The basic proposition is this: What an investor should pay today for a dollar to be received tomorrow can only be determined by first looking at the risk-free interest rate. Consequently, every time the risk-free rate moves by one basis point—by 0.01%—the value of every investment in the country changes. People can see this easily in the case of bonds, whose value is normally affected only by interest rates. In the case of equities or real estate or farms or whatever, other very important variables are almost always at work, and that means the effect of interest rate changes is usually

...more

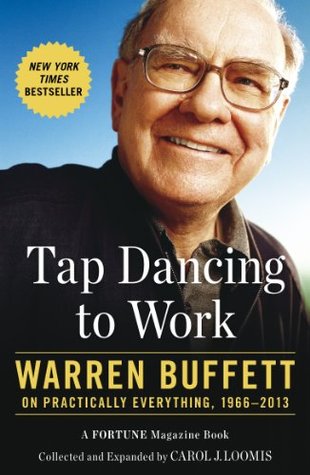

Welcome back. Just a moment while we sign you in to your Goodreads account.