More on this book

Kindle Notes & Highlights

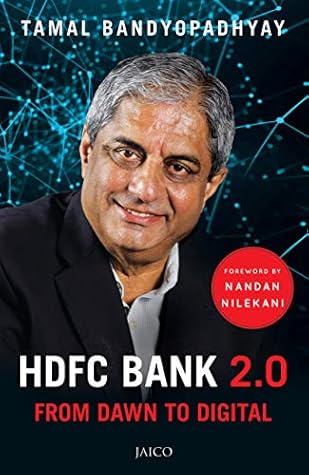

Aditya and HDFC Bank decided that they would rather disrupt themselves than be disrupted.

While it had been done in India before, HDFC Bank was the first to implement it at such a large scale.

For example, the 10-second

loan is a genuine innovation that has enabled the bank to reach both existing and new customers, anytime and anywhere. This product, based on the principle of ‘paperless, presence-less and cashless’, is a great example of combining the traditional strength of the bank in credit underwriting and risk management with the latest technology. Today, around 30% of HDFC Bank’s personal loans come from this product, with no increase in delinquency.

In the 1990s, talking about banks as dinosaurs, Bill Gates of Microsoft famously said, “We need banking, but we don’t need banks anymore.”

The HDFC Bank 2.0 journey began four and a half years ago, with MD Aditya Puri’s trip to California in September 2014.

Their genius lay in developing sophisticated APIs—rules, commands, functions and objects for building software applications. And these

apps were finding a home on every smartphone.

I started reporting on the banking sector about a year after HDFC Bank was born, but I discovered several incidents narrated in this book only while working on this project. They have been impeccably sourced, even though in some cases the people involved don’t want to be named.

The key lesson from the HDFC Bank story is that freedom for professional managers, non-interference by the board and the promoter and a passion for success are more important than ownership.