More on this book

Community

Kindle Notes & Highlights

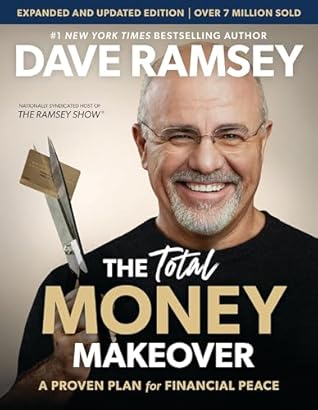

by

Dave Ramsey

Read between

November 2, 2024 - January 15, 2025

Here’s the lesson: Just because you see a turkey flying in a tornado doesn’t mean turkeys can fly. Just because some wild-eyed theory of investing, borrowing, and living without cash reserves works in good times doesn’t mean you can survive a storm. Remember, your ways of handling money have to work in good times and in bad.

The whole point of your Total Money Makeover is for you to learn to control the things you can control. What can you control? Your habits, your choices, and your actions.

This system will not work unless you do, and then only to the degree of your intensity in implementing it.

The first step to getting into shape was to realize I needed to change my ways, but the second and equally important step was to identify the obstacles to getting there. What would stop me from getting into shape? Once I understood those obstacles, I began a process to lose weight, grow muscle, and become fitter. Your Total Money Makeover is the same.

The lesson is that while it is fine to give money to friends in need if you have it, loaning them money will mess up relationships.

If you truly want to help someone, give money. If you don’t have it, then don’t sign up to pay it, because you likely will.

The average private nursing home room costs nearly $110,000 per year, which will crack and scramble a nest egg in a heartbeat.

People who win at anything have written goals. Goals are what you are aiming at.

Why do you want to have wealth? If you think wealth will answer all life’s questions and make you trouble-free, you are delusional.

Money is good for FUN. Money is good to INVEST. And money is good to GIVE.

All the “stuff” in the world can’t compare to the feeling of helping others in need.