Kindle Notes & Highlights

by

Philip Klein

Read between

October 30, 2019 - January 3, 2021

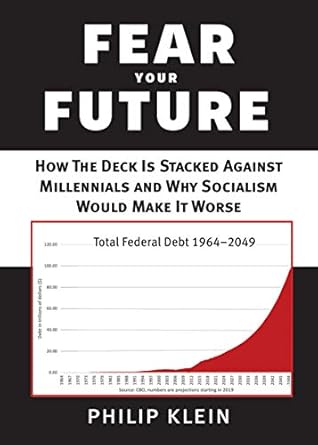

As CBO puts it, in its projections, “large budget deficits would arise because spending would grow steadily under current law, and revenues would not keep pace with that spending growth.”3 In other words, the story of the growing debt is one of taxes not rising fast enough to keep pace with dramatically higher spending, rather than of dramatically lower taxes making modest spending suddenly unaffordable.

But the reality is that America does not redistribute wealth from the rich to the poor as much as it redistributes wealth from the young to the old.

The first popular myth is that people pay payroll taxes while they are working, and then that money is put into some sort of government account, saved until their retirement, and then used to pay their retirement benefits. In reality, the payroll taxes of current workers are being used to cover the benefits of those who are currently retired. Thus, millennials will be paying for baby boomers’ retirement benefits for the rest of their working lives.

The second myth is that younger generations are simply “paying it forward,” just as older generations did for retirees when they were young. In this formulation, baby boomers may not literally be withdrawing from some sort of government savings account they’ve been putting money into all these years, but they are at least just taking out what they put in to fund the system when they were working and paying payroll taxes. This is also a misconception. In most cases, baby boomers will be collecting a lot more in benefits than they paid in taxes.