Tadas Talaikis's Blog, page 6

September 10, 2018

This is pretty insecure, full implementation would require a lot more of coding.

This is pretty insecure, full implementation would require a lot more of coding.

September 6, 2018

What is quantitative trading and other questions

Photo by Manuel Geissinger from Pexels

Photo by Manuel Geissinger from PexelsQuantitative trading is basically a trading based on data and data models as opposed to biased and random opinions based trading. Data can also be biased, of course, but applying the law of large numbers and proper processes, biases are usually minimized, and consequentially we can arrive at more truthful answers than having only an opinion.

For example, if programmed system says that situation sin’t good, we would buy less of the stocks if ever, and vice...

August 28, 2018

200+ years of economic idiocy or how to get rid of inflation and recessions

Guess what, after reading numerous books about economics I understood that majority of economist know nothing, usually represented by their scientifically unfounded, even religious ideologically biased theories that probably they can’t understand themselves.

But recently I had found very interesting project, which describes the elementary economy with just a few axioms. See more, if interested, in my references below.

I would talk here about just one idea from them— how to eradicate inflation a...

August 27, 2018

Fooled by games of different scales

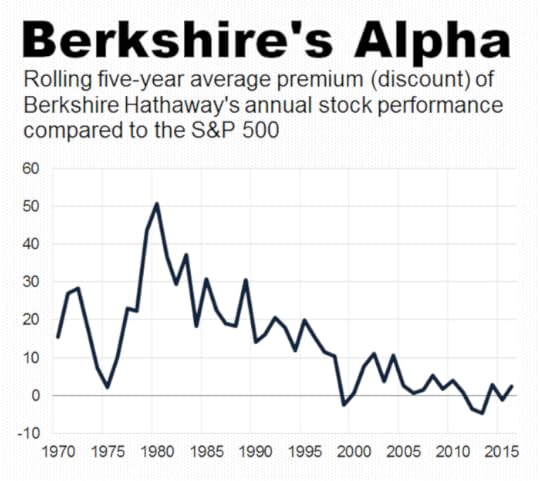

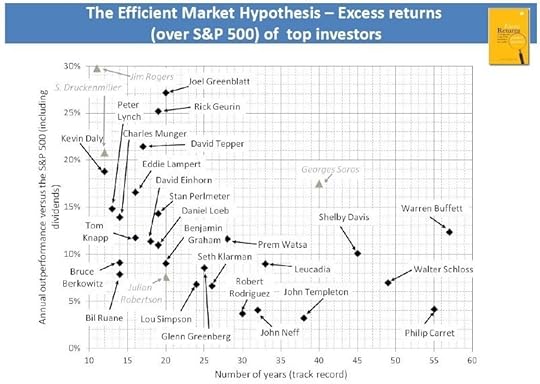

Everyone loves citing Warren Buffett (me too). He, of course, has a lot to offer for business life, but his fund doesn’t have alpha anymore:

Then how Berkshire makes excess over S&P500 for 50+ years?

Because of compound interest. No wonder that biography of Buffett is called “The snowball” (The Snowball: Warren Buffett and the Business of Life, by Alice Schroeder, recommend it), because compound interest (or time based returns) is working like snowball.

“Imagine that you make 20% per...

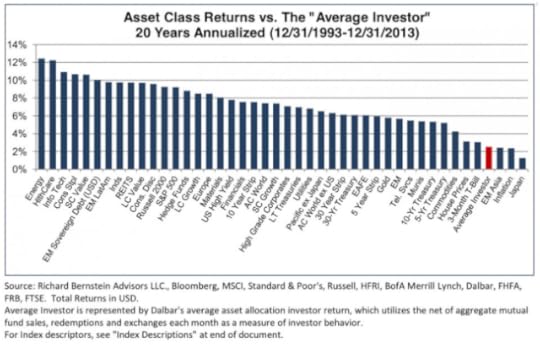

Why the average investor underperforms almost every asset class

The average investor underperformed nearly every asset class, including even government bonds:

Source

SourceThe reason is emotional (inconsistent) behavior of average investor:

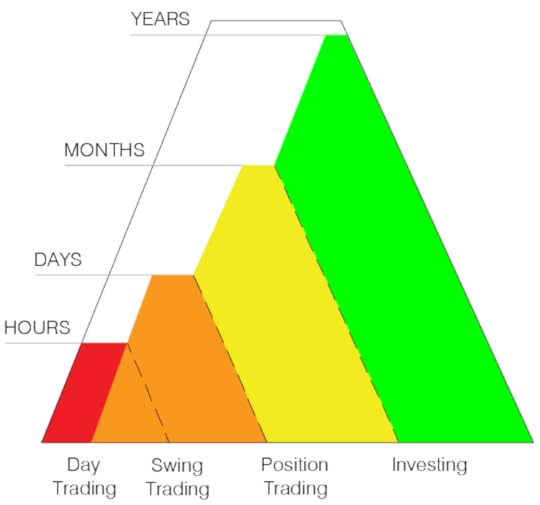

expecting to find high returns with low risk, when returns, actually, depend on risk taken,copying the behavior of others (“herding”),treating errors of commission more seriously than errors with omission,tendency to react to news without quantitative examination,belief that good things happen to me, and bad things happen to ot...The difference between trading and investing

There is no difference besides time horizon, because today’s trading or investment strategies are diverse and complex, involving numerous asset classes and approaches:

Traders and investors though are forced to choose higher time horizon with increasing capital due to liquidity and market impact issues.

https://medium.com/media/c8c1c8199799713d5e4aa62dd7484dd0/href

The difference between trading and investing was originally published in BlueBloodLtd on Medium, where people are continuing the con...

August 23, 2018

Fooled by adjusted prices

For years I am amazed how many people, even quants and academia, use adjusted prices for their strategies signals generation.

Problem with using adjusted prices for signals is that we cannot experience adjusted prices in the reality and that dividends, when added to the adjusted share price create drifts, which create skewed strategy results.

Let’s try a simple example. We’ll take a few dividend paying ETFs (SPY and TLT) and will test simple strategy on adjusted and on non-adjusted data:

from nu...August 22, 2018

Why rentier capitalism is harmful

Source

SourceWealth will accumulate around rentiers at an increased rate, and wealth inequality will become a potential catalyst of social instability. — Wu Xiaobo

The term is Marxist’s, describing the social class that seeks rent and gives nothing back to society. Origins of it are unknown, Karl Marx never used that combination of words.

One of examples of the rentier may be pharmacy industry. Companies ”regularly unwell new drugs, yet most real medical breakthroughs are made quietly at government-su...

How to redistribute wealth back to bottom 90%

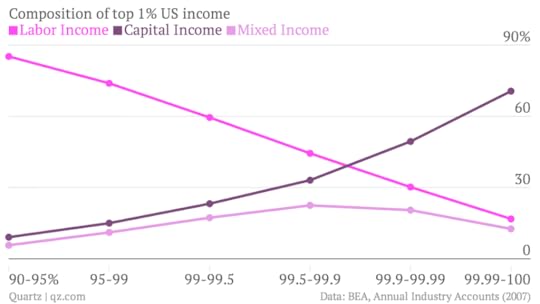

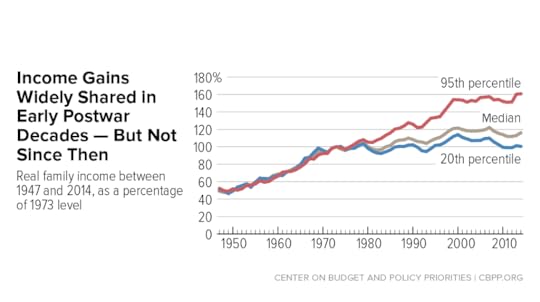

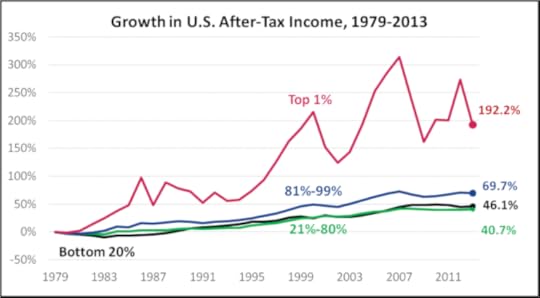

Inequality is increasing:

Source

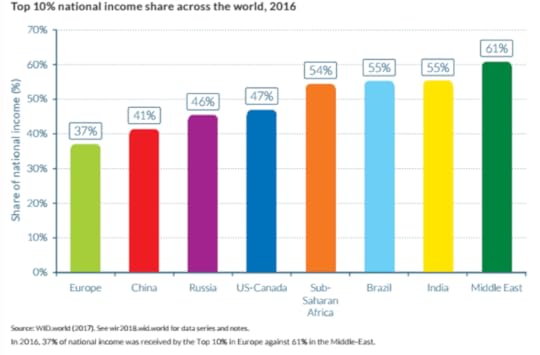

SourceTop 10% have majority of the global wealth:

Source

SourceAnd all of this even with tax for the rich increasing much faster than for the bottom 20%:

Source

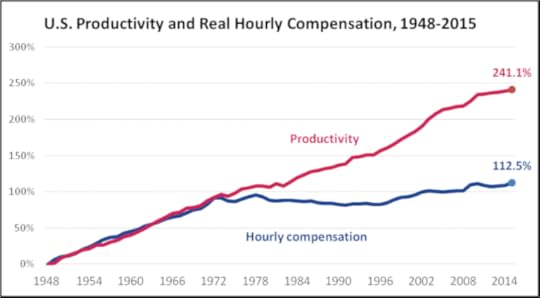

SourceProductivity is also increasing, but not compensation for it:

…meaning that technology and automation is replacing people, along with that of bigger part of income from new technologies is going to wealthy owners.

Micro problem“We have met the enemy, and he is us.” — Walt Kelly

The micro-scale difference betwe...

August 18, 2018

The law of large numbers, part II: Estimating expected values with Monte Carlo analysis

Photo by Daniel Frank from Pexels

Photo by Daniel Frank from PexelsLittle rephrasing from the first part about this important theorem:

The average of a sequence of random variables from the same distribution converges to the expected value of that distribution. — “Bayesian Methods for Hackers: Probabilistic Programming and Bayesian Inference” by Cameron Davidson-Pilon

In human language, as I had said in the first part, it means, that in short term we can experience wild swings of lucky or unlucky events, but on the longer term,...