Tadas Talaikis's Blog, page 7

August 16, 2018

Goals of trading and investing

Photo by Voicu Oara from Pexels

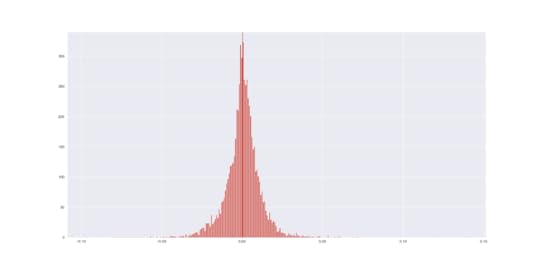

Photo by Voicu Oara from PexelsAs we can see from the following distribution of SPY (S&P500 index ETF) daily returns, they are basically random, having pretty equal left (negative returns) and right (positive returns) sides with little average upside.

from numpy import sortdf['ret'] = df['SPY_Close'].pct_change()df = df.dropna()

_sorted = sort(df['ret'].values)

plt.hist(_sorted, bins=300)

plt.axvline(df['ret'].mean())

plt.show()

As such, goals of trading and investing is to:

Minimize the left tail (...Two basic types of quantitative strategies

Photo by Voicu Oara from Pexels

Photo by Voicu Oara from PexelsToday’s finance world is very creative and complex. There is no shortage of ideas what or how to trade. However, we can classify all quantitative trading strategies into two basic categories:

Mean reversion strategies.Momentum (“trend following”) strategies.Mean reversion refers to data (prices, in our case) going back to the longer term mean. They usually have high smaller wins rate. Examples of such strategies are statistical, information arbitrage, pair tradin...

August 15, 2018

Key components of a quantitative trading strategy

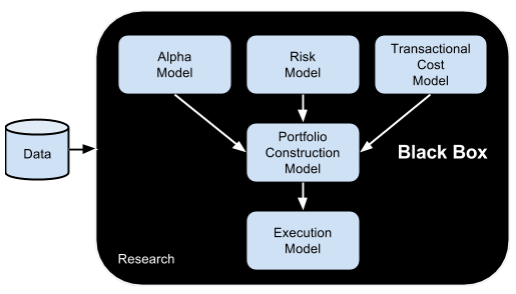

Probably the simplest ever structure of quantitative trading strategy was proposed in a book “Inside the Black Box: A Simple Guide to Quantitative and High Frequency Trading” by Rishi K. Narang:

So, according to this model, basically each strategy consists of the following components:

Alpha model.Alpha model consists of some sort of rules or predictive factors that derive the active value of the strategy.

Risk (constraints) model.Risk model has some sort of constraints, for example, how much we...

August 13, 2018

The law of large numbers in trading and investing for non-statisticians

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. [Wikipedia]

This law in trading and investing can be applied two ways:

To derive the true (expected) value from some tested event, we should gather as much event and its outcome(s) samples...August 12, 2018

How pro-cyclicality kills crypto

Procyclicality refers to a positive correlation between the value or price of a good, a service or an economic indicator and the overall state of the economy or the sentiment of the crowds.

In other words, the value of the good, service or indicator tends to move in the same direction as the economy, growing when the economy grows and declining when the economy declines. [Investopedia]

Human nature is pro-cyclical. For example, we tend to buy when we feel good about something and, vice versa, w...

August 3, 2018

How to have your own ICO (along with the dApp) in 5 minutes

One day I was thinking, why we should program everything from scratch for every project, if most of the functions are repetitive and can be easily wrapped into higher order management logic and as such — universalized.

The main idea is to question widely held beliefs how it should be done. Why instead we can’t manage our contracts much much easier, via simple web interface, without any programming, logins, administrative validations, and basically any other old-world stuff, when all we need is...