Our consistently conservative financial policies may appear to have been a mistake, but in my view were not. In retrospect, it is clear that significantly higher, though still conventional, leverage ratios at Berkshire would have produced considerably better returns on equity than the 23.8% we have actually averaged. Even in 1965, perhaps we could have judged there to be a 99% probability that higher leverage would lead to nothing but good. Correspondingly, we might have seen only a 1% chance that some shock factor, external or internal, would cause a conventional debt ratio to produce a

...more

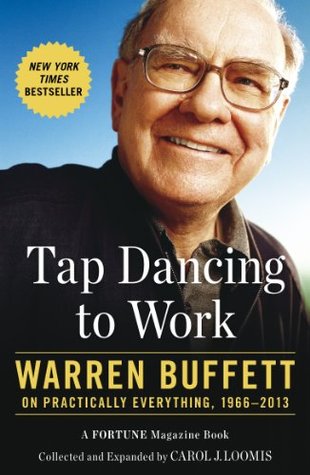

Welcome back. Just a moment while we sign you in to your Goodreads account.