Matthew Yglesias's Blog, page 2322

May 7, 2011

Taller Buildings

Roger Lewis makes the case in The Washington Post for taller buildings in DC. I agree with what he says, though I think he's far too ginger about calling for taller buildings in the existing central business district. Most people seem to think the downtown height limit has something to do with the Capitol Dome. So what if we replaced the current 130 foot limit with something closer to the actual 288 foot Capitol building? Say we let people go up to 260 feet?

Well you'd have higher property tax revenue, and you'd have a more vibrant retail scene downtown with more sales tax revenue. You'd have more employment, both in terms of high-end office jobs and also lower end service work related to that. You'd probably have fewer unemployed people in the poor sections of the city, and higher income tax revenue. That would all let the city reduce sales tax rates slightly (we're currently at a very high 10 percent), thus putting more money into the pockets of low income families while allowing us to have more expansive city services.

It'd be a huge, huge, huge practical win. You can quibble about the aesthetics if you like, but the starting point of any aesthetics-based conversation about the evils of 250 foot office buildings (in Providence, Rhode Island buildings get over 400 feet and Paris has a building that's almost 700 feet tall) has to be the huge practical price. If DC had no poverty, or unusually good public schools, or an unusually low crime rate, or even well-paved streets I'd be more open to the idea that it makes sense for us to leave all this money on the table.

The Myth Of The Responsible Saver

Responding to Morgan Kelly's excellent rundown of the Irish situation, I think Kevin Drum goes way too far in accepting German framing of the issue:

It's easy to see why this is the case — why should thrifty Germans bail out spendthrift euro countries on the periphery? — but it's also easy to see that there's no way it can end well.

I think this conceptual scheme of saver = responsible, borrower = irresponsible needs to be challenged. It's true that German households were thrifty net savers. But a German household that saves isn't engaged in a self-sacrificing pursuit, it's getting paid interest. And the institutions paying the interest are doing it because they're expecting to make a profit by offering loans. And when they offer the loans, they're charging interest. The entire claim of people in this line of work is that they're good at making decisions about who to lend money to and what interest rate to charge them in light of default risk. When I got my mortgage it involved a phone call with a guy from Bank of America. The premise of the conversation was that of the two people on the call, one of us was a highly trained professional with expertise in mortgage lending and the other one was me. And it's just the same with Irish borrowers and German banks. In that transaction it's the Germans who are supposed to be the experts. When the whole thing goes sideways it's the Germans who failed to be responsible stewards of the Eurozone's capital.

Poor Economics

Esther Duflo won the John Bates Clark medal last year for her work on development economics, so I was excited to read her new book with Abhijit Banerjee Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty. It's a good book. It doesn't really contain a radical rethinking of the way to fight global poverty, but it does try to cut past lame debates over whether or not foreign aid "works" to instead attempt to find ways to actually assess which programs are working, which aren't, and how to improve those that don't. The book is structured around a set of questions, which are answered with a mix of illustrative anecdotes and randomized control trials of different anti-poverty interventions.

I suppose the RCT methodology is, itself, supposed to be the radical new way to fight poverty, but of course it's not. It's a way of assessing anti-poverty interventions. It doesn't actually fight poverty. And even though bringing additional rigor to the subject is welcome, it hardly makes all difficulties melt away. For one thing, it's very difficult to know how generalizable the results of any given RCT are. Is a really good experiment in Kenyan farming villages telling us something about Kenya? Something about a particular set of crops? Something about Africa? Something about a specific set of climactic conditions? It's difficult to know. But this passage near the end about the importance of patient diligent work struck me as convincing:

We also have no lever guaranteed to eradicate poverty, but once we accept that, time is on our side. Poverty has been with us for many thousands of years; if we have to wait another fifty or hundred years for the end of poverty, so be it. At least we can stop pretending that there is some solution at hand and instead join hands with millions of well-intentioned people across the world—elected officials and bureaucrats, teachers and NGO workers, academics and entrepreneurs—in the quest for the many ideas, big and small, that will eventually take us to that world where no one has to live on 99 cents per day.

And the book is just full of striking factoids, for example this:

We have started including the question "What are your ambitions for your children?" in surveys given to poor people around the world. The results are striking. Everywhere we have asked, the most common dream of the poor is that their children become government workers. Among very poor households in Udaipur, for example, 34 percent of the parents would like to see their son become a government teacher and another 41 percent want him to have a nonteaching government job; 18 percent more want him to be a salaried employee in a private firm. For girls, 31 percent would like her to be a teacher, 31 percent would want her to have another kind of government job, and 19 percent want her to be a nurse. The poor don't see becoming an entrepreneur as something to aspire to.

What the very poor want, overwhelmingly, is a job where you show up, do as you're told, and get a guaranteed paycheck at the end. Given the fact that the prospects for government employment are always limited, I assume this explains a lot of the appeal of super low wage sweatshop work when it becomes available in poor countries. Evidently agricultural labor and informal work, even if "entrepreneurial," is something most of the global poor really hate doing.

Alternative Vote Fails In the UK

I think passing the Alternative Vote referendum (this is what Americans normally call "instant runoff voting") would have been a good idea for the United Kingdom. At the same time, it's easy to see why AV failed. Its key proponents are the Liberal Democrats, and they're hideously unpopular for the very good reason that their decision to join David Cameron's coalition has given the Tories the votes they need in parliament to enact a highly ideological and macroeconomically destructive agenda.

Nick Clegg, who certainly looked to be like a fairly charismatic and compelling leader during the campaign, has proven to be a total disaster. As Brad DeLong says he sold his birthright for a mess of pottage and then didn't get any pottage. It was bizarre to agree to a coalition deal that had the Tory budget as a key plank but carried with it no guarantee of voting reform. Now at the next election the minority of UK voters who approve of the Coalition approach will vote for them, the majority who disapprove will vote Labour, and the Liberal Democrats will be wiped out. That it was the descendants of J.M. Keynes' own Liberal Party who engaged in this blunder instead of recalling their party's distinctive and noteworthy contribution to thinking about macroeconomic stabilization is just another sad irony.

In the long run, though, I tend to agree with Matt Wootton that AV's passage would have been a win for progressives.

Fast Food Fish

It always seems to me that you have to be a bit nuts to order fast food fish sandwiches. But if you must, you might be wondering which of the major national chains offer the most sustainable options. And since CAP is a full-service think tank, we're here with the answers. Basically, McDonalds and KFC seem to be the best, and Subway the worst.

Fun With Forecasts

Do we really think this Nigeria forecast is going to happen?

I mean I guess it might. And there is a fair amount of momentum built into demographic trends. But this seems an awful lot like an unwarranted straight line projection.

May 6, 2011

Endgame

Bring your friends:

— GOP budget balance plan doesn't add up without privatizing Medicare.

— Walkability and greener both boost property values.

— If this is supposed to be an affordable housing program then it's extremely poorly targeted.

— Smart takes on testing and performance pay from a former school administrator.

— The future of Stanford.

— Kaplan Higher Education profits plummeting.

Tori Amos' "Smells Like Teen Spirit" cover is even better than the Miley Cyrus version.

The Case For A Public Option For Small-Scale Savings

Kevin Drum's stewing about banks and hidden fees seems to me to suggest a case for "postal banking," in other words a public option for small dollar deposits:

I have a visceral aversion to doing business like this, but I also understand why they do it: any bank that charged simple, flat, annual fees would lose all of its good customers, who would migrate to banks that make most of their money from penalty fees that they'll never have to pay. Bad customers, conversely, would eventually migrate to the bank with flat fees as they came to realize that it was a better deal with them. So the nice bank would have lots of bad customers and the evil bank would have all the good customers.

If every bank charged simple, open fees, there would be an equilibrium of sorts. But how do you get there? And should we even try? I'd like to, but I can't pretend it's very likely to happen, or even that it's in the top 20 problems facing the poor. So here we stay.

I'm not holding my breath on this, but in principle the solution is to run small-scale banking as a public service. Every Social Security card would come with a bank account attached. The account would pay an interest rate pegged to always be lower than the 30-year treasury rate. You'd get an ATM card and some checks. The accounts would have some fairly low maximum quantity of money that could be deposited ($20,000?) and a very simple, flat, transparent fee structure. The challenge to private sector banks would be to either deliver a level of features and customer service that tempt people out of the public bank, or else to just focus on raising funds from rich people by offering a good interest rate.

You could leave things there, but the government bank accounts could also be a useful lever for other policy initiatives down the road. Each American could be offered a $500 high school graduation present, and the Federal Reserve could be authorized to use the government banking system to deliver "helicopter drops" of money as a macroeconomic stabilization tool.

GOP Still Fundraising Off Medicare Privatization Plan

Suzy Khimm brings us perhaps the best evidence yet of the ambiguous status of the House Republican plan to privatize Medicare—the party is sending a fundraising email touting the plan, but the email doesn't actually mention Medicare. It's kind of like how Eric Cantor had his whole caucus vote to privatize Medicare, then said he's dropping the idea, then turned back around and said it might still be a key negotiating demand.

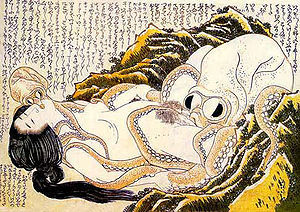

Florida Legislature Acts To Ban Bestiality and Excessively Baggy Pants

Too hot for Florida

The Florida state legislature, apparently tired of dealing with thorny budget issues, has decided instead to tackle the big issues of bestiality and baggy pants:

Floridians are going to have to start pulling up their pants and stop having sex with animals soon. It's up to Gov. Rick Scott to sign off on two bills passed in the Florida Senate and House Wednesday which target droopy drawers and bestiality. The bestiality bill (SB 344) bans sexual activity between humans and animals and has been championed for years by Sen. Nan Rich, from Sunrise. Rich took up the anti-bestiality fight after a number of cases involving sexual activity with animals in recent years, including a Panhandle man who was suspected of accidentally asphyxiating a family goat during a sex act and the abuse of a horse in the Keys. The bill would make such acts a first-degree misdemeanor. Also passed by the House and Senate Wednesday is the so-called "droopy drawers bill" (SB 228), will will force students to hike up their pants while at school.

It seems strange to ban human-animal sex on the grounds that it might lead to dead goats. Presumably the Florida Meat Goat Association is responsible for more goat deaths than the state's bestiality community. Speaking of which, I think goat meat is underrated. Great in stews and other slow-cooked applications.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers