J. Bradford DeLong's Blog, page 239

February 6, 2019

Donald Tusk: "I've been wondering what that special place...

Donald Tusk: "I've been wondering what that special place in hell looks like, for those who promoted #Brexit, without even a sketch of a plan how to carry it out safely...

#noted

Anatole Kaletsky: How EU Leaders Can Prevent a No-Deal Br...

Anatole Kaletsky: How EU Leaders Can Prevent a No-Deal Brexit: "Once May���s negotiating strategy is properly understood, the EU���s rational response becomes obvious: total inflexibility on the Brexit deal���s substance, but removal of the Brexit deadline..... No concessions of any kind on the withdrawal agreement... the commitment to Ireland... no hints about future trade deals. But they should also state publicly that they no longer consider March 29 a hard deadline and would be happy to extend the Brexit negotiating period for as long as is necessary not only to agree on a new UK-EU relationship, but also to demonstrate that what is agreed satisfies both sides...

#noted

February 5, 2019

?????? it certainly seems to me as though Donald Trump wa...

?????? it certainly seems to me as though Donald Trump wants there to be a Sino-American trade war���after all they are, as he says, easy to win. If the U.S. wants a tussle with China over intellectual property, the right strategy is for the U.S to back off now, go to the TPP members, apologize for its actions in rejecting the TPP in early 2017, join the TPP, and then negotiate as part of a United front with other TPP members. The U.S. by itself has no leverage ���the IP China can grab is worth more than the cost of losing access to the U.S. market. So I have no idea what Marty thinks he is saying here: Martin Feldstein: There Is No Sino-American Trade War: "Chinese negotiators recently offered to buy enough American products to reduce the bilateral trade deficit to zero by 2024. Why, then, have US negotiators rejected that as a way to end the dispute?...

...The current conflict between the United States and China is not a trade war. Although the US has a large trade deficit with China, that is not the reason why it is imposing high tariffs on imports from China and threatening to increase them further after the end of the current 90-day truce on March 1. The purpose of those tariffs is to induce China to end its policy of stealing US technology.... The US wants China to stop requiring American firms that seek to do business in China to have a Chinese partner and to share their technology with that partner. That policy is explicitly forbidden by World Trade Organization rules.... The Chinese use the stolen technology to compete with US firms in China and in other parts of the world.... The US government has no desire to stop China���s economic growth or the growth of its high-tech industries. But stealing technology is wrong. It has gone on for too long and should not be allowed to continue.

The US is determined to stop it. If nothing is resolved by March 1, the US will raise the tariff on $200 billion of Chinese exports from 10% to 25%. That will hurt the Chinese economy further and cause the Chinese authorities to take the US demands more seriously���and to negotiate accordingly...

#noted

Emil Verner and Gyozo Gyongyosi: Household Debt Revaluati...

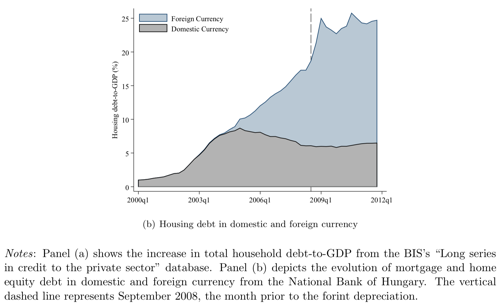

Emil Verner and Gyozo Gyongyosi: Household Debt Revaluation and the Real Economy: Evidence from a Foreign Currency Debt Crisis: "The large (over 30%) and unexpected depreciation of the Hungarian forint in late 2008... a shock to local household debt... a rise in default rates and a persistent decline in local durable and non-durable consumption...

...Next, we find that regions with greater exposure to foreign currency debt experience a persistent increase in local unemployment. Firm-level census data reveal that employment losses are driven by firms dependent on local demand. Exposed areas see a modest decline in wages, but no adjustment through reallocation toward exporting firms or migration. In addition to the direct effect of higher debt, we find evidence of local spillovers. Regional exposure to foreign currency debt predicts a decline in house prices and an increase in the probability of default for households with only domestic currency debt. Our results are consistent with demand and pecuniary externalities of household foreign currency debt financing...

#noted

A very nice Twitter rant from Tom Nichols.

A very nice Twitter rant from Tom Nichols. In fact, I think it is worse���if they could be bought off, it would be fine.

But they can't be bought off since they have no idea what they want.

The people of the hill country of Kentucky needed the end of pre-existing condition exclusions for the upper half of and access to Medicaid for the lower half of the working class. They buy-off was accomplished. And yet...:

Tom Nichols: "If Trump wanted to add 15 more countries to NATO and fund the World Bank from Social Security taxes, Lindsey Graham would propose the legislation and guys in diners in Ohio would be explaining why it was the right thing to do���as long as some intellectual objected first. I'm not sure how long we have to go on pretending Trump's policies reflect a 'view', any more than any other group of populist idiots. What does the current Italian govt want to do? Heard about them lately? They're bogged down in dumb stuff. Because populism isn't a program. It's stupefying to watch intelligent men and women wishcasting 'idea'" onto Trumpism or Leavers or Europopulists. There's no 'there' there. It's the Seinfeld of political movements: about nothing, but passionately about nothing. Yes, yes, I know. Immigration. Income inequality. Gas prices. Mostly, it's about change, and why people hate it, and why they want to be bought off rather than accept it. More transfers for me, and also, please magically create an idealized version of 1970 that never existed. The tell is that people are aggrieved over things that aren't true. Ask Americans-or even the French-how many Muslims live in their country. How much they think gas should be. What they think was better in 1970 or 1980 or 1990. They can't tell you in any real way. In fact, ask them what they want. As a thought exercise, say: 'You win. What do you want?' They can't really answer that, either, because they know the answer is impossible (or racist, or self-serving). Mostly, they want to piss off other people. That's the key. That's why you can never find a compromise with the hard-core 35 percent in the U.S., or the rioters in Europe. (Short of just sending cash to them as a buy-off.) Imputing 'policy' preferences to them is a mug's game, and it's long past time to stop playing it...

#noted

Fairly Recently: Must- and Should-Reads, and Writings... (February 5, 2019)

Hoisted from the Archives: "Gunpowder Empire": Should We Generalize Mark Elvin's High-Level Equilibrium Trap?: Looking forward from even as late as 1750, therefore, it is not insane to project that the Gunpowder Empire is in the natural course of events the climax socioecological state of the Sociable Language-Using East African Plains Ape. The notional quartering of farm sizes worldwide from 500 BC to 1500 had been offset by the development of maize, of double-crop wet rice, of the combination of the iron axe and the moldboard plow that could turn northern temperate forests into farms, the domestication of cotton, and the breeding of the merino sheep. People in 1500 were as well fed and clothed as they had been in 500 BC. But what would have been the next agricultural miracle technologies... to... compensate for the further quartering of farm sizes that would have been inevitable had population growth continued and human numbers topped 2 billion in 3500[?] And where would the breakthrough to steampower���or even to enough fodder to feed enough draft animals for oxen and horses to replace or even supplement human backs and thighs���to interrupt this Gunpowder-Empire climax socioecology of the Sociable Language-Using East African Plains Ape come from?...

Comment of the Day: Graydon: "Anyone who can put off investing is going to do so; there's Brexit, there's 'Ok, yeah, there isn't an adult anywhere in the Trump administration', plus there's the complete lack of statistics. Uncertainty is high and rising. Incompetence has real costs...

Blogging: What to Expect Here...: The purpose of this weblog is to be the best possible portal into what I am thinking, what I am reading, what I think about what I am reading, and what other smart people think about what I am reading...

This is, in its historical context, just bizarre: What happened to the 90% debt-to-annual-GDP redline? What happened to the claim that the idea of secular stagnation���that interest rates were likely to be at or neat the zero lower bound for decades to come���would be forgotten in a decade? What happened to the claim that "low sovereign bond yields do not necessarily capture the broader ���credit surface��� the global economy faces"?: Ken Rogoff: Never Mind The Debt: If��There���s A Hard Brexit Britain Will Have to Splash the Cash: "What���s the point of saving for a rainy day if you don���t use the savings in an epic storm? Instead of attempting to reduce the UK���s debt-to-GDP ratio (now 84%), the government should find ways to strengthen investment in physical and human capital, to help the poorest, who will be hit the hardest, and to incentivise international businesses not to abandon ship.... It has never been remotely obvious to me why the UK should be worrying about reducing its debt���GDP burden, given modest growth, high inequality and the steady (and largely unexpected) decline in global real interest rates. It is one thing to have an exit plan for controlling the rate of debt increase after a deep financial crisis; it is entirely another thing to be in any rush to bring debt levels down.... Yes, it is wise not to let debt grow inexorably, but there is also no need to run suddenly into reverse...

Carmen Reinhart and Ken Rogoff (2013): Austerity Is Not the Only Answer to a Debt Problem: "Ultra-Keynesians would go further and abandon any pretence of concern about longer-term debt reduction. This position has been in the rhetorical ascendancy in recent months.... It throws caution to the wind on debt.... The basic rationale is that low interest rates make borrowing a free lunch. Unfortunately, ultra-Keynesians are too dismissive of the risk of a rise in real interest rates. No one fully understands why rates have fallen so far so fast, and therefore no one can be sure for how long their current low level will be sustained...

From last November: Rahm Emmanuel's words have not aged well: Charles P. Pierce: Rahm Emanuel Suggests Democratic Party Rift Between Beto O'Rourke, Nancy Pelos���Wants Outreach to Trump Voters:Political Genius Rahm Emanuel Strikes Again.... I'll never understand why Mark Penn isn't selling velvet Elvis paintings at an abandoned gas station by now, but I've learned to live with that disappointment.... In one of the first really bad moves President Barack Obama made after being elected, he brought Emanuel in as his chief of staff. (I rank this just behind installing Tim Geithner at Treasury as the worst hire of the newly formed Obama administration.) It was he who cut out the legs from under a larger stimulus program and it was he who encouraged the administration's retreat from the public option on health care...

We had a dry run for this age of disinformation back in the McCarthy era. Back then the journalistic profession failed in much the same way as it has failed in our age that started with Iraq War weapons-of-mass destruction disinformation. Yet The journalistic community group no lessons from McCarthy���other than to deify Edward R. Murrow. The McCarthy era was less serious than ours, largely because Republican politicians withdrew their support for McCarthy when Eisenhower became president. But will anything cause a similar shift today?: Claire Wardle: 5 Lessons for Reporting in an Age of Disinformation: ���Doing journalism in an age of disinformation is incredibly hard, and I simply don���t think the news industry has even started grappling with the difficult questions being raised...

A totally awesome and excellent choice here���if he cannot increase the amount of attention the media pays to the very important and massively underquoted EPI, nobody can: Economic Policy Institute: Pedro da Costa Joins the Economic Policy Institute as Communications Director: "The Economic Policy Institute is pleased to announce journalist and economics commentator Pedro Nicolai da Costa as the institute���s new communications director. He will work to promote EPI���s research and policy proposals through traditional and digital media. 'I am delighted to welcome Pedro to the EPI team', said EPI President Thea Lee. 'For years, he has been an important voice in the economic discourse���and his deep knowledge of economics and passion for creating a more equitable economy will be tremendous assets to EPI'...

Channeling the great Aba Lerner: Simon Wren-Lewis: The Interest Rate Lower Bound Trap and the Ideas that Keep Us There: "Inflation... is the ultimate constraint on... fiscal stimulus.... If inflation is stuck below target and your measure of the output gap says that gap is zero, you should ignore the output gap measure and enact a fiscal stimulus. So why has this not happened in Japan, or the UK, or the Eurozone?... There are three candidates...

It would be good if this wing of the Republican Party became very strong indeed. Of course, it is still not clear to me how Brink���s approach is different from that of the Rubin Wing of the Democratic Party. Then again, a world in which the Rubin Wing of the Democratic Party were to be the dominant force in the Republican Party would surely be a world with much more space for a real debate about what policies would produce equitable growth than the world we have. Plus those policies could then be implemented! I am still scarred by the fact that not single Republican legislator would support John McCain���s climate policy, Mitt Romney���s healthcare policy, or George H.W. Bush���s foreign policy when they were advocated by a Democrat who happened to be a black man. And I still do not know how I should react to this... desertion: Brink Lindsey: Republicanism for Republicans: ���This essay is addressed to those conservatives and Republicans, from leaners to stalwarts, whose loyalties to movement and party are now badly strained or even severed.... I understand what you���re going through.... We cannot simply wait for Trump to pass from the scene, or for Democrats to win big, and hope that things will then somehow go back to normal.... We need a new political language.... The answer is right under our noses, hiding in plain sight. The project... is... to develop and articulate the principles and program of the republican wing of the Republican Party...

This is a very nice piece of work. Unfortunately, the major conclusion I draw from it is that there is much slippage between numbers of patents on the one hand and true economically relevant Innovation on the other. So I cannot see what conclusions to raw from what is a lot of hard and ingenious work: Bryan Kelly, Dimitris Papanikolaou, Amit Seru, and Matt Taddy: Measuring Technological Innovation over the Long Run: "We use textual analysis of high-dimensional data from patent documents to create new indicators of technological innovation. We identify significant patents based on textual similarity of a given patent to previous and subsequent work: these patents are distinct from previous work but are related to subsequent innovations...

The first truly good conceptual framework I have seen on where the future of employment growth may lie: David Autor: The Future Of Work: "Three trends... help explain where employment... may be headed.... 'Frontier work'... Jetson jobs... all about new technology... Supervisor, Word Processing (1980); Robotic Machine Operator (1990); Chief Information Officer (2000); Technician, Wind Turbines; and Intelligence Analyst (2010).... 'Wealth work',... jobs that primarily provide fancy-schmancy services to the rich... Hypnotherapist and Gift Wrapper (1980), Fingernail Former and Marriage Counselor (1990), Mystery Shopper, Horse Exerciser���our personal favorite���and Barista (2000); Oyster Preparer and Sommelier (2010).... 'Last mile'... what's left after machines have eaten the tasks... the atrophied husk remaining of a job when most of it has been automated... an airline ticket agent. A couple of decades ago... greet customers, help check baggage, and assign seats on the plane. Now... throwing bags on a conveyor belt and checking IDs. And so you can think of that as sort of the last mile, the last little bit of the job that remains...

Cory Doctorow: How To: Make Up Swears: "the 'pyrrhic foot' of a 'familiar profanity compounded with a non-profane word of two unaccented syllables'... especially good for coming up with nongendered swears that are not slurs, which is useful if you're trying to insult an individual.... The best of these mean nothing, but sound wonderful, evocative and fun to say...

Laura Davison: [Rubio Tweets Tax Bill He Voted For Helps Companies Over Workers(https://www.bloomberg.com/news/articl...): "Florida Republican aligns himself with Democrats on tax law Stock buybacks have jumped as wages show modest increase...

Jonathan Portes (2013): Comment on Reinhart and Rogoff's FT Article: "My letter to the FT... deliberately concentrates on the case for borrowing now to finance investment, where Reinhart and Rogoff have belatedly joined a growing consensus.... I omitted a couple of points where their article is simply incoherent.... They argue that we should be cautious about borrowing because interest rates might rise: 'Unfortunately, ultra-Keynesians are too dismissive of the risk of a rise in real interest rates. No one fully understands why [real interest] rates have fallen so far so fast, and therefore no one can be sure for how long their current low level will be sustained...

Cal Daily News: Campus Must Prioritize The Health of Cal Football Players: "Sure, the rules and regulations surrounding football go far beyond Cal, and the NCAA has revised rules regarding targeting and kickoffs to lower injury risk, but there���s still much the campus can do. A significant percentage of the revenue from football games���Cal���s most lucrative sport���should go toward CTE research and support for the players who are most likely to develop it. If the campus truly wants to support its athletes, it needs to prove it...

Marko Kloos: "I don���t know who first called Bitcoin ���Dunning-Krugerrands���, but I applaud that person every time I read an article about cryptocurrency fails like this https://gizmodo.com/crypto-exchange-says-it-cant-repay-190-million-to-clie-1832309454...

Vik's Chaat House: Menu

Brad DeLong: FT Alphachatterbox: Hamiltonian Economics

Nicholas Lardy: Xi Jinping���s turn away from the market puts Chinese growth at risk: "Credit is flowing to state-owned companies, not more productive private ones.... Xi... has also repeatedly emphasised the role of state industrial policy and state-owned companies, despite overwhelming evidence that the latter are inefficient. Even after receiving various direct subsidies, the Chinese ministry of finance acknowledges that more than two-fifths of these state companies persistently rack up losses. They are kept afloat with massive increases in bank credit that are almost entirely responsible for the increase to record levels of leverage in China���s corporate sector.... Predictably, the return on assets of the largest state-owned companies has fallen by more than half since the merger mania began. At the same time, the productivity of private companies has increased, and in the industrial sector is now almost three times that of their state-owned counterparts.... Without a return to a more marketed-oriented economic policy, even if bilateral trade disputes with the US are resolved, the likelihood is that China���s growth will slow further���with unpleasant consequence...

Azeen Ghorayshi, Jason Leopold, Anthony Cormier, and Emma Loop: Secret Files Show How Trump Moscow Talks Unfolded While Trump Heaped Praise On Putin: "Ahead of Michael Cohen���s testimony, read the original paper trail behind the campaign to build Europe���s tallest tower in Moscow���and how it played out alongside Donald Trump���s presidential campaign...

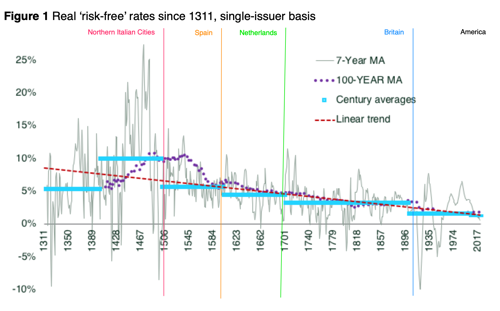

Data! Suppose that you were a rich person in Europe, and wanted to diversify and put some of your wealth not in landed estates or commercial ventures or bureaucratic office or mortgage loans, but instead simply wanted to lend it to the least-risky sovereign you could find. Paul Schmelzing has collected the data. It is very interesting. I have only one data complaint: I think he should swap out the debt of the Italian city-state average���Genoa, Florence, and Venice���that he regards as the safest sovereign from 1300 to 1500 for the debt of Barcelona, which was as financially sophisticated and was secure under the aegis of the crown of Aragon in a way that the Italian city-states were not. None of them was sacked and defaulted from 1300 to 1500. But they could have been. And I read the higher interest rates of the late 1400s as powerful evidence that the debts of Genoa, Florence, and Venice ere not regarded as safe: they might decisively lose in the wars of the condottieri, or the Turk might come. Do note that these interest rates are a different concept than the Piketty rate of profit on capital. These are, I think, best thought of as the profit rate minus an interest-rate discount for the safety and liquidity that the debt of the world's most prudent sovereign could offer. It thus depends not just on the then-current long-term rate of profit but also on perceived risks of other investments, risk tolerance, and the safe asset supply the sovereign is currently offering: Paul Schmelzing: The ���Suprasecular��� Stagnation: "Growth rates have been stubbornly low since the financial crisis, and many have noted that the interest rate environment has been weakening since the 1980s. This column places recent episodes in the context of longer-term economic history, going back to the 14th century. Trends over recent decades are generally in line with a long-term ���suprasecular��� trend of declining real rates. Negative real rates could become a more frequent phenomenon, and indeed constitute a ���new normal���...

Emil Verner and Gyozo Gyongyosi: Household Debt Revaluation and the Real Economy: Evidence from a Foreign Currency Debt Crisis: "The large (over 30%) and unexpected depreciation of the Hungarian forint in late 2008... a shock to local household debt... a rise in default rates and a persistent decline in local durable and non-durable consumption...

Natalie Pierson: Comparative Look at the Gunpowder Empires

Michael Kremer (1993): Population Growth and Technological Change: One Million B.C. to 1990

Robert C. Allen (2006): The British Industrial Revolution in Global Perspective: How Commerce Created The Industrial Revolution and Modern Economic Growth

Wikipedia is Anglocentric. There were not two but three "Protestant Winds": the wind that scattered the Spanish Armada in 1588, the wind that blew William of Orange to England in 1688, and the wind that blew the armies of his ancestor William the Silent to the relief of Leyden in September-October 1574 Wikipedia: Protestant Wind

Kim-Mai Cutler: The new NIMBY mayor of Cupertino made an entirely tasteless joke about building a wall around Cupertino and then making San Jose pay for it in his State of the City address...

Jason Kottke: Patreon had revenue from day one and could have been a fully independent company. Perhaps smaller but sustainable���a great business focused solely on their users. The VC funding model of ���go big or go home��� doesn���t work well w/ so many people���s livelihoods on the line...

#noted #weblogs

"Gunpowder Empire": Should We Generalize Mark Elvin's High-Level Equilibrium Trap?: Hoisted from the Archives

Hoisted from the Archives: "Gunpowder Empire": Should We Generalize Mark Elvin's High-Level Equilibrium Trap?: OK. Popping the distraction stack again. A chance remark by the extremely sharp Cosma Shalizi when he came through Berkeley has caused me to spend a lot of time meditating upon a passage written by Bob Allen:

Robert Allen (2006): The British Industrial Revolution in Global Perspective: "The different trajectories of the wage-rental ratio created different incentives to mechanize production.... It was not Newtonian science that inclined British inventors and entrepreneurs to seek machines that raised labour productivity but the rising cost of labour... due to... Britain���s success in the global economy... in part the result of state policy... Britain['s] vast and readily worked coal deposits...

...Cost reductions were greatest at British factor prices, so the new technologies were adopted in Britain and not on the continent.... British technology was not cost-effective at continental input prices.... The necessary R&D was profitable in Britain (under British conditions) but unprofitable elsewhere.... Why did the industrial revolution lead to modern economic growth? I have argued that the famous inventions of the British industrial revolution were responses to Britain���s unique economic environment and would not have been developed anywhere else. This is one reason that the Industrial Revolution was British. But why did those inventions matter?... Wouldn���t the French, or the Germans, or the Italians, have produced an industrial revolution by another route? Weren���t there alternative paths to the twentieth century?... In previous occasions when important inventions were made... a one-shot rise in productivity.... The nineteenth century was different���the First Industrial Revolution turned into Modern Economic Growth. Why? Mokyr���s answer is that scientific knowledge increased enough to allow continuous invention. Technological improvement was certainly at the heart of the matter, but... the nineteenth century engineering industry was a spin-off of the coal industry. All three of the developments that raised productivity in the nineteenth century depended on... the steam engine and cheap iron... closely related to coal.... There is no reason to believe that French technology would have led to the engineering industry, the general mechanization of industrial processes, the railway, the steam ship, or the global economy. In other words, there was only one route to the twentieth century���and it went through northern Britain...

But what if not?

Let as start between 1500 and 1750, in the age of the Gunpowder Empires...

That world is, by and large, Malthusian. There are exceptional region-eras in which there is a considerable margin above bare biological subsistence. And the ruling classes are rich, both much richer than the peasants upon whom they rest, and much richer, comparing half-millennium to half-millennium, than their predecessor ruling classes. For their slaves and peasants, not so much, but Cicero lived much better in terms of accessible technology and material comfort than Patroklos, Aaron the Just than Cicero, John of Gaunt than Aaron the Just, Thomas Jefferson than John of Gaunt.

Thus for the bulk of the population, or so it appears to me, for two millennia--at least since the founding of the Han and the Roman Empires--increasing numbers and resource depletion ate up all of the benefits from slowly-advancing technologies. When I try to assess economic growth in the very longest run, I come up with global rates of growth of total factor productivity on the order of 0.02%/year. That is 1%/century. That is enough to support a population growth rate of 7%/century--the doubling of human populations every millennium that we appear to see since 4000 BC.

Looking forward from even as late as 1750, therefore, it is not insane to project that the Gunpowder Empire is in the natural course of events the climax socioecological state of the Sociable Language-Using East African Plains Ape. The notional quartering of farm sizes worldwide from 500 BC to 1500 had been offset by the development of maize, of double-crop wet rice, of the combination of the iron axe and the moldboard plow that could turn northern temperate forests into farms, the domestication of cotton, and the breeding of the merino sheep. People in 1500 were as well fed and clothed as they had been in 500 BC.

But what would have been the next agricultural miracle technologies--besides the potato? You would have needed a number of them to attain continued total factor productivity growth at 0.02%/year to compensate for the further quartering of farm sizes that would have been inevitable had population growth continued and human numbers topped 2 billion in 3500.

And where would the breakthrough to steampower--or even to enough fodder to feed enough draft animals for oxen and horses to replace or even supplement human backs and thighs--to interrupt this Gunpowder-Empire climax socioecology of the Sociable Language-Using East African Plains Ape come from? Heron of Alexandria's aeolipile was 1500 years old. If the Hellenistic, Roman, Byzantine, Abbasid, Tang, Sung, and Ming Eras could not show any signs of a breakthrough to steam, what were the odds some other civilization would have done it had eighteenth-century Britain not been there?

Important questions. Unanswerable questions--at least by me. Not, mind you, that I want to positively and definitively assert that the Gunpowder-Empire is the climax socioecology of the Sociable Language-Using East African Plains Ape in the natural course of events. But I do wonder.

#noted #hoistedfromthearchives #economicgrowth #economichistory #industrialrevolution #robertallen #joelmokyr #highighted

Data!

Suppose that you were a rich person in Europe, ...

Data!

Suppose that you were a rich person in Europe, and wanted to diversify and put some of your wealth not in landed estates or commercial ventures or bureaucratic office or mortgage loans, but instead simply wanted to lend it to the least-risky sovereign you could find. Paul Schmelzing has collected the data. It is very interesting.

I have only one data complaint: I think he should swap out the debt of the Italian city-state average���Genoa, Florence, and Venice���that he regards as the safest sovereign from 1300 to 1500 for the debt of Barcelona, which was as financially sophisticated and was secure under the aegis of the crown of Aragon in a way that the Italian city-states were not. None of them was sacked and defaulted from 1300 to 1500. But they could have been. And I read the higher interest rates of the late 1400s as powerful evidence that the debts of Genoa, Florence, and Venice ere not regarded as safe: they might decisively lose in the wars of the condottieri, or the Turk might come.

Do note that these interest rates are a different concept than the Piketty rate of profit on capital. These are, I think, best thought of as the profit rate minus an interest-rate discount for the safety and liquidity that the debt of the world's most prudent sovereign could offer. It thus depends not just on the then-current long-term rate of profit but also on perceived risks of other investments, risk tolerance, and the safe asset supply the sovereign is currently offering: Paul Schmelzing: The ���Suprasecular��� Stagnation: "Growth rates have been stubbornly low since the financial crisis, and many have noted that the interest rate environment has been weakening since the 1980s. This column places recent episodes in the context of longer-term economic history, going back to the 14th century. Trends over recent decades are generally in line with a long-term ���suprasecular��� trend of declining real rates. Negative real rates could become a more frequent phenomenon, and indeed constitute a ���new normal���...

#noted

Azeen Ghorayshi, Jason Leopold, Anthony Cormier, and Emma...

Azeen Ghorayshi, Jason Leopold, Anthony Cormier, and Emma Loop: Secret Files Show How Trump Moscow Talks Unfolded While Trump Heaped Praise On Putin: "Ahead of Michael Cohen���s testimony, read the original paper trail behind the campaign to build Europe���s tallest tower in Moscow���and how it played out alongside Donald Trump���s presidential campaign...

#noted

February 4, 2019

Nicholas Lardy: Xi Jinping���s turn away from the market ...

Nicholas Lardy: Xi Jinping���s turn away from the market puts Chinese growth at risk: "Credit is flowing to state-owned companies, not more productive private ones.... Xi... has also repeatedly emphasised the role of state industrial policy and state-owned companies, despite overwhelming evidence that the latter are inefficient. Even after receiving various direct subsidies, the Chinese ministry of finance acknowledges that more than two-fifths of these state companies persistently rack up losses. They are kept afloat with massive increases in bank credit that are almost entirely responsible for the increase to record levels of leverage in China���s corporate sector.... Predictably, the return on assets of the largest state-owned companies has fallen by more than half since the merger mania began. At the same time, the productivity of private companies has increased, and in the industrial sector is now almost three times that of their state-owned counterparts.... Without a return to a more marketed-oriented economic policy, even if bilateral trade disputes with the US are resolved, the likelihood is that China���s growth will slow further���with unpleasant consequence...

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers