J. Bradford DeLong's Blog, page 2107

January 31, 2011

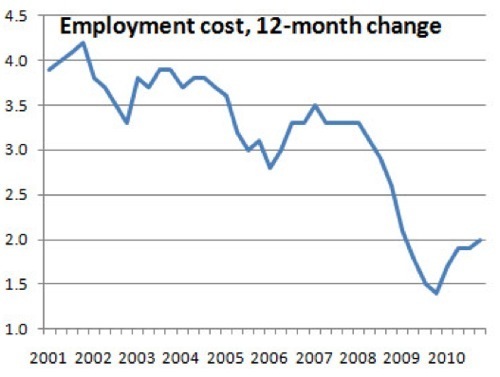

A 2% Inflation Rate Requires in the Long Run a 4% Rate of Growth in the Employment Cost Index

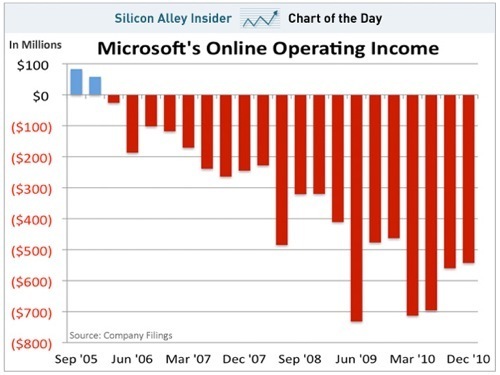

How Is Microsoft Doing This?

Compound -$2.5 billion at 7%/year and you get -$35 billion...

Jay Yarow and Kamelia Angelova:

CHART OF THE DAY: Microsoft Incinerates ANOTHER $543 Million Online: Every quarter Microsoft reports earnings, and every quarter it reports a massive loss in its online operations. Today it reported a $543 million loss for its December quarter. This gives Microsoft a trailing-four-quarter loss of $2.5 billion. That's simply astounding. We've asked it before, and we'll ask it again: Has any company lost as much money online as Microsoft?

Speaker Boehner: Failure to Raise Debt Ceiling Spells 'Financial Disaster'

That would be a financial disaster, not only for us, but for the worldwide economy. I don't think it's a question that's even on the table.

Vernon Smith on Balance Sheet Recessions, Left-Right-And-Center on Underwater Homes and Bankruptcy Modification

Why the Eurozone Should Have a 4% Inflation Target

Paul Krugman:

Eurozone Inflation: Wolfgang Munchau agonizes over European inflation targets; he worries that rising German inflation may lead the ECB to raise rates, which would be disastrous for troubled peripheral economies.... Trying to keep German inflation low means imposing harsh deflation on the European periphery, as it tries to get costs and prices back in line.... [G]iven what we know about price adjustment during persistent large output gaps (PLOGs), the reality is that keeping overall eurozone inflation at 2 percent would probably mean at best very slow deflation in the periphery — because prices really don’t want to fall — but a prolonged period of very high unemployment.

The point, as Munchau says, is that a monetary union of imperfectly integrated economies really needed a higher inflation target than the United States; having what amounts to a low-inflation target, and a central bank that’s always looking for reasons to worry about inflation, is really destructive.

We Should Have Imposed a Carbon Tax 50 Years Ago. We Still Should Impose a Carbon Tax

Alan Blinder:

The timing is critical. With the recovery just starting—we hope—to gather steam, this is a terrible time to hit it with some big new tax. Hence, while the CO2 tax should be enacted now, it should be set at zero for 2011 and 2012. After that, it would ramp up gradually. Adapting some calculations from a recent paper by Prof. William Nordhaus of Yale, the tax might start at something like $8 per ton of CO2 in 2013 (that's roughly eight cents per gallon of gasoline), reach $25 a ton by 2015 (still just 26 cents per gallon), $40 by 2020, and keep on rising. I'd like to see it top out at more than $200 a ton in, say, 2040—which is higher than in Mr. Nordhaus's example.... What's critical is that we lock in higher future costs of carbon today. The key thing, as the president said, is that "businesses know there will be a market for what they're selling." Think about what would happen. Once America's entrepreneurs and corporate executives see lucrative opportunities from carbon-saving devices and technologies....

No one likes to pay higher taxes. But every realistic observer knows that closing our humongous federal budget deficit will require a mix of higher taxes and lower spending as shares of GDP. Forget about value-added taxes and other new levies you may have heard about. A CO2 tax trumps them all....

I know this sounds like a pipe dream now. America has elected a Republican House of Representatives that, among its first acts, decided that tax increases don't really add revenue and that tax cuts don't really lose revenue—at least not any revenue they are willing to count. These folks are not about to vote for a CO2 tax, even one starting at zero.

But let's remember Winston Churchill's marvelous aphorism: "You can always count on Americans to do the right thing—after they've tried everything else." First, we'll try everything else. But eventually we'll succumb to the inexorable logic of a phased-in CO2 tax. Just watch—if you're young enough to live that long.

Thou Shalt Not Crucify Humanity Upon a Cross of Rubber

Paul Krugman:

The Demands for Higher Interest Rates: Last Saturday, reported The Financial Times, some of the world’s most powerful financial executives were going to hold a private meeting with finance ministers in Davos, the site of the World Economic Forum. The principal demand of the executives, the newspaper suggested, would be that governments “stop banker-bashing.” Apparently bailing bankers out after they precipitated the worst slump since the Great Depression isn’t enough — politicians have to stop hurting their feelings, too.

But the bankers also had a more substantive demand: they want higher interest rates, despite the persistence of very high unemployment in the United States and Europe, because they say that low rates are feeding inflation. And what worries me is the possibility that policy makers might actually take their advice....

[W]e’re in the midst of what the International Monetary Fund calls a “two speed” recovery, in which some countries are speeding ahead, but others — including the United States — have yet to get out of first gear.... What about inflation? High unemployment has kept a lid on the measures of inflation that usually guide policy. The Federal Reserve’s preferred measure, which excludes volatile energy and food prices, is now running below half a percent at an annual rate, far below the informal target of 2 percent.

But food and energy prices — and commodity prices in general — have, of course, been rising lately.... What’s that about? The answer, mainly, is growth in emerging markets. While recovery in advanced nations has been sluggish, developing countries — China in particular — have come roaring back from the 2008 slump. This has created inflation pressures within many of these countries; it has also led to sharply rising global demand for raw materials. Bad weather — especially an unprecedented heat wave in the former Soviet Union, which led to a sharp fall in world wheat production — has also played a role in driving up food prices.

The question is, what bearing should all of this have on policy at the Federal Reserve and the European Central Bank?...

The Fed normally focuses on “core” inflation, which excludes food and energy, rather than “headline” inflation, because experience shows that while some prices fluctuate widely from month to month, others have a lot of inertia — and it’s the ones with inertia you want to worry about.... And this focus has served the Fed well in the past. In particular, the Fed was right not to raise rates in 2007-8, when commodity prices soared — briefly pushing headline inflation above 5 percent — only to plunge right back to earth. It’s hard to see why the Fed should behave differently this time, with inflation nowhere near as high as it was during the last commodity boom....

Ben Bernanke clearly understands that raising rates now would be a huge mistake. But Jean-Claude Trichet, his European counterpart, is making hawkish noises — and both the Fed and the European Central Bank are under a lot of external pressure to do the wrong thing.

They need to resist this pressure. Yes, commodity prices are up — but that’s no reason to perpetuate mass unemployment. To paraphrase William Jennings Bryan, we must not crucify our economies upon a cross of rubber.

Photons and Electrons

James Condliffe:

One Per Cent: Kindle is mightier than the book, for Amazon at least: Forget the dog-eared holiday paperback: you'll be reading an ebook on the beach this summer, if Amazon's latest sales figures are anything to go by. For the first time, Amazon's Kindle book sales have overtaken those of their paperbacks, making ebooks the company's most popular format in the US. In a statement published on their website, Amazon announced:

Amazon.com is now selling more Kindle books than paperback books. Since the beginning of the year, for every 100 paperback books Amazon has sold, the Company has sold 115 Kindle books. Additionally, during this same time period the company has sold three times as many Kindle books as hardcover books.

Kindle sales first overtook hardbacks back in July of 2010. But this latest announcement marks a much more significant step forward. The company's aggressive marketing of digital books seems to have helped it achieve its first ever $10 billion quarter at the end of last year, and ebook sales look set to keep breaking records. Last December, the Kindle device replaced J.K. Rowling's "Harry Potter and the Deathly Hallows" as Amazon's biggest-selling single product ever, and the Kindle store itself now boasts over 810,000 titles.

Amazon has very cleverly separated hardback and paperback sales in these newly-released figures - and remained tight-lipped about the raw sales numbers for the time period they quote in their release. The Guardian points out that this differentiation actually "suggests that the online retailer still sells 120 print books for every 100 ebooks sold". So in absolute terms, the hard-copy book still outsells its digital counterpart.

Nevertheless, the news suggests that the Kindle's success is sealed as the champion of e-readers - and maybe even reading, full stop.

January 30, 2011

Sunday Morning Theology Blogging: Is Tom Waits More Merciful than God?

Slacktivist fears being Justified, and sends us to Tony Jones, who asks:

Is is palatable to worship a God who allows Judas (and Hitler) to enjoy eternal life in God’s presence?

Put me down among those who think that a God that could not even Justify finite beings like Judas Iscariot and Charles Whitman would be a pretty wimpy God indeed.

And, of course, there is: Kenny Loggins wouldn't beat the baby Jesus...

January 29, 2011

Why Friends Don't Let Friends Support the Republican Party: Steve Pearlstein on Public Investment

SP:

Steven Pearlstein: On public investment, Republicans again show they aren't serious: When talking about the federal government and its budget deficit, Republican politicians love to score points by noting that "you'd never run your household or your business that way." Then again, you'd never run your household or your business by ignoring investment. Yet now that President Obama has proposed stepped-up public investment in infrastructure, energy, education and basic research, Republicans have suddenly decided their favorite analogy no longer applies.... Republicans, it turns out, have no public investment strategy, just as they have no health-care strategy and no agreed-upon blueprint for reducing federal spending. What they have are poll-tested talking points, economic delusions and an overwhelming partisan instinct to say "no" to anything Barack Obama proposes....

[A]s the president should have learned from health-care reform, the danger in tailoring his strategy to the partisan back and forth on Capitol Hill is that he risks losing the more important battle for broad popular support. By endorsing the markers laid down by his own commission, Obama could have taken the the deficit issue away from Republicans and gained the political credibility he needs to push through his investment agenda. To use the president's phrase, that would have been doing "big things."

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers