In the wake of the 2008 crisis, Clinton is most frequently criticized for overseeing two radical changes to our regulatory structure: the repeal of the Glass-Steagall Act to allow the mergers of investment banks, commercial banks, and insurance companies, and the Commodity Futures Modernization Act of 2000, which deregulated the burgeoning derivatives market. Less commonly understood is that Clinton, Greenspan, Rubin, and Summers also oversaw the collapse of what are known as “selective credit controls,” the tools used to rein in irresponsible lending.

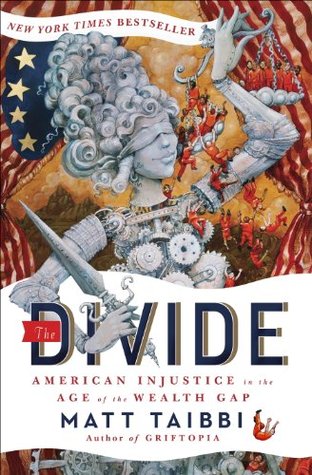

Welcome back. Just a moment while we sign you in to your Goodreads account.