J. Bradford DeLong's Blog, page 2083

February 24, 2011

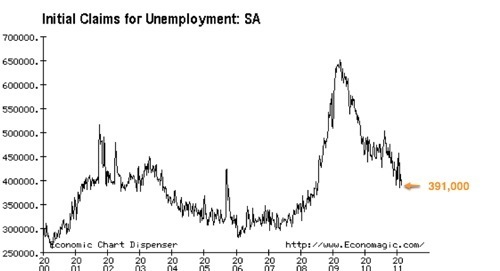

The Labor Market: No Longer Just Getting Worse More Slowly...

Carl Shapiro and Katherine Abraham to Obama's Council of Economic Advisers

Excellent choices:

Obama to Nominate Justice's Carl Shapiro to Council of Economic Advisers: President Barack Obama will nominate Carl Shapiro, the deputy assistant attorney general for economics at the antitrust division of the Justice Department, to his Council of Economic Advisers, White House press secretary Jay Carney said. Shapiro, who is also an economics professor at the University of California at Berkeley, will replace Cecilia Rouse, who is leaving the panel at the end of next month. Obama previously nominated University of Maryland Professor Katharine Abraham to the vacancy on the panel created when [Christina Romer returned to Berkeley.]

Carl Shapiro to and Katherine Abraham to Obama's Council of Economic Advisers

Excellent choices:

Obama to Nominate Justice's Carl Shapiro to Council of Economic Advisers: President Barack Obama will nominate Carl Shapiro, the deputy assistant attorney general for economics at the antitrust division of the Justice Department, to his Council of Economic Advisers, White House press secretary Jay Carney said. Shapiro, who is also an economics professor at the University of California at Berkeley, will replace Cecilia Rouse, who is leaving the panel at the end of next month. Obama previously nominated University of Maryland Professor Katharine Abraham to the vacancy on the panel created when [Christina Romer returned to Berkeley.]

Liveblogging World War II: February 24, 1941

Jeffrey Frankel: Why Oh Why Can't We Have a Better Press Corps?

JF:

Democrats should not rise to the bait of “fiscal conservatives”: I never cease to be frustrated that the current public policy debate is described as a contest of ideas: fiscal conservatives versus liberals. It is not just Republicans or Tea Partiers who believe that they are fiscal conservatives, no doubt sincerely. Democrats and liberals seem to accept this characterization at face value, as does most of the media.

The problem is that a heavy majority of the supposed fiscally conservative congressmen, although passionate about cutting government spending in the abstract, are in truth no better able to find specific dollars of budget cuts that they can support or defend to their constituents than are the Democrats.... [I]f the Republicans were in full control, we would have larger budget deficits in the coming years than if the Obama crowd retained power. This is what happened in a big way when Presidents Reagan and GW Bush took office promising to cut the debt while also cutting taxes. Spending, deficits, and debt soared during their terms, relative to their respective Democratic predecessors. There is no reason to think anything has changed.

The first thing the Republicans did after their congressional victories in the November election was achieve their precious extension of the Bush tax cuts for the wealthy. This extension will raise the budget deficit by more than all the domestic spending cuts that all of the Congressional freshmen have identified put together.

Next they turned to their campaign to kill Obamacare.... [I]t is even more surprising that the conservatives can continue to get away with simultaneously tarring the reform as “death panels” while refusing to acknowledge that it will cut costs. Their plans for going back to our previous health care system include suspending their own rule that bills that would increase spending (as determined by the non-partisan Congressional Budget Office) must be paid for....

Yes, fiscal adjustment is necessary. I might even think that such cuts would be a price worth paying, if they were a proportionate component of a comprehensive plan to address the long-run fiscal situation. But they are nothing remotely like that. Rep. Paul Ryan’s supposedly tough long-term plan to cut spending doesn’t balance the budget until 50 years from now and runs up another $62 trillion in national debt in the meantime.... I would prefer to divert the narrative from the unenlightening and sterile debate of small versus big government, to the realities of arithmetic and history.

Ryan Avent: The Republican Party Deserves Political Annihilation

Ryan Avent:

Fiscal policy: Cutting recovery short | The Economist: REPUBLICANS are pushing to slash federal government spending in the present fiscal year. If they don't get their way, the government will shut down. And if they do get their way?

Spending cuts approved by House Republicans would act as a drag on the U.S. economy, according to a Wall Street analysis that put new pressure on the political debate in Washington. The report by the investment firm Goldman Sachs said the cuts would reduce the growth in gross domestic product by up to 2 percentage points this year, essentially cutting in half the nation's projected economic growth for 2011.

That's just one estimate, of course. It's also possible that the Fed would react to these deep cuts by pursuing a more expansionary monetary policy than they'd planned, but the British example suggests that rising commodity prices may make this balancing act difficult.

What really makes this so upsetting, and it's really, genuinely upsetting, is that these proposed cuts are basically useless. America doesn't face a short-term fiscal crisis; its debt is dirt cheap. America faces a long-term fiscal crisis due to projected increases in government health spending. So Republicans are cutting short-term discretionary spending to address a fiscal crisis that doesn't exist while ignoring the fiscal crisis that does exist. Their proposed cuts aren't emerging from any cost-benefit analysis; rather they seem designed to spare GOP interests at the expense of Democratic interests. And to do this, they're prepared to—potentially—cost the American economy 2 percentage points of growth.

It's really remarkable. It's remarkable how things have deteriorated in so short a time. Last year, the president's bipartisan deficit commission recommended deficit cuts that didn't focus on the short-term, and that did put defence and entitlements on the table. Now Republicans are declaring that they'll shut down the government unless all of their demands are met—demands with virtually no redeeming value. This is no way to govern. No way at all.

Clive Crook: The Republican Party Deserves Political Annihilation

It took Clive long enough to get to where the reality-based community has been for... quite a while. But welcome!

Clive Crook:

A daft way to tackle America’s debt: Tea Party true believers may be salivating at the prospect... [of s]hutting down the government.... They did it once before, during the Clinton administration, and were slammed: the shutdown rescued the Clinton presidency. To do it in 2011, with the economy laid low and financial markets still twitchy, would be the limit of irresponsibility. It would be betting the recovery to make a point. This time, political annihilation might follow, and the party would deserve it...

Republican Congress Seeks to Slow Economic Growth

James Politi and Stephanie Kirchgaessner:

FT.com / US / Economy & Fed - Goldman sees danger in US budget cuts: The Republican plan to slash government spending by $61bn in 2011 could reduce US economic growth by 1.5 to 2 percentage points in the second and third quarters of the year, a Goldman Sachs economist has warned... Alec Phillips, a forecaster based in Washington.... The Goldman analysis also points out that a potential compromise deal with $25bn in spending reductions this year – a more likely scenario – would lead to a smaller drag on growth of 1 percentage point in the second quarter.... Goldman, which is currently forecasting US gross domestic product growth of 4 per cent in the second and third quarters of 2011, also pegged the cost of a government shutdown to the US economy at $8bn in reduced spending per week, based on the experience of the federal closures of 1995 and 1996. A government shutdown in the world’s largest economy will occur if Congress and the White House do not agree on a budget measure by the end of next week. Tough rhetoric from Republicans and Democrats has engulfed Washington in recent days, as both sides are positioning themselves for the final round of negotiations and trying to avoid blame if a shutdown occurs...

February 23, 2011

The Best Book I Have Read So Far This Year Is:

Mark Thoma: How Long Will It Be Until the Fed Raises Interest Rates?

He peers into his crystal ball:

How Long Will It Be Until the Fed Raises Interest Rates? - CBS MoneyWatch.com: There’s another factor that increases uncertainty about the future of the economy, and hence argues for continued monetary accommodation. Oil prices are rising, and if they continue to do so that could put a substantial drag on the recovery.... For that reason, keeping the target interest rate at its present level for an extended period of time is warranted (and I agree that there is no indication at present that the Fed intends to change the federal funds rate “anytime soon”).... [I]n this case, rising prices are not a signal that monetary policy is too loose. The price increases are due to worries about oil supplies. Some people will try to argue for interest hikes based upon these price increases, but that would be the wrong response.

The other factor that could come into play is budget reduction. As we are seeing right now, state budgets are still in shambles largely from the effects of the recession, and there is considerable pressure to take action on the federal budget. Budget cuts at all levels of government — which will involve loss of jobs and cutbacks in spending — will reduce demand and slow the recovery.... The Fed should also maintain an accommodative stance to offset, as best they can, the effects of any premature fiscal contraction.

I agree with the forecasts given above, though I’m probably more worried than they are about a wave of hawkishness coming over the Fed at the slightest hint of positive data. But my best guess it that the Fed will keep the federal funds rate at its present level through the end of the year and perhaps a bit longer. I also believe this is the correct policy...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers