More on this book

Kindle Notes & Highlights

by

J.D. ALT

Read between

November 25 - November 25, 2020

In fact—and when you think about it, it’s obvious—the Federal Government buys its public goods and services from the Private Sector. Aircraft carriers and submarines are built by Private Sector shipyards. Weather and GPS satellites are designed and built by private engineering laboratories. And while the space-launch facilities at NASA are a “public” enterprise, all the scientists and technicians who work there are private citizens. Even the Navy’s Vice-Admiral in charge of sea-recovery operations, when he goes home on weekends and changes into his gardening clothes, is a private citizen.

is not possible for the Private Sector pot to “generate” its own U.S. Dollars! This is because, by law, a U.S. Dollar can only be created—printed or issued electronically—by the U.S. sovereign government. Anyone else who tries to create or issue a U.S. Dollar is a counterfeiter and subject to imprisonment. Of course banks in the PS pot leverage U.S. Dollars with bank loans into huge sums of “bank dollars” and these are used for “money” in the PS pot just as real U.S. Dollars are used. But Federal Taxes must always be paid with real U.S. Dollars—and the “bank dollars”, when the loans that

...more

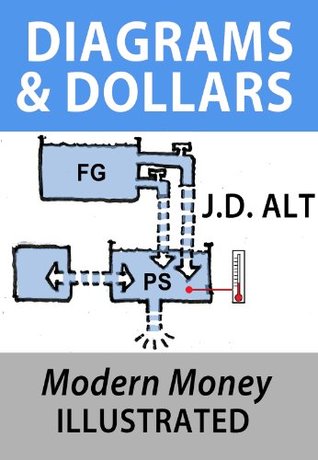

What we are seeing now is a completely new fiscal perspective: The sovereign government issues U.S. Dollars in the FG pot and then spends those Dollars through it’s own SPENDING spigot into the PS pot! Entrepreneurs in the Private Sector then use the Dollars the FG has issued and spent—leveraging them with bank loans and creative financing—to launch business ventures that generate private sector jobs and wages. Can this possibly be the way it actually is? Please hold onto your objections for just a few minutes.... You might be pleasantly surprised, or at least find yourself reconsidering some

...more

As the FG spends, the number of Dollars in the PS pot grows. If the number of goods and services available for people to buy in the PS pot does not grow by an equivalent amount, the additional Dollars flowing in will cause prices to go up—perhaps dramatically. This is the “inflation” that Congressmen and economists are constantly warning against. To prevent this from happening—or to prevent the rate of inflation from getting disruptively high—there has to be some means for taking Dollars out of the PS pot.

The first plumbing addition is a “drain” that simply takes Dollars out of the PS pot and destroys them. This drain is Federal Taxes. Drained out and destroyed, Dollars paid in Federal taxes are no longer available for Private Sector spending—and, therefore, can no longer contribute to price-inflation.

The reason is the underlying reality of what a U.S. Dollar actually is: It is simply a promise, by the U.S. sovereign government, that it will accept the Dollar as payment for a Dollar’s worth of taxes. That’s it. A Dollar—whether it’s a paper Dollar or an “electronic” Dollar—is nothing more than that promise. The sovereign government doesn’t promise to exchange a Dollar for gold or silver, or for anything else of intrinsic value. It promises only to accept the Dollar in exchange for the cancellation of a Dollar’s worth of taxes due. In other words, a Dollar is the I.O.U. of the sovereign

...more

ventures, and to save for future spending in our retirement. But at its most official heart, the U.S. Dollar is simply the “I.O.U. a Dollar’s worth of Tax credit” promise of our sovereign Federal Government.

So that’s why the FG SPENDING spigot works in the first place—because all the citizens and businesses in the Private Sector are willing to provide goods and services to the Federal Government in exchange for the Dollars they need to pay their Federal Tax bill.

You give the Federal Government back its I.O.U., the FG declares your taxes paid, and the I.O.U. is cancelled. That I.O.U. no longer exists because the promise has been fulfilled. It is easy to see this when the tax-Dollar redeemed is electronic (as virtually every tax-Dollar paid today is): the taxes owed and the taxes paid simply cancel each other out.

This, in fact, is exactly what is happening when the Federal Government “sells” a Treasury Bond. U.S. Dollars—whether they reside in a bank account or a wallet—do not pay interest. When a bank (or business, or person) “buys” a Treasury Bond from the FG, that bank or business or person is simply transferring some its financial wealth from Dollars (which pay no interest) into a Treasury Bond “account” which does pay interest. And the agreement is exactly the same as with the CD: In exchange for receiving the interest, you agree to leave your money in the Treasury Bond “account” for a specified

...more

Theoretically, for a given amount of Sovereign Spending, we should be able to adjust the draining operations of Taxes and Bonds to keep prices under control.

But the diagram shows no Dollars ever flowing into the FG pot. How can that be? We already know the answer: A Dollar that flows into the FG pot can serve no logical purpose. The Federal Government doesn’t need that Dollar in order to have a Dollar to spend. For the sovereign to collect I.O.U.s to itself makes no sense. What we have been calling the FG “pot”, then, is not really a “pot” at all in the sense that something can be added to it—and we should modify our diagram slightly to avoid this potential confusion:

accept those Dollars for goods and services they provide to us. But at the very center of things, what makes the Dollars go round is that we’re all in debt to the sovereign government, and can only cancel that debt with the sovereign’s I.O.U.s.

What is amazing to contemplate, however, is that the initial Sovereign Spending of these Dollars also accomplishes something else: it pays us to create for ourselves goods and services that we benefit from collectively as a society—in many cases, that we benefit from substantially (as in: we might not even be alive without them.) In other words, the thing that drives our fiscal-monetary system coincidentally also makes it possible for us to pay ourselves to build and create goods and services that make us collectively healthy and prosperous. The implications of this dynamic coincidence—when

...more