More on this book

Community

Kindle Notes & Highlights

Read between

April 8 - April 15, 2021

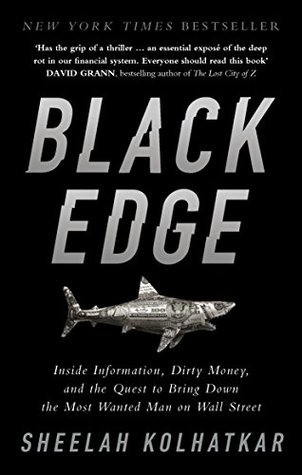

Hedge funds are always trying to find what traders call “edge”—information that gives them an advantage over other investors.

This kind of information—proprietary, nonpublic, and certain to move markets—is known on Wall Street as “black edge,” and it’s the most valuable information of all.

Cohen figured that 5 percent of his trades accounted for most of the money he made. If he’d only placed those winning trades on a modest scale, those profits would have been considerably smaller.

The key to making money, they believed, was by intelligently controlling their losses. Academically, this was known as risk management.

If a trade is going against you, you set a limit, and then you sell, no matter what. Never let emotions get in the way.

The most critical thing was to appear relaxed. Squirming, Hollander recalled, picking lint off your clothes, or fiddling with your eyeglasses all could signal that you were lying.

It basically grants permission to trade on material nonpublic information, as long as you don’t know too much about where it came from.