Matthew Yglesias's Blog, page 2355

April 14, 2011

Debating Paul Ryan's "Path To Prosperity"

Me and Reihan Salam:

Something underlining this debate that unfortunately didn't come to the surface is this. If you cut spending on Medicare, it matters what you do with that spending. Personally, I'm sympathetic to the Ryan/Salam view that Medicare is no great shakes. Cutting it to increase Social Security benefits (much of which might get plowed back into buying health care services, but then again might not), or to create high-quality universal preschool, or just to shower the poor with dollar bills sounds fine to me. But the "Path To Prosperity" wants to ax Medicare in order to shower the rich with tax cuts, which is a different question entirely.

April 13, 2011

Endgame

La vie est un long chemin:

— The Fed's huge profits.

— Barack Obama has "an aspiration to cut $400 billion by 2023, which is pretty much meaningless in a world of half-trillion annual defense budgets and wars that cost an additional $150-plus billion."

— Student loan debt is a growing business.

— Sarah Laskow smears Joey Potter.

— George W Bush in 2001: "At the end of those 10 years, we will have paid down all the debt that is available to retire."

My country is weirdly obsessed with hypothetical debt crises. But Yelle's "Mon Pays" makes me feel better.

Food Trucks And Clean Energy

I'm obsessed with the strides municipalities have made in facilitating the development of a food truck sector, and a great example of the utility of such a thing comes from this notice for the weekend's Power Shift conference:

Food Trucks

From Korean BBQ, to Cupcakes, to Pizza, to Vegan Delights, the DC Food truck community heard about Power Shift and will be out in full force around the Washington Convention Center. You can track their movements at www.FoodTruckFiesta.com, and look out for updates on the display screens about specific food truck locations and twitter updates.

Delicious! The Convention Center area is a few blocks away from the downtown core where there's high demand for lunch Monday through Friday. Consequently, the lunch options in the immediate vicinity are sometimes a bit scarce. But food trucks have the flexibility to be there on the weekend, and then go where weekend demand is highest during the week.

For a more substantive take on Power Shift, please read my colleague Brad Johnson.

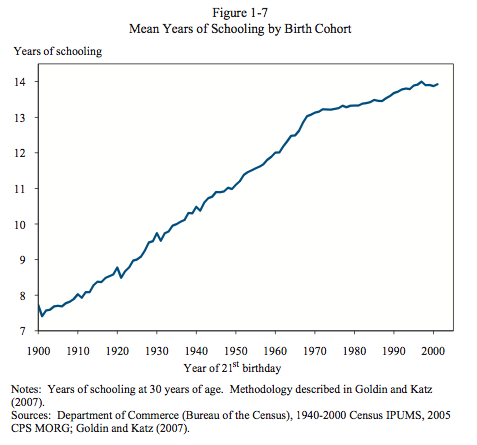

America's Human Capital Slowdown

A new Brink Lindsay paper "Frontier Economics: Why Entrepreneurial Capitalism Is Needed Now More Than Ever" (PDF) aims to persuade you that even though US growth has been slower in the neoliberal era than in the postwar era, and even though growth is faster in less-neoliberal developing countries than in more neoliberal developed ones, you should nonetheless not give up on neoliberalism. Rather, you should conclude that the richer you are the harder it is to obtain additional growth.

I find various elements of the argument fairly convincing, but to offer an observation in defense of the "big government" (i.e., high levels of spending on public services) fork of the neoliberal tree, it seems to me that it's a mistake to talk about this without talking about human capital stagnation:

There's an image of the United States out there as the land of free market capitalism. And certainly there's something to that. But it's also the case that throughout our history, America has traditionally been the best educated country in the world. That goes all the way back to New England's settlement by Bible-obsessed Puritans who through up schools everywhere so kids could learn to read the word of God. It continues through Justin Smith Morrill's Land Grant Colleges Act, through an emphasis on being an attractive destination for high-skill workers, through to the GI Bill, and public school desegregation in the twenty years after 1955. But we've really slowed down. Our fancy colleges are getting more expensive rather than getting bigger or better. The downscale for-profit college sector is dynamic and innovative, but it's basically a scam where barely anyone graduates. We're not investing in high-quality preschool, we're shutting the door on skilled migrants, and we're not investing in effective job training programs. On top of that, we've created housing policies that generally make it too expensive for low-income families to move to school districts whose public school perform well!

And yet while all this is happening, financial deregulation has sucked an increasingly large share of ambitious people with technical skills into the financial sector and out of more entrepreneurial realms of endeavor.

Mitt Romney Defends Ben Bernanke

It involves grading on a curve, yes, but it continues to be the case that for a man pandering to the Republican Party's conservative base, Mitt Romney is mighty sensible. Not only has he come out against birthers, he's staying reasonably reasonable on monetary policy:

Despite Kudlow's often combative questioning, Romney stuck relentlessly to his economy-and-job-creation message, refusing to criticize Ben Bernanke even as the Federal Reserve's monetary policy has become a frequent target on the right.

"I think Ben Bernanke is a student of monetary policy; he's doing as good a job as he thinks he can do," Romney said when Kudlow asked what kind of job Bernanke is doing. "I'm not going to spend my time going after Ben Bernanke. I'm not going to spend my time focusing on the Federal Reserve."

That's not my view, as you know, but it's head and shoulders better than Tim Pawlenty's crank monetary policy.

The "Do Nothing" Deficit Reduction Plan

Annie Lowrey writes about the fact that if we stick to the current law baseline the budget deficit goes away. Nobody has to do anything. Congress merely needs to refuse to do the things that make up the "current policy" baseline where we do doc fixed and extend tax cuts and add AMT patches.

I think that this is an important point not because doing nothing is optimal policy, but because it highlights the worthlessness of long-term deficit reduction plans. If the goal is to produce a projection that says the budget will be balanced in the medium term, then we've already achieved that—the current law baseline projection says the budget will be balances. If the goal is to produce a deficit reduction plan that's credible with the markets and allows us to maintain low interest rates and low inflation, then we've already achieved that—the status quo is low interest rates and low inflation. In other words, there's nothing that changing current law could possibly accomplish.

That's not to deny that we should worry about what the actual budget deficit is in 2014, 2016, 2026 and all the rest. But the deficit in future fiscal years will be determined by the actions of future members of congress. What makes deficits low is not "deficit reduction plans" but disposition of members of congress to refuse to vote for deficit-increasing legislation. Like Barack Obama said he wanted to sign a universal health insurance bill but only if it didn't increase the deficit. At the same time, he's happy to sign "doc fix" bills, tax cut extensions, etc. regardless of deficit impact. George W Bush, by contrast, was happy to sign all kinds of bills (tax cuts, K-12 education spending hikes, Medicare expansions, more generous Pell Grants) irrespective of their impact on the deficit. If more members of congress shifted from a Bush-like view to an Obama-like view, deficits would go down. And if more members shifted from an Obama-like view to a Lowrey-like view, deficits would go down. But either way, what it takes is members who won't vote to increase the deficit rather than members talking about deficit reduction plan.

Are Naked Credit Default Swaps A Case of Too Much Information?

Credit default swaps are an insurance-like derivative that pays off if someone defaults on their debt. But with conventional insurance, you're normally not allowed to buy unless you have an "insurable interest" in the thing being insured. I can buy fire insurance on my house, but not on my neighbor's house, in part out of fear that this would create a profit-making opportunity in the arson sector. Many people criticize CDS on this grounds, for reasons that don't strike me as particularly persuasive.

But in an interesting paper (PDF) published a year ago that I read last night, Gary Gorton looks at a different potential problem here. The idea of complete financial markets is that they're more efficient, and the idea of efficient financial markets is that they disclose information. Specifically, naked CDS mean that corporate debt prices now reflect specific information about the firm in question and not just general credit conditions:

Expressing a negative view was next to impossible because it is hard to find the bonds and short them for a longer period. Even expressing a positive view would usually require finding off‐the‐run bonds to buy, not easy in size. But, more importantly, it simply would not pay to investigate, or analyze, and find information that was so important that it would affect a reference entity's bond prices. Information always impacts the equity because that is the residual claim, but information has to be fairly important to affect bond prices. That's why, prior to the introduction of CDS, changes in the spreads on investment grade corporate debt were functions of U.S. Treasury rates, but not of firm‐specific information.

Now thanks to the possibility of buying CDS, that's not true any more. So we know more. But is that a good thing? Well as Gorton observes, information-insensitive assets play an important role in the economy:

Information‐insensitive debt plays an important role in the economy because it can be sold fairly easily without fear of losing to better informed traders (because it is not profitable for them to become informed). So, it is held, for example, by insurance companies which have to sell to payoff claims at random times. It can be used as collateral for repo, clearing and settlement. The reason that Treasuries were scarce before the crisis is because they are information‐insensitive.

In the long-run, the availability of naked CDS and therefore more information about firms could be a good thing that enhances the operation of the economy. But in the specific moment, it contributed to a shortage of Treasuries that exacerbated the crisis. And it also means that going forward we need to do something—like maintain the existence of a large pool of federal debt—to make sure that the world has the quantity of information-insensitive debt it needs to continue routine operation.

Barack Obama's Deficit Plan

Brad DeLong's summary of Barack Obama's budget ideas is useful (though caveat emptor here, there's rounding so the numbers don't add up right):

— Restore high-bracket tax rates to Clinton-era levels: $1T

— Cut tax-expenditure spending through the tax code: $1T

— Cut health care spending: $0.5T

— Cut other mandatory spending by: $0.4T

— Cut security spending: $0.4T

— Cut non-security discretionary spending: $0.8T

— Those reductions will carry with them a reduction in net interest of: $1.2T

Some of these are fine however. However, the basic premise continues to be weird. At the moment the international investment class is prepared to lend money to the United States of America at low interest rates. What's more, at the moment the United States of America has a lot of infrastructure needs. Furthermore, at the moment the United States of America has a large number of unemployed people. The logical course of action would be to accept international investors' desire for us to increase our volume of low interest borrowing in order to put people to work on useful infrastructure projects. Near the end of his speech, Obama said that "doing nothing on the deficit is just not an option." But it is an option! It's not an option for Spain, which is facing sky-high borrowing costs. It's not an option for Portugal, which just accepted a bailout from the European Union. But it is very much an option for the United States of America. It's a good option, an appealing option, an option that will increase our wealth over the long term. It won't be an option forever, but that's all the more reason to exercise the option while we can.

The Myth Of The Jobless Recovery

One of the weirder ideas to take hold over the past twelve months is that we're in the midst of some kind of mysterious "jobless recovery" where GDP growth has become uncoupled from unemployment. This is just false. As Scott Sumner observes the labor market has been doing exactly what you would expect in response to weak GDP growth: "In the first 6 quarters of recovery we've seen 2.8% annualised growth in real GDP, which is roughly the trend rate of GDP growth."

2.8 percent annualized growth in real GDP is perfectly respectable for a country operating at full employment. And by the same token, the increases in employment we've seen would be perfectly respectable for a country operating at full employment. Job growth would expand roughly in proportion to population growth, with some movement around the margins in how many people are looking for work. That's all fine stuff. The issue, obviously, is that we're not at full employment. The recovery starts with us in a deep hole. So to get back to full employment you need rapid, catchup growth like after the 1981-82 recession where in "the first 6 quarters of recovery from that slump we saw 7.7% annualised real GDP growth."

In other words, we need more demand-boosting measures. Nothing funny is happening other than bad public policy.

Health Care Costs And The Rise Of The Superkitchen

Megan McArdle has an interesting column on the paradox that our kitchens are better, fancier, and more expensive than ever even though we spend less and less time actually cooking in them (the video is also recommended).

She makes some good points, but this is also why I'm fundamentally un-threatened by the idea of health care services or pension benefits consuming a larger and larger share of national output in the future. The fact of the matter is that even though economic growth over the past thirty years has been disappointed and the middle class' share of that economic growth has also been disappointing, the average American middle class family has an awful lot of stuff. We have a cornucopia of kitchen gadgets, automobiles, televisions, and furniture. Scarcity of material goods is not high on the list of American problems. We do have an extreme scarcity of affordable houses in urban neighborhoods with low crime and decent public schools. We spend a lot of time stuck in traffic jams. We don't provide enough social mobility for low income children. And lots of people are in ill health. These are all serious problems and it's very reasonable to worry that the amount of money we're spending on treating illness is all out of proportion to the quality of health outcomes.

But that's a cost-effectiveness problem not a gross cost problem. Shifting money out of the healthcare sector and into fancier blenders doesn't really solve anything. Shifting money out of health care services to health-enhancing things like healthier food and going to the gym, by contrast, might help.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers