Matthew Yglesias's Blog, page 2423

February 11, 2011

How China's Currency Will Float

David Barboza has an interesting piece in the NYT about tentative steps the Chinese government is taking to encourage international use of the Yuan and "erode the dollar's dominance" as the currency used for reserves and international settlements.

In some ways, I think this saga is a fascinating case study in agenda setting and issue construction. There are basically two parallel discourses happening on both sides of the Pacific. One is a discourse about exchange rates. In this discourse "force China to stop unfair currency manipulation" is a tough-minded nationalist thing to do while "give in to American pressure to revalue" is a puny policy. The other is a discourse about global reserve currencies. In this discourse "erode the dollar's dominance" is a tough-minded nationalist thing to do while, "let the Yuan play a bigger international role" is a puny policy. And yet these parallel discourses are about the same thing.

The measures that would be required for the Yuan to play a larger international role—the creation of large, deep, and liquid markets in RMB-denominated financial instruments—would necessarily require the People's Bank of China to stop manipulating the exchange rate. By the same token, were the People's Bank of China to let the exchange rate float as the US government is demanding, that would necessarily lead to a steady erosion of the dollar's dominance as China's economy continues to grow.

The Military Takeover

Hosni Mubarak stepping down definitely seems like progress, but "military takeover" and "democracy" aren't exactly the same thing. After all, Mubarak himself was a senior military officer before being brought into the "civilian" regime which, itself, had origins in the military coup.

Price Level Targeting

Here's Michael Woodford writing back in October about how the Fed should go beyond QE2 and embrace price level targeting to ensure maximum efficacy of monetary stimulus:

Please respect FT.com's ts&cs and copyright policy which allow you to: share links; copy content for personal use; & redistribute limited extracts. Email ftsales.support@ft.com to buy additional rights or use this link to reference the article – http://www.ft.com/cms/s/0/4d54e574-d5...

Instead, as suggested in a recent speech by William Dudley of the Federal Reserve Bank of New York, the Fed should commit to make up for current "inflation shortfalls" due to its inability to cut interest rates. If, for example, inflation was predicted to run half a percentage point below the Fed's target for the next two years, the Fed could announce plans to offset this by allowing an additional one per cent rise in prices after that. Once the shortfall has been made up, the Fed would return to its previous, lower target.

Critics will say this will undermine the Fed's credibility on price stability. They are wrong because the price increases allowed under this "catch-up" policy would be limited in advance. Catch-up inflation would simply put prices back on the path they would have followed had the Fed been able to cut interest rates earlier.

Woodford doesn't have a Nobel Prize, but he is author of a book "which has quickly become the standard reference for monetary theory and analysis among academic economists and their colleagues at central banks". Not bad. And by coincidence there's a seat opening up on the Federal Reserve Board of Governors.

Chamber Lobbyists Targeting Progressives

I wrote earlier this week about the tragicomic efforts of the law firm Hunton and Williams to solicit ideas from security contractors about how to take down Glenn Greenwald. Today, my colleagues have two pieces indicating that the very same law firm did similar work for the Chamber of Commerce. Specifically, they "solicited a set of private security firms — HB Gary Federal, Palantir, and Berico Technologies (collectively called Team Themis) — to develop a sabotage campaign against progressive groups and labor unions, including ThinkProgress, the labor coalition Change to Win, SEIU, US Chamber Watch, and StopTheChamber.com."

The sabotage concepts floated were multi-faceted, and included the idea of trying to deliberately leak misinformation in the hopes that Chamber critics would run with it and discredit themselves. But Aaron Barr, the HB Gary executive who spearheaded the initiative, also liked to circulate personal information about progressive staffers involved in Chamber-critical enterprises. My personal favorite is this email about Mike Gehrke, formerly of Change to Win, that thinks it's important to detail which "Jewish church" he and his family attend:

I assume Barr would tell you he's just doing his job. He has a duty to make as much money for HB Gary as possible, never mind the consequences. And folks at Hunton and Williams would tell you that they're just doing their job. They have a duty to serve the interests of the Chamber of Commerce as zealously as possible. And folks at the US Chamber would tell you that they're just doing their jobs. They have a duty to make US public policy as beneficial as possible to US Chamber of Commerce members, never mind the consequences. And executives at Chamber-member firms would tell you that they have a duty to maximize the profitability of their firms, never mind the consequences. So if you need to engage in a little public disinformation campaign or peer into people's "Jewish church" activities, so be it. After all, it's small potatoes compared to earning your daily bread by poisoning the environment.

But personally I'm old-fashioned and I think the concept of individual ethical responsibilities has traditionally served the country well.

The Biggest Arts Subsidy Of All

Jon Chait is government funding of the arts through mechanisms like the NEA, arguing that it's "not a clear cut case of market failure requiring government intervention, and the complications involved with either censoring or failing to censor offensive exhibits are hard to square."

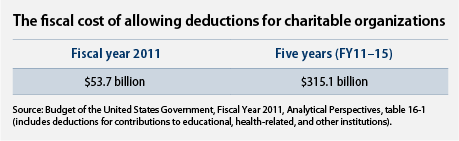

I don't know which way this cuts, but it's worth pointing out that for all the sporadic hubub over the NEA, by far the biggest federal subsidy to the arts comes in the form of the federal income tax deduction for charitable contributions:

This costs a ton of money, a lot of charitable donations go directly to the arts (museums, ballets, opera, etc.) and another large chunk goes to universities that, in turn, spend money on the arts. The huge advantage of subsidizing the arts this way is it lets you hide the ball. You never hear people getting mad over the fact that tax-exempt contributions are going to fund controversial or offensive art. It's a pretty good model, and yet nobody ever talks about it, in part because it works precisely through the mechanism of people not talking about it.

Paul Ryan's Limited Imagination

Everyone knows that Ron Paul has some crank notions about monetary economics, but Paul Ryan's own crankitude on this score is badly underrated. Will Wilkinson, for example, flags from Ryan's participation in a recent committee hearing with Ben Bernanke:

"Our currency should provide a reliable store of value—it should be guided by the rule of law, not the rule of men," Mr Ryan informed Mr Bernanke. "There is nothing more insidious that a country can do to its citizens than debase its currency."

This is reminiscent of VI Lenin's old time claim that "the best way to destroy the capitalist system is to debase the currency." That said, Lenin's takeover of the Russian government led to, among other things, the Povolzhye famine of 1921 which I'd say was considerably worse than inflation. And that's to say nothing of the worse famine of 1933 under Stalin. Closer to home, the Tuskegee syphilis experiment in which people were duped into not seeking antibiotic treatment for their illness strikes me as considerably more insidious than inflation.

February 10, 2011

Endgame

What are we gonna do now?

— Streetcars could do a lot for LA.

— Mitt Romney has re-written his book to make his views less reasonable.

— Cutting preventative health care is a bad idea.

— How Huffington Post really works.

For Hosni Mubarak, it's "Clampdown" by The Clash.

— The clean energy race with China is more "Biggest Loser" than "Survivor".

Modeling The Apocalypse

Dave Roberts has an interesting piece about the alarmism gap between climate scientists and climate economists, where economists take a much rosier view.

I think there are two main things going on here. One is that to an extent I think scientists (like people in general) tend to underestimate the robustness of human systems in the face of physical devastation. Someone standing amidst the wreckage of Japan in late 1945 would be hard-pressed to realize how bright the country's future would be. And by the same token, if you had a predictive model in 1845 that said it was likely that 100 years later all of Japan's major population centers would be rubble and its population starving to death you'd likely say you were predicting a doomsday scenario. And that's where I think the scientists sometimes go wrong. They predict a wasteland and fail to see that we could recovery.

The larger error is the economists' tendency to make the reverse error, seeing a steady upswing in economic growth and doing a "yadda yadda yadda" past the intervening devastation. If something happens that leads you to increase your estimate of total extinction of homo sapiens from 0.01% to 0.1%, that still leaves you with a model whose central tendency predicts steady growth. And yet that'd be a big deal. Meanwhile, if grandma dies of heatstroke that doesn't really hurt GDP. Grandma's not a productive citizen. She's retired. But you probably love her anyway. GDP doesn't care if Miami-area construction activity goes into building larger, nicer houses or bigger, better seawalls but people like large fancy houses. As far as global economic output is concerned, even hundreds of millions of dead subsistence farmers is no big deal. As long as it's generally possible for rich people to buy the "unlikely to lead to death" land, production will continue apace.

The irony of all this is that from the point of view of something an economist can model, a tax on carbon dioxide emissions would be extremely growth-friendly relative to other possible taxes.

The Specter of Inflation

From Annie Lowrey's excellent profile of Ron Paul's monetary economics:

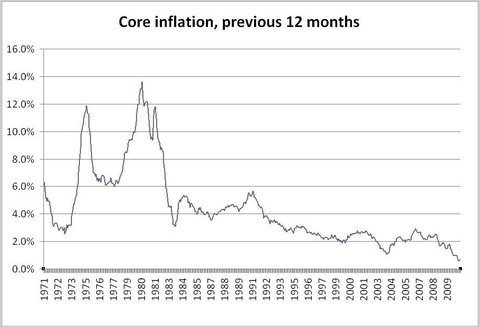

When I asked Paul about this, he maintained the Fed has set us up for a currency crisis down the road. "It won't be as bad as Zimbabwe," he says. "But perhaps something like 1979 or 1980." He noted that geopolitical events often kick of economic ones. "The revolutions in the Middle East, that could end up being the precipitating event," he said. "Tunisia, Egypt—they may well tumble."

From David Leonhardt:

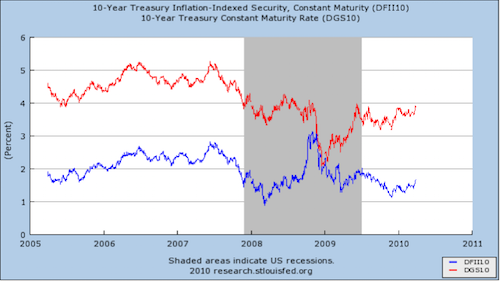

Even better than look at current core inflation, nowadays we can look at the TIPS spread and measure market expectations of inflation over the next ten years:

The market thinks Paul is really wrong. Lowrey quotes him complaining that the Fed "sticks it to the people who want to save and make money. It is so unfair." But there's nothing stopping Paul or any other inflation-averse savers from investing in inflation protected securities (TIPS) that pay a guaranteed interest rate over and above the inflation rate. Indeed, if Paul's right he and his followers will be able to make a killing in this market.

Let Airports Be Airports

I'm basically in agreement with Atrios on the question of intercity rail. One thing I do want to add to the conversation, however, is that better intercity rail connections could free up some valuable airport space.

The DC metro area, for example, is served by three airports. One of them, DCA, is much more centrally located than the other two but it's also smaller and because it's centrally located it can't really be expanded. That airport features six daily flights to Pittsburgh, 245 miles away. There are also four flights per day from Dulles, and three flights per day from BWI. Clearly, there's a lot of demand for going to Pittsburgh. Were there a high-quality DC-Pittsburg rail connection, many of these air trips would instead be done by train. And were that the case, then airport space—particularly the scarce space at DCA—would be reallocated to flights to destinations that really need a plane to get to. Portland or Los Angeles or Miami or what have you. This isn't number one on my list of American problems, but it really isn't ideal to have so much of our airport capacity sucked up by these relatively short trips. There are large classes of travel for which there's no good alternative to an airplane and in an ideal world the vast majority of flights would be on routes like that.

What's more, there's a decent chance that jet fuel is going to become prohibitively expensive at some point in the future and then we'll really be sorry if we're stuck relying on planes for 200-400 miles trips.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers