J. Bradford DeLong's Blog, page 224

March 1, 2019

Todd N. Tucker: @toddntucker: "Trump's desperation to get...

Todd N. Tucker: @toddntucker: "Trump's desperation to get a deal after the collapse of North Korea talks is probably going to mean the US will not get anything meaningful on Chinese economic reforms:

Jenny Leonard: @jendeben: "NEW: U.S. officials are rushing to finalize Trump's China deal even as hawks in his administration want to push Beijing for more concessions. Trump wants a signing summit ASAP. His team has been on the phone with Chinese officials to iron out details:

Jenny Leonard, Andrew Mayeda, and Saleha Mohsin: U.S. Said to Ready Final China Trade Deal as Hawks Urge Caution: "The preparations for a Trump-Xi summit come amid conflicting signals from the Trump administration.... Mnuchin... Kudlow said the countries are on the verge of an 'historic' pact.... Lighthizer told lawmakers that more work needs to be done and said the administration won���t accept a deal that doesn���t include significant 'structural' changes to China���s state-driven economy. He also stressed the need for a enforcement mechanism, allowing the U.S. to take unilateral action if China breaks the rules...

#noted

It is far from clear to me that the risk of a U.S. recess...

It is far from clear to me that the risk of a U.S. recession this year is low. The risk that a recession will be called is low. The risk that a recession will start is 30%:Gavyn Davies: Alarm Bells Ring for the��Goldilocks World Economy: "Markets seem willing to overlook the continuing slowdown in the advanced economies, which has taken the latest growth rate to only 0.8 per cent.... This is perversely seen as good news because it will reduce the likelihood of further interest rate increases.... The dovish turn in US monetary policy has been confirmed by an unusual��volte-face in policy guidance by the Fed leadership in the space of a few weeks.... This phase of the cycle is often described as the��Goldilocks zone, in which growth ��� like the heroine���s porridge in��The��Story of the Three Bears���is neither too hot nor too cold.... Meanwhile, growth is still high enough to indicate that the risk of outright recession in the next 12 months remains close to zero.... While the US is still clinging to the middle of the��Goldilocks zone, the eurozone is flirting with the bottom boundary of its zone. Any further decline in the nowcast would see a large increase in the probability of a European recession this year. With the Japanese nowcast already in negative territory and Asian trade flows headed sharply downwards, the markets may not be able to ignore much further weakness in the world economy...

#noted

Three cheers for Janet Napolitano!: Brian Resnick: Univer...

Three cheers for Janet Napolitano!: Brian Resnick: University of California Drops Subscriptions to Elsevier, World���s Largest Publisher of Scientific Papers: "The University of California, the largest public academic system in the US, is ending its subscription to Elsevier, the world���s biggest and most influential publisher of academic research.... The University of California doesn���t want scientific knowledge locked up behind paywalls, and thinks the costs of academic publishing have grown out of control. 'I fully support our faculty, staff, and students in breaking down paywalls that hinder the sharing of groundbreaking research', said UC president and former Secretary of Homeland Security Janet Napolitano. 'This issue does not just impact UC, but also countless scholars, researchers, and scientists across the globe���and we stand with them in their push for full, unfettered access'. The break came, as Stat News reports, after months of failed negotiations between the California university system and the publisher...

... ...

#noted

Dylan Riley (2003): Privilege and Property: The Political...

Dylan Riley (2003): Privilege and Property: The Political Foundations of Failed Class Formation in Eighteenth-Century Austrian Lombardy: "Political society is reducible neither to interests in civil society, nor to the state.... The structure of political society matters for group formation.... A political society, in which actors make claims on the state in terms of privileges attached to residence, rather than property ownership, inhibits class formation even when other factors, such as the relations of production, state pressure, and culture, promote it. Where such a political organization is not broken, class formation will not occur even in the presence of strong economic, state-centered, and cultural pressures...

#noted

Yes, the Fed's Target Is Now too High. Why Do You Ask?

Even though the first quarter of 2019 is only two-thirds over, practically all of the private-sector decisions that will determine the level of economic growth from the first quarter of 2018 to the first quarter of 2019 have already been made. Moreover, because of a statistical quirk 8/9 of the components of the growth rate have already occurred, and we have reasonable data on 2/3 of the components. So the Federal Reserve Bank of New York's forecast that the first-quarter growth rate will be only 0.9% is now a semi-solid thing: you cannot take it to the bank, but you can borrow on it (the last three month-out misses were 0, +0.2, and -0.4 respectively):

It's not a recession. Not quite. But it is clear that even if 2.4% were the right target for the short safe nominal interest rate two months ago, it is not the right target for the short safe nominal interest rate now. The Fed should cut.

#monetarypolicy

This is wrong. It says Paul Krugman believes things he si...

This is wrong. It says Paul Krugman believes things he simply does not believe. Paul Krugman simply does not believe that "you can have any size deficit and still have full employment because the central bank can always establish the 'right size' interest rate to get you there". Not "always": sometimes. There is a point where the IS-Curve intersects the x-axis, and if you are not at full employment by then���if the neutral interest rate is below zero���then conventional monetary policy cannot get to full employment. Thus this response is simply not useful at all: Stephanie Kelton: Paul Krugman���s Four Questions About MMT: "Krugman...[is] asserting that you can have any size deficit and still have full employment because the central bank can always establish the 'right size' interest rate to get you there. I disagree...

Maybe some clarity could be achieved if Paul were to write "bond-financed expansions in government purchases with the central bank intervening to hold [the interest rate, trhe monertary base, the money stock] constant", and Stephanie were to write "money-printing-financed expansions in government purchases with the central bank doing [something]", but I doubt it. The fact that even I do not know why the canonical MMT IS Curve is vertical (construction responds very strongly to interest rates; wealth-dependent components of consumer spending respond substantially if less strongly) or what the canonical MMT LM Curve/central bank reaction function is makes me think this is not worth pursuing further. I am going to continue to interpret MMT as Abba Lerner: a steep IS Curve, and thus the ability to use monetary policy to insure that there is no government-budget constraint that binds when the stable-inflation constraint does not.

#noted

February 28, 2019

Note to Self: Neoliberal: The 2019 Neoliberal Shill Brack...

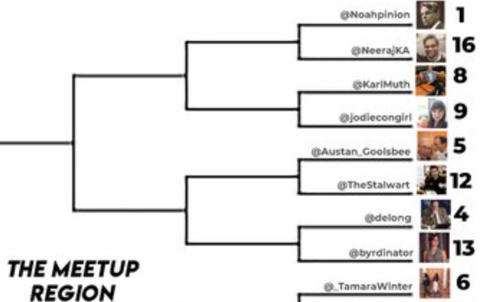

Note to Self: Neoliberal: The 2019 Neoliberal Shill Bracket: "The round of 64 polls will be published tomorrow and will remain up for 48 hours. Each round will have its own thread with all the polls in it. There will be a 24 hour cool off period between rounds for tasteful smack talk:

#notetoself

Big oligopolistic companies conduct research and developm...

Big oligopolistic companies conduct research and development to produce technologies that benefit them���which typically means technologies In which capital substitutes for labor and allows them to shed jobs from their value chain. Enhancing societal well-being, however, requires the development of technologies that do not substitute for but that complement human capabilities. It is becoming increasingly clear to me that the private sector cannot get this balance right: Tim O'Reilly: Gradually, Then Suddenly: "Neural interfaces: One of my biggest 'Wow!' moments of 2018 took place in the offices of��neural interface company CTRL-labs.��The company's demo involves someone playing the old��Asteroids��computer game without touching a keyboard, using machine learning to interpret the nerve signals.... But that���s just the first stage. Essentially, users of this technology 'grow' another virtual hand, which they can move independently of their physical hands.... Humanity is already going cyborg.... Don���t fall into the trap of thinking that AI will replace humans when it can be used even more powerfully to augment them...

#noted

There do not appear to be many examples of governments th...

There do not appear to be many examples of governments that both increase inequality and raise the standard of living of the bottom 10%. Instead, it appears to be one or the other: Dan Davies (2015): Up and Down, Left and Right: "Inequality in the UK against the income of the poorest 10%, as a time series.... It hits you right between the eyes. It���s all up-and-down or left-and-right. The sort of thing that generates the difficult cases for liberal political philosophy���increases in inequality which nevertheless benefited the worst-off, which would have showed up as a southwest-to-northeast upward slope���never happened...

#noted

Yet more evidence that inflation builds very slowly. Ther...

Yet more evidence that inflation builds very slowly. There appears to be no such thing as a red line that prudent economies dare not cross: Sylvain Leduc, Chitra Marti, and Daniel J. Wilson: Does Ultra-Low Unemployment Spur Rapid Wage Growth?: "The unemployment rate ended 2018 at just under 4%, substantially lower than most estimates of the natural rate. Could such an ostensibly tight labor market lead to a sharp pickup in wage growth from its recent moderate pace, such that the relationship between wage growth and unemployment is not always linear? Investigations using state-level data show no economically significant nonlinearity between wage growth and unemployment that would predict an abrupt jump in wage growth...

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers