The dollarization of liabilities has become widespread in recent years. More and more countries, banks, and firms in emerging markets issue debt denominated in a foreign currency (typically the dollar), even though they don’t have large dollar revenues. When a country’s currency depreciates, the resulting currency mismatch between revenues and obligations can lead to serious consequences – sovereign defaults, banking system meltdowns, and widespread corporate bankruptcy. Given these risks, why do countries persist in borrowing in foreign currencies? One reason – referred to as the ‘original

...more

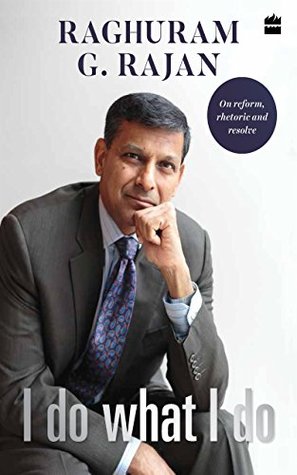

Welcome back. Just a moment while we sign you in to your Goodreads account.