The US is able to carry out quantitative easing because its dollar happens to be the world’s reserve currency. They are allowed to run a deficit for a long time with very few consequences. If other countries were to do that, they run the risk of capital outflow and exchange rate collapse. The cost is low to the Americans because some of what it would have cost a regular country has been transferred to the rest of the world. The Americans can borrow at more favourable interest rates because of a greater willingness by people elsewhere to hold cash reserves and assets in US dollars. That is the

...more

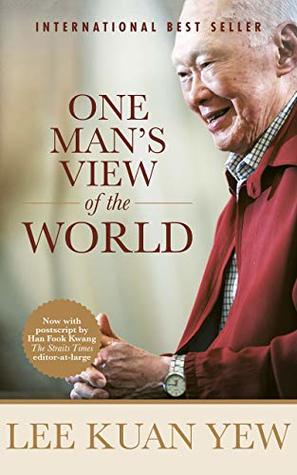

Welcome back. Just a moment while we sign you in to your Goodreads account.