���The net present value (NPV) test is a simple, appropriate, and classic way to determine whether management is living up to this responsibility. Passing the NPV test means that $1 invested in the business is worth more than $1 in the market. This occurs when the present value of the long-term cash flow from an investment exceeds the initial cost.��� Of course just passing the NPV test is not enough since the investor or business person���s job to seek the most attractive opportunity of all the opportunities that are available. Building long-term value per share is the capital allocator���s ultimate objective. Buffett puts it this way: ���If we���re keeping $1 bills that would be worth more in your hands than in ours, then we���ve failed to exceed our cost of capital.���

���It���s obvious that if a company generates high returns on capital and reinvests at high returns, it will do well. But this wouldn���t sell books, so there���s a lot of twaddle and fuzzy concepts that have been introduced that don���t add much.��� Munger is not a fan of academic approaches to capital allocation. He would rather keep the analysis simple. One issue that concerns both Buffett and Munger is that many CEOs arrive in their job without having sound capital allocation skills. The jobs that they have had previously in many cases do not provide them with sufficient capital allocation experience. Buffett has written: ���Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration or, sometimes, institutional politics.��� The best way to learn to wisely allocate capital is to actually allocate capital and get market feedback on those decisions. Allocating capital requires judgment and the best way to have good judgment is often to have experienced some effects of bad judgment. This lack of capital allocation experience can create problems since many people tend to focus on short-term stock prices and quarterly results. Munger believes that if an investor or CEO focuses on wise capital allocation and��long term value the stock price will take care of itself.

���In the real world, you uncover an opportunity, and then you compare other opportunities with that. And you only invest in the most attractive opportunities. That���s your opportunity cost. That���s what you learn in freshman economics. The game hasn���t changed at all. That���s why Modern Portfolio Theory is so asinine.��� ���It���s your alternatives that matter. That���s how we make all of our decisions. The rest of the world has gone off on some kick ��� there���s even a cost of equity capital. A perfectly amazing mental malfunction.��� ���I���ve never heard an intelligent discussion on cost of capital.��� Munger has on several occasions expressed his unhappiness with academic approaches to finance. Buffett describes their approach as follows: ���Cost of capital is what could be produced by our 2nd best idea and our best idea has to beat it.��� All capital has an opportunity costs ��� what you can do with the next best alternative. If your next best alternative is 1%, it is 1% and if it is 10% it is 10%, no matter what some formula created in academia might say. Allocating capital to a sub-optimal use is a mis-allocation of capital. As an example, if you are a startup founder and you are buying expensive chairs for your conference room the same process should apply. Is that your best opportunity to deploy capital? Those chairs can potentially be some of the most expensive chairs ever purchased on an opportunity cost basis. I have heard second hand that if you drive an expensive sports car Buffett has in the past on the spot calculated in his head what your opportunity cost is in buying that car versus investing.

���We���re guessing at our future opportunity cost. Warren is guessing that he���ll have the opportunity to put capital out at high rates of return, so he���s not willing to put it out at less than 10% now. But if we knew interest rates would stay at 1%, we���d change. Our hurdles reflect our estimate of future opportunity costs.��� ���Finding a single investment that will return 20% per year for 40 years tends to happen only in dreamland.��� The current interest rate environment is a big departure from the past. Andy Haldane has pointed out that interest rates appear to be lower than at any time in the past 5,000 years. These very low interest rates driven by a ���zero interest rate policy��� or ZIRP have created new challenges for investors and business people. One issue that seems to exists today is a stickiness of hurdle rate at some businesses. Hurdle rates that were put in place in the past may not be appropriate in today���s world. Buffett has said: ���The real test is whether the capital that we retain generates more in market value than is retained. If we keep billions, and the present value is more than we���re keeping, we���ll do it. We bought a company yesterday because we thought it was the best thing that we could do with $3 million on that day.��� In 2003 Buffett said: ���The trouble isn���t that we don���t have one [a hurdle rate] ��� we sort of do ��� but it interferes with logical comparison. If I know I have something that yields 8% for sure, and something else came along at 7%, I���d reject it instantly. Everything is a function of opportunity cost.��� Warren also recently said that he wasn���t just going to buy using today���s very low rates just because they were his current best opportunity. These sorts of questions are very hard to sort out given the economic environment we are in now is new. The last point Munger makes is that when someone promises you a long term return of something like 20% for 40 years hold on to your wallet tightly and run like the wind.

���There are two kinds of businesses: The first earns 12%, and you can take it out at the end of the year. The second earns 12%, but all the excess cash must be reinvested ��� there���s never any cash. It reminds me of the guy who looks at all of his equipment and says, ���There���s all of my profit.��� We hate that kind of business.��� Munger likes a business that generates free cash flow that need not be reinvested and not just an accounting profit. Some business with an accounting profit require that you reinvest all or nearly all of any cash generated into the business and Munger is saying businesses like this are not favored. Coke and See���s Candies are attractive businesses based on this test. Airlines by contrast are not favored. Munger calls an airlines ���marginal cost with wings.��� Munger is also not a fan of creative accounting���s attempt to hide real costs: ���People who use EBITDA are either trying to con you or they���re conning themselves. Interest and taxes are real costs.��� ���I think that, every time you see the word EBITDA, you should substitute the word ���bullshit��� earnings.��� Buffett says: ���Interest and taxes are real expenses. Depreciation is the worst kind of expense: You buy an asset first and then pay a deduction, and you don���t get the tax benefit until you start making money.���

���Of course capital isn���t free. It���s easy to figure out your cost of borrowing, but theorists went bonkers on the cost of equity capital.��� ���A phrase like cost of capital means different things to different people. We just don���t know how to measure it. Warren���s way of describing it, opportunity cost, is probably right. The answer is simple: we���re right and you���re wrong.��� ���A corporation���s cost of capital is 1/4 of 1% below the return on capital of any deal the CEO wants to do. I���ve listened to many cost of capital discussions and they���ve never made much sense. It���s taught in business school and consultants use it, so Board members nod their heads without any idea of what���s going on.��� Berkshire does not ���want managers to think of other people���s money as ���free money������ says Buffett, who points out that Berkshire imposes a cost of capital on its managers based on opportunity cost. One thing I love about this set of quotes is Munger admitting that Buffett is only ���probably��� right and that they don���t know how to measure something others talk about. It indicates that Munger is always willing to consider that he is wrong. While he has said that he has a ���a black belt in chutzpah,��� he has also said that if he does not overturn a treasured belief at least once a year, it is a wasted year since it means he is not always looking hard at whether his beliefs are correct. In his��new book Superforecasting, Professor Philip Teltock��might as well have been writing about Charlie Munger when he wrote:�����The humility required for good judgment is not self doubt ��� the sense that you are untalented, unintelligent or unworthy. It is intellectual humility. It is a recognition that reality is profoundly complex, that seeing things clearly is a constant struggle, when it can be done at all, and that human judgment must therefore be riddled with mistakes.���

���We���re partial to putting out large amounts of money where we won���t have to make another decision.��� Attractive opportunities to put capital to work at high rates of return don���t come along that often. Munger is saying that if you are a ���know something investor��� when you find one of these opportunities you should load up the truck and invest in a big way. He is also saying that he agrees with Buffett that their preferred holding period ���is forever.��� Buffett looks for a business: ���where you have to be smart only once instead of being smart forever.��� That inevitably means a business that has a solid sustainable moat. Buffett believes that finding great investment opportunities is a relatively rare event: ���I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches ��� representing all the investments that you got to make in a lifetime. And once you���d punched through the card, you couldn���t make any more investments at all. Under those rules, you���d really think carefully about what you did, and you���d be forced to load up on what you���d really thought about. So you���d do so much better.��� When he finds a really great business the desire of Charlie Munger is to hold on to it. Munger elaborates on the benefits of not selling: ���You���re paying less to brokers, you���re listening to less nonsense, and if it works, the tax system gives you an extra one, two, or three percentage points per annum.���

���We have extreme centralization at headquarters where a single person makes all the capital allocation decisions.��� Centralization of capital allocation decisions at Berkshire to take advantage of��Warren Buffett���s extraordinary abilities is an example of opportunity cost analysis at work. Why allow your second best capital allocator or 50th best do this essential work? Here���s Buffett on his process: ���In allocating Berkshire���s capital, we ask three questions: Should we keep the capital or pay it out to shareholders? If pay it out, then you have to decide whether to repurchase shares or issue a dividend.��� ���To decide whether to retain the capital, we have to answer the question: do we create more than $1 of value for every dollar we retain? Historically, the answer has been yes and we hope this will continue to be the case in the future, but it���s not certain. If we decide to retain and invest the capital, then we ask, what is the risk?, and seek to do the most intelligent thing we can find. The cost of a deal is relative to the cost of the second best deal.��� As was noted in the previous blog post in this series, nearly everything else other than capital allocation and executive compensation is decentralized at Berkshire.

���We���re not going to put huge amounts of new capital into a lousy business. There are all kinds of wonderful new inventions that give you nothing as owners except the opportunity to spend a lot more money in a business that���s still going to be lousy. The money still won���t come to you. All of the advantages from great improvements are going to flow through to the customers.��� This is such an important idea and yet it is often poorly understood. Many investments in a business are only going to benefit customers because the business has no moat. In economic terminology, the investment produces all ���consumer surplus��� and no ���producer surplus.��� Some businesses must continue to plow capital into their business to remain competitive in a business that is still going to deliver lousy financial returns. Journalists often talk about businesses that ���earn��� some amount without noting that what they refer to is revenue not profit. What makes a business thrive is profit and absolute dollar free cash flow. One thing I am struck by in today���s world is how hard nearly every business is in terms of making a significant genuine profit. The business world is consistently hyper competitive. There is no place to hide from competition and potential disruption. If you have a profit margin, it is someone else���s opportunity. Now more than ever. People who don���t think this contributes the inability of central banks to create more inflation are not living in the real business world.�� Making a sustained profit in a real business is very hard.

���I don���t think our successors will be as good as Warren at capital allocation.��� There will never be another Warren Buffett just as there will never be another Charlie Munger. But that does not mean you can���t learn from the way they make decisions, including, but not limited to, capital allocation decisions. Learning from others is strangely underutilized despite its huge rewards. Some of this aversion to learning from others must come from overconfidence. This overconfidence is good for society since it results in a lot of intentional and accidental discovery. But at an individual level it is hard on the people doing the experimentation. Reading widely about how others investors and business people approach capital allocation is wise. As an example, Howard Marks and Seth Klarman are people who have learned from Buffett and Munger and vice versa. Having said that, we are all unique as investors. There is no formula or recipe for successful investing. But there are approaches and processes that are far more sound than others that can generate an investing edge if you are willing to do the necessary work. These better decision making process are applicable in life generally. If you are not willing to do the work that an investor like Munger does in his investing, you should buy a diversified low cost portfolio of index funds/ETFs. A dumb ���know nothing investor��� can transform themselves into a smart investor by acknowledging that they are dumb. Buffett calls this transformation from��dumb to smart of they��admit they��are dumb an investing paradox.

���All large aggregations of capital eventually find it hell on earth to grow and thus find a lower rate of return.��� Munger is saying that the more assets you must manage the harder it is to earn an above market return. Putting large amounts of money to work means it takes more time to get in and out of positions and for that reason it becomes hard to effectively invest in relatively smaller opportunities. Buffett puts it this way: ���There is no question that size is an anchor to performance. We intend to prove that up to the point that it really starts biting. We can���t earn the same returns on capital with over $300 billion in market cap. Archimedes said he could move the world with a long enough lever. I wish I had his lever.���

���Size will hurt returns. We can only buy big positions, and the only time we can get big positions is during a horrible period of decline or stasis. That really doesn���t happen very often.��� There are times when Mr. Market turns fearful and huge amounts of capital can be put to work even by Berkshire as was the case in 2008. To be able to take advantage of this requires that the investor (1) be patient and (2) be aggressive when it is time. Jumping in when things are falling apart takes courage. Not jumping is during a period of investing frenzy takes character. Bill Ruane believes: ���Staying small in terms of the size of fund is simply good business. There aren���t that many great companies.��� The bigger the fund the harder it is to outperform. Bill Ruane famously closed his fund to new investors to be ���fair��� to his clients.��

In terms of��an example of outperforming during what for others was a horrible time, the following��example of Munger in action below speaks for itself. Bloomberg wrote at the time: ���By diving into stocks amid the market panic of 2009, Munger reaped millions in paper profits for the Daily Journal. The investment gains, applauded by Buffett at Berkshire Hathaway���s annual meeting in May, have helped triple Daily Journal���s own share price. While Munger���s specific picks remain a mystery, a bet on Wells Fargo (WFC) probably fueled the gains, according to shareholders who have heard Munger, 89, discuss the investments at the company���s annual meetings. ���Here���s a guy who���s in his mid-80s at the time, sitting around with cash at the Daily Journal for a decade, and all of a sudden hits the bottom perfect.������

Munger having the necessary cash to do this investment in size at the right time in 2009 was not accidental. You don���t have the cash at the right time by following the crowd. As Buffett points out holding cash is not costless:�����The one thing I will tell you is the worst investment you can have is cash. Everybody is talking about cash being king and all that sort of thing. Cash is going to become worth less over time. But good businesses are going to become worth more over time.��� That available cash was a residual of a disciplined buying process focused on a bottoms-up analysis by Munger of individual stocks. His ability to do this explains why he is a billionaire and we are not...

#noted #weekendreading

February 1, 2019

But the demented yo-yo-ness of the stock market is import...

But the demented yo-yo-ness of the stock market is important because it signals yo-yo-ness in investment spending three quarters down the road. "Deserve" has absolutely nothing to do with it. And Felix asks "how long is too long for real rates to be negative"? The answer is: as long as inflation is below its target���or below what the inflation target should be���it's not too long: Felix Salmon: The Case Against Raising Rates: "Brad is right that the stock market decline is new information, but it's new information that tells us more about stock-market volatility than it does about the health of the economy. The market does not deserve some kind of Fed-dispensed doggie treat just for bouncing around like a demented yo-yo...

...Brad then says that interest rates can't have been artificially low, even when they were negative in real terms for almost a decade, because we haven't seen any inflation. He's conflating two different things. Negative real interest rates can cause speculative asset bubbles even if they don't cause inflation. Brad also thinks that "reserve and capital requirements"can "nip potential overleverage in the bud". But no one has come close to being able to apply such requirements to non-banks like private-equity shops and hedge funds, let alone corporations.

The bottom line: So long as inflation remains below its 2% target, critics will be able to make a credible case that rates should stay low. But how low is too low? (The current range of 2.25% to 2.5% is hardly high.) The question can also be posed a different way: How long is too long for real rates to be negative?...

#noted

Harry Brighouse: Navigating the Need for Rigor and Engage...

Harry Brighouse: Navigating the Need for Rigor and Engagement: How to Make Fruitful Class Discussions Happen: "Derek Bok... a passage that, ultimately, transformed my teaching:

Teaching by discussion can also seem forbidding because it makes instructors uncomfortably aware of their shortcomings. Lecturers can delude themselves that their courses are going well, but discussion leaders know when their teaching is failing to rouse the students��� interest by the indifferent quality of responses and the general torpor of the class. Trying to conduct a discussion with apathetic students is much like giving a bad dinner party...

...Reading it was like receiving a slap in the face from someone who had been sitting in my classroom, and knew me better than I know myself. Why do we lecture so much? All teachers experience a tension between the need for engagement and the need for rigor. Without rigor, the students won���t learn what we want them to; without engagement, they won���t learn anything at all. In the classroom, the best way to guarantee rigor is for the professor to do all the talking���this is how they delude themselves that the class is going well. Unfortunately, this is also the best way to ensure complete disengagement, leading to torpor when we do try to stimulate discussion. Students have to talk and write, because talking and writing are essential for practicing the discursive practices and thinking skills that we are trying to make them learn in the humanities. We can make them write (some) outside the classroom; but in my experience most students have to talk in the classroom if they are going to talk at all. Realizing that students need to discuss is helpful, but actually knowing how to make them discuss is another matter���it���s a skill that has to be learned. The challenge is not getting them to talk, but doing so without sacrificing too much rigor���how to ensure high-quality thinking and talking which engages the whole class....

#noted #teachingeconomics #berkeley

Scott Lemiueux: Mitch McConnell: Free and Fair Elections ...

Scott Lemiueux: Mitch McConnell: Free and Fair Elections Would Be Disastrous For the Republican Party

#noted #moralresponsibility

Josh Marshall: Why the Outlook for Digital Media Behemoth...

Josh Marshall: Why the Outlook for Digital Media Behemoths is Worse than You Think: "There are reasons to own a media company that posts consistent if modest profits.... even reasons to own media companies that lose predictable and relatively small amounts of money every year. The problem is that the people who currently own these companies aren���t in it for any of those reasons.... News organization don���t need to be wildly profitable. But the people who own most digital media today are owning for wild profitability or... the credible hope of future wild profitability... to sell the media companies for big returns. That���s a problem...

...You can say... lots of people would be happy to own a big media operation that threw off even modest profits. No doubt. But again, how does it get into those people���s hands? One of the VC���s that currently owns Buzzfeed (and this applies to all these companies) may be happy to hand it off to that kind of owner. But they really want a big return on their investment or at least they don���t want to lose money. And they���re the owners. So it���s hard for me to see how we���re not looking at a near to medium term outlook with accelerating efforts to drive the levels of profitability that can get the exits their investors want...

#noted #journamalism

This is hugely double-plus unhood. You would think Facebo...

This is hugely double-plus unhood. You would think Facebook would be more careful these days: Jeremy B. Merrill: Facebook Moves to Block Ad Transparency Tools���Including Ours: "Our tool had let the public see exactly how users were being targeted by advertisers. The social media giant urged us to shut it down...

#noted #behavioral #riseoftherobots #moralresponsibility

Barry Ritholtz (2016): The Counterfactual: "States, those...

Barry Ritholtz (2016): The Counterfactual: "States, those so-called laboratories of democracy, have been engaging in a variety of different policy experiments.... Consider the following... "fourteen states begin the new year with higher minimum wages"... and, during the next few years, minimum wage increases are scheduled to take place in California, New York, Oregon and elsewhere. Regardless of your views... we will get a huge run of data in the coming years. Whatever your beliefs may be, you should pay attention to this data to learn if they are well-supported or not. We also see similar experiments taking place in tax policy.... During the past few years, we saw big tax cuts in Kansas, Louisiana and New Jersey, with big tax increases in others...

#noted #equitablegrowth #labormarket

Barry Ritholtz: More Noise, Less Signal: "What would happ...

Barry Ritholtz: More Noise, Less Signal: "What would happen if you purposefully tried to assemble a ���How-to��� list to pursue the exact opposite goal���how to get more noise, and less signal? In other words, what are the exactly wrong things to do as an investor? I took last week���s list, and updated it to be the anti-list...

...How to Get More Noise & Less��Signal:

Mainstream media is an excellent source of actionable trading & investing ideas. Especially financial television (FinTV). You should uncritically consume even more of it.

Data is overrated. Go with anecdotes from people you know personally and your gut instincts;

Pundits and TV guests are there to help you reach a comfortable retirement. They have no other agendas.

The most important information about the stock market ��� especially about when to buy or sell ��� is known only to handful of insiders. Envy them (and blame your losses on not being in that circle).

You need to exert lots of energy, spend lots of time, and create lots of stress about the following: The Federal Reserve, the Dollar, Congress, Inflation, Sovereign Bank Debt in Europe, Peak Oil, China, Deflation, Austerity in the UK, and the��Hindenburg Omen.

Don���t worry if you are not good at math or science; Empiricism and probability analysis are vastly overrated (they are for geeks anyway); WTF is mean reversion?

Focus on the news sources that are in sync with your own political views and opinions and investment postures. Do not read anything that challenges your pre-existing beliefs. Besides, analysts and websites and fund managers that have been wrong for years are due for a winner!

Short term trading is where its at! Don���t worry about the long term ��� its way off in the future. Measure your success in minutes and hours, not years and decades.

There is no reason that you cannot also have a good time with your retirement account; That���s what its there for anyway.

Never listen to those who people with good long time track records who have had a losing trade or a bad quarter. It's all about recent performance!...

#noted #finance

Sydnee Caldwell and Nikolaj Harmon: Outside Options, Barg...

Sydnee Caldwell and Nikolaj Harmon: Outside Options, Bargaining, and Wages: Evidence from Coworker Networks: "We develop a strategy that isolates changes in a worker���s information about her outside options...

...Individuals often learn about jobs through social networks, including former coworkers. We implement this strategy using employer-employee data from Denmark that contain monthly information on wages and detailed measures of worker skills. We find that increases in labor demand at former coworkers��� current firms lead to job-to-job mobility and wage growth.... Larger changes are necessary to induce a job-to-job transition than to induce a wage gain. Specification tests leveraging alternative sources of variation suggest these responses are indeed due to information rather than unobserved demand shocks. Impacts on earnings are concentrated among workers in the top half of the skill distribution...

#noted

The important takeaway from the February 1 BLS Employment...

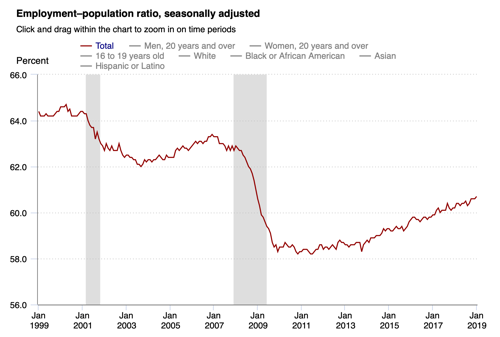

The important takeaway from the February 1 BLS Employment Report is that good-producing wage growth was remarkably low. No one data point should cause you to change your view radically. But it is yet another brick in the wall of evidence that the Federal Reserve has been massively underestimating how much slack there is in the U.S. economy by focusing on the unemployment rate. The current employment-to-population ratio is 60.7%. The prime-age rate tells us that we should probably adjust that upward by 2.1% to take account of population aging over the last two decades. That tells us that the labor market is still slack relative to its state in the late 1990s to the extent of a full percentage point or so. We should not expect to see higher inflation now���and the Fed should not have tied itself to the mast of using the unemployment rate as thecyclical variable over the past decade. Dan Alpert brings the main course. Karl Smith, Ryan Avent, Nick Bunker: Dan Alpert: Dan Alpert on Twitter: "Hourly and weekly wages for literally all categories of goods producing jobs took a huge tumble last month-down 13 cents/hr or 0.45% on average M/M. Its good :-( that there are so few of them or wages across the board would have plummeted! This is huge news!...

...Karl Smith: @karlbykarlsmith: There is no evidence of increasing inflation in the wings. What this shows is that the potential labor force is larger than the models suggested. That is a result we've seen repeatedly confirmed by multiple independent measures of slack. #ourFullPotential...

Ryan Avent: @ryanavent: We'll see where it ends up after revisions; probs not far from 2018 trend. But when you're adding jobs like this ten years into the expansion, you're not at full employment. Would have been cool if the Fed had allowed the economy to create some of these jobs a few years ago! This kind of jobs report at this point in the cycle means the Fed did a bad job, not a good job. Still have to just stand back and marvel at this kind of job growth, a decade into the expansion, with inflation under 2% and 30-year bonds at 3%. I understand that political constraints that applied at the time, but man would it have been nice to have been rolling out a several trillion dollar package of infrastructure upgrades, green investment, etc over the past decade. Pivoting to deficit reduction = one of the great missed economic opportunities ever...

Nick Bunker: @nickbunker_: If anything payroll growth still this high signals a bit more slack in labor market and that we���re still not at ���maximum employment���. That would supports the dovish turn...

Joe Weisenthal _@TheStalwart**: I take the exact opposite view. The new jobs data shows that we've been massively underestimating the amount of slack in the economy and therefore the Fed should be cautious about further hikes when there are so many people out there who still want to work. When the pace of jobs growth slows to 100k, the LFPR plateaus, and wage growth starts accelerating past pre-crisis levels, let's talk about the labor market getting too tight or too hot...

Note to Self: The gap between the prime-age and the overall employment-to-population ratio has widened from 17.0% to 19.1% over the past two decades.

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers