Kindle Notes & Highlights

Read between

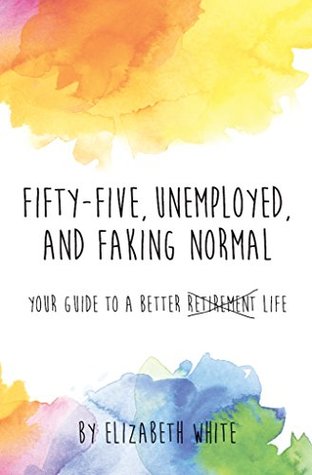

April 19 - May 26, 2018

Friends wonder privately how someone so well educated could be in economic free fall. She is still as talented as ever and as smart as a whip, but her work is sketchy now, mostly on and off consulting gigs. Friends hear about this and that assignment but can’t remember when she had a real job. At fifty-five, she has learned how to fake cheeriness and to appear to be engaged, but her phone doesn’t ring with opportunities anymore.

We endure what is happening to us in silence and often alone, too embarrassed or ashamed to talk about it. We assume we are small in number—that we are the only ones facing serious, life-altering financial challenges. We fake normal as best we can, trying to keep up appearances as the floor collapses underneath us.

the fifty-plus segment of the population consists of some one hundred million consumers spending $7 trillion annually on goods and services.4 In fact, we make nearly half of all of the purchases in entertainment and apparel and account for 55 percent of the sales of consumer packaged goods.

The economics of aging is forcing millions of us to live more frugally and to redefine what is enough. We’re cutting back, downsizing, and rethinking how we live, work, and play.

It is the book you should read to help you navigate the emotional aspects of where you have landed.

Housing is often one of the biggest nuts we have to crack.

Income is the other big one.

We find ourselves suddenly in the workforce after divorce or the illness or death of a spouse.

Think freelance, multiple income streams, or working from home. Fewer and fewer of us will be sitting all day with our feet under someone else’s desk.

We can’t be proactive if we’re depressed, guilt ridden, hiding with the covers over our heads, and wasting valuable energy pretending we’re fine.

too—like who we were without our props and credentials

and our “job identities.”

I’m calling a “Resilience Circle” (RC). And I strongly urge you to do so if you feel that you’re circling the drain, exhausted by the sheer effort it takes to pretend you’re fine when you’re not. For me, finding my tribe and being part of a supportive community is critical to my sense of well-being and key to my ability to choose what’s right for me and to act on my own behalf.

Also, don’t make the group too big. Your group is your safe place. It’s where you get to open your kimono and say what is true for you. You

You will want to invite each person in your Resilience Circle to commit to coming to the meetings and working through the book. Intentions matter. We’re talking about holding meetings for three or four months depending on how often you meet.

Americans have and what we need to retire is $7.7 trillion.6 Wrap your brain around that number. It assumes that we will be spending down ALL of our assets, including our home equity.

half of all American households have no retirement savings at all. That’s zero—no 401(k)s, no IRAs. Not a dime.

the median value of retirement accounts is about $104,000. Now, $104,000 sounds a lot better than zero until you look

According to GAO, your $104,000 nest egg will

about $310 per month.

average monthly social security benefit of $1,328, it’s still depressing. And you’re definitely screwed if you live in a major metropolitan area where one-room studios go for that much.

The truth is that for many households, there’s just nothing left to save after the bills have been paid. According to the Social Security Administration,8 in 2014 the average US worker’s pay was $44,569. If we set aside in savings the 20 percent that financial experts tell us we’ll need to maintain our current lifestyle in retirement, we’d be left with $35,655 to live on before taxes.

why one in four Americans dip into their 401(k) accounts before they reach retirement age. This “leakage” in the form of withdrawals, cash outs, and loans accounts for $70 billion, or nearly a quarter of the $293 billion that workers and employers deposit into their accounts annually.

are using the money to pay mortgages, rent, and medical bills; to make car repairs; and so on. In other words, for the most part, these withdrawals are not for discretionary spending.

flat or falling wages, disappearing pensions, and steeply rising costs in housing, health care, and education. If that pummeling wasn’t bad enough, in 2008 you were hit by the largest economic downturn in decades.

The three-legged stool of retirement income that we boomers thought we could count on—social security, company pensions, and personal savings—has gone wobbly.

people voluntarily saving money for forty years; the sharp drop in personal savings; and thirty plus years of stagnant wages, many near retirees are left with what some experts describe as the “pogo stick” of social security during their golden years.

Back then, the average twenty-one year old male had about a 50 percent chance of making it to the age of sixty-five. To put that in context, you retired at sixty, sat in your rocking chair, went fishing, kissed your grandkids, and died within five years of collecting benefits.

Social security was never intended to be the retirement plan. In the 1950s the promise was that it would provide a base of income for American workers, who would then supplement it with occupational pensions and personal savings.

with the average retiree receiving only $15,528 annually. And many of you—especially women—have told me that you’re surviving on a lot less than the average.

at age sixty-two, which locked them into payments as much as 30 percent lower over their lifetimes.

In 2013 nearly 2.9 million women over the age of sixty-five in the United States lived in poverty. According to US Census Bureau data cited by the National Women’s Law Center, that’s more than double the number of men (about 1.3 million) who lived in poverty.17

48 percent of women are filing for social security at age sixty-two, as soon as they are eligible, instead of holding off to full retirement at sixty-six. This

the gender wage gap.20 According to the latest data from the US Census Bureau, the typical woman working a full-time, year-round job earned eighty21 cents for every one dollar that a man earned in 2015; Asian American women earned ninety cents on the dollar, African American women earned sixty-four cents on the dollar, and Hispanic and Latina women earned fifty-four cents on the dollar.22

forfeit by taking time off from their paid work to tend to their parents,24 and the hundreds of thousands more that they forfeit caring for children and other family members and the consequences of spending a lifetime at an economic disadvantage become clear in lost wages, reduced pensions and social security benefits.

So basically, we have gone from a retirement system that was automatic and managed for us by our employers to a voluntary, self-directed system where we have been given the reins and the risks. And it turns out that many of us just aren’t that good at investing long term or

The Dodd-Frank report concluded that “investors have a weak grasp of elementary financial concepts and lack critical knowledge of ways to avoid investment fraud.”

on more and more responsibility for managing our retirement accounts, millions of us don’t know how.

Just think about everything you have to get right to manage your 401(k) plan successfully, and you’ll see why our do-it-yourself pension system is failing millions of Americans. You’re expected to know what to invest in and to make consistently smart decisions over decades, managing your investments through stock-market highs and lows with the right balance of stocks and bonds. Good luck with that!

You have to voluntarily save 10—or, as some experts say, 15 to 20—percent out of each paycheck for forty years despite flat wages and rising expenses.

Depending on the survey, the collective average savings ranges from $25,000 to about $75,000.

Research Institute Issue Brief, the median amount in 401(k) savings is $18,433.27

For starters, many of us don’t own our homes. According to a GAO report on retirement readiness, only 41 percent of American households fifty-five and older do.29

Social security

In fact, 65 percent of beneficiaries depend on it for 50 percent or more of their retirement incomes, and of this number, 36 percent rely on it for 90 percent or more of their incomes.33