J. Bradford DeLong's Blog, page 220

March 8, 2019

An Antiplatonic Twitter Dialogue on What the Wish to "Preserve a Cultural Centrism" Actually Means

As Noah Smith says: "Please stop I give up you can have all my money":

Noah Smith: ����: Write another post! I'd be interested to know how you think Obama abandoned the cultural centrist ground, specifically.

#MMT: Moral Money Tao: @samvega: "Obama abandoned the cultural centrist ground" by moving ever further right to appease Republican leaders. Who doesn't know this?

Brad DeLong: ��������: Obama abandoned the "cultural centrist" ground because he decided to be a Black person, unlike Clinton, who decided to be a white person. See?

Noah Smith: ����: But his race did not change AFAIK. What did change? Did he start acting more culturally "black" in his second term? I detected no change.

Mark Talarico: @MarkTalarico1: No, he was pretty consistent being the father I could only hope to emulate.

Geriatric Millenial JD: @Errorreporrt: That is important. He abandoned it because while educated elites listened to his message the vast majority of people used the heuristic of race and the cultural centrism was useless. This is why the very sudden realignment of parties started in 2008 and peaked by Trump. Wealth and Education are no longer the best predictors of Democrat of Republican. Views relating to race are now the best predictor and wealth and education just correlated.

Riot Diet: @MrRiotDiet: He said ���If I had a son, he���d look like Trayvon Martin��� See, that was abandoning centrism. He was supposed to say ���given the genetic variation inherent in reproduction, my son could have looked like Trayvon Martin, George Zimmerman, or anyone.��� That���s centrism.

Noah Smith: ����: Was it just that one line? Seriously?! If so that's NUTS.

Brad DeLong: ��������: Remember, for Ross Douthat, "preserve a cultural centrism" starts out with Ross wanting a society and culture that is a safe space to be disgusted if attractive young women offering you a great gift are taking birth control:

A girl who resembled a chunkier Reese Witherspoon drunkenly masticating my neck and cheeks. It had taken some time to reach this point���"Do most Harvard guys take so long to get what they want?" she had asked, pushing her tongue into my mouth. I wasn't sure what to say, but then I wasn't sure this was what I wanted. My throat was dry from too much vodka, and her breasts, spilling out of pink pajamas, threatened my ability to. I was supposed to be excited, but I was bored and somewhat disgusted with myself, with her, with the whole business... and then whatever residual...

Rachel Palmer: _@RachelPalmerCam**: Oh that's gross. Had had some level of respect for Doughat. But gross.

Brad DeLong: ��������: "...enthusiasm I felt for the venture dissipated, with shocking speed, as she nibbled at my ear and whispered���'You know, I'm on the pill'..."

Noah Smith: ����: Please stop I give up you can have all my money

#MMT: Moral Money Tao: @samvega: What Noah said. ���� Douthat titled his book "Privilege" thus demonstrating his total insensitivity to irony or shame or self awareness, a common Republican superpower.

Scott Gosnell: @infiniteme_: Are you sure this isn't one of the lesser Bret Easton Ellis novels?

Brad DeLong: ��������: If it were, it would be titled "Chunky Reese Witherspoon"...

Brad DeLong: ��������: Then Ross retreats���"preserve a cultural centrism" becomes keeping a society and culture that is a safe space for Niall Ferguson to get applause from, as Tom Kostigen reports:

John Maynard Keynes' economic philosophy was flawed and he didn't care about future generations because he was gay and didn't have children.... Speaking at the Tenth Annual Altegris Conference in Carlsbad, Calif., in front of a group of more than 500 financial advisors and investors.... Ferguson... explained that Keynes had no [children] because he was a homosexual and was married to a ballerina, with whom he likely talked of 'poetry' rather than procreated... sa[id] it's only logical that Keynes would take this selfish worldview because he was an 'effete' member of society...

Then Ross retreats further, and "preserve a cultural centrism" becomes keeping a society and culture that is a safe space for people to say that, while homosexuals' private lives are their own business, allowing civil same-sex marriage would gravely damage the moral fabric of society.

I don't know whether Ross would still maintain today that his own marriage is gravely injured by happy lesbians outside of San Francisco's City Hall. And it is not completely clear what "preserve a cultural centrism" means to him today. We do, however, know what it...

Aardvark Avenger: @matthoboken: People who think Obama abandoned "cultural centrism" are not cultural centrists.

Brad DeLong: ��������: ...means to his political allies; bashing transsexuals every chance they get for being... something... IMHO, James Bennet is not doing his job when he allows Ross Douthat to write "preserve a cultural centrism" instead of "tacitly winking at transsexual bashing".

Riot Diet: @MrRiotDiet: Title of a book: James Cashill: _"If I Had a Son": Race, Guns, and the Railroading of George Zimmerman" https://books.google.com/books?isbn=1938067215

William Schaden, Saloon Keeper & end filibusters: @puckthecat1: good lord. of course, the upshot of the focus on that one weak-ass line is that his identity was the problem and they would have searched through his entire public record for something else to latch onto if he hadn't said that

Riot Diet: @MrRiotDiet: Pretty much.

1 reply 0 retweets 2 likes

#orangehairedbaboons #highlighted

New York Fed Nowcasts: 1.4% for 2019Q1, 1.5% for 2019Q2: ...

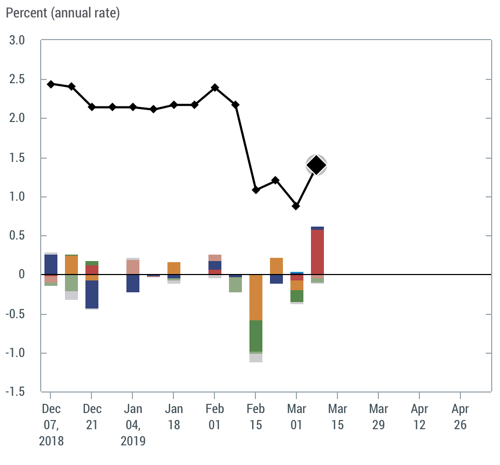

New York Fed Nowcasts: 1.4% for 2019Q1, 1.5% for 2019Q2: FRBNY: Mar 08, 2019: New York Fed Staff Nowcast. The Atlanta Fed Nowcast stands at 0.5% for 2019Q1: https://www.frbatlanta.org/-/media/documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf

#noted

Lying Liar Kevin Hassett Lies Again...

I have here a transcript from a week or so ago of Kevin Hassett on Fox Business telling transparent lies. Seriously: why does he bother? What does he gain? Is it really the case that AEI will have him back after things like this? WILL banks like JPM Chase will pay him to speak to conferences?

If so, they have really really really really bad judgment:

7:38:49 BARTIROMO: The Atlanta Federal Reserve on Friday issued its GDP forecast for the first quarter, it���s three-tenths of a percent. What was your reaction to this? I know that this changes a lot, by the way...

7:38:59 HASSETT: Sure it does, yeah...

7:39:00 BARTIROMO: You���ll probably revise it umpteen times, but 0.3%, obviously not great for the first quarter...

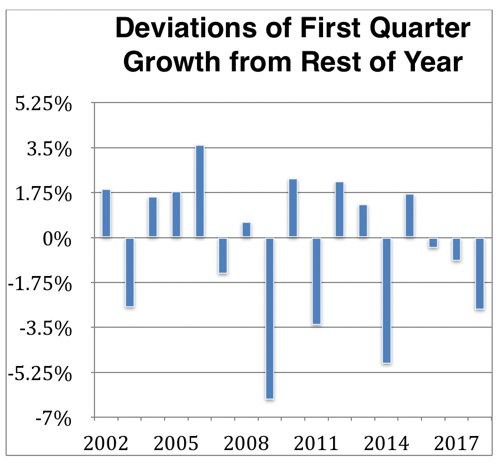

7:39:05 HASSETT: Right, well there are two things going on. The first is that we started the quarter out with a 300,000 jobs number, north of 300,000. And most of the time when you do that, you end up with a 3% quarter. And so we���re gonna get jobs again this week, and if we get another really big number, and I think we���ll have a lot of confidence that something as low as three-tenths isn���t gonna happen. But there is this weird pattern in the data all the way back to 2010, that the first quarter tends to be about 1% below the average for the year. So if we think as we do at the White House that we���re gonna have about a 3% year, then right now, if you wanted me to put a number on the table, I���d say it���s probably gonna be about a 2% first quarter.

7:39:38 BARTIROMO: Okay, so is that largely because of the shutdown, or what happened in the first quarter...

7:39:41 HASSETT: No, it���s because of the seasonality thing, they don���t seasonally adjust the data correctly in Q1, it���s a weird technical thing. And you know, we could go to the blackboard, I know you���d love it, but your viewers would probably never get me invited back again...

These are lies.

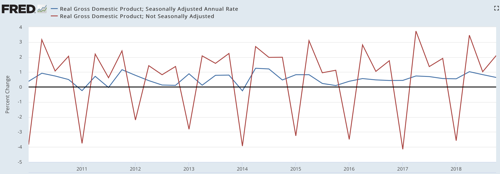

The BEA's seasonal-adjustment process of trying to produce, in the graph at the top, a smooth seasonally-adjusted growth blue line from the jagged raw seasonally-unadjusted red line. There my have been a tendency for the process to generate a first-quarter estimate that undershot what was going to happen the rest of the year. But that was corrected. Only one of the past four years has a substantial undershoot.

And with respect to: "We started the quarter out with a 300,000 jobs number, north of 300,000. And most of the time when you do that, you end up with a 3% quarter. And so we���re gonna get jobs again this week, and if we get another really big number, and I think we���ll have a lot of confidence that something as low as three-tenths isn���t gonna happen..." That is now completely inoperative, no? We were not going to get another really big number���odds are that a really big number is followed by a small one���and we have not: we got +20,000.

We are thus highly, highly unlikely to get a 3% number. I don't think we will see a number as low as 0.3%���I am at 0.7% right now for what will be announced, and 1.0% after all the revisions are done. But we might. But 0.3% is what the numbers that have come in so far that feed into the first quarter growth number say, and about 2/3 of the numbers that feed the estimate have come in.

Moreover, the monthly employment growth numbers have very little to do with the quarterly economic growth numbers. The difference between them���measured productivity growth���fluctuates a lot at monthly and quarterly time scales. Thus you do not want to be in the business of guessing what a GDP growth report will be based on monthly job market reports.

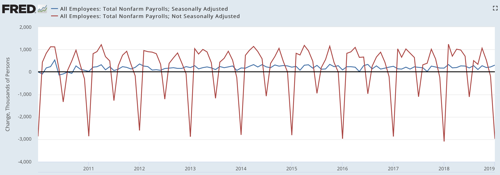

And you really really really do not want to be making any inferences at all from the seasonally-adjusted January employment growth number. why not? Because the seasonally-unadjusted raw numbers are so large and negative. Thus the smoothed seasonally-adjusted January jobs number is a statistical guess about how many of those laid off after Christmas are just businesses stepping down from the Christmas rush and how many represent a trend that will persist throughout the year. The resulting seasonally-adjusted January jobs estimate is a small difference between two much larger numbers, and hence has a lot of error noise in it. Look at the two series in the graph below:

So: More lies. Kevin does not think that any jobs number tells us much about the next GDP report, and he knows as well as I do that a 300,000 January job number tells him next to nothing about the Q1 GDP report.

So why does he do this? Seriously, what's in it for him?

I find myself thinking of those economists who signed the letter in support of Kevin Hassett as CEA Chair: Alan J. Auerbach, Martin N. Baily, Dean Baker, Robert J. Barro, Ben S. Bernanke, Jared Bernstein, Alan S. Blinder, Michael J. Boskin, Arthur C. Brooks, John H. Cochrane, Karen Dynan, Janice Eberly, Douglas W. Elmendorf, Martin S. Feldstein, Jason Furman, William G. Gale, Ted Gayer, Austan D. Goolsbee, Alan Greenspan, Robert E. Hall, Douglas J. Holtz-Eakin, R. Glenn Hubbard, Randall S. Kroszner, Alan B. Krueger, Edward P. Lazear, Lawrence Lindsey, N. Gregory Mankiw, Donald B. Marron, Peter R. Orszag, Adam S. Posen, James Michael Poterba, Christina D. Romer, Harvey S. Rosen, Cecilia Elena Rouse, Jay C. Shambaugh, Robert J. Shapiro, Betsey Stevenson, James H. Stock, Michael R. Strain, Phillip Swagel, John B. Taylor, Laura D. Tyson, Justin Wolfers, and Mark M. Zandi. Really: what were they thinking?

#orangehairedbaboons #economicsgonewrong #highlighted

March 7, 2019

For the Weekend: Bruce Springsteen & the E Street Band: Prove It All Night

For the Weekend: I am a big fan of the version of "Prove It All Night" with the 1978 Introduction: Bruce Springsteen & the E Street Band: Prove It All Night:

#fortheweekend

On "On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation:

I have been thinking about this by ��ukasz Rachel and Lawrence H. Summers this week: On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation.

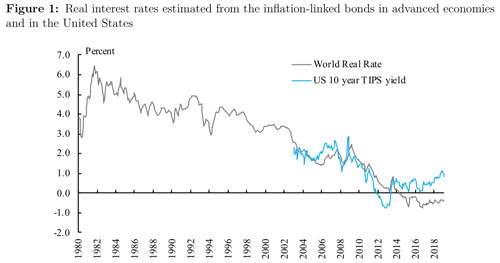

It says an awful lot of true things. The average "neutral" 10-year safe real interest rate consistent with full employment in the Global North does look like it has fallen from 4% per year in the 1990s to -0.5% per year today. That does pose a huge problem for central banks that seek to use monetary policy s as the principal depression-fighting tool: a small negative shock that reduces this rate by only a little bit more would drive an economy into territory where the central bank cannot do its job. During this period of decline, increased government debts have put perhaps 2%-points of upward pressure on the neutral rate: the actual decline has been 6.5%-points.

But I find myself uncertain on what conclusions to draw from their paper. They focus on only one of what I think are three key interest-profit-discount rates in play here:

There is the (short or long) real safe interest rate on the securities of governments that issue reserve currencies and thus possess exorbitant privilege. This is down to today's -0.5% from 3% 20 years ago and 4.5% 40 years ago.

There is the long-term real risky discount rate at which the cash flows accruing to owners of capital are discounted in the market���the expected return on financial investments in stocks. This is at to 5% today, up from 4% 20 years ago, down from 12% 40 years ago, and down from 6% 50 years ago.

There is the societal profit rate earned by new investments in physical or intellectual capital. This is ??? to today's ???, from ??? 20 years ago and from ??? 40 years ago.

This third social profit rate is in some sense the fundamental opportunity-benefit-of-investment ground out by the real economy of production and distribution on top of which the financial superstructure is built.

The second is the quotient of profit flows over the market value stock, and takes the societal profit rate returns to society's capital and adds to them the amount of monopoly rents captured by enterprises, subtracts from them labor rents and spillover benefits, both organizational and technological, that are not captured by those who undertake the actions that generate those spillovers, and then values those cash flows at the long-term risky discount rate.

The first of safe interest rate is the second minus the liquidity and safety terms that lower the required rate of return on safe assets.

��ukasz Rachel and Lawrence H. Summers focus on rate (1): the (short or long) real interest rate on the safe securities of governments that issue reserve currencies and thus possess exorbitant privilege. The problem is that the wedge between this (1) safe interest rate and the risky discount rate (2)���the rate at which risky cash flows are discounted���is worse than poorly understood by economists: it is not understood at all.

Economic and finance professors continue to attempt to understand this large equity return premium as somehow reflecting some market-maker somewhere's attitude toward risk. They fail. They will continue to fail.

The gap between the risky discount rate and the safe interest rate is 5.5%-points today, was 1%-point 20 years ago, was 7.5% 40 years ago, and was 4% 50 years ago. Most of the time since the development of stock markets that were more than grifter cons for insiders 150 years ago, this gap has been vastly in excess of any rational assessment of the extra risk born from investing in a diversified portfolio of stocks rather than in safe government bonds. But sometimes���1998, when the risk associated with investments in stocks was not low but was unusually high���it is not.

What else can this be, economic and finance professors ask, but the attitude toward risk of the market-maker who posts the prices? People can invest in diversified stock portfolios: doing so requires neither expertise nor information but simply a chimpanzee at the keyboard picking from a list. People can invest in bonds. The only difference between the portfolios is risk. And this margin must be in equilibrium, right?

Manifestly, wrong.

The market-maker at the stock-bonds margin, whoever that may be, is sometimes prone to episodes of irrational exuberance in which they greatly overestimate the likely returns from diversified stock portfolios. And the market-maker at the stock-bonds margin, whoever that may be, is usually greatly averse to risky equities in a manner no rational von Neumann-Morgenstern with any not-insane utility function would ever be.

My guess is that the risky discount rate is driven by greed and fear���fears of depression and political collapse on the one hand, and greed for the benefits of economic and technological growth as well. And my guess is that modeling these as anything more than herd episodes of irrational exuberance and irrational pessimism is a fool's game. My guess is that any form of arbitrage between the risky discount rate and the safe interest rate fails because the typical market-maker, whoever that may be, does not understand that you need 50 stocks to be diversified, focuses their attention on 10 often-correlated stocks that they know, and so does face unacceptable existential risk were they to leverage their portfolio toward equities.

If you accept these guesses, then you will be tempted by the following narrative to account for the past 20 years' moves in the equity return premium:

The end of dot-com irrational exuberance that drives the equity premium up from 1998-2002 with no effect on the *safe interest rate.

The financial side of the China shock 2002-2008 that greatly increases the demand worldwide for safe assets. Political risks in emerging markets and economic risks of stalling emerging-market growth greatly increased demand for safe assets like U.S. Treasuries: it seems sensible to hold U.S. Treasuries for that portion of your portfolio which will be the only thing left if the balloon goes up and you have to flee your country in the Learjet, or in a rubber boat. This drives the equity premium up further.

The financial crisis's destruction of confidence that any organization besides Global North governments is or will be in the business of providing AAA assets eliminated AAA and near-AAA private close substitutes for Treasuries. This drives the equity premium up still further.

The natural conclusion I am tempted to draw���which ��ukasz Rachel and Lawrence H. Summers do not���is

The world economy today desperately wants to hold its wealth in claims on Global North sovereigns with exorbitant privilege issuing reserve currencies.

A well-functioning economy creates things of value.

The Global North sovereigns with exorbitant privilege issuing reserve currencies can create a lot of value. They should do so: governments should run up their debts until they satisfy demand with an equity return premium at a value we think is sensible and "normal".

What should governments do with the money they raise from issuing more debt? The natural answer is "everything that promises a social return": Global-warming research, global-warming control, infrastructure, education, beefing-up the Social Security trust fund and investing int in equities: The world wants risk borne���desperately. The private sector does not mobilize society's potential risk-bearing capacity. Global North sovereigns with exorbitant privilege issuing reserve currencies can mobilize their societies' risk-bearing bearing capacity. They should do so.

��ukasz Rachel and Lawrence H. Summers: On Falling Neutral Real Rates, Fiscal Policy, and the Risk of Secular Stagnation: "Simple calculations using observed estimates of the impact of deficits on interest rates suggest that the increase from 18% to 68% in the public debt-to-GDP ratio of the advanced economies should ceteris paribus have raised real rates by between 1.5 and 2%-points over the last four decades. This effect is quantitatively important but is a presumptive underestimate of the impact of fiscal policy changes given the rise in pay-as-you-go government pensions and other social insurance programs. This analysis leads to the conclusion that the fall in real long-term interest rate observed in the data masks an even more dramatic decline in the equilibrium ���private sector��� real rate...

...Building on... Gertler (1999)... life-cycle behavior... heterogeneity in marginal propensities to consume and differences in the implicit discount rates across agents mean that Ricardian Equivalence... does not hold... making the effects of a range of government policies on real rates non-trivial.... Simulations suggest that shifts in these policies pushed equilibrium real rates up by over 3.2%-points between the early 1970s and today....

Bewley-Huggett-Aiyagari... idiosyncratic risks and precautionary behavior... degree of income uncertainty matches the risks estimated from the data on individual household incomes... rising government debt accounts for around 1.5%-points... upwards pressure on the neutral real interest rate....

Private sector forces dragging down on interest rates are more powerful than previously anticipated, and that on average across the business cycle, equilibration of private-sector saving and private-sector investment may indeed require very low real rate of interest in advanced economies for years to come.... The developed world is at risk of mirroring the experience of Japan, whereby the very low equilibrium rate of interest appears to be a semi-permanent feature of the economic landscape....

Current real rates appear to be quite well predicted by pre-financial crisis trends. We believe that the these trends are best analyzed in terms of changes in saving and investment propensities or equivalently in terms of trends in desired wealth holdings by consumers and desired capital accumulation by producers. While factors involving liquidity, scarcity and risk no doubt bear on levels of real interest rates we find it highly implausible that they are the main factor accounting for trend movements. The movements are too large and too pervasive across assets and the fluctuations in spreads are too small and lacking in trend for these factors to account for the observed trends in the data....

The neutral real rate would have declined substantially more over the last generation but for increases in government debt and expansions in social insurance programs.... The specific magnitudes are very uncertain, but open-economy aspects and the possibility suggested by our analysis���that budget deficits emerge in response to excesses of private saving over private investment���lead us to think that we are more likely to understate than overstate the extent of fiscal support for real interest rates in recent years.... But for major increases in deficits debt and social insurance neutral real rates in the industrial world would be significantly negative by as much as several hundred basis points....

The private economy is prone to being caught in an underemployment equilibrium if real interest rates cannot fall far below zero. Full employment in recent years has been achieved where it has been achieved either through large budget deficits as in the United States or Japan or large trade surpluses as in Germany. It is worth considering that in the United States during the period prior to the financial crisis, negative real short term interest rates, a huge housing bubble, erosion of credit standards and expansionary fiscal policy were only sufficient to achieve moderate growth. Adequate growth in Europe was only maintained through what in retrospect appears to have been clearly unsustainable lending to the periphery....

It has to be acknowledged that the US economy appears to be slowing to below potential growth despite projected primary deficits that will lead even on very favorable interest rate assumptions to steadily growing debt���to-GDP ratios that will ultimately set historical records. There is no guarantee that deficits sufficient to maintain positive neutral real rates will be associated with sustainable debt trajectories. Indeed, the Japanese experience suggests that this may not be the case....

Monetary policies that induce significantly negative real rates.. might be achieved through setting negative nominal rates, raising or adjusting inflation targets... or using unconventional monetary policies such as quantitative easing.... There is a range of concerns about the possible toxic effects of low rates, including suggestions that they make bubbles and over-leveraging more likely as they encourage risk taking, that they may lead to misallocation of capital by reducing loan payment levels and required rates of return, reinforce monopoly power....

A final possibility is structural measures that reduce saving or promote investment. Clearly regulatory policies that encourage investment without sacrificing vital social objectives are desirable. The extent to which these are available is very much open to question....

If secular stagnation is avoided in the years ahead it will not be be because it is somehow impossible in a free market economy, but instead because of policy choices. Our conclusions thus underscore the urgent priority for governments to find new sustainable ways of promoting investment to absorb the large supply of private savings and to devise novel long-term strategies to rekindle private demand...

#finance #highlighted #macro #publicfinance #fiscalpolicy

Victor Davis Hanson has decided that he is an evil person...

Victor Davis Hanson has decided that he is an evil person who does evil by telling lies in support of other evil people.

He has stopped resisting.

He has recognized that this is his nature: to be a one-man definitive refutation to Sokrates's doctrine that nobody does evil knowingly:

Gabriel Schofield: Sophistry in the Service of Evil : "Mounting a persuasive case for the presidency of Donald Trump turns out to be a problematic enterprise.... Throughout Trump���s career, blatant racial prejudice has been a continuous thread.... Hanson... acknowledges that Trump was 'likely wrong' in holding the view that Judge Curiel harbored some innate bias. ��But Trump, he continues, was merely 'clumsy in his phraseology' and, moreover, his identification of the American-born judge as Mexican was actually 'correct', explaining that there is never a 'commensurate outcry about identifying Swedish Americans as "Swedes" or using "the Irish" for Irish Americans'. From beginning to end, Hanson���s treatment of this episode is an exercise in sophistry. Was Trump wrong or was he just ���likely��� wrong���Hanson���s equivocating interpolation���about Judge Curiel���s innate bias as a ���Mexican���? Racism is America���s original sin, a sin that we as a nation have struggled long and hard to expiate. Yet with a drumbeat of racially charged remarks emanating from the White House, Trump has been setting the nation back to a darker time. Hanson���s casuistry about the Swedes and the Irish, and the gaping hole that is his treatment of Trump���s odious life-long record in matters of race, are worse than sophistry; they are sophistry in the service of a genuine evil. Hanson has also drunk deeply from the gourd of conspiratorial thinking. He goes on for pages about the nefarious 'deep state', which he claims has 'the unlimited resources of government at its call', and whose 'operating premises have embraced multiculturalism, feminism, and identity politics'.... It was not Trump���s but Hillary Clinton���s campaign that was tacitly colluding with Russia to manipulate the 2016 election. Trump, he insists, was actually 'a victim of Russian collusion at the very time he was being accused of it'...

... ...

#noted

Mike Konczal: The Failures of Neoliberalism Are Bigger Th...

Mike Konczal: The Failures of Neoliberalism Are Bigger Than Politics: "Here are two statement... I associate with left neoliberalism.... The first is that neoliberal policies would create more growth. Sure, inequality might increase, but so would wages; and even if not wages, mobility up and down the income ladder.... The second is that if we get government out of corporations��� way, the market would become more dynamic, competitive and innovative. Sure, there might be some level of profits and questionable behavior in the short term, but the market itself would fix it, such that in the long term the corporate sector looked much healthier in terms of profits and dynamism. I want to ground it this way, in two intellectual statements about the tradeoffs of a policy regime, to help understand why the confidence that left neoliberalism once held over the baseline assumption of economics has collapsed.... This is a matter of ideas: ideas having failed, and us needing new ones...

... ...

#noted

Douglass C. North, John Joseph Wallis,and Barry R. Weing...

Douglass C. North, John Joseph Wallis,and Barry R. Weingast: A Conceptual Framework for Interpreting Recorded Human History: "Beginning 10,000 years ago, limited-access social orders developed that were able to control violence, provide order, and allow greater production through specialization and exchange... using the political system to limit economic entry to create rents, and then using the rents to stabilize the political system and limit violence.... This type of political economy arrangement... appears to be the natural way that human societies are organized.... In contrast, a handful of developed societies have developed open-access social orders. In these societies, open access and entry into economic and political organizations sustains economic and political competition. Social order is sustained by competition rather than rent-creation. The key to understanding modern social development is understanding the transition from limited- to open-access social orders, which only a handful of countries have managed since WWII...

#noted

Los Angeles Times: Today: A Trade and Truth Deficit: "Tru...

Los Angeles Times: Today: A Trade and Truth Deficit: "Trump hasn���t been living up to a number of his biggest campaign promises, including reducing the trade deficit, but that hasn���t stopped him from boasting about them.... President Trump has long talked about reducing the trade deficit.... The gap in imported and exported goods soared to an all-time high last year, largely because of Trump���s policies. And it���s just one area where Trump is falling short of his own goals.... Facts haven���t stopped Trump from boasting about his record over and over again with exaggerations and outright untruths. But will he pay a political price among his supporters? Probably not. As Matt Schlapp, chairman of the American Conservative Union, put it: 'Maybe 50% of Americans look at Donald Trump as struggling to accomplish things, but the other 50% looks at him as willing to take on challenges other presidents weren���t'...

#noted

March 6, 2019

Yevgeny Simkin: You���re Not the Asshole Twitter Makes Yo...

Yevgeny Simkin: You���re Not the Asshole Twitter Makes You Out To Be: "Twitter is the functional equivalent of shoving tens of millions of people into a closet, wrapping them in barbed wire, and pumping them full of PCP. It���s a miracle that anyone makes it out alive. The very fact that we volunteer to go in there is a testament to how badly we want to connect, and be heard, and maybe even understood because we feel like we���re standing here, all alone, shouting from the wilderness. So don���t fall for the narrative that humans are all a bunch of ill-tempered, arrogant, imbeciles filled with rage. Definitely don���t fall for that narrative if the evidence for it is Twitter. We���re not. Under the right circumstances these qualities, which exist to some small degree in everyone, can be illuminated and brought to the fore. Twitter is practically engineered to bring the worst out in people. But the real you is the one in the grocery store, not the one being cut off on the 405...

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers