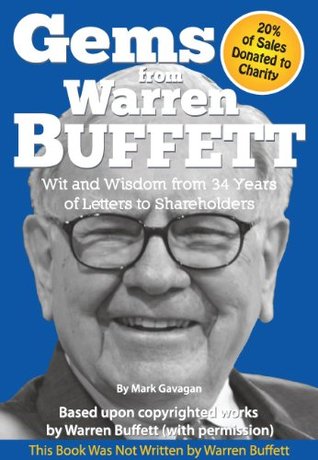

More on this book

Community

Kindle Notes & Highlights

by

Mark Gavagan

Read between

April 30 - May 3, 2018

“Berkshire’s operating CEOs are masters of their crafts and run their businesses as if they were their own. My job is to stay out of their way and allocate whatever excess capital their businesses generate. It’s easy work.”

“Ben Graham taught me 45 years ago that in investing it is not necessary to do extraordinary things to get extraordinary results. In later life, I have been surprised to find that this statement holds true in business management as well. What a manager must do is handle the basics well and not get diverted.”

“Berkshire is my first love and one that will never fade: At the Harvard Business School last year, a student asked me when I planned to retire and I replied, ‘About five to ten years after I die.’

“I’ve reluctantly discarded the notion of my continuing to manage the portfolio after my death – abandoning my hope to give new meaning to the term ‘thinking outside the box.’ ” -2007 letter

“The reaction of weak managements to weak operations is often weak accounting. (‘It’s difficult for an empty sack to stand upright.’)”

After all, what are we paying the accountants for if it is not to deliver us the "truth" about our business. But the accountants' job is to record, not to evaluate. The evaluation job falls to investors and managers.”

It has been far safer to steal large sums with a pen than small sums with a gun.”

“Bad terminology is the enemy of good thinking. When companies or investment professionals use terms such as "EBITDA" and "pro forma," they want you to unthinkingly accept concepts that are dangerously flawed.

“Managers that always promise to ‘make the numbers’ will at some point be tempted to make up the numbers.”

“A small chance of distress or disgrace cannot, in our view, be offset by a large chance of extra returns.

“Our preaching was better than our performance. (We neglected the Noah principle: predicting rain doesn’t count, building arks does.)”

“One of the lessons your management has learned - and, unfortunately, sometimes re-learned - is the importance of being in businesses where tailwinds prevail rather than headwinds.”

“Price and value can differ; price is what you give, value is what you get.”

“No matter how attractive the prospects of their business. We've never succeeded in making a good deal with a bad person.”

“We’ve always found a telephone call to be more productive than a half-day committee meeting.”

“An iron law of business is that growth eventually dampens exceptional economics.” -1985

‘If something’s not worth doing at all, it’s not worth doing well.’)

“This devastating outcome for the shareholders indicates what can happen when much brain power and energy are applied to a faulty premise. The situation is suggestive of Samuel Johnson’s horse: ‘A horse that can count to ten is a remarkable horse - not a remarkable mathematician.’

“My conclusion from my own experiences and from much observation of other businesses is that a good managerial record (measured by economic returns) is far more a function of what business boat you get into than it is of how effectively you row

Should you find yourself in a chronically-leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.”

Time is the friend of the wonderful business.”

“Managers with bright, but adrenaline-soaked minds scramble after foolish acquisitions...”

“If a CEO is enthused about a particularly foolish acquisition, both his internal staff and his outside advisors will come up with whatever projections are needed to justify his stance. Only in fairy tales are emperors told that they are naked.”

“In selecting common stocks, we devote our attention to attractive purchases, not to the possibility of attractive sales.”

‘Forecasts’, said Sam Goldwyn, ‘are dangerous, particularly those about the future.’

“Occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. And the market aberrations produced by them will be equally unpredictable, both as to duration and degree. Therefore, we never try to anticipate the arrival or departure of either disease. Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Bull markets can obscure mathematical laws, but they cannot repeal them.”

long periods of substantial undervaluation and/or overvaluation will cause the gains of the business to be inequitably distributed among various owners, with the investment result of any given owner largely depending upon how lucky, shrewd, or foolish he happens to be.”

“No matter how great the talent or effort, some things just take time: you can’t produce a baby in one month by getting nine women pregnant.”

“Lester Maddox, when Governor of Georgia, was criticized regarding the state’s abysmal prison system. ‘The solution’, he said, ‘is simple. All we need is a better class of prisoners.’

“The most important thing to do when you find yourself in a hole is to stop digging.”

“Over the years, a number of very smart people have learned the hard way that a long string of impressive numbers multiplied by a single zero always equals zero.”

“A promise is no better than the person or institution making it.”

the most elusive of human goals - keeping things simple and remembering what you set out to do.”

“As one investor said in 2009 (regarding the effects of the Financial Crisis): ‘This is worse than divorce. I’ve lost half my net worth – and I still have my wife.’ ”