As the table shows, expectations in 1975 were modest: 7% for Exxon, 6% for GE and GM, and under 5% for IBM. The oddity of these assumptions is that investors could then buy long-term government noncallable bonds that paid 8%. In other words, these companies could have loaded up their entire portfolio with 8% no-risk bonds, but they nevertheless used lower assumptions. By 1982, as you can see, they had moved up their assumptions a little bit, most to around 7%. But now you could buy long-term governments at 10.4%. You could in fact have locked in that yield for decades by buying so-called

...more

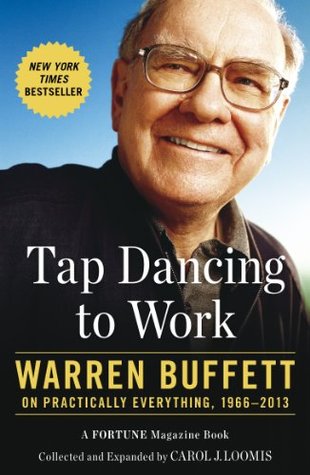

Welcome back. Just a moment while we sign you in to your Goodreads account.