J. Bradford DeLong's Blog, page 2085

February 23, 2011

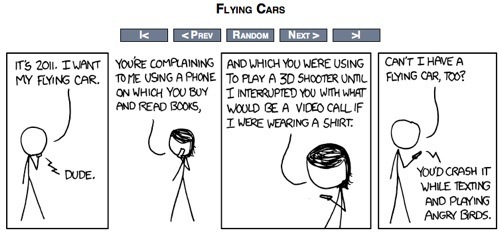

Flying Cars

February 22, 2011

DeLong Smackdown Watch: The Theory of Relativity

Matthew Johnson writes:

The Theory of Relativity: Is It Time to "Teach the Controversy" in America's High Schools?: "Outside of everyday human experience"? Not so, mon amis, not so.

This is why it was such a valuable part of the Caltech experience that my then physics professor started his best lecture of the year by entering the room, turning on the light, and saying, "that was a relativity demonstration"; then he tossed an eraser lightly in the air, so that it would clearly tumble as it fell, and said, "that was a general relativity demonstration".

Then he spent the next 20-30 min. or so explaining why these everyday phenomena really ARE "relativity demonstrations", showing that we now understand these phenomena better than ever before now that we understand them in the light of the theories of special and general relativity.

Liveblogging World War II: February 22, 1941

February 22, 1941: Greek and British discussions in Athens reach agreement on a British commitment of 100,000 soldiers, with artillery and tank support, to defend Greece. Fewer soldiers, the Greek government had maintained, would have been counterproductive, but with 100,000 the German temptation to attack the forces of its British adversary would be outweighed by the difficulty of conquering Greece.

Xoom, Honeycomb, Flash...

Matt Drance:

Apple Outsider » Flash on Android 3.0 Isn’t Ready: Engadget reported yesterday that Motorola’s Xoom tablet would initially ship without Adobe Flash 10.1, which has been a marquee feature leading up to the launch. I wondered if the delay was specific to Xoom, or to the new Android 3.0 “Honeycomb” OS. Macworld has noted an Adobe blog post that answers the question: it’s late for Honeycomb, and it’ll be ready “within a few weeks.” Until then, we have a product that can’t view its own website. And people still ask, with a straight face, why Flash isn’t on iOS.

Dan Nystedt:

Adobe says Honeycomb tablets to get Flash in 'a few weeks' | Tablets | iOS Central | Macworld: Adobe says Flash support for tablets based on Google’s upcoming “Honeycomb” version of the Android operating system will be available “within a few weeks.” Honeycomb is the first version of Android designed for tablets and is eagerly anticipated. Motorola’s Xoom tablet will launch on Thursday as the first to run the software, but initial versions won’t come with Flash support. Verizon, which is putting the device on sale, previously said Flash would be available in “spring 2011.” The vague time reference had people fearing Flash wouldn’t be available until the end of the season, but a posting on Adobe’s blog points to a slightly earlier release.

“Consumers are clearly asking for Flash support on tablet devices and the good news is that they won’t have to wait long. We are aware of over 50 tablets that will ship in 2011 supporting a full web experience (including Flash support) and Xoom users will be among the first to enjoy this benefit,” wrote Matt Rozen, on Adobe’s Flash Platform Blog.

Adobe said version 10.2 of its Flash Player will be offered as a download or preinstalled on some tablets launching later in 2011. Adobe has said that Flash Player 10.2 will offer users of dual-core tablets and smartphones HD Flash video and up to 30 frames per second video performance.

Ryan Thomas McNeely Has a Weblog...

RTM:

R.T. McNeely « Ryan Thomas McNeely: I grew up in Chatham, New Jersey and attended Williams College in Williamstown, Massachusetts. After college I did non-profit work in post-Katrina New Orleans for three years before returning to school, and most recently I had a brief stint interning for Matthew Yglesias at the Center for American Progress. I'm currently pursuing a Master's in Public Affairs (focus on Domestic and Urban Policy) at the Woodrow Wilson School at Princeton University. I'm graduating this May -- please hire me!

Do the Motivations of Politicians Matter? « Ryan Thomas McNeely

Adele Releases “21″ « Ryan Thomas McNeely

Actual Horrible People in Office in America « Ryan Thomas McNeely

The Elephant Not in the Room « Ryan Thomas McNeely

So I’ve Decided to Finally Try Starting a Blog « Ryan Thomas McNeely

DeLong Smackdown Watch: "Politics Is Undermining Our Economy" Edition

Dean Baker justly complains that I have misread him here: "Politics Is Undermining Our Economy." He does not think that it would have been economically impossible to maintain near-full employment after the collapse of the housing bubble, just that it was politically difficult.

When he writes:

The Right Prescription for an Ailing Economy: As much as economists like to pretend to be sorcerers, they have no easy way to replace $1 trillion in annual demand. The Obama Administration's 2009 stimulus package went perhaps one-third of the way, but it was nowhere near large enough...

and:

Dean Baker | The Bursting of the Housing Bubble and the Coming Recession: If housing construction and sales fall back to trend levels, it would mean a loss of more than 2 million jobs. The decline in consumption that will result because people can no longer borrow against their homes will have an even more dramatic impact on the economy. The financial system will also be shaken by an unprecedented wave of mortgage defaults. Unfortunately, at this point there is no obvious way to avoid this scenario...

and:

Beating Up On Brad DeLong | TPMCafe: There is nothing in our economist's bag of tricks that gives us an easy mechanism for replacing 9 percent of GDP quickly, which leaves me wondering what the reality grasping Mr. DeLong been smoking?... Exactly what mechanism do we have in the private economy for replacing $1.2 trillion in private demand in a short period of time?

he is not throwing up his hands in despair, but rather calling for a boost to total government purchases on the order of four times as great as the boost to federal government purchases in the Recovery Act.

Politics Is Undermining Our Economy

We are live at The Week:

Politics is undermining our economy - The Week: There is a line of argument that I do not understand — even though it is made by economists I respect. It is that our current labor-market depression was baked in the cake from the moment that Alan Greenspan decided to keep interest rates low in the early 2000s, declining to stop would-be homeowners from borrowing from would-be mortgage lenders who were eager to lend. I disagree. I think that our current labor-market depression was baked in the cake when we started electing leaders who put other political and policy objectives far in advance of maintaining full employment.

Economist Dean Baker's formulation of what I call the household-balance-sheet-recession argument goes roughly as follows: The housing boom created some $8 trillion of fictitious housing wealth — wealth that people thought they had because they believed they would be able to sell their homes at inflated prices. When housing prices collapsed, home owners realized that they were a lot poorer than they had thought. They cut back their spending on consumer goods by $1 trillion a year, and that is the source of our current downturn and high unemployment. With no way to recreate the $8 trillion of fool's gold that was the housing bubble, there is no way to get American consumers spending again. So we were doomed to undergo this depression from the moment Greenspan failed to choke off the housing bubble.

But this argument seems wrong to me. Consumers are not the only spenders in the economy. Businesses can spend as well to boost their productive capacity — although it would be hard to get businesses to spend much to expand their factories if they don't foresee the consumer spending to make those factories profitable. Exporters can lend money abroad to finance the purchase of U.S.-made goods and so pile up wealth in the form of money owed to us by foreigners. The government can borrow-and-spend, and if it spends wisely on human and physical infrastructure to boost our national wealth then it will have no problem repaying its debts in the future.

Yes, the collapse of the housing boom and the consequent $8 trillion reduction in household wealth does mean that consumer spending will be significantly below trend for quite a while to come. But when the consumer stops spending and sits down, the government and the exporter — and also the capacity-building business — can stand up: There is no chain of logical necessity leading from the collapse of the housing boom to a prolonged period of very high unemployment.

U.S. households want to save? Then let them save. And let businesses invest in productive capital, let the government invest in infrastructure, and let exporters invest in wealth claims abroad. The re-attainment and maintenance of full-employment, an a commensurate level of aggregate demand, should not be a problem as long as the federal government is willing to spend enough on building infrastructure and human capital, as long as the Federal Reserve can promise markets that it will keep real interest rates low enough for long enough to make building business capacity a no-lose bet, and as long as the Treasury is willing to let the value of the dollar fall far enough that America's exporters can offer foreigners attractive deals on the goods and services we make.

Of course, if boosts to economy-wide spending led to inflation instead of increases in capacity utilization, then we would have a very big problem; we would be in the alternative universe of the Hayekians in which we have a fundamental mismatch between the skills of our labor force and the goods wanted by consumers. But there are no signs that we are in that alternative universe — no signs at all.

What, then, is our immediate problem?

It is political.

The Federal Reserve would rather let unemployment remain above 8 percent for a good long while than run the slightest risk of higher inflation. The Treasury would rather let unemployment remain above 8 percent for a good long while than say that a strong dollar is not in America's interest (even though it is not). The Republican decision-makers in Congress would rather let unemployment remain above 8 percent for a good long while than let Obama win legislative victories.

Most puzzling, the Obama administration would rather let unemployment remain above 8 percent for a good long while than make what it thinks is likely to be an unsuccessful push that will reveal its lack of control over the government. Perhaps they are right that they have pushed the envelope as far as they can go with respect to Congressional action (although not as far as they could have with quantitative easing, loan guarantees or mortgage restructuring via the Treasury). But until you push, you do not really know. And back in the late 1940s Harry Truman welcomed the opportunity to run against the Republican Congress — to say that these were the policies he advocated, and he was sorry that the do-nothing Congress would not pass them. The Obama administration seems to feel differently: as if they dare not strip off the mask of competence and control to show the conflicted face beneath.

The current jockeying on competing budgets is yet additional proof of our political dysfunction. Our urgent problem right now is 9 percent unemployment. We need investment to speed productivity and income growth — and we need it soon. In the long run, we need to control health care program costs.

A game of budget chicken does not bring us closer to achieving these goals.

20110222 Lecture: Liquidity-Money

Robert Murphy Joins the "Reasonable People Differ About Whether It Would Be Moral to Tax Americans to Destroy an Asteroid" "It's Immoral to Tax Americans to Destroy an Asteroid" Caucus

UPDATE: I appear to have mischaracterized Murphy. He goes the whole Volokh: it is, he says, simply immoral to tax people to fund the construction of the giant asteroid-killing lasers we need.

Wow.

No, Bob, reasonable people do not think that it is immoral to tax people in order to blow up an asteroid that is about to annihilate the human race.

And reasonable people do not think that reasonable people can think that it is immoral to tax people in order to blow up an asteroid that is about to annihilate the human race.

They just don't.

Murphy:

Empirical Evidence That Brad DeLong Is Completely Obtuse - Robert P. Murphy - Mises Daily: Volokh's position... is an entirely reasonable view, and it is surprising to me that DeLong doesn't even understand it.... [T]here is a general moral prohibition against violating another person's rights.... Volokh's... point should be obvious: Just because an asteroid threatens to destroy all human life, that alone is not sufficient to justify violating people's rights. It is not morally acceptable to engage in theft, if doing so would merely prevent people's deaths from natural causes (i.e., the asteroid strike).... [DeLong] is aghast that someone actually takes seriously the fact that people have rights. The reason DeLong finds Volokh's views "insane" is that Volokh has elevated his precious political principles to such a height that they trump the survival of the human race. What an ideologue!

Yet if we go and read Volokh's actual post.... This example of the killer asteroid was indeed designed to test libertarian rights theory. Volokh knows full well the implications of his stance, but he is reporting that he cannot conclude that it is moral to steal from people in order to prevent natural deaths...

Just wow.

As I already said:

We economists do not like lexicographic preference offerings precisely because they lead to catastrophe--to results that nobody can with a straight face say are good or moral. Or, at least, we think that those who do say such are either bullshitting us or are unbalanced in mind.

And they are unbalanced in mind--the fact that philosophers and lawyers claim to believe in lexicographic preference offerings is a sign that (a) their minds were unbalanced to begin with or (b) their professional training has unbalanced their minds.

And they are unbalanced: the sabbath was made for humanity; humanity was not made for the sabbath.

Robert Murphy Joins the "Reasonable People Differ About Whether It Would Be Moral to Tax Americans to Destroy an Asteroid" Caucus

Wow.

No, Bob, reasonable people do not think that it is immoral to tax people in order to blow up an asteroid that is about to annihilate the human race.

And reasonable people do not think that reasonable people can think that it is immoral to tax people in order to blow up an asteroid that is about to annihilate the human race.

They just don't.

Murphy:

Empirical Evidence That Brad DeLong Is Completely Obtuse - Robert P. Murphy - Mises Daily: Volokh's position... is an entirely reasonable view, and it is surprising to me that DeLong doesn't even understand it.... [T]here is a general moral prohibition against violating another person's rights.... Volokh's... point should be obvious: Just because an asteroid threatens to destroy all human life, that alone is not sufficient to justify violating people's rights. It is not morally acceptable to engage in theft, if doing so would merely prevent people's deaths from natural causes (i.e., the asteroid strike).... [DeLong] is aghast that someone actually takes seriously the fact that people have rights. The reason DeLong finds Volokh's views "insane" is that Volokh has elevated his precious political principles to such a height that they trump the survival of the human race. What an ideologue!

Yet if we go and read Volokh's actual post.... This example of the killer asteroid was indeed designed to test libertarian rights theory. Volokh knows full well the implications of his stance, but he is reporting that he cannot conclude that it is moral to steal from people in order to prevent natural deaths...

Just wow.

As I already said:

We economists do not like lexicographic preference offerings precisely because they lead to catastrophe--to results that nobody can with a straight face say are good or moral. Or, at least, we think that those who do say such are either bullshitting us or are unbalanced in mind.

And they are unbalanced in mind--the fact that philosophers and lawyers claim to believe in lexicographic preference offerings is a sign that (a) their minds were unbalanced to begin with or (b) their professional training has unbalanced their minds.

And they are unbalanced: the sabbath was made for humanity; humanity was not made for the sabbath.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers