J. Bradford DeLong's Blog, page 2110

January 27, 2011

Screencasts and Problem Sets: Spring 2011 IAS 107 Intermediate Macro for Political Economy Majors

Screencasts:

Some huge honking files here:

Lecture 1 January 18: http://delong.typepad.com/files/lecture-1-ias-107-spring-2011.m4a

Lecture 2 January 20: http://delong.typepad.com/files/lecture-2-ias-107-spring-2011.mp4

Lecture 3 January 25: http://delong.typepad.com/files/lecture-3-ias-107-spring-2011.mp4

Lecture 4 January 27: http://delong.typepad.com/files/lecture-4-ias-107-spring-2011.mp4

Problem Sets:

Problem Set 1 with answers: http://delong.typepad.com/20110118-ias-107-pset1-with-answers.pdf

Problem Set 2: http://delong.typepad.com/20110126-ias-107-pset2.pdf

Econ 210a: Memo Question for February 2, 2011

Econ 210a: Memo Question for February 2, 2011:

Adam Smith confidently predicted that slavery was on its way out for economic reasons. In commercial society, manumission would be the rule because the carrot of working for yourself is much more efficient than the stick of being whipped by others. Was Smith right? If you conclude he was wrong, why was he wrong?

Intelligent Economic Design: Live at Project Syndicate

Intelligent Economic Design by J. Bradford DeLong - Project Syndicate: BERKELEY – As Stephen Cohen, with whom I wrote The End of Influence: What Happens When Other Countries Have the Money, likes to say, economies do not evolve; they are, rather, intelligently designed. He also likes to say that, though there is an intelligence behind their design, this does not mean that the design is in any sense wise.

The first claim is, I think, incontrovertible. Since long before Croesus, King of Lydia, came up with the game-changing idea of standardized “coinage,” what governments have done and not done to structure, nudge, and put their thumbs on the scales has been decisively important for economic development.

Just look around you. Notice the hundred-fold divergence across political jurisdictions in relative levels of economic productivity and prosperity? I dare anyone to claim that the overwhelming bulk of that disparity springs from causes other than history and the current state of governance.

The second claim is also, I think, true. To say that economies are the products of intelligent design means only that some human intelligence or intelligences lies behind the design. It does not mean that the design is smart or optimal.

For one thing, the process by which the design decisions are made resembles committee work: most people want a horse, but the push and pull and tug of negotiation produces a camel. Moreover, the government officials, lobbyists, and interest groups doing the designing may not have the public interest in mind – or even know what the public interest happens to be.

Most of the time in America, the process of intelligent design of the economy has gone well: that is why Americans are so relatively and absolutely rich today. After all, the Founding Fathers were keen on redesigning the infant American economy. Alexander Hamilton was clear on the primacy of commerce and industry.

In particular, Hamilton was convinced of the importance of a sophisticated banking system to support the growing economy. And he and his Federalist colleagues, including John Adams, believed strongly in providing infant industries with room to grow – even using money from the Department of War to fund experiments in high-tech industry.

When the Democratic-Republicans, led by Thomas Jefferson and James Madison, replaced the Federalists, they quickly decided that their small-government principles were an out-of-power luxury. Wars of conquest, territorial acquisition, continental surveying, and canal and then railroad subsidies were good for voters, immigrants, and pretty much everyone else except the outnumbered and outgunned Native Americans who got in the way.

Indeed, any government that builds infrastructure and allocates land titles on the scale of the nineteenth-century US government is “Big Government” incarnate. Add steep tariffs on imported manufactured goods – rammed through over the angry protests of farmers and southern planters – and you have the policies that intelligently designed much of nineteenth- and early twentieth-century America.

After World War II, it was again government that led the redesign of the US economy. The decisions to build an interstate highway system (and to spend most of that money on suburban commuter roads) and to jump-start the long-term mortgage market – reflecting the widespread belief that General Motors’ interests were identical with America’s – literally reconfigured the landscape. Combine that with the large-scale development of the world’s leading research universities, which then educated tens of millions of people, and with the tradition of using defense money to finance high-tech research and development, and, voilà, you have the post-war US economy.

Whenever push has come to economic shove, America’s government has even deliberately devalued the dollar in the interest of economic prosperity. Franklin Roosevelt did it during the Great Depression, and Richard Nixon and Ronald Reagan did it, too.

This history is worth reviewing because America is poised for another debate over whether its economy evolves or is designed, with President Barack Obama’s opponents claiming that whatever is good in America’s economy has always evolved with no guidance, and that whatever is bad has been designed by government.

This claim is, of course, ludicrous. American governments will continue to plan and design the development of the economy, as they always have in the past. The question is how, and whether the design will be in any sense wise.

But there are two dangers in America’s forthcoming debate. The first concerns the term likely to be used to frame the debate: competitiveness. “Productivity” would be much better. "Competitiveness" carries the implication of a zero-sum game, in which America can win only if its trading partners lose.

That is a misleading, and dangerous, implication. Instead, all else being equal, richer trading partners benefit America: they make more good stuff for Americans to buy and sell more cheaply, and their stronger demand means that they are willing to pay more for the stuff that America has to sell. Win-win.

The second danger is that “competitiveness” implies that what is good for companies located in America – good, that is, for their investors, executives, and financiers – is good for America as a whole. Back when President Dwight D. Eisenhower’s cabinet nominee Charlie Wilson claimed that what was “good for America was good for General Motors – and vice versa,” GM included not just shareholders, executives, and financiers, but also suppliers and members of the United Auto Workers union. By contrast, General Electric CEO Jeffrey Immelt, recently appointed by Obama to lead the President’s Council on Jobs and Competitiveness, runs a company that has long since narrowed to executives, investors, and financiers.

Let us hope that the looming debate goes well. A more prosperous and rapidly growing America – a scenario in which the rest of the world has a vital interest – hangs in the balance.

Why Oh Why Can't We Have a Better Press Corps? (Sewell Chan of the New York Times Edition)

Outsourced to Barry Ritholtz:

More Snow : It appears we got hit with another 10-12 inches of snow overnight. Schools are cancelled, and my trains are not running into the city yet.

I need to go blow the snow off the driveway, then figure out what I am gong to do today. I was hoping to read the FCIC report, but it does not look like I will get to the store today.

And speaking of Snow Jobs, the dissenters in the FCIC continue their embarrassing foolishness.

The NYT devotes two paragraphs to Peter Wallison — they mention he was “chief lawyer for the Treasury Department and then the White House during the Reagan administration” and that he is “now at the conservative American Enterprise Institute.”

But nowhere do they mention that he was co-director of the AEI’s Financial Deregulation Project. This is a serious omission by a major publication.

The New York Times should be much better than this . .

Do TV Stations on the East Coast Spend as Much Time Covering East Coast Snowstorms as Our TV Stations Do?

Short Answers to Simple Questions: Affordable Care Act Edition

Me: So Chief Medicare Actuary Richard Foster's position is that repealing the Affordable Care Act will not increase the deficit because if the Republicans don't repeal it now some other congress will repeal the deficit-reducing parts of it later?

Respected Real Health Care Expert: Yes.

This has been another addition of short answers to simple questions.

Berkeley Screencasts Spring 2011 IAS 107 Intermediate Macro for Political Economy Majors

Some huge honking files here:

Lecture 1 January 18: http://delong.typepad.com/files/lecture-1-ias-107-spring-2011.m4a

Lecture 2 January 20: http://delong.typepad.com/files/lecture-2-ias-107-spring-2011.mp4

Lecture 3 January 25: http://delong.typepad.com/files/lecture-3-ias-107-spring-2011.mp4

Lecture 4 January 27:

Paul Van de Water on Budget Arithmetic:

PVdW:

Testimony: Paul Van de Water: The Medicare actuary has raised questions about the sustainability of one particular category of Medicare savings in health reform — the reductions in payment updates for most providers to reflect economy-wide gains in productivity. Although these concerns deserve a serious hearing, other experts see more room to extract efficiencies and improve productivity in the health care sector. Notably, the Medicare Payment Advisory Commission (MedPAC), Congress’s expert advisory body on Medicare payment policies, generally expects that Medicare should benefit from productivity gains in the economy at large. MedPAC finds that hospitals with low Medicare profit margins often have inadequate cost controls, not inadequate Medicare payments.

Because the productivity adjustments are now law, Congress would have to pass a new law to stop them from taking effect. Under the statutory pay-as-you-go rules, that future legislation would have to be paid for, so that it didn’t increase the deficit....

[B]oth CBO and the Medicare actuary have always assumed [in the past] in their projections that the laws of the land will be implemented, rather than hazard guesses about how future Congresses might change those laws.... Gail Wilensky, who ran Medicare under President George H.W. Bush, has expressed it this way: “It would be very hard to know what you would use if you didn’t use current law — whose view you would use.”...

Bringing deficits under control will require making difficult trade-offs and tough political decisions on both taxes and spending, especially for health care. If we can’t count any provision that is controversial and might later be changed, we would have to conclude that neither the Bowles-Simpson proposals, the Rivlin-Domenici plan, nor Congressman Ryan’s Roadmap would really reduce the deficit. In fact, if we can’t count any provision that a later Congress might reverse, we can’t [ever] do serious deficit reduction...

Sigh

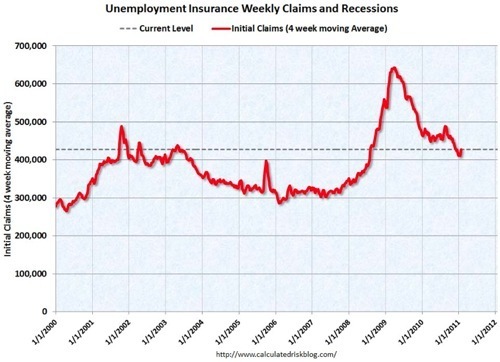

All statistics around Christmastide are shaky because of the unreliability of the seasonal adjustment factors. But this is not good news:

Calculated Risk: Weekly Initial Unemployment Claims increase sharply to 454,000: The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 22, the advance figure for seasonally adjusted initial claims was 454,000, an increase of 51,000 from the previous week's revised figure of 403,000. The 4-week moving average was 428,750, an increase of 15,750 from the previous week's revised average of 413,000.

Click on graph for larger image in new window.

This graph shows the 4-week moving average of weekly claims for the last 10 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 15,750 to 428,750...

January 26, 2011

California School Fundraisers Are Not What They Used to Be...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers