More on this book

Kindle Notes & Highlights

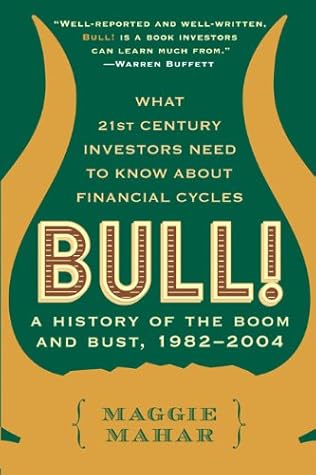

by

Maggie Mahar

Read between

November 13 - November 16, 2020

fund managers

The only way they could hope to keep up with the index’s double-digit jumps was by riding the market’s leaders. By definition, of course, this meant pouring investors’ retirement savings into the market’s most expensive shares—often just as they were peaking.

While mutual fund managers chased the hottest shares, individual investors pursued the hottest funds. “The American public was writing endless checks to these funds—and the funds then had to invest the money,” recalled George Kelly, an analyst at Morgan Stanley.14 No matter how high the market climbed, most mutual fund managers were expected to stay fully invested. The only way to dispose of the bags of money piling up at their doors was to pou...

This highlight has been truncated due to consecutive passage length restrictions.

THE UNSUS...

This highlight has been truncated due to consecutive passage length restrictions.

David Tice,

the spring of 2001: “The unsuspecting,” said Tice, were gulled by “those most skilled at this game of speculation.”

(IPOs).

IPO

“Oh,” her daughter replied coolly, “I’ll be out by then.”16

Morgan Stanley,

Byron Wien

New Technology

The Internet, cell phones, and affordable computers would lay the foundation for a New Era in global communication and education that could raise living standards worldwide.

But what the New Economy’s promoters failed to mention was that major advances in technology usually benefit...

This highlight has been truncated due to consecutive passage length restrictions.

Consider, for example, the auto industry. “If you had foreseen in the early days of cars how this industry would develop, you would have said, ‘Here is the road to riches,’” Warren Buffett observ...

This highlight has been truncated due to consecutive passage length restrictions.

an enormous impact on America—

brilliant future

“Sizing all this up,” Buffett concluded, “I like to think that if I’d been at Kitty Hawk in 1903 when Orville Wright took off, I would have been farsighted enough, and public-spirited enough—I owed this to future capitalists—to shoot him down. I mean, Karl Marx couldn’t have done as much damage to capitalists as Orville did.”19

THE BROAD MARKET

But the mania for Internet stocks turned out to be only the froth on the cappuccino.

Ultimately,

On the Dow, in 1998, the top six belonged to the “Old Economy”: Wal-Mart (up 106 percent); IBM (up 75 percent), McDonald’s (up 61 percent), UT (up 49 percent), Merck (up 37 percent), and GE (up 38 percent).

On the S&P 500 that year, large-cap technology companies like Dell, Apple, and Lucent were among the big winners.21

The...

This highlight has been truncated due to consecutive passage length restrictions.

The Old Economy’s stars fell hard.

The Gap

Wal-Mart

UT

As the market heated up, experienced investors knew, with a sinking certainty, that the big caps were rising too high, too fast.

Richard Russell’s Dow Theory Letter,

In a major bear market, it can be an absolutely disastrous policy,” Russell told his subscribers in October of 1999.24

THE INDIVIDUAL INVESTOR

While insiders bailed out, most small investors did not sell.

2000,

1999.25

As always when a bull market ends, those who could afford it least lost the most.

In Massachusetts, Sharon Cassidy, a divorced college professor who had single-handedly put her four children through college, began to step up saving for her own retirement in 1990. By then she was 52, and earning roughly $42,000 a year. Listening to the financial advisors who visited her college, she stashed most of her money in broad-based equity funds, and, by the end of 1998, she had managed to accumulate over $350,...

This highlight has been truncated due to consecutive passage length restrictions.

By the end of 2001, at age 63, she was forced to rethink her life plan. “If I work until I’m 70, I can retire with $400,000,” she said. “I’m lucky—I like my work, and $400,000 is a lot more than most people have. But I’m angry, angry at myself and angry at the people who advised me.”26

401(k)s,

James Garfinkel,

39-year-old investor in Great Neck, New York,

as he talked to The Wall Street Journal: “It’s just devastating—I’m not a day trader. I did not load up on dot.coms. I picked good, solid blue-chip tech stocks—AT&T Corp., Lucent Technologies Inc., Sun Microsystem...

This highlight has been truncated due to consecutive passage length restrictions.

In Florida, Ed Wasserman took the bait only at the very ...

This highlight has been truncated due to consecutive passage length restrictions.

Wasserman.

2000,

Wasserman,

“This aggressive fund that my broker is offering puts me into companies like Quest, Oracle, Cisco—these aren’t little companies with no revenues—they’re blue chips. So I buy in. It was March of 2000.”

At the end of 2001, Wall Street bonuses were slashed by some 30 percent,

Wasserman noted, “The price of first-tier Bordeaux wines, being casked in 2001, has been bid way up, mainly by Americans. Meanwhile Detroit is preparing a new generation of overweight, $40,000-and-up sports utility vehicles, which, in spite of everything—are selling for 9 percent more than last year. “And who is buying these top-shelf goodies if not the investment bankers and fund managers?” he asked. “Some of the same people who collected fees for putting my nest eggs in the wrong basket and looking on as they cracked and dribbled onto the ground.”28

By 2000, many investors began to realize just how long it would take to ma...

This highlight has been truncated due to consecutive passage length restrictions.