So where do some reasonable assumptions lead us? Let’s say that GDP grows at an average 5% a year—3% real growth, which is pretty darn good, plus 2% inflation. If GDP grows at 5%, and you don’t have some help from interest rates, the aggregate value of equities is not going to grow a whole lot more. Yes, you can add on a bit of return from dividends. But with stocks selling where they are today, the importance of dividends to total return is way down from what it used to be. Nor can investors expect to score because companies are busy boosting their per-share earnings by buying in their stock.

...more

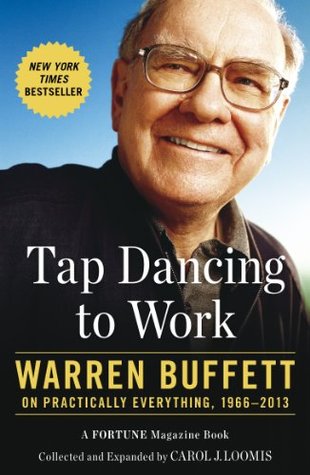

Welcome back. Just a moment while we sign you in to your Goodreads account.