Therefore, the incentive structure for investment managers today differs from the incentive structure for bank managers of the past in two important ways. First, there is typically less downside and more upside from generating investment returns, implying that these managers have the incentive to take more risk. Second, their performance relative to other peer managers matters, either because it’s directly embedded in their compensation, or because investors exit or enter funds on that basis. The knowledge that managers are being evaluated against others can induce superior performance, but

...more

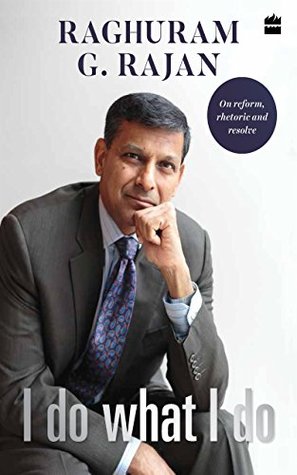

Welcome back. Just a moment while we sign you in to your Goodreads account.