Let’s also assume, in line with recent experience, that corporations earning 12 percent on equity pay out 5 percent in cash dividends (2.5 percent after tax) and retain 7 percent, with those retained earnings producing a corresponding market-value growth (4.9 percent after the 30 percent tax). The after-tax return, then, would be 7.4 percent. Probably this should be rounded down to about 7 percent to allow for frictional costs. To push our stocks-disguised-as-bonds thesis one notch further, then, stocks might be regarded as the equivalent, for individuals, of 7 percent tax-exempt perpetual

...more

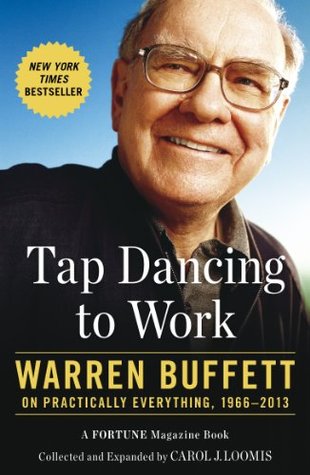

Welcome back. Just a moment while we sign you in to your Goodreads account.