J. Bradford DeLong's Blog, page 2127

January 2, 2011

Hudson's Bay Has Still Not Completely Frozen Over

Who Should Replace Larry Summers?

From my perspective, the scary thing is that as of now nobody has replaced Larry Summers inside the White House. Either promote Jason Furman to the job, or tell him who he is going to be working for. Keeping your staff positions staffed is the first task of government. It's not rocket science.

Mark Thoma:

Economist's View: Who Should Replace Larry Summers?: Noam Scheiber defends Gene Sperling as "a leading candidate or the leading candidate to replace Larry Summers as head of Obama’s NEC":

Is the Favorite to Replace Larry Summers Too Close To Wall Street?, by Noam Scheiber, TNR: ...Gene Sperling, a counselor to Secretary Tim Geithner,... was director of Bill Clinton’s National Economic Council (NEC) in the late ‘90s, a period when the White House got pretty good marks for its understanding of business and the broader economy. But ... Sperling often speaks up for the little guy in internal deliberations—he was one of the administration wonks most concerned about executive pay, and he argued passionately for saving Chrysler...

Sperling’s record has suddenly become highly relevant because, depending on who you talk to, he’s either a leading candidate or the leading candidate to replace Larry Summers as head of Obama’s NEC. In light of the forgoing, you might also think he’d be a liberal favorite for the job. But Sperling has recently taken some lumps in the Huffington Post for his alleged sympathy for bankers and his ties to former Clinton Treasury Secretary Robert Rubin....

Sperling was NEC director when the Clinton administration ushered in some unfortunate deregulatory changes, pretty much every account I’ve either read or heard from people involved confirms that ... Sperling was a marginal player at best....

What about his instincts when he did work on issues of interest to Wall Street?... Sperling turns out to be the Treasury official who was most influential in helping persuade Geithner to embrace a fee on large financial firms to make the government whole after TARP, the vehicle for its various bailouts. The president unveiled the 10-year, $90 billion fee in January of 2010. Wall Street promptly howled....

Long story short: This hardly strikes me as the profile of a man out to do the banks’ bidding. Sperling may not be the kind of populist who makes the average HuffPo reader swoon. But I doubt his record as a policymaker inspires much chuckling on Wall Street.

I still think a break from the Wall Street connected side of the Clinton administration would have political value. Even better, no matter the choice, would be to show through action that the administration is, in fact, determined to reduce the chances of another meltdown by being tough on the financial sector. But, so far as I can tell, that doesn't seem to be the direction Obama intends to go.

Gene would, I think, be one of many possible excellent choices for NEC Director.

Here's what I wrote about this last November:

Obama's Next NEC Director: At the moment the lead candidates to replace Larry Summers as NEC Director--big shoes to fill--appear to be Roger Altman and Gene Sperling. I think both of them would probably do very well. But there are other people who I think would also be very good. And the professional economist in me wants somebody who thinks more like an economist. I don't think the administration has enough economists in it's top ranks.

So let me throw out a few names of people who would, I think, be as good as Roger and Gene--and who also think more like economists: Alan Blinder, Lael Brainard, Roger Ferguson, Jason Furman, Larry Meyer, and Laura Tyson...

Post-Christmas Shopping in the WC

This post-Christmas shopping season in the WC--Walnut Creek-- is genuinely scary. Tiffanys. Apple. Nordstrom. Barnes and Noble. Talbots. WTF are so many people doing shopping here and buying so much expensive stuff with 12% statewide unemployment?

From here it does look like a two-tier, profit-driven recovery--no parking places within a quarter mike of Tiffanys and long lines at Williams and Sonoma and Sur la Table, with pepple buying $12 cans of almond paste, while some of my daughter's high school classmates are now being told they cannot afford to go to college next year.

I wonder what Union Square looks like now?

Perhaps Obama Has Learned Something About Negotiating...

He should have called a Republican bluff by now. He has not. Perhaps he will.

Sam Stein:

Austan Goolsbee: Hitting Debt Ceiling Would Be 'First Default In History Caused Purely By Insanity': There are, it seems, only two major issues that have a set time frame for political brinkmanship between the White House and Congressional Republicans. The Bush tax cuts will make for an interesting election-year dynamic when they expire in two years. Well before that, however, the president will have to persuade GOP leadership to ignore Tea Party insistence and allow for the country's debt ceiling to be raised.... Appearing on ABC's "This Week," Austan Goolsbee, the chairman of the Council of Economic Advisers, laid out the fairly alarming implications of the United States defaulting on its obligations while asking the question: What type of insanity would persuade us to do this? "Well, look, it pains me that we would even be talking about this," he told co-host Jake Tapper. "This is not a game. You know, the debt ceiling is not something to toy with. If we hit the debt ceiling, that's essentially defaulting on our obligations, which is totally unprecedented in American history. The impact on the economy would be catastrophic. That would be a worst financial economic crisis than anything we saw in 2008."

"As I say that's not a game," Goolsbee went on. "I don't see why anybody's talking about playing chicken with the debt ceiling. If we get to the point where you've damaged the full faith and credit of the United States, that would be the first default in history caused purely by insanity....

The good news for Goolsbee and the president is that House GOP leadership does seem to see the deficit ceiling debate a bit differently than their incoming Tea Party brethren -- as does the intellectual establishment of the Republican Party, including George Will, who, following Goolsbee on ABC, criticized the idea of defaulting simply for symbolic reasons.

John Scalzi Tries to Deal with His Internet Addiction

I am betting that the internet will pwn him quickly. Just saying.

John Scalzi:

That One Small Detail I Alluded To In the Previous Post: Last year about this time I mentioned that my plan for the year was to devote my mornings to writing pay copy, which meant less time doing things on the Internet before noon. It was a good idea, and in a general sense I did much of my non-net writing during that time. But I also ended up doing a fair amount of backsliding. Basically what I’ve found is that if I pop up the Internet first thing in the morning, just to check e-mail, etc, I have a pretty good chance of then not getting to actual work until much later in the day, at a point when I am not as energized for it, and therefore do commensurately less of it.

So this year I’m going to get serious about things, time-wise.... I will not be online at all before noon, or before 2,000 words of pay copy, whichever comes first. Because now that I am old, morning is my best creative time, and because self-knowledge tells me that I allow myself to get distracted if I don’t set down an actual rule for myself. Now I have....

This goes in effect starting tomorrow. Wheee! Wish me luck.

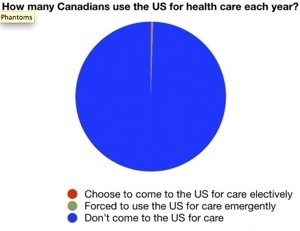

Voting with Their Feet for the U.S. Health Care Financing System? No

Aaron Carroll:

Phantoms in the snow | The Incidental Economist: Based on the comments I’ve seen over the last week, many of you are still going with that well used meme in the health care debate that people in other countries – frustrated by wait times and rationing – come to the United States for care. These are almost always anecdotal stories... when we can we should turn to evidence and research, and on this topic it does exist. The most comprehensive work I’ve seen on this topic was published in a manuscript in the peer-reviewed journal Health Affairs. That study looked at how Canadians cross the border for care. Most anecdotes involve Canadians, since it’s easy for those on the border to come here. And, the authors used a number of different methods to try and answer the question:

First, they surveyed United States border facilities in Michigan, New York, and Washington. It makes sense that Canadians crossing the border for care would favor sites close by, right? It turns out that about 80% of such facilities saw fewer than one Canadian per month. About 40% saw none in the prior year. And when looking at the reasons for visits, more than 80% were emergencies or urgent visits (ie tourists who had to go to the ER). Only about 19% of those already few visits were for elective purposes.

Next, they surveyed “America’s Best Hospitals”, because if Canadians were going to travel for care, they would be more likely to go to the most well-known and highest quality facilities, right? Only one of the surveyed hospitals saw more than 60 Canadians in one year. And, again, that included both emergencies and elective care.

Finally, they examined data from the 18,000 Canadians who participated in the National Population Health Survey. In the previous year, only 90 of those 18,000 Canadians had received care in the United States; only 20 of them had done so electively....

Look, I’m not denying that some people with means might come to the United States for care. If I needed a heart/lung transplant, there’s no place I’d rather be. But for the vast, vast majority of people, that’s not happening. You shouldn’t use the anecdote to describe things at a population level. This study showed you three different methodologies, all with solid rationales behind them, all showing that this meme is mostly apocryphal.

Welcome to the Teens

With the decision of the power elite in Washington to accept a long, deep economic downturn and a slow, hesitant, low-inflation recovery, I think that the American Century may have finally come to an end.

Matthew Yglesias

Yglesias » Future Shock: The Economist did an interesting 2010 in charts feature to close the year out.... I think what we see is that for unclear reasons leaders in developed countries have basically given up on trying to have economic growth. The US, the Eurozone, and Japan are so terrified that real growth might lead to growth-imperiling inflation that we’ve just decided to live without the growth in the first place. To me this is also Tyler Cowen’s real message here. But if the developed world has decided it’s not interested in growth anymore, I think we can look forward to many more stories like this:

With a market share of 31.5 percent, Nokia is still the largest vendor of handsets in the Indian market, followed by Chinese brand G’Five with about 10 percent share, IDC said on Wednesday.

That’s via full-time professional mobile device market analyst Horace Dedieu who remarks: “No, I haven’t heard of G’Five either.”

Welcome to the teens.

Stupidest Man Alive Nominations for Don Boudreaux, Mark Perry, and John Tierney

Why oh why can't we have a better press corps? Yes, it is the New York Times again.

Nomination made by and smackdown provided by Jim Hamilton:

Econbrowser: Energy cornucopia?: Don Boudreaux and Mark Perry are among those who regard John Tierney's claims of energy cornucopia to be persuasive.

Here are Tierney's strongest arguments:

Giant new oil fields have been discovered off the coasts of Africa and Brazil. The new oil sands projects in Canada now supply more oil to the United States than Saudi Arabia does. Oil production in the United States increased last year, and the Department of Energy projects further increases over the next two decades.

Let me discuss each of these observations in turn:

Africa and Brazil. It is true that these areas are increasing production.... However, consumption from China alone increased 1.5 mb/d between 2005 and 2009, meaning that despite the increased production from Brazil, Africa, and anywhere else in the world, everyone outside of China had to make do with less.

Canadian oil sands.... The appropriate measure is not exports to the U.S. but rather exports to the world as a whole. On a global basis Canada exported 1.5 million barrels of oil per day in 2009.... The Canadian Association of Petroleum Producers expects that with aggressive growth their oil sands production could increase an additional 1.6 mb/d by 2025....

U.S. oil production. Here's a graph of U.S. oil production since 1920, in which the recent increase that Tierney mentions is clearly evident, as a modest blip back up in what has been a profound decline going back to 1971....

Tierney goes on to claim that "the really good news is the discovery of vast quantities of natural gas," and here I agree. The discovery of abundant new sources of natural gas is a huge story. Figuring out how to use this resource to replace our reliance on oil ought to be one of our highest priorities.

But the inference that we have nothing to worry about in terms of global oil supplies is not the conclusion that I would draw from the facts that Tierney discusses.

Might I suggest that the New York Times think about an alternative editorial model?

Budget-Arsonists-Wearing-Firechief-Hats Watch: Greg Mankiw vs. Greg Mankiw

Why oh why can't we have a better press corps?

Let the record show that when Greg Mankiw was chair of the President's Council of Economic Advisers he worked for a president, George W. Bush, who took less than zero regard for the long-term fiscal stability of the United States. And let the record show that Mankiw did not put his or his staff's credibility on the line in an attempt to reverse either of the five big budget-busting decisions--the 2001 abandonment of congressional PAYGO, the 2003 shift of taxes from the present into the future, the 2003 decision not to raise taxes to pay for any portion of the war in Iraq, and the 2003 decision not to find a revenue source to cover any part of the expense of Medicare Part D--of the George W. Bush administration.

Greg Mankiw, 2004, as observed by Noam Scheiber--working for

Out of Depth: [Y]ou can practically see the dissonance spelled out on Mankiw's face. He appears to wince when he gets a question from the generally anodyne NABE crowd about the administration's dubious promise to cut the deficit in half in five years.... [He explains] that the administration plans to achieve its goal through a mixture of spending restraint and entitlement reform. He cites the recent Medicare reform bill as an example:

The easy thing to do would have been to take the existing system and add a prescription-drug benefit on top of it.

But, instead, he continues--utterly unconvincingly--the president demanded changes that will save real money over the long term. (This, describing a bill recently estimated to cost $534 billion over ten years.) "So there's--there's a fundamental rethinking" going on, he concludes...

And let the record show that there have been four big moves on the long-term budget in the past year: (1) the inclusion in the Affordable Care Act of the IPAB to slow the growth rate of Medicare spending (good for long-run fiscal stability, and which the Republicans have sworn to repeal), (2) the inclusion in the Affordable Care Act of the tax on high-cost health plans (good for fiscal stability, and which the Republicans have sworn to repeal), (3) the late 2010 Obama-McConnell deal on extending the shift of taxes from the present to the future (bad for fiscal stability, which the Republicans supported), and (4) the abandonment of PAYGO by the Republican House majority (bad for fiscal stability). Let the record show that Greg Mankiw has not endorsed (1) or (2), and has not lamented (3) or (4).

But he does put on his firechief hat and lecture Obama about how concerned conservative economists like him are with long term fiscal stability. Greg Mankiw, 2011:

How Obama Can Work With Republicans: In a matter of days, Republicans will control the House of Representatives and have a larger voting bloc in the Senate. If economic policy is to make any progress over the next two years, you really will have to be bipartisan. To do so, you’ll need to get inside the heads of the opposition. I am here to help. As a sometime adviser to Republicans, I’d like to offer a few guidelines to understanding their approach to economic policy. Follow these rules of thumb and your job will be a lot easier.

FOCUS ON THE LONG RUN Charles L. Schultze, chief economist for former President Jimmy Carter, once proposed a simple test for telling a conservative economist from a liberal one. Ask each to fill in the blanks in this sentence with the words “long” and “short”: “Take care of the _ run and the _ run will take care of itself.” Liberals, Mr. Schultze suggested, tend to worry most about short-run policy. And, indeed, starting with the stimulus package in early 2009, your economic policy has focused on the short-run problem of promoting recovery from the financial crisis and economic downturn.

But now it is time to pivot and address the long-term fiscal problem. In last year’s proposed budget, you projected a rising debt-to-G.D.P. ratio for as far as the eye can see. That is not sustainable. Conservatives believe that if the nation credibly addresses this long-term problem, such a change will bolster confidence and have positive short-run effects as well...

January 1, 2011

The Third Generation of Voodoo Economics

Stan Collender:

Paul Krugman Understands That Voodoo Is Red (Ink) Rather Than Black Magic: Paul Krugman's column in today's New York Times, which discusses many of the themes I've been posting about lately, is right on the money in every sense of that phrase.

Paul Krugman:

Hypocrisy never goes out of style, but, even so, 2010 was something special. For it was the year of budget doubletalk — the year of arsonists posing as firemen, of people railing against deficits while doing everything they could to make those deficits bigger. And I don’t just mean politicians. Did you notice the U-turn many political commentators and other Serious People made when the Obama-McConnell tax-cut deal was announced? One day deficits were the great evil and we needed fiscal austerity now now now, never mind the state of the economy. The next day $800 billion in debt-financed tax cuts, with the prospect of more to come, was the greatest thing since sliced bread, a triumph of bipartisanship. Still, it was the politicians — and, yes, that mainly meant Republicans — who took the lead on the hypocrisy front.

In the first half of 2010, impassioned speeches denouncing federal red ink were the G.O.P. norm. And concerns about the deficit were the stated reason for Republican opposition to extension of unemployment benefits, or for that matter any proposal to help Americans cope with economic hardship. But the tone changed during the summer, as B-day — the day when the Bush tax breaks for the wealthy were scheduled to expire — began to approach. My nomination for headline of the year comes from the newspaper Roll Call, on July 18: “McConnell Blasts Deficit Spending, Urges Extension of Tax Cuts.” How did Republican leaders reconcile their purported deep concern about budget deficits with their advocacy of large tax cuts? Was it that old voodoo economics — the belief, refuted by study after study, that tax cuts pay for themselves — making a comeback? No, it was something new and worse.

To be sure, there were renewed claims that tax cuts lead to higher revenue. But 2010 marked the emergence of a new, even more profound level of magical thinking: the belief that deficits created by tax cuts just don’t matter. For example, Senator Jon Kyl of Arizona — who had denounced President Obama for running deficits — declared that “you should never have to offset the cost of a deliberate decision to reduce tax rates on Americans.” It’s an easy position to ridicule. After all, if you never have to offset the cost of tax cuts, why not just eliminate taxes altogether? But the joke’s on us because while this kind of magical thinking may not yet be the law of the land, it’s about to become part of the rules governing legislation in the House of Representatives....

How will this all end? I have seen the future, and it’s on Long Island, where I grew up. Nassau County — the part of Long Island that directly abuts New York City — is one of the wealthiest counties in America and has an unemployment rate well below the national average. So it should be weathering the economic storm better than most places. But a year ago, in one of the first major Tea Party victories, the county elected a new executive who railed against budget deficits and promised both to cut taxes and to balance the budget. The tax cuts happened; the promised spending cuts didn’t. And now the county is in fiscal crisis.... Nassau County shows how easily responsible government can collapse in this country, now that one of our major parties believes in budget magic. All it takes is disgruntled voters who don’t know what’s at stake — and we have plenty of those. Banana republic, here we come.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers