More on this book

Community

Kindle Notes & Highlights

Read between

February 2 - February 24, 2018

As we saw, academics are paid by administrators via colleagues to make life complicated, not simpler. They invented something useless called utility theory (tens of thousands of papers are still waiting for a real reader).

Ah, here we see some classic Taleb (this is from the foreword, not written by Thorp—get the impression he’s too humble to write this way?)

With a smirk the man said, “Okay, kid, name all the kings and queens of England in order and tell me the years that they reigned.” My father’s face fell but to me this seemed to be just another routine request to look into my head to see if the information was there. I did and then recited, “Alfred the Great, began 871, ended 901, Edward the Elder, began 901, ended 925,” and so on. As I finished the list of fifty or so rulers with “Victoria, began in 1837 and it doesn’t say when she ended,” the man’s smirk had long vanished. Silently he handed me back the book. My father’s eyes were shining.

when my father gave me a nickel to shovel the snow from our sidewalk, I hit a bonanza. I offered the same deal to our neighbors and, after an exhausting day of snow removal, returned home soaked in sweat and bearing the huge sum of a couple of dollars, almost half of what my father was paid per day. Soon lots of the kids were out following my lead and the bonanza ended—an early lesson in how competition can drive down profits.

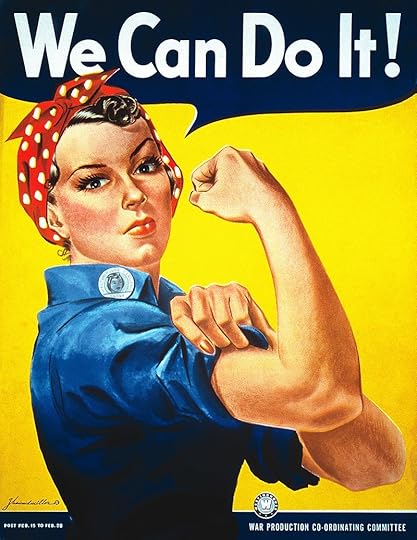

My mother was a riveter on the swing shift (4 P.M. until midnight) at Douglas Aircraft. Diligent and dexterous, she was nicknamed “Josie the riveter” by her co-workers after famous World War II posters of the bandanna-clad heroine.

I took to biking over to the base to sell my extras for a few cents apiece. Before long I was invited to join the soldiers for breakfast in the mess. I stuffed the bounty of ham, eggs, toast, and pancakes into my skinny frame while the soldiers read the papers I sold them. They often gave them back, encouraging me to sell them again. But selling papers on the base was too good to last. After a few weeks, the base commander called me into his office one morning and explained, sadly and considerately, that because of wartime security I was no longer allowed entry.

We understood when we signed on that if we continued to do our jobs well, we would get our full pay and eventually maybe get a small raise. Now the boss was taking part of our pay simply because he could get away with it. This was unfair but what could a bunch of kids do? Would King Arthur’s Knights of the Round Table tolerate this? No! We took action. My friends and I went on strike against the Examiner. Our supervisor, an ever-perspiring obese man of about fifty, with thinning black hair and rumpled clothing, was forced to deliver newspapers to ten routes in his aging black Cadillac.

The largest heated indoor pool in Southern California, it was 120 feet long and 60 feet wide, with an average depth of 5 feet. That’s a volume of about a thousand cubic meters. My remaining nineteen grams of aniline red would intensely color only about an eighth of that. I decided to go ahead anyhow.

Hijinx I never would have thought of as a kid. Like his playful mischief (retrospectively, as part of a memoir, at least)

I simply couldn’t afford Caltech. My UC–Berkeley scholarship, the largest they then gave, was for $300 a year. Tuition, which was $70 a year, was covered separately for me by a scholarship for children of World War I veterans. Berkeley also had low-cost room and board just off campus. Cheaper yet was the Student Cooperative Housing Association, with room and board for $35 per month and four hours of work a week. When I picked Berkeley, I consoled myself with the hope that at least there would be plenty of girls and my social life might bloom.

I decided to begin by finding the best strategy to use when I knew which cards had already been played. Then I could bet more when the odds were in my favor and bet less otherwise. The casino would win more of the small bets, but I would win a majority of the big wagers. And if I bet enough where I had an advantage, I should eventually get ahead and stay ahead.

Does the card count ever affect the best action strategy (not just betting strategy)? (Hit when you otherwise wouldn’t, vice verse etc)

This turned out to be true, and it meant, for example, that the effect of 12 Tens when, say, forty cards were left to be played, was about the same as 9 Tens with thirty cards left, and 6 Tens with twenty left, as all three of these decks have the same fraction, 3⁄10, or 30 percent, of Ten-value cards. In counting cards, it’s mainly the fraction remaining that matters, not the number.

Except the variance will be different when there are many vs few cards left. Expected returns will be the same but probability of ruin will vary. Looking forward to seeing how avoiding ruin affects betting strategies....

The first results indicated that the casino advantage, when you played as perfectly as possible without keeping track of the cards that have been played, was 0.21 percent. The game was virtually even for anyone. It wouldn’t take much in the way of card counting to give the player an edge!

As computers became more powerful, my approximations were removed step by step. Twenty years later, around 1980, computers had finally become powerful enough to show that the final figure for one deck using the blackjack rules as given in the book I would go on to write, Beat the Dealer, was +0.13 percent in favor of the player. Players using my strategy had had, all along, a small edge over the casino even without keeping track of the cards.

The result was a player disadvantage of 2.72 percent with all the Aces gone—2.51 percent worse than the overall 0.21 percent casino edge. Although this was a huge shift in favor of the casino, it was actually great news.

Clever to take an extreme case and prove huge disadvantage to player to demonstrate that varying bets can theoretically tip odds in player. Trick was definitely to devise a strategy that would be memorable enough /and/ cover enough cases they he’d be likely to encounter them.

The math also showed me that if removing a specific group of cards from the deck shifted the odds in one direction, adding an equal number of the same cards instead would move the odds the other way about the same amount.

I now knew the impact of removing any four cards of one type from the deck. Taking out four Aces was worst for the player, and removing four Tens was next worst, adding 1.94 percent to the house edge. But taking out the “small” cards, which are 2, 3, 4, 5, and 6, helped the player enormously. Removing four 5s was best, changing the casino edge of 0.21 percent to a huge player edge of 3.29 percent.

So cool. Really impressive, methodical approach to this problem. Kind of wish he had applied his innovative thinking to something more beneficial to humanity. :/

MIT’s IBM 704 had produced the basic results that gave me the Five-Count System, most of the Ten-Count System, and the ideas for what I called the ultimate strategy. The latter assigned a point value to every card, proportional to its effect on the game, with Aces each counted as −9, 2s counted as +5, and so on, down to Tens counted as −

What’s the edge when applying this counting + optimal (yet to be explained) betting strategy—presumably using Kelly.

One of the best compromises between ease of use and profitability was to count the small-value cards (2, 3, 4, 5, 6) as +1 as they are seen during play, intermediate cards (7, 8, 9) as 0, and large-value cards (10, J, Q, K, A) as −1. From the results of my computer runs anyone could work out the details of nearly all the blackjack card counting systems in use today.

For actual casino play, I built a much more powerful winning strategy based on the fluctuation in the percentage of Ten-value cards in the deck, even though my calculations showed that the impact of a Ten was less than that of a 5, since there were four times as many Tens. The larger fluctuations in “Ten-richness” that resulted gave the player more and better opportunities.

He asked me to change the title from “A Winning Strategy for Blackjack” to “A Favorable Strategy for Twenty-One,” as this title was more sedate and acceptable to the academy. Space in the magazine was tight, and each member could submit only a limited number of pages per year, so I reluctantly accepted Shannon’s suggestions for condensation. We agreed that I’d send him the revision right away to forward to the academy.

I like that his intent was to publish (in academic journal, not first by book for money-making purposes). I imagine that many would keep it secret and profit handsomely...like hedge funds.

As we returned to the office he asked, “Are you working on anything else in the gambling area?” I hesitated for a moment then decided to spill my other big secret, explaining why roulette was predictable, and that I planned to build a small computer to make the predictions, wearing it hidden under my clothing. As I outlined my progress, ideas flew between us. Several hours later, as the Cambridge sky turned dusky, we finally parted, excited by our plans to work together to beat the game.

This encounter with Shannon is pretty amazing. My advisor was around MIT at the time and had many legends to tell about his near demigod status. Also: he was a miserable driver.

after an hour I raised the bets to the $50-to-$500 range. I had calculated this to be the highest we could bet safely with our $10,000 bankroll. This plan, of betting only at a level at which I was emotionally comfortable and not advancing until I was ready, enabled me to play my system with a calm and disciplined accuracy. This lesson from the blackjack tables would prove invaluable throughout my investment lifetime as the stakes grew ever larger.

The strategy incorporating avoiding risk of ruin is simply to bet much smaller than bankroll? Guess makes some sense, but doesn’t eliminate risk of ruin? Or do you scale up/down bets according to current holdings? Still can get down below minimum bet that way with some nonzero probability.

This trip taught me that while playing well, even with experts to warn me of dirty dealing, I could no longer openly win a significant amount. On future visits, I would need to change my appearance, be low-key, and generally avoid drawing attention to myself.

I felt satisfaction and vindication when the great beast panicked. It felt good to know that, just by sitting in a room and using pure math, I could change the world around me.

But was it a better world? Reminds me of prisoners who create havoc (or self-mutilate) simply to exert some control on their world. Or two-year olds for that matter. The goal shouldn’t be to simply change the world, but rather to improve it.

Still, the fact that blackjack could be beaten led to an upsurge in play. As a result, during the next few decades blackjack displaced craps as the dominant table game.

There’s a fun irony here. Thorp probably lifted casino blackjack revenue as a result (though the cannibalization of other game revenue might’ve meant a net decrease overall—would any casino admit either way?)

Update: later he reveals they do in a way after changing rules in favor of dealer then quickly reversing in response to drop in blackjack revenue.

Eric Franklin liked this

After watching the dealers at Treasure Island and at two other casinos, and seeing what was wrong, with a little math I found a new shuffle that prevented tracking. I kept it to myself.

Eric Franklin liked this

For a few thousand dollars I learned from this to make proper risk management a major theme of my life for more than fifty years thereafter. In 2008 almost the entire world financial establishment didn’t understand this lesson and had overleveraged itself.

I think this is still the wrong perspective on 2008. Aside from home buyers, the entire financial hairball was due to individuals seeking high-risk returns knowing that their worst outcome would be job loss if their firm tanked. Limited downside (loss of future earnings not current wealth) and huge upside (they didn’t put many limits on themselves selling CDSs, buying and repackaging crap loans etc). The folly of his analysis here is in assuming that the individuals had the same incentives/risks/interests as the companies they represented. Truth is far from this as a company must ensure long-term health and revenue to survive. An employee (or even partner of an LLP) earns income every year and gets to keep it even if their firm implodes. They’re actually motivated to bet the firm and take high-risk returns now and bank them before some other bloke does the same thing first.

Ok, he gets to agency problem just a bit after this. ;)

On my first day in my new teaching position at UCI, in September 1965, Julian Feldman, the head of the school of information and computer sciences, asked me what I was working on. When I described my ideas about a theory of warrant valuation and hedging, he said that another member of the new faculty, an economist named Sheen Kassouf (1928–2005), had written his PhD thesis on the subject.

Trying to work out from this book what actual contribution to mathematics he made in his research....was it all in applied probability/games? Or did he do ‘real’ mathematics too? Surprised he’s so welcomed in math departments with what we’ve covered so far. Celebrity mathematician perhaps, but not seeing what I would expect a math department to demand in the way of publications.

That same year I began using the formula to trade and hedge over-the-counter warrants and options and, a little later, convertible bonds. An option to buy a stock is similar to a warrant, the principal difference being that warrants are typically issued by the company itself and options are not. Convertible bonds are like ordinary bonds but with the additional feature that they can be exchanged for a fixed number of shares of the issuing company’s stock if the holder so desires.

Do these inefficiencies still exist? He was estimating warrant/convertible/option value and presumably there are better means of computing them now and computing resources to do them insanely fast. Where would he turn in 2018 for opportunities that haven’t been closed already? These days, don’t you need to be the first quant to catch an inefficiency to actually make money?

These dice are used to play a gambling game: You pick the “best” of the three dice, then from the remaining two I pick the “second best.” We both roll and the high number wins. I can beat you, on average, even though you chose the better die. The surprise for nearly everyone is that there is no “best” die. Call the dice A, B, and C. If A beats B, and B beats C, it seems plausible that since A was better than B and B was better than C, A ought to be much better than C. Instead C beats A.

A) Kind of reminds me of a trick my friend Joe pulled on me where you take turns picking your best poker hand from the deck (“open hand draw poker” or some such). I said, but we’ll just both choose a royal flush and it’ll be a draw. He let me go first and it ended up just his way, though he did ask (and I laughed, demuring) if I wanted to draw any additional cards). Then he asked to pick first and chose four aces, let me pick an aceless straight flush, the. Reminded me it was draw poker, so he could go back into the deck and convert one of his aces into a royal flush. All the aces were thus consumed so I couldn’t improve on my straight flush and lost

B) really curious about these dice. Wonder how many such sets there are with 3 6-sided dice. And how many dice in the set before it becomes impossible to create this condition (first need to generalize beyond 3 dice...such that for every die there is at least one that beats it?)?

Note: stop reading the book of you want to figure out for yourself. He reveals a solution in short order. Avert thine eyes!

Businesses did even better than homeowners. They created companies to hold properties. Instead of selling a particular property, they sold the company that owned it. By keeping the same “owner,” this scheme could preserve forever the original low valuation of the individual properties a particular company owned rather than increasing the tax based on a new, higher and more realistic sales price.

when I was thinking about Buffett, his favorite game—bridge—and the nontransitive dice, I wondered whether bidding systems at bridge might be like those dice. Could it be that no matter which bidding system you use, there will always be another system that beats it, so there’s no best system? If so, the inventors of new “better” bidding systems could be chasing their tails forever, only to have their systems beaten by still newer systems,

Possible. Though there’s the fuzzy rule about how arbitrary of a bidding system you’re allowed to use. Information theory can probably shed light on theoretical limits on bidding system effectiveness, but rules prevent their exploitation. Though it was never clear to me how to determine if a bidding system is legal or not. Interesting area for bridge Talmudic scholars to pursue and publish on.

Suppose it turned out that no bidding system is best. Then your best strategy would be to ask the opponents to disclose their bidding system, as they are required to do, then choose the most lethal counter to it. When the opponents catch on and demand that your team chooses its bidding system first, this leads to an impasse that might have to be resolved by a lottery to see who chooses first, or by some kind of random assignment of bidding systems.

Our operation was an example of what had come to be known as a hedge fund. A hedge fund in the United States is simply a private limited partnership managed by one or more general partners (each of whom risks the loss of their entire net worth should things go badly wrong) and a group of investors, or limited partners, whose loss is limited to the amount they commit.

General partners are personally liable? For what % of investors’ loss? Or only to unwind if overleveraged and receiving collateral calls? Hedge funding sounds even less fun all of a sudden ;)

It was clear that I was at a crossroad. I could use my mathematical skills to develop strategies for hedging and possibly become rich; or I could compete in the academic world for advancement and distinction. I loved university-level teaching and research, and decided to stay with it as long as I could. My best quantitative financial ideas would be saved for our investors, not published, and over time would be rediscovered by and credited to others.

To form these hedges, we simultaneously bought the relatively underpriced security while offsetting the risk from adverse changes in its price by selling short the comparatively overpriced security. Since the prices of these two securities tended to move in tandem, I expected the combination to reduce risk while capturing extra returns. I identified these situations using the mathematical methods I had worked out for judging the proper price of a warrant, option, or convertible bond versus the common stock of the same company.

Re: Black-Scholes, looks very likely (or maybe he had even better model? His reticence suggests perhaps?)

But also: when he says “sell short” would that include options (eg buying puts)? Always seemed that actually shorting (borrowing and selling) was expensive and overly risky. What’re the rates on borrowing securities? Expect much higher than interest rates on cash.

A so-called convertible preferred is one that can be exchanged for a specified number of shares of the common. So a convertible preferred is like a convertible bond but less secure, as it is paid only if there is enough money to do so after the bondholders receive their interest. At that time they gave us numerous investment possibilities.

Definitely see that these would be difficult to value and easy for market to be inefficient. So many random variables!

After suffering for a few months with the distractions from the beehive of activity at the house, Vivian made me lease an office. Moving to the second floor of a small office building, I bought computers and hired more people. I developed printed tables for trading each hedge. These tables listed the prices of the stock versus the convertible needed to achieve our target return. Besides the new hedges we wanted to add, the tables told us how to adjust existing positions that needed the hedge ratio changed (so-called dynamic hedging) because the stock price had moved or that should be closed

...more

Why didn’t people work for him, steal his ideas/formulae, and replicate? Seems big business risk. Wonder if he had means of keeping secret sauce secret from others. And I guess for a long time he could do all this himself. At what point did he need to disclose secrets to continue to scale?

Later he explains he just paid them a lot of money.

Our computers used so much electricity that the office was always hot. We left the windows open and blew out the heat with fans, even during the coolest part of the California winter. Our landlord didn’t charge tenants for utilities, instead paying it from his lease revenues. When the heat got my attention, I calculated that the cost of the electricity we used was more than our rent. We were getting paid to be there.

Seems like something the landlord would notice. Though perhaps the metering was done at the building level. So a) the increase wasn’t as dramatic as the increase for PNP’s office space alone, and b) landlord couldn’t tell where increased usage was coming from. But kind of unfair that landlord was losing money on a solvent tenant. Exception to the “rent-seeking” notion ? (Or just revenge on rent-seekers?)

I supposed that both the unknown growth rate and the discount factor in the existing warrant valuation formula could be replaced by the so-called riskless interest rate, namely that which was paid by a US Treasury bill maturing at the warrant expiration date. This converted an unusable formula with unknown quantities into a simple practical trading tool. I began using it for my own account and for my investors in 1967. It performed spectacularly. In 1969, unknown to me, Fischer Black and Myron Scholes, motivated in part by Beat the Market, rigorously proved the identical formula, publishing it

...more

We modified our performance fee of 20 percent of the profits, billed annually, by including a “new high water” provision. This meant that if we had a losing year, we carried forward the losses and used them to offset future profits before we were paid more fees.

This is great. Did this catch on at all in rest of hedge fund community? With 2 & 20, I kind of assume not—never really understood the 2% bit: heavy tax to pay.

Investment opportunities were expanding, too, notably in April 1973 when the new Chicago Board Options Exchange (CBOE), created and managed by the long-established Chicago Board of Trade, began trading options. Before this, options were traded only over the counter (OTC), meaning that would-be buyers or sellers had to use brokers to search on their behalf for someone to take the other side of the trade. It was inefficient, and the brokers charged the customers high fees.

Ah, explains earlier question I had about options vs selling short. Options too were very expensive.

When I asked his lawyer associate how he could ratify such unethical behavior, he said, “They don’t teach ethics in law school.

My shifting mathematical interests were also distancing me professionally from my colleagues in the department at UCI. As is generally true in universities, the research emphasis was on pure mathematics.

Seriously. Still don’t understand how he got by on this probability/gambling stuff. We’re there no applied math faculty then? Might’ve made some sense in that case?

I knew that to maintain PNP’s trading edge I would have to develop my tools for valuing warrants, options, convertible bonds, and other derivative securities rapidly enough to stay ahead of future marching legions of PhDs hungry for academic advancement through publication. Though I had to keep important results secret for the benefit of our investors, I could publicize lesser ideas that I thought would soon be found by others.

Pretty full and rapid transition from academic to mercenary. Kind of question the ethics of his period when he was doing both simultaneously. Then again, plenty of academics keep secrets for fear of rivals catching up and surpassing them too quickly.

Two other computational methods for finding American put prices were eventually published in scholarly journals in 1977.

Interesting that American puts can’t be valued directly but only via computationally intense approximations. Though I guess the whole field of convex optimization is somewhat analogous and no one’s all that upset.