A “put” represents the right to sell shares of stock, which means that the owner of a put will benefit if the stock price drops, allowing him or her to sell the underlying shares at the agreed-upon higher price. “Calls” are the opposite, granting the holder the right to buy a particular stock at a specific price on or before the expiration date, so the owner of the call will benefit if the stock rises, as the option contract allows him or her to buy it for less than it would cost on the open market, yielding an instantaneous profit. Investors sometimes use options as a way to hedge a stock

...more

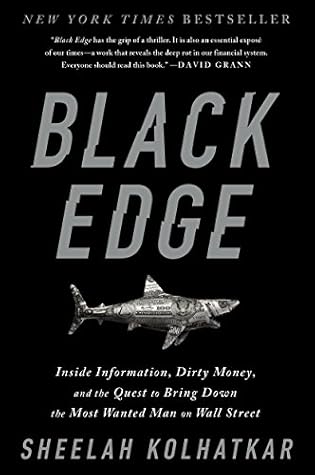

Welcome back. Just a moment while we sign you in to your Goodreads account.