J. Bradford DeLong's Blog, page 2227

August 18, 2010

Yes, There Was a Housing Bubble Identifiable at the Time

Paul Krugman rolls the videotape:

Wrong To Be Right: Yves Smith says most of what needs to be said about the Boston Fed study saying that nobody could have called the housing bubble. I’d just add that it’s helpful to look at what we knew back when. Here’s a picture from Kash of house prices up to early 2005; by the way, these were OFHEO prices, which most now believe understated the rise, which was better shown by Case-Shiller. But here’s what it looked like.... Given this kind of...

Why Oh Why Can't We Have a Better Press Corps? (Atlantic Monthly Edition)

Clive Crook accuses Obama of a:

...muddled message exposed him to attack from both sides... incompetent politics...

What Clive Crook says would have been competent politics--what he says Obama should have said about the mosque of lower Manhattan:

What Obama Should Have Said: The Constitution's protection of religious freedom is central to this country's meaning and purpose. Yet many Americans are uneasy about this project. I understand and respect their feelings. The Ground Zero...

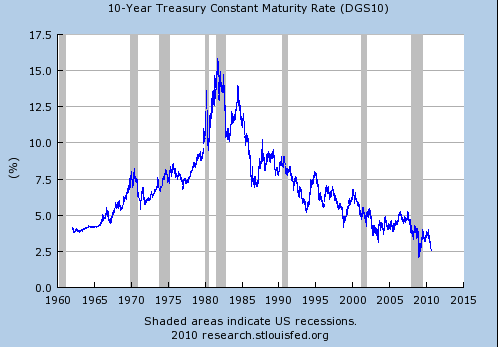

What is Happening with Bond Prices?

It is very hard to have a bubble in bonds because there is a date certain at which the principal is repaid. In year nine you cannot delude yourself into thinking that somebody will pay more than face value in year ten. And so in eight it is very hard to delude yourself into thinking that somebody in year nine will delude themselves into thinking that somebody will pay more than face value in year ten.

Nevertheless, Jeremy Siegel and Jeremy Schwartz think that we are in a bond bubble:

...

Reinhart And Rogoff Are Members of the More Expansionary Policy Caucus

Paul Krugman:

Reinhart And Rogoff Walk In The Light: Here.

Rogoff:

We may need another stimulus bill just to decompress from the previous one, a smaller one to cushion the landing.

Reinhart:

I’m not one of those deficit hawks. … I’m not saying you run out and pull the plug and have an adjustment that could derail what fragile recovery we do have.

Good for them.

Roger Farmer Is a Member of the More Expansionary Policy Caucus...

...and he is a very smart if (because he is a?) non-standard macroeconomist.

Roger:

We need more quantitative easing to create jobs: I argue in this piece that:

Quantitative easing should be expanded

Even if the Bank of England were to buy the entire UK national debt that this policy would not be inflationary

The global recovery is faltering and an expansionary policy is needed to encourage private investors to create jobs

Additional quantitative easing could save as much...

August 17, 2010

links for 2010-08-17

Felix Salmon: The Fiscal Times vs Elizabeth Warren: http://tinyurl.com/2axunur #worthreading

Liquidity Preference And Loanable Funds, Revisited - Paul Krugman Blog - NYTimes.com

Paul Krugman: Liquidity Preference And Loanable Funds, Revisited: http://tinyurl.com/2bh4g7y #worthreading

...

Mark Zandi's Take on the Obama Tax Cuts

The Obama administration thinks that, after taxes revert to their 2001 levels next year it should provide the middle class with a permanent tax cut equal to the Bush 2001 tax cut. I disagree: I think that the Obama administration should provide the middle class with a temporary two-year tax cut equal to the Bush 2001 tax cut.

Now comes Mark Zandi--who I respect, and who you have to respect--to argue that the Obama administration should provide the middle class with a permanent tax cut equal...

Federal Reserve Bank of Minneapolis Narayana Kocherlatkota Gets One Very Wrong

There is no reason to think that the bulk of current unemployment is any sense "structural": if aggregate demand were higher it would melt away just as unemployment in 1982 melted away.

There is good reason to think that if we do nothing for the next two years and unemployment remains elevated that a good deal of unemployment then will be "structural," not amenable to being cured by aggregate demand.

Fear of the transformation of current cyclical into future structural unemployment is a...

Why Oh Why Doesn't Barack Obama Recess-Appoint joe Gagnon to the Federal Reserve Board of Governors?

It is a mystery to me.

Joe Gagnon:

Monetary policy: Joseph Gagnon on monetary policy: IT IS now apparent that deflation is a more serious risk for the US economy than inflation. Both headline and core inflation are well below the 2% level that central banks view as optimal for economic growth and that the Fed has adopted as its goal. Recent bad news on economic growth and employment further increase the risk of plunging into outright deflation.

The case for monetary stimulus is...

August 16, 2010

links for 2010-08-16

Matt Welch: Ross Douthat is full of crap in several ways: http://tinyurl.com/2cp3gkc #worthreading

Marshal Putnik Gets Home

FT.com / US / Economy & Fed - US house mortgage arrears mount

Aline van Duyn and Anna Fifield: US house mortgage arrears mount: http://tinyurl.com/28r9n8d...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers