Russell Roberts's Blog, page 131

June 20, 2022

Quotation of the Day…

… is from page 11 of Edwin Cannan’s superb November 13th, 1931, Sidney Ball Lecture – a lecture titled “Balance of Trade Delusions“:

So firmly rooted was the belief that it was better to give to the foreigner than to receive from him that even ardent free traders would defend imports not on the ground that it is a happy thing to receive goods and services and the less you pay for them the better, but because, as they put it, “if you don’t import you won’t be able to export!” As if to send out goods and services and get back as little as possible was the ideal.

DBx: Brilliant!

Cannan (1861-1935), who taught at the London School of Economics, was one of the early 20th century’s greatest expositors of basic economic reasoning. In the speech from which this quotation is drawn, Cannan intellectually destroys the notion that a nation that runs a so-called ‘negative’ balance of trade – that is, a trade deficit – is necessarily (as most protectionists still in ignorance insist today) “losing” at trade.

I thank my GMU Econ colleague Dan Klein for alerting me to this lecture by Cannan.

June 19, 2022

Some Links

Chris Freiman is correct: “Socialism doesn’t liberate workers from domination.”

James Harrigan celebrates Juneteenth.

Juliette Sellgren talks with Walter Olson about election fraud.

As the supply chain fell into disarray, the market adjusted and prices increased, including shipping prices. These price increases were the result of simple economics, not price gouging by greedy shipping companies. Ocean carriers raised prices in response to high demand for goods with a limited supply of shipping as ships and containers were stuck in congested ports. Ocean carriers increased prices in an attempt to temper demand for shipping. As evidence that prices rose because of supply and demand, not greed, consider that shipping prices have recently fallen as supply chain woes have started to abate: Spot rates for 20-foot containers from Asia to the United States dropped almost 33 percent since peaking in September 2021.

Here’s wisdom and insight from the always-wise and always-insightful Bruce Yandle.

Pierre Lemieux isn’t surprised by Biden’s economic myopia.

Liz Wolfe reports on more absurdity from the CDC.

Covid is not a leading cause of death in children.

Bonus Quotation of the Day…

… is from page 230 of Robert Higgs’s September 1986 Freeman essay, “To Deal With A Crisis: Governmental Program or Free Market?” as this essay is reprinted and slightly revised in the superb 2004 collection of some of Bob’s essays, Against Leviathan (original emphasis):

Emergency government programs, then, offer exceptional opportunities for those who would substitute their own values for those ordinarily guiding the allocation of resources in the market. When the cry of “Emergency!” goes up, the public’s resistance to government takeovers comes down. Hence, aspiring redistributors of income, collectivist planners, and do-gooders at other people’s expense rush in to exploit the unusual opportunity for replacing market processes with government controls. Whatever one may think about the immediate desirability of an emergency government program, however, one must recognize that the program is almost certainly only a beginning; and what follows in its train may be far less desirable.

Quotation of the Day…

… is from pages 502-503 of the late Wesleyan University economic historian Stanley Lebergott’s great 1984 book, The Americans: An Economic Record (footnotes deleted; link added; brackets and ellipses original to Lebergott):

The “progressive deterioration in the value of money through history is not an accident, and has behind it two great driving forces,” wrote Keynes in 1924. One was the “superior political influence of the debtor class.” That force has been only mildly effective in the United States. Connecticut and Massachusetts experimented by printing paper money in the 1740s and Rhode Island by printing it in the 1790s. These represented the high point of debtor influence. Populism’s failure in the 1890s, and the limited “reflation” of the 1930s, showed that such forces have been weak in the United States.

The second force, said Keynes, was “the impecuniosity of governments.” What is “raised by printing notes [i.e., money] is just as much taken from the public as is a beer duty or an income-tax…. In some countries it seems plausible to please and content the public by giving them, in return for the taxes they pay, finely engraved acknowledgements on water-marked paper.” Inflation as a “potent instrument of government extraction” surfaced in 1968-69 when the federal government rapidly increased expenditure for both a war in Vietnam and a “war on poverty” at home. Over the next decade the voters revealed their desire for ever more programs of expenditure, welfare and/or defense, and an almost equal desire to pay no increased taxes for such programs. Inflation proved a way to reconcile these conflicting desires.

DBx: History will tell if, in the 21st century, debtors in America remained as politically neutered as they were in earlier centuries.

June 18, 2022

The Deficit of Economic Understanding Is, Unfortunately, De Maximus

Here’s a letter to the Wall Street Journal:

Editor:

Josh Zumbrun reports as newsworthy Jeff Ferry’s warning that America’s trade deficit with China is undercounted because of the exclusion from trade statistics of the value of de minimis imports (“The Tiny Loophole That Understates the Trade Deficit With China,” June 17). These imports are consumer goods brought by travelers into the U.S. in bundles worth less than $800.

Yet rather than suggest that the protectionist Mr. Ferry is justified in raising concerns over the fact that America’s trade deficit with China is larger than is officially reported, Mr. Zumbrun should instead report this fact: In our world of more than two countries, any talk of one country’s trade deficit or surplus with any other individual country is utterly and indisputably nonsensical. When the number of participants in a market is larger than two, there’s simply no reason to expect any pair of participants to sell to each other the same amounts as they buy from each other.

Because you, the Wall Street Journal, buy more (namely, his labor) from Josh Zumbrun than Mr. Zumbrun buys from you, you run what Mr. Ferry would call a trade deficit with Mr. Zumbrum. Yet clearly this fact implies nothing amiss. And so just as there’s no reason to worry that Mr. Zumbrun doesn’t buy from you the same dollar amounts as you buy from him, there’s no reason to worry that the Chinese don’t buy from us Americans the same dollar amounts as we buy from them.

Sincerely,

Donald J. Boudreaux

Professor of Economics

and

Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center

George Mason University

Fairfax, VA 22030

Let It Be Known that Today Is Paul McCartney’s 80th Birthday

Perhaps this post is written for no one but me….

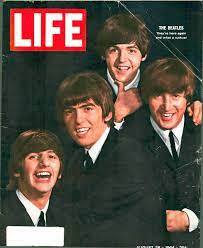

My earliest clear memory the length of which is greater than that of a jpeg shared on Facebook is the assassination of JFK. I’d turned five just two months earlier. My next such memory, from just weeks later, is of the news made by the Beatles’ arrival on the international music scene. My grandmother and great aunt showed me a cover of Life magazine featuring a color photo of these strange men with long hair. I can’t today say why – I couldn’t then say why – but as a young child I got caught up in the hype, the “Beatlemania.” This new music, and the band playing it, were revolutionary, and very exciting.

My earliest clear memory the length of which is greater than that of a jpeg shared on Facebook is the assassination of JFK. I’d turned five just two months earlier. My next such memory, from just weeks later, is of the news made by the Beatles’ arrival on the international music scene. My grandmother and great aunt showed me a cover of Life magazine featuring a color photo of these strange men with long hair. I can’t today say why – I couldn’t then say why – but as a young child I got caught up in the hype, the “Beatlemania.” This new music, and the band playing it, were revolutionary, and very exciting.

I remember well sitting on my maternal grandmother’s lap, at my grandparents’ home at 1337 Elysian Fields Avenue in New Orleans, watching on television – black-and-white, of course – the Beatles’ first appearance on the Ed Sullivan Show in February 1964. (Sunday, February 9th, 1964, to be exact.) I remember someone giving me, as a gift, the album “Meet the Beatles!” and me wanting to hear it played over and over again. I’ve been a fan ever since. (I also remember wondering, whenever I looked at the album cover, if there was something wrong with Ringo’s neck – a tumor, perhaps? – that my young eyes didn’t realize was simply a consequence of the way the photograph was posed and shot.)

(Many memories are flawed, especially long-ago ones and more so if they’re from early childhood. In my memory, I saw the cover of Life before watching the Beatles on Ed Sullivan, but that can’t have been the case because that issue of Life didn’t appear until August 1964.)

Anyway, today is Paul McCartney’s 80th birthday. Happy Birthday, Sir. You’ve given the world much happiness. Pasted below the fold is what I wrote here at Cafe Hayek 16 years ago, when McCartney turned the age that I will turn in three months: 64.

Quotation of the Day…

… is the closing paragraph of Robert Higgs’s excellent September 2006 essay “When the Government Took Over U.S. Investment” (footnote deleted):

In sum, most contemporaries greatly exaggerated the heroic achievements of the wartime socialization of investment, as have subsequent historians and economists. In large part, they simply failed to appreciate how much of the “capital” took strictly military forms. Even the industrial investments, however, proved largely ill-suited for making a valuable contribution to postwar civilian production: they were too concentrated in the wrong industries and in the wrong locations for postwar purposes. The wartime socialization of investment served a definite purpose in helping the U.S. military-industrial complex to triumph over the nation’s enemies in World War II, but beyond that, its achievements had little, if anything, to recommend them.

[image error]

[image error]

[image error]

[image error]

[image error]

[image error]

June 17, 2022

Yet Another Genius Proposal from Sen. Warren

Here’s a letter to the Wall Street Journal:

Editor:

You report that “high U.S. fuel exports are contributing to $5-a-gallon gas” (June 16). Despite Sen. Elizabeth Warren (D-MA) agreeing with you, both you and she are mistaken to imply that freedom to export keeps prices unnecessarily high in the home market.

The greater are energy producers’ abilities to export, the larger are their markets for domestically produced energy and, thus, the greater are their incentives to invest in domestic exploration, drilling, and refining. While forcibly curtailing fuel exports, as Sen. Warren proposes, might decrease the prices that we Americans pay for gasoline today, the resulting reduced investment in domestic fuel production will ensure that we pay inordinately higher prices in the future.

Sincerely,

Donald J. Boudreaux

Professor of Economics

and

Martha and Nelson Getchell Chair for the Study of Free Market Capitalism at the Mercatus Center

George Mason University

Fairfax, VA 22030

…..

Among the many myths about markets is they are myopic while government takes an appropriate long-run perspective. The truth – as evidenced by Sen. Warren’s destructive proposal – is the polar opposite.

Pittsburgh Tribune-Review: “The middle class, then & now”

In my column for the December 25th, 2012, edition of the Pittsburgh Tribune-Review I wrote again about the myth of the economic stagnation of America’s middle class. You can read my column in full beneath the fold.

Some Links

Plastics and many other materials are made from petroleum. High oil prices raise costs of production and prices for everything from laptop computers to Patagonia vests to, perhaps of greatest current importance, fertilizers. High fertilizer prices, of course, raise food prices.

The consequences resulting from Biden’s restriction of U.S. natural gas production may be even worse. The price of natural gas price has tripled, from about $3 per million British thermal units in June 2021 to about $9 by May 2022. This has raised not only utility bills but also prices of goods manufactured by gas powered plants.

But higher prices may not be the worst of it. The longer-term climate campaign against natural gas use has resulted in utilities having less power-generating capacity. This, the Wall Street Journal recently reported, has led electric-grid operators to warn “that power-generating capacity is struggling to keep up with demand, a gap that could lead to rolling blackouts during heat waves or other peak periods as soon as this year.”

On the other hand, a longer-term view from the most recent U.S. National Climate Assessment report finds that while the frequency of heat waves has been increasing since the 1960s, they were more common and fiercer during the first third of the 20th century.

“It is true that if analysis of data begins in the 1960s, then an increase in heat waves can be shown. However, if the data analyses begins before the 1930s then there is no upwards trend, and a case can even be made for a decline. It is a fertile field for cherry pickers,” observes University of Colorado climate policy researcher Roger Pielke Jr. over at his invaluable Honest Broker Substack. Pielke does note that ongoing man-made climate change will tend to make future heat waves more frequent and last longer.

The falling trends in U.S. heat mortality are associated with increased air conditioning, less work outdoors, and better weather warning systems.

Writing in the Wall Street Journal, Todd Henderson explains how a proposed change in the operation of futures markets is likely to be beneficial – and why this change is opposed by some players. Here’s his conclusion:

If the FTX model proves more efficient, and is eventually cleared for use in agricultural products, these farmers, with the help of intermediaries if they want, are well-equipped to navigate any change to the incumbent exchanges outmoded way of doing things. The incumbent exchanges (the bootleggers) clearly benefit from maintaining the status quo, but their self-interest won’t sell on Capitol Hill or the CFTC. Instead, they cloak private gains in public terms, hoping the Agriculture Committee and farming advocates (the Baptists) play along.

Ethan Yang and Dorothy Chan explore Chinese antitrust policy.

Connor Harris reviews some of the foul and costly consequences of rent control. A slice:

In 2000, New York Times columnist Paul Krugman commented on a story about apartment seekers in San Francisco who spent months making apartment searches a full-time job, dressing up in suits and ties and bringing resumes to open houses where landlords expected them to act enthusiastic. As Krugman pointed out, “Landlords don’t want groveling—they would rather have money. In uncontrolled markets the question of who gets an apartment is settled quickly by the question of who is able and willing to pay the most.” Sure enough, San Francisco was not an uncontrolled market, but rather one where “a technology-fueled housing boom has collided with a draconian rent-control law.” In rent-controlled markets, landlords can repel most prospective tenants by making absurd demands—or by being prejudiced—and still have plenty of prospects willing to pay the maximum legal rent.

Economists almost all agree on the evils of rent control. It discourages housing maintenance, spurs black markets, reduces supply and increases prices on the open market, and removes the incentive for people who don’t need to live near job centers, such as retirees, to move and make way for active workers who need the economic opportunity more. My old professor Edward Glaeser likes telling the story of a corporate executive, who, when asked whether it was unfair that he paid so little for a rent-controlled apartment in Manhattan, said that it was perfectly fair because he almost never lived there. Without rent control, he might have decided that keeping a desirable apartment empty wasn’t a good use of his money.

Scott Morefield points to more evidence against the efficacy of mask mandates. A slice:

Remember that CDC study purporting to show that school masking was effective? Did you wonder what the results would have been if someone had conducted a higher quality study over a greater sample size and period of time? Ambarish Chandra of University of Toronto and Dr. Tracy Hoeg of University of California, Davis did exactly that with this Lancet study titled, “Revisiting Pediatric COVID-19 Cases in Counties With and Without School Mask Requirements—United States, July 1—October 20 2021.” Their results: “… no significant relationship between mask mandates and case rates.”

Johan Anderberg applauds Sweden for saving children from lockdowns. Two slices:

What no one at the time knew was that, behind the scenes, a retired epidemiologist had won his first battle. Seventy-year-old Johan Giesecke had been Sweden’s state epidemiologist between 1995 and 2005, and had a good relationship with Anders Tegnell, the man who now held the title. Decades earlier, Giesecke had hired Tegnell because he appreciated what appeared to be Tegnell’s complete indifference to what other people thought of him. Now, Giesecke referred to Tegnell as “his son”.

Both men, at the start of the pandemic, advocated for keeping schools open.

They did this for a number of reasons. Firstly, no one knew if school closures worked. On the one hand, there was some historic support for the policy: experiences from school holidays during influenza outbreaks in France, and the varying responses to the 1918 pandemic in the US, suggested that the number of cases could “maybe” be reduced by 15% by closures, in an optimistic scenario. But it also suggested that those gains would likely be lost if the children weren’t completely isolated when staying home from school.

…..

The Swedes monitored the course of events unfurling on the rest of the continent. The countries closing their schools and preschools were growing more and more numerous. Tegnell couldn’t understand what they were doing.

His confidantes at the agency agreed with his assessment: the rest of the world was rushing headlong into a dangerous experiment with unforeseen consequences. The head of analysis at the agency explained that Spanish school closures had pushed the virus from the cities to the coasts, as wealthy families fled to their holiday homes. And school closures would force many key workers, including doctors and nurses, to stay home from their jobs.

“The world has gone mad,” Tegnell wrote to two colleagues.

Here’s some good news out of Canada: (HT Jay Bhattacharya)

The House of Commons is suspending COVID-19 vaccine mandates for MPs, staff and visitors next week.

Proof of vaccination will no longer required to attend sessions, meetings starting June 20.

Russell Roberts's Blog

- Russell Roberts's profile

- 39 followers